2024-07-22 07:07

Speculation is high that Trump will announce a bigger role for BTC in the financial system, triggering a parabolic rise in the cryptocurrency's price, one observer said. BTC's options market shows increased expectations for fat tails or outliers impacting returns. Speculation is rife that Trump may announce a bigger role for BTC in the U.S. financial system, according to one observer. Donald Trump's impending appearance at the Nashville Bitcoin conference has traders preparing for fat-tails – extreme or unusual price movements in the leading cryptocurrency. Activity in the options market listed on Deribit and tracked by Amberdata shows a noticeable increase in the "butterfly index," which measures the volatility of the out-of-the-money (OTM) 25-delta (∆25) call and put options listed at a distance from the going market price of bitcoin {{BTC}] relative to at-the-money (ATM) options closer the spot price. The spike in the index indicates expectations for more extreme market movements. "This week we’re going to hear Trump speak at the Nashville Bitcoin conference. As long as Trump remains a front-runner, this is a potential catalyst for 'something to happen' this week. The derivative markets seem to agree, and we’re seeing pricing support the 'something is about to happen' narrative." Greg Magadini, director of derivatives at Amberdata, said in an email. "Something we don’t often talk about, but merits a shoutout this week, is the spike higher in 25-delta wings versus ATM volatility. This type of activity in the options market reflects the anticipation for higher return distribution Kurtosis or fat tails," Magadini added. Options are derivative contracts that protect the buyer from bullish or bearish price movements. A call offers protection from bullish moves, while a put is insurance against price slides. Calls at strikes above BTC's going market rate are said to be OTM, while puts below the going rate are said to be OTM. Traders typically buy OTM options when preparing for unexpected market movements, pushing the butterfly index higher. Hence, trading desks typically use the term "butterfly" to indicate the extent of change in the volatility smile or the volatility profile of options at various strike levels and expiration dates. When butterflies become costly, it suggests that the volatility smile has steepened, a sign of the potential for extreme or unexpected events to affect market outcomes. Trump is scheduled to speak at the Nashville conference on July 27, despite the recent assassination attempt that boosted his chances of winning the Nov. 4 Presidential elections. The grapevine is that Trump might announce a more significant role for BTC in the U.S. financial system. "Speculation is high that he will announce bitcoin as a strategic reserve asset, which could trigger a parabolic rise in bitcoin's price," Markus Thielen, founder of 10x Research, said in Monday's edition of the newsletter. "Taking profit, or even shorting bitcoin ahead of Trump’s Nashville speech, could turn out to be an expensive exercise." Additional factors, such as the expected debut of spot ether ETFs in the U.S., also explain the rise in the butterfly index. "Traders and market makers are worried about tail risks from the FOMC on July 31 and the upcoming spot ETFs, which has pushed up the pricing for BTC's tail risks [butterfly index]," Griffin Ardern, head of options trading and research at crypto financial platform BloFin, told CoinDesk. Tail risk refers to the risk of unexpected events that occur outside the normal distribution of returns. This week, traders will also receive advance estimates of the U.S. GDP growth for the June quarter of 2024, the Fed's preferred inflation measure, and the core PCE prices, durable goods, and retail sales for June. All these numbers will likely influence Fed rate cut expectations and demand for risk assets, including BTC. https://www.coindesk.com/markets/2024/07/22/bitcoin-traders-brace-for-fat-tails-as-focus-shifts-to-trumps-nashville-conference/

2024-07-22 07:00

The RWA Vaults built with the help of OpenTrade had previously operated over a seven or 28-day term. The upgraded RWA Vaults allows users to withdraw Treasury Bill-backed interest on their USDC, on a daily basis. Woo X and partners OpenTrade claimed bragging rights for being the first exchange to offer T-Bill interest bearing products to retail customers. Cryptocurrency exchange Woo X has upgraded its U.S. Treasury Bill-backed yield earning products such that customers can withdraw interest on a daily basis, rather than having to wait the customary seven or 28 days associated with T-Bills. Tokenization – especially involving bank-grade assets like U.S. Treasuries – has become popular thanks to interest rate increases, with a groundswell of innovations from traditional finance firms and startups alike. The Woo X RWA Earn Vaults, built with the help of tokenized yield specialists OpenTrade, now allows retail and institutional users to withdraw daily interest accrued from depositing USDC stablecoin in the vaults with no term, the companies said on Monday. “You can now earn the risk free rate of return on the Woo X exchange through the application you already use today to trade and get in and get out at any time,” said OpenTrade CEO Dave Sutter in an interview. “This is an even better experience than what you'd see from traditional finance products. It's basically giving you that ultimate flexibility to the user to get yield on USDC with maximum safety.” Woo X’s innovation partner on the project OpenTrade has links to Center, the now-dissolved collaboration between USDC issuer Circle and Coinbase, and, going further back, the Marco Polo enterprise blockchain project. https://www.coindesk.com/business/2024/07/22/crypto-exchange-woo-x-allows-daily-interest-withdrawals-from-t-bill-backed-earn-vaults/

2024-07-22 06:32

Market data shows Polymarket bettors called Biden's drop out hours before it was announced. Nearly $80 million was wagered on Polymarket in various contracts about Joe Biden's political future. $51.5 million was at stake on a question regarding Biden's leadership of the Democrats, while $27.5 million was bet on variations of the question as to if he'd drop out of the race. Nearly $80 million was in play across six bets related to President Joe Biden's status as the Democrat's nominee, according to Polymarket data, excluding specific bets related to the presidency. The market with the largest pool asked bettors to pick the Democratic nominee. This process of officially picking a nominee begins for the party on August 19 at its convention, but the specifics are now up in the air with Biden's resignation. In total, $51.5 million was bet directly on, or against, Biden in a pool of $205 million. At the end of June, the market as to whether Biden would be the nominee was trading at 90 cents, representing a 90% chance he would be the Democrat's candidate. While there was a considerable amount of volatility throughout the first weeks of July as calls for Biden to drop out amplified – met with a resolute insistence on Biden saying he was staying in – as of July 17, it was back up to 80 cents. One trader by the name of AnonBidenBull lost nearly $1.8 million on this contract, and over $2 million in total with their other related Biden bets. Meanwhile, markets that asked bettors to speculate on some variation of the question as to whether Biden would resign pooled a total of $27.5 million. The largest of these markets, with $21 million at stake, asked if Biden would drop out of the race. Other markets asked for a specific date of his resignation, or if he'd be on specific state ballots for the Presidential ticket. One user by the name of 'therealbatman' lost nearly $647,500 on this specific bet, and around $1 million in total on his Biden-related punts as they projected Biden to win the popular vote. On Twitter, Polymarket pointed out that traders had given a significant edge to Biden dropping out in the days before the announcement was made, with the market shooting up to 100% in the moments prior to media coverage of the announcement (Polymarket initially claimed it was hours before, but a community note on X said that because of the difference in time zones it was only minutes). Market data shows a flurry of activity in the time before the announcement was made. Overall the user polybets1 appears to be the most profitable political trader of the moment, as they are well in the green on their Biden, Kamala Harris, and Donald Trump positions. Overall this trader has so far booked a profit of $691,000 on positions worth $1.7 million. https://www.coindesk.com/markets/2024/07/22/polymarket-bettors-put-nearly-80m-on-bidens-democratic-chances/

2024-07-21 19:07

Crypto traders are once again betting on the very serious business of presidential politics via very silly meme coins. Crypto traders are once again betting on the very serious business of presidential politics via very silly meme coins, including one for Vice President Kamala Harris that more than doubled in price Sunday. KAMA hit an all-time high of 2.4 cents in the minutes following President Joe Biden's announcement that he was dropping his re-election campaign. With a market cap of $24 million, KAMA is now nearly four times as large as the Biden-inspired coin BODEN, once the kingmaker crypto of so-called PolitiFi. BODEN fell by nearly 50% following Biden's announcement. The political shake-up prompted traders to create a wave of new tokens lampooning Harris and Biden on the meme coin launchpad Pump.fun. If history is any guide, most of those tokens will likely crater in value as buyers and sellers play a game of order book chicken atop the Solana (SOL) blockchain, where most meme coins trade. Biden endorsed Harris' campaign for president. So did former President Bill Clinton, former Secretary of State Hillary Clinton and crypto-critic Sen. Elizabeth Warren. "I am honored to have the President's endorsement and my intention is to earn and win this nomination," Harris said in a statement. "I will do everything in my power to unite the Democratic Party – and unite our nation – to defeat Donald Trump and his extreme Project 2025 agenda." https://www.coindesk.com/markets/2024/07/21/kamala-harris-meme-coin-soars-to-all-time-high-after-joe-biden-drops-out/

2024-07-21 18:20

Vice President Kamala Harris is in the strongest position after Biden's departure. U.S. President Joe Biden will end his campaign for a second term, he announced Sunday, sending meme coins tied to his campaign plummeting and slightly decreasing Republican nominee and former President Donald Trump's chances on the Polymarket prediction market. Vice President Kamala Harris is now the leading contender for becoming the new Democratic Party nominee for the 2024 race, according to another Polymarket contract. Biden gave his No. 2 a shout-out in his departure letter, endorsing her in a second tweet shortly after announcing the end of his campaign. "Today I want to offer my full support and endorsement for Kamala to be the nominee of our party this year. Democrats – it's time to come together and beat Trump. Let's do this," he said in a post on X. Biden's departure came after weeks of pushback that grew to more than a dozen lawmakers in his own party following a disastrous debate performance in June. The price of BODEN, a meme coin poking fun at the president, fell by nearly half in the aftermath of his announcement. KAMA, a Harris coin, doubled in price. Meanwhile, TREMP, a similar coin pointing to Trump, rose over 20%. After Biden's announcement, bitcoin (BTC) initially fell below $66,000 before snapping back above $67,000. The 2024 presidential election, which will also see voters choose the makeup of the U.S. House of Representatives and Senate, will take place this November. "I am honored to have the President's endorsement and my intention is to earn and win this nomination," Harris said in a statement. "I will do everything in my power to unite the Democratic Party – and unite our nation – to defeat Donald Trump and his extreme Project 2025 agenda." https://www.coindesk.com/policy/2024/07/21/with-biden-out-polymarket-favors-harris-for-democratic-presidential-nominee/

2024-07-19 17:48

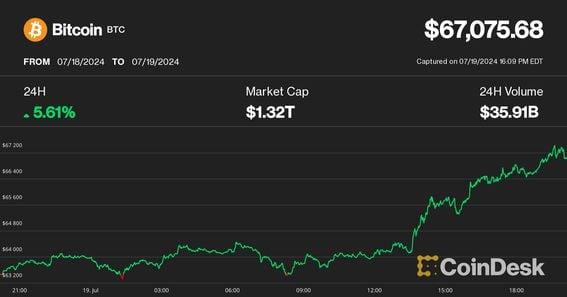

Friday's crypto rally defied past days' correlation with U.S equities, which continued their losing streak. Bitcoin hit a one-month high price, surging 5.5% over the past 24 hours. Solana rose 8%, topping $170 for the first time since early June. Crypto observers highlight the resiliency of decentralized blockchains as a malfunctioning software update caused worldwide disruptions in IT systems. The crypto rally resumed on Friday with bitcoin (BTC) notching its highest price in a month, while the world grappled with a major IT outage. BTC started rising from $64,000 during the early U.S. trading hours and broke above $67,000 later in the day for the first time since June 17. The price increase was accompanied by strong trading volumes for BlackRock's spot bitcoin ETF (IBIT). At press time, the largest crypto asset changed hands slightly above $67,000 advancing 5.5% over the past 24 hours. Solana (SOL) led among altcoin majors with an 8.5% increase over the same period, topping $170 for the first time since early June. The token outperformed the broad-based digital asset benchmark CoinDesk 20 Index (CD20), which rose 4.3%. Ethereum's ether (ETH) reclaimed the $3,500 level, but underperformed with a 3% increase. The first spot-based ETH exchange-traded funds (ETF) in the U.S. will likely start trading on Tuesday next week, Friday regulatory filings by Cboe showed. Cryptocurrencies slid lower earlier this week in tandem with a U.S. stock sell-off. However, Friday's rally happened as major equity indexes continued their losing streak. The tech heavy Nasdaq Composite was down 0.8%, while the broad-based S&P 500 lost 0.6% as of 1 p.m. ET, while gold plummeted over 2% during the day following a fresh all-time earlier this week. As a software update by cybersecurity service provider CrowdStrike caused widespread computer outages around the world halting airlines, banks and businesses, some crypto observers emphasized the resiliency of decentralized systems like public blockchains compared to centralized networks. Charles Edwards, founder of crypto hedge fund Capriole Investments, took notice of bitcoin's rapid surge coinciding with the U.S. traditional market opening, perhaps a sign of bidding from institutional investors. "Did some institution just wake up and decide Bitcoin is a safe haven decentralized store of value as global tech and banking systems fail from Microsoft's blue screen of death?," he posted on X. Bitcoin targets $100,000 by year-end Looking at a longer timeframe, bitcoin is trading around the midpoint of a multi-month sideways channel between $56,000 and $73,000. Spot prices might be range-bound in the near term, but traders are increasingly positioning for a breakout to new all-time highs towards the U.S. elections in November, digital asset hedge fund QCP said in a market update. QCP analysts noted strong demand for December $100,000 bitcoin call options from institutions. Mads Eberhardt, crypto analyst at Steno Research, expressed a bullish view for the second half of the year for crypto assets, supported by multiple tailwinds including coming U.S. interest rate cuts, rising liquidity, regulatory clarity in Europe and rising chances of more crypto-friendly U.S. leadership. "Bitcoin at $100,000. Ethereum at $6,500," he said about his price targets. Update (July 19, 20:25 UTC): Updates headline, story with latest prices. Adds paragraph with ether (ETH) price and Cboe filing about spot ETF trading. https://www.coindesk.com/markets/2024/07/19/bitcoin-tops-66k-as-cryptos-rally-amid-global-it-outage-solanas-sol-leads-altcoins/