2024-10-23 10:02

Partisia blockchain has a proven track record of over 16 years, including with the Danish health authorities, global leaders like Bosch and humanitarian institutions like the Red Cross. The “unparalleled” nature of Partisia Blockchain’s “provenance and depth of experience” makes it uniquely placed to solve the problem of data privacy in public blockchains, Adrienne Youngman, CEO of Partisia Blockchain Foundation told CoinDesk in an interview on Tuesday. Privacy has been a weakness for public blockchains for years causing enterprises and institutions to be reluctant in using the technology to solve real world problems because it reveals sensitive data. Earlier this year, crypto analytics platform Arkham’s CEO Miguel Morel said “Publicly available blockchains are probably the worst possible way of keeping one's private information private.” Partisia says it offers “complete data privacy” as the “industry’s most secure,” interoperable token and data bridge using advanced multiparty computation (MPC) to bring privacy to public blockchains, helping anyone trying to implement complex use cases affecting the average person. But what made Partisia uniquely positioned to offer this solution when similar service providers such as Fireblocks, Zama.ai and Chainlink are visible competitors. Youngman and Partisia’s Chief Product Officer Mark Bundgaard said its depth of experience, a result of its origins which go back 36 years makes it unique. In 1988, Danish cryptographer Ivan Damgård co-wrote the first paper on multiparty computation (MPC) while pursuing his PHD studies in Aarhus University. He would also co-invent the Merkle–Damgård construction, which is used in influential cryptographic hash functions. By the time of the 2008 financial crisis, Damgård was a full professor at the university and had founded Partisia, a Denmark based tech group. Partisia applied MPC to solutions for the Danish and Norwegian governments, and multinational corporations, before combining it with blockchain for private deployments. “Partisia was founded to tackle a critical 'real world' challenge: enabling collaboration on sensitive data without compromising privacy,” Youngman said. “Our blockchain draws on decades of cryptographic expertise from pioneers like Ivan Damgård allowing us to build solutions that not only overcome barriers to real-world adoption but also create entirely new business models, giving individuals and enterprises unprecedented control over their data.” Youngman said Partisia blockchain has a proven track record of over 16 years, including with the Danish health authorities to use patients’ data without revealing their identity. It has also collaborated with global leaders like Bosch and humanitarian institutions like the Red Cross, with whom they are working to make aid-distribution in conflict zones more efficient and safe. MPC is a cryptographic technique secures secrets by sharing them among multiple parties ensuring that no single party has complete control over the wallet, increasing security. It’s different from Zero Knowledge Proofs because it offers more composability or more combinations, and makes it possible to run more complex queries. ZKPs validate knowledge without revealing it. The MPC token is also the Partisia blockchain’s native token. Read More: MPC Explained: The Bold New Vision for Securing Crypto Money https://www.coindesk.com/policy/2024/10/23/why-partisias-blockchain-may-be-uniquely-placed-to-solve-the-data-privacy-issue/

2024-10-23 10:00

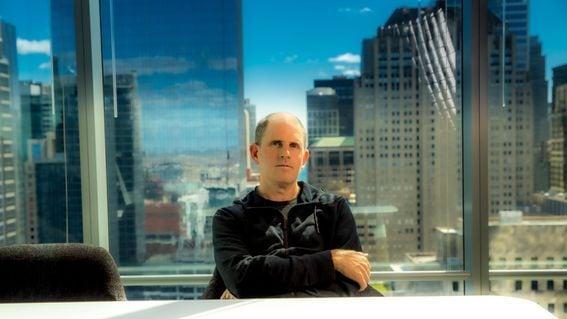

Gensler's SEC has been vague about how crypto firms can register to legally trade digital assets in the U.S. Chicago-based markets giant Don Wilson thinks that’s a strategy, not an accident. In an interview with CoinDesk, Don Wilson slams the SEC's crypto crackdown, drawing parallels to his past victory over the CFTC, another Gary Gensler-led regulatory agency The SEC's stance toward crypto "reminds me of 'Atlas Shrugged,'" Wilson said. "[If] everybody is breaking the law, they get to selectively harass whoever they want to." Wilson thinks the SEC's lack of clarity for crypto companies is intentional, not accidental. Don Wilson is feeling déjà vu. This month, the U.S. Securities and Exchange Commission sued Cumberland DRW, a division of DRW, the Chicago-based trading giant Wilson founded and runs. The markets regulator accused the company of trading at least $2 billion of cryptocurrencies including Solana's SOL and Polygon's POL (formerly MATIC) without first getting permission. The case hinges on the SEC deeming those assets securities, a designation that imposes all sorts of requirements on traders like DRW. It's not DRW's first tangle with a regulator. In fact, it's not even DRW's first tangle with Gary Gensler, the SEC's chairman. Back in 2013, when Gensler ran the U.S. Commodity Futures Trading Commission, the agency filed suit against DRW and Wilson himself, claiming that they manipulated the market for an obscure interest-rate swap. Wilson and his firm denied any wrongdoing – they had, they argued, simply discovered a lucrative arbitrage opportunity their competitors overlooked. They fought the CFTC and won – big time. The judge in the case, District Judge Richard Sullivan of the Southern District of New York (now a judge in the U.S. Court of Appeals for the Second Circuit) emphatically sided with Wilson after a four-day bench trial, slapping down the CFTC's suit in a scathing 2018 dismissal. He called the CFTC's arguments "absurd." Wilson recalls that ruling fondly. 'Earth is flat' In an interview with CoinDesk on Friday, Wilson said his favorite lines in the dismissal were Sullivan's quip that "it is not illegal to be smarter than your counterparty in a swap transaction" and the judge's assertion that "it is only the CFTC's Enforcement Division that has persisted in its cry of market manipulation, based on little more than an 'Earth is flat'-style conviction." Gensler had long since left the CFTC by the time Sullivan smacked down the regulator's case. But he was there to launch it. "It seemed to us that what the CFTC was trying to do was expand the definition of manipulation," Wilson said. That line probably sounds uncomfortably familiar to crypto insiders. Under Gensler's leadership, the SEC has taken steps, both official and unofficial, to expand its authority over crypto. In February, it broadened the definition of a securities "dealer" to capture a large swath of the crypto market, which fits with Genser's often-repeated belief that "the vast majority" of crypto tokens are securities and thus deserve SEC oversight. Gensler has said over and over that crypto businesses simply need to "come in and register," and they'll be able to trade crypto without issue. The Oct. 10 lawsuit against DRW says: "Cumberland bought and sold, for its own accounts as part of its regular business, at least $2 billion worth of crypto assets that were offered and sold as securities. In doing so, Cumberland acted as a securities dealer but failed to register as a securities dealer with the Commission." Wilson sees it very differently. "We set up a broker-dealer and tried to register it to trade crypto assets," Wilson said in the interview. "The markets division of the SEC said, 'If you register, the only ones you could trade are ETH and bitcoin.' The enforcement arm said, 'You failed to register.' Obviously, those two things are inconsistent." The SEC did not respond to CoinDesk's request for comment. Bringing 'Atlas Shrugged' to life? Kevin Haeberle, a professor of corporate law and securities law at U.C. Irvine School of Law, said that some heads of regulatory agencies are simply "more aggressive" than others. "When those individuals find themselves limited in what they can do in terms of rule-making, they often turn to regulation by enforcement," Haeberle said. "The SEC has a history of using the broker-dealer definition in a broad manner in order to ensure that customer-protection laws apply in a situation where the SEC would like them to apply – even where it isn't clear that the entities at issue are in fact acting as broker-dealers." To Wilson, there are many similarities between the SEC's enforcement actions under Gensler and the enforcement action he faced from the Gensler-led CFTC. He has a theory about why. In Wilson's view, the lack of regulatory clarity from the SEC is a feature, not a bug, of Gensler's leadership at both agencies. Without establishing clear rules or guidance, and demurring when asked whether a given token might be a security, the SEC preserves its ability to selectively prosecute, Wilson said. "This dynamic put the SEC in a position where they could say everyone is breaking the rule, and we're just going to go after whoever we want to. [It] reminds me of 'Atlas Shrugged,'" Wilson said. "[If] everybody is breaking the law, they get to selectively harass whoever they want to." Wilson's theory is not outside the realm of possibility. James Fanto, a professor of Law at Brooklyn Law School and co-director of the school's Center for the Study of Business Law and Regulation, told CoinDesk it's "absolutely" possible that Gensler's SEC is being purposely vague in order to preserve its power. "That's sort of the typical enforcement approach," Fanto said. "They don't gain from being crystal clear on things, especially in a new area." And what does the SEC stand to gain from its opacity towards crypto? Fanto said it could be a few things. "Some of it's money, some of it's just to get the publicity and attention," Fanto said. "Probably some of it is just this space that's not regulated, and 'Someone's got to do it, [so] we're going to do it.' But this is an SEC, under [the Biden] Administration, that has been very, very activist in an enforcement-driven way on everything, and not just crypto – on everything." It's not just Wilson who's frustrated with the situation. Last month, Rep. Patrick McHenry (R-N.C.) called the SEC a "rogue agency." SEC Commissioner Mark Uyeda recently called Gensler's tenure a "disaster for the whole [crypto] industry." Gensler, for his part, has emphatically denied accusations that his agency hasn't established clear regulations. He frequently points to a 2017 report from the agency (before he joined it in 2021) concluding that tokens issued by a decentralized autonomous organization called "The DAO" were securities. He has also swatted aside the industry's pleas for a comprehensive regulatory framework for crypto, claiming that "it already exists" in the form of the U.S. securities regulatory system that stretches back to the 1930s. At a fireside chat at NYU's law school earlier this month, he testily said, "Just because people don't like the law doesn't mean there's not law. You don't get to choose." Come in and register Gensler's oft-repeated "come in and register" refrain has become something of a joke within the crypto industry. Companies including Coinbase and Robinhood have said they tried to register as broker-dealers and were turned away. (It is worth noting that a few companies, including controversial firm Prometheum, have successfully registered as crypto broker-dealers with the SEC.) Chelsea Pizzola, counsel for DRW, called the company's rebuffed attempts to register its crypto broker-dealer Cumberland Securities LLC with FINRA (which also plays a role overseeing U.S. markets) "very frustrating," adding: "We're not the only ones out here saying we tried to register and [who] acquired a broker-dealer, tried for years to use it … tried in good faith to engage with the SEC trading and markets staff." There is some evidence that Cumberland DRW would have registered with the SEC if such a path were available. In June, the company received a highly coveted but hard-to-get BitLicense from the New York Department of Financial Services. NYDFS is known to be an exacting regulator and getting a BitLicense takes, on average, three years. But compared to Cumberland's experience attempting to register with the SEC, NYDFS seemed flexible in its approach to crypto regulation. "As we were going through the process with [NY]DFS … we were also trying to engage with FINRA, trying to engage with the SEC to use our registered broker-dealer," Pizzola recounted. "We were getting so much more traction with [NY]DFS. It's a long and complicated process, but we at least felt like we were making progress, moving forward and weren't being stonewalled." Slowing evolution Though not registered with the SEC as a broker-dealer, Cumberland DRW is a regulated entity. It's been a leading liquidity provider to the crypto industry since its inception in 2014. And, due to parent company DRW's TradFi pedigree, it has served as a self-described bridge from crypto to the traditional financial world. Wilson speculated that it's possible the SEC enforcement action could be a way to slow down the evolution of crypto. "There are some people in government who believe that it's best that government has complete control," Wilson said. "And I think that crypto, as a decentralizing technology, threatens that, and if you want to slow that down, then certainly going after the TradFi–crypto bridge would be a way of doing that." Wilson added that some lawmakers and regulators like Sen. Elizabeth Warren (D-Mass.) are antagonistic toward crypto because they "really believe in the power of the state," which crypto undermines. "If that's your worldview – that the world is better off with the government having much more control – then anything you can do to slow down the progress of crypto is making the world a better place," Wilson said. "And if you have to do it in a way that's a little bit unfair to market participants, well, you're still making the world a better place." Throwing down the gauntlet Wilson and his company are ready for another fight against a Gensler-led regulatory agency. In a statement posted to X (formerly Twitter) on Oct. 10, a spokesperson for the firm wrote: "We have proven before our firm's willingness to defend ourselves against overzealous regulators wielding their power in ways that harm rather than benefit the market. … We are ready to defend ourselves again." Wilson told CoinDesk that the best-case outcome for Cumberland DRW is a dismissal akin to the one he received in 2018. "This is such a Kafka-esque situation. I'm hopeful that the courts will see just how ludicrous this is and we'll straighten things out," he said with a laugh. "The shortest, fastest, easiest outcome would be if the judge just dismisses it." But beyond a dismissal, Wilson and Pizzola said their hope for the case is that it will lead to clarity for Cumberland DRW and other market participants. "We are good actors. We just want people like us to be able to innovate and engage productively," Pizzola said. "We just don't see the rationale for this kind of destructive engagement." Wilson said beating the CFTC cost DRW a lot of money – money that the firm, as one of the nation's largest trading firms, could afford. The SEC kerfuffle has already cost DRW a lot, he said. "It's really unfortunate," Wilson said. "In the CFTC case, there were a lot of our resources wasted and taxpayers. Now with the SEC, a tremendous amount of taxpayer resources are wasted on these cases. Obviously, there were people who did bad things in crypto and the SEC should go after these people." But in the case of DRW and others like Coinbase, "There was no path to registration, and the SEC said, 'You failed to register.'" https://www.coindesk.com/policy/2024/10/23/whos-afraid-of-gary-gensler-not-don-wilson-the-trader-who-beat-the-regulator-once-before/

2024-10-23 08:16

The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market capitalization, fell nearly 2% while bitcoin lost 1%. Bitcoin failed to sustain a rally towards $70,000, influencing a broader market decline where the CoinDesk 20 index also fell by nearly 2%. U.S.-listed Bitcoin ETFs saw a break in their inflow streak with a net outflow, suggesting a shift in investor sentiment or profit-taking after recent gains. Traders said the stablecoin volume, which often correlates with liquidity and buying power in the crypto market, has not grown, potentially signaling a slowdown in crypto market growth. Dogecoin (DOGE) and xrp (XRP) led losses among majors tokens amid a broader market downturn as traders took profits from a move higher earlier this week and U.S.-listed bitcoin (BTC)} exchange-traded funds (ETFs) snapped a 7-day inflow streak. DOGE dropped 5% while XRP fell 4% as bitcoin failed to continue a Monday rally to nearly $70,000. The tokens led gains among majors in the past 7 days on an Elon Musk endorsement and fundamental developments, respectively. The broad-based CoinDesk 20 (CD20), a liquid index tracking the largest tokens by market capitalization, fell nearly 2% while bitcoin lost 1%. Traders, however, foresee a run to $80,000 in the coming weeks as the U.S. elections draw near, regardless of who is elected president. Market action remained generally flat on mid-caps and low-caps. However, memecoin bonk (BONK) and governance token APE dropped over 7% to lead losses among smaller tokens. Traders pointed out that a key bitcoin resistance and a pause in stablecoin issuances were among the causes for a slow uptrend in bitcoin and other cryptocurrencies. “The main reason for the entire crypto market's subsidence seems to be Bitcoin, which the bears defended against an assault on the $70K level,” Alex Kuptsikevich, senior market analyst at FxPro, told CoinDesk in an email. “They intensified selling at $69.5K early in the day on Monday and dropped the price to $66.5K on Tuesday morning.” “Stablecoin volume has not increased since late September, setting up a potential pause in the growth of the broader cryptocurrency market, as stablecoins are often seen as liquidity for quick purchases of coins of interest. The previous growth momentum was from August to September, when the overall crypto market capitalization pushed off the bottom,” Kuptsikevich added. Stablecoin liquidity and growth are closely related to higher bitcoin and crypto prices, as a CoinDesk analysis previously showed. Bitcoin ETFs lost a net $80 million on Tuesday with Ark Invest’s ARKB seeing a $134 million outflow, a record figure for the product. BlackRock’s IBIT took in $42 million, leading inflows, while Fidelity’s FBTC and VanEck’s HODL took in $8 million and $3 million, respectively. Meanwhile, BlackRock’s ether ETF took in $11 million on Tuesday while other products showed no inflow or outflow activity. https://www.coindesk.com/markets/2024/10/23/doge-xrp-lead-crypto-majors-decline-as-bitcoin-etfs-bleed-80m/

2024-10-23 07:40

The uptick in Treasury yields is consistent with the Fed's previous non-recessionary rate cuts and is not bearish for risk assets, according to TS Lombard. Concerns about rising U.S. Treasury yields and Fed's supposed policy mistake may be overblown, according to TS Lombard. BTC's daily chart shows an impending golden cross, signaling bullish outlook. Bitcoin's (BTC) latest failure to surpass $70,000 has analysts scrambling for an explanation, with some worrying the ongoing rise in the U.S. Treasury yields could lead to an extended drop. The concerns, however, may be overblown, and the path of least resistance for bitcoin remains on the higher side, consistent with the upcoming coveted "golden cross" price pattern. The yield on the U.S. 10-year note topped its 200-day simple moving average Monday, reaching a three-month high of 4.26% at press time, according to charting platform TradingView. The benchmark bond yield has surged 60 basis points since the Fed cut rates by 50 basis points on Sept. 18. The rise in the so-called risk-free rate makes bonds more appealing, often sucking out money from relatively riskier assets like cryptocurrencies and technology stocks. Interestingly, bitcoin's ascent ran out of steam on Monday at nearly $70,000, and prices have since retreated to $67,000. Pseudonymous analyst The Great Martis, who often describes bitcoin as Nasdaq ETF, sees a perfect storm for risk assets as bond yields surge. Several others see the post-rate cut uptick in the yield as a evidence of a policy mistake, comparing the recent outsized 50 basis point rate cut implemented in a non-recessionary environment with the premature easing of 1967. Back then, the central bank cut rates in the face of a tighter labor market, paving the way for broad-based inflation that eventually led to a recession in a couple of years. The fears likely stem from the hotter-than-expected September jobs report and inflation data, which have dented the case for continued Fed rate cuts, adding upward pressure on yields. TS Lombard disagrees London-based macroeconomic research firm TS Lombard disagrees with the narrative. "Central banks think policy is tight and want to cut gradually. If employment cracks, they will cut fast. If employment bounces, they will cut less. Two months ago, bonds were pricing a strong possibility of falling behind the curve. Now the recession skew is gone, yields are up. That is not bearish risk assets and it doesn't mean the Fed has screwed up," Dario Perkins, managing direction, global macro at TS Lombard, said in a note to clients on Oct. 17. "If someone is making a mistake, it is those who anchor their views on a 'policy error' – seemingly irrespective of what authorities do," Perkins added. The research note explained that Fed rate cuts won't restoke inflation as it did in 1967 for several reasons, including the rollover of debt at higher rates, while stressing that the recent rise in Treasury yields is consistent with the past "non-recessionary rate cuts." The chart shows the performance of the 10-year yield in 12 months following the initial rate cut of the past non-recessionary easing cycles. Except for 1984, the 10-year yield hardened after the first rate cut., which means what we are seeing right now is not surprising and may not lead to a significant outflow of money from risk assets and into bonds. Besides, according to the Fed, the neutral interest rate, which is neither stimulatory nor tight, is in the 2½-3% range – 200 basis points below the present Fed funds rate (the benchmark interest rate) range of 4.75% to 5%. In other words, the recent rate cut is not necessarily a policy mistake and the central bank "can cut a lot even if the economy is resilient," according to Perkins. Note that gold, a zero-yielding traditional safe haven asset, has been setting record highs in the face of rising nominal and real yields, offering bullish cues to perceived store of value assets like bitcoin. Golden cross BTC's 50-day SMA has turned up and looks set to move above the 200-day SMA in the coming days, confirming what is known as the "golden crossover." The pattern indicates that the short-term price momentum is outperforming the long-term, potentially evolving into a bull run. The moving average-based indicator is often criticized for being a lagging signal and trapping traders on the wrong side of the market. While that's largely true, there have been instances of the Golden Cross presaging major bull runs. A trader holding BTC for a year following the occurrence of the first two golden crosses and the one in May 2020 would have made triple-digit percentage returns. The cryptocurrency doubled in value to new lifetime highs over $73,000 following the golden cross dated Oct. 30, 2023. https://www.coindesk.com/markets/2024/10/23/as-bitcoin-nears-golden-cross-concerns-about-rising-treasury-yields-look-overhyped/

2024-10-23 07:12

SKY has significantly underperformed the CoinDesk 20 index, since the re-brand. MakerDAO's community is set to debate dropping the Sky brand. A formal governance poll is scheduled for November 4. MakerDAO is contemplating dropping the Sky brand after a lukewarm reception to the re-brand and a successful launch of the USDS stablecoin. The USDS stablecoin, launched in August, is designed to offer native token rewards and operate alongside the existing DAI synthetic stablecoin, which remains unchanged. On-chain data shows it has a supply of $1.2 billion and offers a savings rate of 6.5%, with a general agreement amongst community members that the launch was successful. “It is also now more clear than ever just how much the DeFi community loves and trusts the Maker brand,” Sky co-founder Rune Christensen wrote on its governance forum. "There was a lot of affinity for the brand and what it stands for: stability, security, and DeFi scale. And there is a lot of commitment to holding the MKR token versus upgrading to SKY." Christensen wrote that three proposals are being considered to address community concerns: continue with Sky as the core brand to build on its recent momentum, recenter the Maker brand with its original identity and reinstate MKR as the sole governance token, or bring Maker back with a refreshed brand that aligns with the current ecosystem while maintaining its established trust and stability. Several contributors have pointed out that the introduction of the SKY token, which replaced MKR as the core governance token under the Sky ecosystem, has not delivered the anticipated growth. In the last two weeks, SKY is down 23% while the CoinDesk 20, an index fund that measures the performance of the largest digital assets, is up 10%. MKR, the governance token, is down 24% on-year according to CoinDesk data. The controversial "freeze function," introduced to ensure regulatory compliance, has also been criticized for its lack of clear utility and potential long-term risks. With 13.79 million DAI and 9,535 MKR (approximately $25 million in total) spent on the rebrand, Christensen said MakerDAO will host a community call to gather feedback about the re-brand, then the platform will conduct a formal governance poll on November 4 to determine its next steps. https://www.coindesk.com/markets/2024/10/23/makerdao-contemplates-dropping-sky-brand-as-community-debates/

2024-10-23 06:52

There are skewed expectations of a Republican win as better for bitcoin. However, some say the asset is poised to go higher either way as several macroeconomic factors weigh in. Crypto options traders are increasing their bets that bitcoin will touch fresh highs by the end of November, per Bloomberg. Options due to expire on November 8 have their highest open interest at the $75,000 strike price, indicating a key market focus area for that period. Bitcoin (BTC) may cross previous highs in the coming weeks regardless of which candidate becomes the U.S. president, some traders say, in a shift of tone ahead of the November elections. Traders have long perceived Republican Donald Trump’s victory as a bullish catalyst for the industry for his pro-crypto stance and promises to make the U.S. a bitcoin powerhouse. Democrat Kamala Harris, on the other hand, has not made similar promises but said he would introduce regulations to protect certain groups. Such stances have skewed expectations of a Republican win as better for bitcoin. However, some say the asset is poised to go higher either way as several macroeconomic factors weigh in. “Both Presidential candidates have adopted pro-crypto stances to appeal to voters, but it's tough to say if any of their promises will come to pass,” Jeff Mei, chief operating officer at crypto exchange BTSE, told CoinDesk in a Telegram message. “However, It is clear that the market is responding positively to the upcoming change in administration and policies - whether it's Harris or Trump, traders and investors think any sort of change will be good.” “The fact that this coincides with the first Fed rate cuts in four years and a recent run-up in stock prices only adds to the thesis that Bitcoin could surpass its all-time high and reach $80,000,” Mei added. Options traders are already increasing bets that bitcoin will touch fresh highs by the end of November, as previously reported. The implied volatility for bitcoin options due around election day is elevated. The open interest for call options expiring on November 29 shows a significant concentration at the $80,000 strike price, followed by a notable interest at the $70,000 level. For call options with expiration on December 27, the open interest is primarily grouped around the $100,000 and $80,000 strike prices. Options due to expire on November 8 have their highest open interest at the $75,000 strike price, indicating a key market focus area for that period. However, some are terming the price behavior as an election hedge rather than a bullish outlook. “I wouldn't say that people buying 80K calls on BTC to be a bet on higher prices, but is more like a cheap option (implied vol really hasn't gone up that much) against a broader market rally,” Augustine Fan, head of insights at SOFA, told CoinDesk in a Telegram message. “BTC vol skews heavily in favor of higher prices post election, but that has been the case for quite a few weeks now as an election 'hedge,” Fan added. BTC is down 0.7% over the past 24 hours, CoinGecko data shows, outperforming a 1.6% drop in the broad-based CoinDesk 20 (CD20). https://www.coindesk.com/markets/2024/10/23/bitcoin-is-going-to-80k-regardless-of-trump-or-harris-win-traders-say/