2024-07-17 07:39

Menendez's sentencing has been scheduled for October 29 and he could face decades in prison. One of New Jersey's Democratic Senators Bob Menendez was found guilty on Tuesday of accepting bribes as a foreign agent. The crypto community pointed to the irony of Menendez getting convicted for corruption given he had labelled bitcoin as "an ideal choice for criminals." U.S. Senator Bob Menendez (Dem) from New Jersey, a staunch crypto critic, was found guilty of accepting bribes, including gold bars and a luxury car, in exchange for his political clout by a jury on Tuesday. The development saw the crypto community point out the irony of a crypto critic who once alleged that bitcoin (BTC) "is an ideal choice for criminals" getting convicted as a criminal. Menendez was also a co-sponsor of a bill titled "Accountability for Cryptocurrency in El Salvador (ACES) Act" which would have required the State Department to report on mitigating risks to the U.S. financial system from El Salvador's adoption of bitcoin as legal tender. Stacy Herbert, a member of The National Bitcoin Office (ONBTC) of El Salvador under President Nayib Bukele, wrote on X that while Senator Menendez was "hiding bars of ill-gotten gold... President Bukele was establishing the most transparent government in the world by posting El Salvador’s public bitcoin address for all the world to audit." Herbert added that the "malign actor was Bob Menendez" and that The Senate Foreign Relations Committee, which Menendez was the chairman of "owes President Bukele and El Salvador an apology." "I have never been anything but a patriot of my country and for my country. I have never, ever been a foreign agent," Menendez said outside the courthouse after the verdict made him the first sitting member of Congress to be convicted of acting as a foreign agent. "This wasn’t politics as usual; this was politics for profit," said U.S. Attorney Damian Williams in a statement. "Because Senator Menendez has now been found guilty, his years of selling his office to the highest bidder have finally come to an end." Menendez was a congressperson since 1993, entering the Senate in 2006, has so far refused to resign despite numerous calls from senior colleagues to do so, including from Democratic Senate Majority leader Chuck Schumer. Menendez's sentencing has been scheduled for October 29 and he could face decades in prison. Read More: Bipartisan Senate Proposal Raises Alarm Over El Salvador's Bitcoin Adoption https://www.coindesk.com/policy/2024/07/17/us-senator-who-called-bitcoin-ideal-choice-for-criminals-convicted-of-bribery/

2024-07-17 07:30

The deal will strengthen Zodia Markets' over-the-counter business while allowing Elwood to conentrate on its software-as-a-service activities. Elwood will focus on its trading technology software-as-a-service products and services. Zodia Markets’ $50 million-$60 million a day OTC business expects to “increase daily volumes significantly,” as a result of the deal. Zodia Markets, a cryptocurrency-focused trading firm backed by the venture arm of Standard Chartered, said it is buying the over-the-counter trading division of Elwood Technologies, confirming media reports the unit was on the block and sale talks were in process. After offloading the business, Elwood, which was championed by crypto-friendly billionaire Alan Howard, will focus on its trading technology software-as-a-service (SaaS) products and services, the company said on Monday. Confidence is running high in the institutional crypto space, with regulated bank-backed projects and qualified custodians building out a base of trading infrastructure to meet the demands of traditional capital markets. Zodia Markets’ OTC business now handles trading volumes of as much as $60 million a day, according to CEO Usman Ahmad. He did not share details of how much customer volume is likely to come Zodia’s way from the deal, but said via email that the firm expects to “increase daily volumes significantly.” He also declined to share financial terms of the deal. Standard Chartered, which was reported recently to be entering the crypto spot trading space, is a backer (through the SC Ventures business) of both Zodia Markets and its sister operation, Zodia Custody. Usman said the deal would not overlap with Standard Chartered’s crypto trading aspirations. “This transaction is an enabler for Zodia Markets’ growth and doesn’t overlap with what Standard Chartered may or may not do directly in trading spot crypto,” he said. Crypto markets, coming out of a long bear market, remain choppy. Elwood CEO Chris Lawn said the decision to sell the OTC business was not about a bull or bear market, but instead an illustration of how the digital assets industry is maturing, with new entrants demanding institutional-grade SaaS solutions. “Increased competition and M&A will force companies to ask tough questions as to who and what they really are,” Lawn said in an email. “For us, the answer is we are a technology company, hence the strategic decision to focus all of our efforts on this part of our business and to sell the OTC business.” https://www.coindesk.com/business/2024/07/17/standard-chartered-backed-zodia-markets-to-buy-elwood-trading-desk/

2024-07-17 07:22

“BTC could hover around the 120-day moving average, and the price may have the momentum to go up to $68k or even $70k, but we need to continue to monitor closely the Fed policies and implications of Mt Gox,” one trader said. Traders anticipate bitcoin rallying to $70,000, buoyed by a more optimistic macro environment and the prospect of a crypto-friendly U.S. administration under Donald Trump. Reduced selling pressure from key wallets and a more positive political outlook for the crypto sector have contributed to the bullish sentiment, despite recent volatility and concerns over Mt. Gox repayments. Bitcoin (BTC) traders expect prices to touch as much as $70,000 in the near term as sentiment around the broader crypto sector bumps ahead of the U.S. elections and selling pressure from key wallets subsides. “The rebound in Bitcoin price shows the market has a more optimistic outlook in the near-term macro environment,” shared Lucy Hu, senior analyst at Metalpha, in a Wednesday message to CoinDesk. “The market was encouraged by Trump’s vice president pick, which indicates a more crypto-friendly administration and policies.” “BTC could hover around the 120-day moving average, and the price may have the momentum to go up to $68k or even $70k, but we need to continue to monitor closely the Fed policies and implications of Mt Gox,” Hu added. Moving average is a technical indicator that sums price data over time to determine a trend's direction. A 120-day moving average is widely used as a long-term indicator. BTC showcased rollercoaster price action in the past few weeks, dropping to as low as $53,500 in early July as wallets from defunct exchange Mt. Gox started their bitcoin repayments, triggering bearish predictions. But favorable developments have since put bulls back on track. Wallets linked to the German state of Saxony have emptied their entire stack of bitcoin. At the same time, Republican candidate Donald Trump’s pro-crypto stance has ushered in renewed hope. Trump has picked Ohio senator JD Vance, a crypto-friendly figure, as his 2024 running mate. In 2022, Vance held as much as $250,000 worth of BTC. “A change in perspective on the digital assets industry in the US is creating expectations of more favorable policy toward Bitcoin and crypto as the elections look to capture single issue voters and special interest groups,” shared Nick Ruck, head of growth at BitU Protocol, in a Telegram message. “There’s also less expected sell pressure in the long term as Mt Gox distributes funds to creditors,” Ruck added. Odds of Trump winning the 2024 elections have shot up to 69% from 60% in the past week, data from betting application Polymarket show. https://www.coindesk.com/markets/2024/07/17/bitcoin-bulls-eye-70k-amid-donald-trumps-rising-chances-of-returning-as-president/

2024-07-17 05:49

Guo was found guilty on nine charges, including racketeering, fraud, and money laundering Guo Wengui, also known as Miles Guo, was convicted of a billion-dollar fraud by U.S. prosecutors in New York. Guo has been an associate of fromer Trump strategist Steve Bannon, who was arrested on Guo's yacht in 2020. Exiled Chinese businessman Guo Wengui, who also uses the alias Miles Guo, has been convicted of defrauding his supporters in a billion-dollar scam involving his company, GTV Media Group. "Today, Guo’s schemes have been put to an end. Moments ago, a unanimous jury found Miles Guo guilty of racketeering conspiracy and various securities fraud, wire fraud, and money laundering charges. He faces decades in prison," U.S. Attorney Damian Williams said in a statement. In March 2023, Guo was arrested in New York, and has been behind bars ever since. Shortly after his arrest, his penthouse in Manhattan's Upper East Side caught fire. Prosecutors said during the trial that Guo fleeced nearly $1 billion from investors to fund his lavish lifestyle. Separate from the criminal trial, the Securities and Exchange Commission has charged Guo with an alleged scheme that raised $500 million from retail investors for a crypto venture called H-Coin, which he falsely claimed was 20% backed by gold. Guo has been a long-time associate of political strategist Steve Bannon, who briefly served in the Trump White House. In 2020, they announced an initiative to overthrow the Chinese government with a plan called the New Federal State of China. Bannon was arrested on Guo's yacht in August 2020 for conspiracy to commit wire fraud and money laundering related to a crowdfunding scheme to build a border wall between the U.S. and Mexico. Although later pardoned by Trump, he was subsequently charged in a separate fraud case by state-level prosecutors. https://www.coindesk.com/policy/2024/07/17/steve-bannon-linked-chinese-businessman-found-guilty-in-fraud-scheme/

2024-07-17 05:12

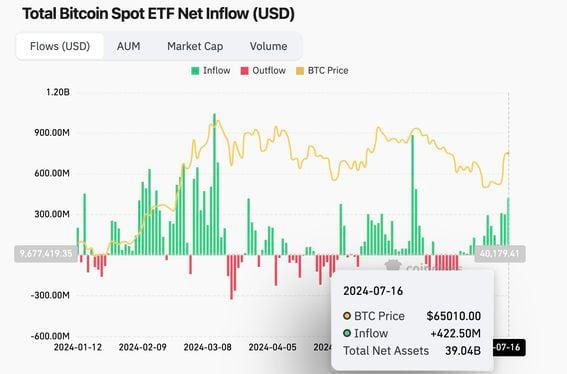

BTC's price has recovered 23% since hitting lows near $53,500 on July 5. The 11 spot BTC ETFs listed in the U.S. recorded a cumulative inflow of $422.5 million on Tuesday. The funds have collected over $1 billion in the past three trading days alone. BTC's price has recovered 23% since hitting lows near $53,500 on July 5. The U.S.-listed exchange-traded funds that closely track bitcoin's (BTC) spot price are back in demand and how. On Tuesday, the 11 funds recorded a cumulative net inflow of $422.5 million, the highest single-day tally since June 5, extending the seven-day winning run, according to data tracked by Farside Investors and Coinglass. BlackRock's IBIT amassed over $260 million on Tuesday, accounting for a giant share of the cumulative inflows. FBTC drew $61.1 million, while others, except GBTC, DEFI and BTCW, pulled in less than $30 million each. These funds have collectively drawn in over $1 billion in just the last three days, underscoring investors' confidence in bitcoin's price prospects. BTC has surged 23% to $65,800 since hitting a low near $53,500 on July 5, CoinDesk data. In addition to the ETF inflows, the price recovery may be linked to the exhaustion of selling pressure from Germany's Saxony state, dramatic improvement in the probability of pro-crypto Republican candidate Donald Trump winning the U.S. presidential election on Nov. 4 and Trump's decision to appoint BTC-holder and Ohio Republican senator James David Vance as vice president. Vance has supported BTC and digital assets since 2021 and began circulating a draft version of crypto legislation last month. "It is notable that Vance advanced crypto legislation at a moment when he knew he was being considered by Trump for VP. This highlights the new-found political relevance of crypto, but also the extent to which digital asset policy has become a part of the Republican vision for the US economy," FRNT Financial said in the newsletter Tuesday. "Additionally, given that Trump can only serve another four years if elected, the VP decision was also seen as a choice on political succession. It is additionally encouraging for the crypto community that Trump’s seeming political successor is a BTC holder and has prioritized crypto-friendly legislation," FRNT added. It's also likely that with the supply overhang from Saxony behind us, the crypto market is catching up the sustained rally in technology stocks on Wall Street. Such is the optimism that reports of renewed creditor reimbursements from defunct exchange Mt. Gox on Tuesday failed to keep BTC prices under pressure for long. https://www.coindesk.com/markets/2024/07/17/bitcoin-etf-inflows-hit-six-week-high-of-4225m/

2024-07-16 23:36

Trump’s presidential campaign has raised about $3 million in crypto, mostly bitcoin and ether. Former president Donald Trump planning to release a fourth NFT collection, according to a Bloomberg interview. Trump has pivoted to embracing the crypto industry, saying "if we don’t do it, China is going to pick it up." Donald Trump plans to release a fourth NFT collection, according to a wide-ranging interview with the former president published in Bloomberg Businessweek on Tuesday. In the interview, Trump said his previous collections were “very successful” and sold out in a day: “The whole thing sold out: 45,000 of the cards. And I did it three times [and] I’m going to do another one, because the people want me to do another one. It’s unbelievable spirit. Beautiful.” Trump previously teased the idea of releasing a fourth NFT collection at a gala for his mugshot NFT holders at Mar-a-Lago in May, but was non-committal at the time, saying “I believe in supply and demand. And as you know, one did great, two did great, three did great. At some point maybe that turns around.” But as the crypto industry continues to rally behind Trump’s reelection campaign, the former president seems to be growing more comfortable embracing NFTs and crypto. In May, Trump’s campaign began accepting crypto donations. A Tuesday report from the Wall Street Journal citing new data from the Federal Election Commission (FEC) found that, of the roughly $331 million raised by Trump’s election campaign last quarter, about $3 million was in crypto. Yesterday, Trump announced pro-Bitcoin senator J.D. Vance (R-Ohio) as his choice for running mate. Major players in the crypto industry, including Kraken co-founder Jesse Powell and Gemini co-founders Tyler and Cameron Winklevoss have donated hefty sums to Trump’s reelection campaign and related super PACs, including the new Trump-focused America PAC and pro-crypto Fairshake. “It’s not going away. It’s amazing,” Trump said to Bloomberg Businessweek about crypto, adding that he’s “gotten to know a lot of people” from the crypto industry at his fundraisers, calling them “top-flight people.” Once an outspoken crypto skeptic, Trump told Bloomberg Businessweek that he’s pivoted to embracing the industry because “if we don’t do it, China is going to pick it up and China’s going to have it – or somebody else, but most likely China. China’s very much into it.” “We have a good foundation,” Trump said of the U.S. crypto industry. “It’s a baby. It’s an infant right now. But I don’t want to be responsible for allowing another country to take over this sphere.” https://www.coindesk.com/policy/2024/07/16/trump-says-hell-release-fourth-nft-collection-the-people-want-me-to-do-another-one/