2024-07-18 07:12

The Mt. Gox claims portal “is temporarily down for maintenance” as of Asian morning hours Thursday, the site shows. Creditors of the defunct crypto exchange Mt. Gox are reporting numerous failed login attempts on their accounts. The situation arised as Mt. Gox started to repay its creditors. Someone is apparently trying to log into creditors' Mt. Gox accounts amid ongoing bitcoin (BTC) repayments, with several Reddit users reporting as many as 22 failed attempts as of Thursday. “Just received 15 notifications for account log in. Now can’t get into my account. Is Mt. Gox under attack???,” claimed Reddit user ovkovk in a trending post on the r/mtgoxinsolvency forum. “Thank god at this point you can’t do payee info change. Still getting log in emails. 22 so far.” More than fifteen other users reported having received similar login notifications, suggesting that an unknown individual was trying to log in to a Mt. Gox – effectively to gain control of that account and likely withdraw any BTC received. The Mt. Gox claims portal “is temporarily down for maintenance” as of Asian morning hours Thursday, the site shows. One user u/Joohansson said that such attempts have been made on their Mt. Gox account previously and that accounts enabled with 2FA—a popular security authentication system—are presumably safe. “I would guess some attacker has a record of all (or a whole lot of) gox emails and trying to brute force their way in. It has happened before. As long as you have a 2FA you should "hopefully" be fine,” the user said. In early July, the defunct crypto exchange Mt. Gox began repaying creditors impacted by a 2014 hack. Over $9 billion worth of BTC and $73 million of bitcoin cash (BCH) will be distributed to traders in the coming months. https://www.coindesk.com/tech/2024/07/18/mt-gox-creditors-reportedly-hit-by-failed-login-attempts-amid-repayments/

2024-07-17 22:16

The forms show what issuers plan to charge customers, with Grayscale at the high end at 2.5%, while competitors including BlackRock and Fidelity pick 0.25% or lower. Prospective issuers of spot ethereum exchange-traded funds have filed their final S-1 documents with the U.S. Securities and Exchanges Commission. Once these documents get approved by the financial regulator, the funds can hit the market. Two sources familiar with the matter told CoinDesk earlier this week that the SEC will likely do this next week on Tuesday. Applicants seeking to issue exchange-traded funds tied to Ethereum's ether (ETH) have now submitted their final documents needed to launch the funds, probably next week. Asset managers including BlackRock, Fidelity, 21Shares, Grayscale, Bitwise and Invesco Galaxy – who are all in the race to launch ether ETFs in the U.S. – submitted amended S-1 filings on Wednesday. Two industry sources previously told CoinDesk that U.S. Securities and Exchange Commission staff advised them to file final amendments by Wednesday and that the applications may be deemed effective – essentially, approved – by Monday, with trading to begin Tuesday. In the filings, the prospective issuers revealed the final details of the fund structures, including management fees, which turned out to be relevant for investors when choosing which spot bitcoin ETF they would invest in when they debuted early this year. Experts have said that the fee war in this round of launches would be similar to the competitive landscape then, when issuers kept lowering their fees to compete with other funds. One similarity so far is Grayscale's distance from its competitors. The asset manager decided to charge a significantly higher fee of 2.5% on its main product than others. Its Mini Ethereum Trust, however, is set at 0.25%, in line with others. "I'm not sure what Grayscale's strategy is here," said industry commentator Scott Johnson in a post on X. "Feels like they started with the right idea, then it got botched somewhere along the way. Investors selling ETHE are probably not going to be charitable with your mid-price mini option after you stick them with a 10x fee and force them to realize gains." "Honestly, they might have screwed themselves worse than GBTC. I didn't think that was possible," he wrote, referring to the Grayscale Bitcoin Trust (GBTC) seeing billions of dollars of outflows since it was converted to an ETF in January as other bitcoin ETFs started trading. BlackRock and Fidelity will also charge 0.25%, while 21Shares set its fee at 0.21%. Bitwise, VanEck and Invesco Galaxy are at the lower end of the spectrum at 0.2% while Franklin Templeton will charge 0.19%. ProShares had not filed an amendment revealing its fee as of press time. Mini ETF launch incoming? The SEC also approved 19b-4 forms for applications from Grayscale to launch a mini ethereum exchange-traded product and ProShares to launch a spot ethereum ETF on Wednesday. Both companies are working with NYSE Arca as their exchange partner that will actually list the products. The SEC previously approved 19b-4 forms from NYSE Arca, Cboe and Nasdaq for the various applications for spot ether ETFs near the end of May, resolving a procedural hurdle and giving the strongest indication thus far that it would ultimately approve the spot ether ETF applications. The timing of Wednesday's 19b-4 approvals suggests that Grayscale and ProShares may also be able to launch their products at the same time as the other applicants. Industry sources previously told CoinDesk they expected these products to launch next Tuesday. If Grayscale can launch its mini ether ETF on Tuesday, it'll do so before it receives approval to launch a mini bitcoin ETF. The company filed to launch a mini bitcoin ETF in April, revealing earlier this year it would charge a 0.15% fee – in contrast to the mini ether product's 0.25%. https://www.coindesk.com/business/2024/07/17/all-ether-etf-applicants-have-submitted-their-final-forms/

2024-07-17 18:43

The comments from Buterin, widely viewed as Ethereum's intellectual leader, stand in stark contrast to the strongly pro-Trump rhetoric from other well-known crypto figures. Vitalik Buterin argued against supporting candidates just based on their "pro-crypto" stances. He said by doing so "you are helping to create an incentive gradient where politicians come to understand that all they need to get your support is to support 'crypto.'" Ethereum co-founder Vitalik Buterin, as other prominent cryptocurrency leaders vocally support Donald Trump's run for U.S. president, argued against supporting candidates purely based on whether they are "pro-crypto." "By publicly giving the impression that you support 'pro-crypto' candidates just because they are 'pro-crypto,' you are helping to create an incentive gradient where politicians come to understand that all they need to get your support is to support 'crypto,'" Buterin posted on his blog Wednesday. "There is a growing push within the crypto space to become more politically active, and favor political parties and candidates almost entirely on whether or not they are willing to be lenient and friendly to 'crypto,'" Buterin added. "In this post, I argue against this trend, and in particular I argue that making decisions in this way carries a high risk of going against the values that brought you into the crypto space in the first place." The comments from Buterin, widely viewed as Ethereum's intellectual leader, stand in stark contrast to the strongly pro-Trump rhetoric from other well-known crypto figures. Ryan Selkis, the co-founder of crypto information platform Messari, has been especially vocal, calling himself a "single issue voter" – meaning he prefers Trump over the incumbent, Joe Biden, because Trump says he likes crypto. Selkis appeared at a recent Mar-a-Lago gala where Trump touted his NFT collection and talked about his newfound friendliness toward digital assets. Coinbase, the large U.S.-based crypto exchange, has emerged as a major force in political donations this year, with its Fairshake PAC. The crypto industry now sports one of the biggest piles of money to sway elections – with wins already notched. At its core, this is about electing politicians who will make the U.S. an easier place for crypto businesses to operate. On X, Selkis blasted Buterin for the post. "I respect Vitalik but he has always been among the most naive and useless political commentators in crypto. Idealism is not realism, and he pretends we aren’t dealing with a cultural cancer and infestation of Marxism. He's wrong." https://www.coindesk.com/policy/2024/07/17/vitalik-buterin-argues-against-supporting-political-candidates-based-only-on-pro-crypto-stances/

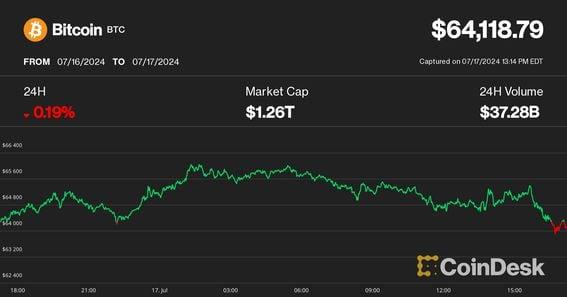

2024-07-17 17:28

A stock market correction is the biggest risk for the crypto market, but a renewed downturn would be a buying opportunity, an LMAX Group strategist said. Cryptocurrencies sharply reversed early gains during the U.S. trading session on Wednesday with bitcoin (BTC) dipping below $64,000 as a broad-market equity sell-off weighed on the digital asset market. The leading cryptocurrency by market cap sold off 2% within an hour, dropping to as low as $63,890 after trading above $66,000 earlier in the session. At publishing time, BTC was trading at $64,000, down 0.5% over the past 24 hours. Altcoin majors such as solana (SOL), cardano (ADA) and Chainlink's token (LINK) sold off 2%-4% over the same time frame. The broad-market crypto benchmark CoinDesk 20 Index (CD20) was down 1.2% over the past 24 hours, with most constituents in the red. The action happened while key U.S. equity indexes also sold off, with tech-heavy Nasdaq plunging 2.7% and the S&P 500 falling 1.3%. Tech megacap stocks such as chipmaker Nvidia (NVDA), which were the biggest contributors of the two benchmarks march to new all-time highs, have been struggling in the past few days as investors rotated capital to smaller cap stocks in anticipation of more accommodating interest rates later this year. Nvidia was lower by 6.5% on Wednesday, though still higher by 145% year-to-date. Joel Kruger, market strategist at LMAX Group, said that the crypto rally might stall if the stock market selloff turns into a deeper correction, but over a longer time frame may provide a haven for investors fleeing stocks. "The one concern we’ve been flagging in recent sessions is our concern about the state of the U.S. equities market and the possibility we could soon see a major bearish reversal to allow for a healthy correction," Kruger said in a Wednesday note. "But even in such a case, there will be plenty of reason to be wanting to buy bitcoin as a flight to safety asset, and plenty of reason to be wanting to pick up other crypto assets into dips on their potential for massive innovation," he added. https://www.coindesk.com/markets/2024/07/17/bitcoin-dips-below-64k-as-us-equity-selloff-stalls-crypto-rebound/

2024-07-17 17:00

StarkWare used its new STARK verifier on the Signet network, a testing environment for Bitcoin, in a proof-on-concept project designed to demonstrate what the oldest blockchain might be capable of were the pending "OP_CAT" technical proposal to get adopted. OP_CAT is a proposed Bitcoin upgrade, aiming to bring Ethereum-like smart contract capability to the world's oldest and largest blockchain network. While by no means short of supporters, OP_CAT remains in its very early stages in terms of acquiring the consensus necessary to be merged into Bitcoin' core software. Layer-2 developer StarkWare, the primary builder behind the Starknet network atop Ethereum, has offered a glimpse of what could be possible on the Bitcoin blockchain if a pending technical proposal known as OP_CAT were adopted. Working on a Bitcoin's testing environment known as Signet, and using OP_CAT, StarkWare says it demonstrated how zero-knowledge proofs - an increasingly popular type of cryptography that's used to compress data or prove the validity of statements without offering information that may compromise privacy - could be carried out on the oldest and original blockchain. The aim of the project was to demonstrate the capabilities of OP_CAT, a proposed Bitcoin upgrade – tipped to bring Ethereum-style "smart contracts" programmability, historically and famously missing from the blockchain designed by Satoshi Nakamoto as a peer-to-peer payments system. While by no means short of supporters, OP_CAT remains in its very early stages in terms of acquiring the consensus necessary to be merged into Bitcoin' core software. "StarkWare is publicly championing the approval of the proposal because of the clear benefits it unlocks for the Bitcoin community as well as the blockchain ecosystem more broadly," the company said in a press release. Read More: Polygon's New ZK Proving System, 'Plonky3,' Comes as Open-Source Toolkit https://www.coindesk.com/tech/2024/07/17/bitcoins-op-cat-possibilities-teased-in-starkware-test-project/

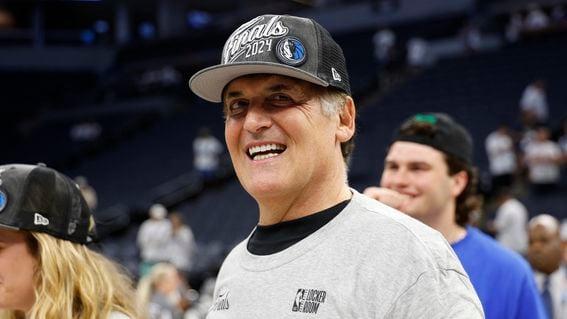

2024-07-17 16:44

Cuban: "You can't align the stars any better for a BTC price acceleration." Venture capitalists and other Silicon Valley figures have embraced Donald Trump's attempt to retake the U.S. presidency. Their rationale? To billionaire Mark Cuban, it's being driven by cryptocurrencies. "It's a bitcoin play," Cuban posted Wednesday on X. Trump as president "makes it easier to operate a crypto business because of the inevitable, and required, changes at the" U.S. Securities and Exchange Commission, he added. The crypto industry has roundly criticized the SEC for making it difficult to run a digital asset business in the U.S. (Cuban is no stranger to criticizing the SEC, the markets regulator with which he once tussled over insider trading allegations. He won.) Under Trump, who appears to be ahead of President Joe Biden, the stage is set for inflation and uncertainty about the role of the U.S. in geopolitics, Cuban said. "You can't align the stars any better for a BTC price acceleration," he wrote. "How high can the price go. Way higher than you think. Remember, the market for BTC is global. And the supply has a final limit of 21m BTC, with unlimited fractionalization," Cuban added. This week, it was reported that major VCs Marc Andreessen and Ben Horowitz plan to donate money to support Trump's campaign. Their firm, Andreessen Horowitz, has a crypto arm. Coinbase, the crypto exchange based in the Silicon Valley town of San Francisco, formed the Fairshake political action committee, which has supported pro-crypto candidates and tried to defeat anti-crypto ones. It's one of the largest PACs in this election cycle. Trump's pick for vice president, Senator J.D. Vance, has ties to Silicon Valley. "If things really go further than we can imagine today (and I'm not saying they will. Just that this has a possibility somewhere above zero), then BTC becomes exactly what the Maxis envision," Cuban wrote Wednesday. "A global currency." https://www.coindesk.com/business/2024/07/17/its-a-bitcoin-play-mark-cuban-says-silicon-valleys-embrace-of-trump-revolves-around-crypto/