2024-10-21 19:59

Chris Larsen has donated more than $11 million to the vice president's election effort, sending millions worth of the crypto token to the Democratic super PAC Future Forward, according to his comments and federal records. Ripple co-founder Chris Larsen said he amplified his support for Vice President Kamala Harris, adding $10 million worth of XRP to her election efforts. Larsen, now the crypto sector's biggest individual Harris booster, said she'll bring a "new approach to tech innovation." Ripple co-founder and Executive Chairman Chris Larsen said he'd added another $10 million in the Ripple-tied token (XRP) in an effort to boost Vice President Kamala Harris as the Democrat faces off against former President Donald Trump in next month's election. Larsen has become the crypto sector's leading supporter for Harris, saying Monday in a posting on X that he's pitching in with $10 million in XRP to the political action committee Future Forward. "It's time for the Democrats to have a new approach to tech innovation, including crypto," he wrote, adding that Harris "will ensure that American technology dominates the world." Federal Election Commission records show Larsen had previously donated $1,750,000 to the PAC. He's also given hundreds of thousands of dollars to Democratic congressional campaigns. While significant, his millions are overshadowed by the overall crypto industry's campaign involvement, led by the super PAC Fairshake. That group's $169 million in donations – primarily from Coinbase Inc. (COIN), Ripple Labs and Andreesen Horowitz (a16z) – has not only dominated the crypto sector's election involvement but has put it among the biggest sources of campaign cash in the 2024 elections. While Fairshake has made some clear efforts to divide its spending between the two major parties and to avoid taking a side in the presidential election, many of the industry's leaders have come out individually for their presidential favorites. Read More: Crypto Insiders Courting Vice President Harris Chase Whispers of Her Openness Countering Larsen, some pro-Trump crypto names have included Tyler and Cameron Winklevoss, Kraken co-founder Jesse Powell and also venture capital giant a16z's leaders, Marc Andreessen and Ben Horowitz. However, Horowitz declared early this month that he also intended "a significant donation to entities who support the Harris Walz campaign," because of a longstanding friendship. Most of the money given by crypto leaders such as Larsen are going into super PACs. Rather than giving directly to a candidate's own campaign, which is heavily limited for individuals, they can send as much as they like to the PACs, thanks to the Supreme Court's 2010 Citizens United opinion. Super PACs can make unlimited so-called "independent expenditures" on advertising that supports a candidate, as long as they don't coordinate with the campaign. While Larsen was among 88 corporate leaders who signed a letter endorsing Harris last month, Ripple and its CEO Brad Garlinghouse have sometimes sought to derail Democrats in these elections. Ripple's giving leaned into the Republican side in one key situation: trying to defeat crypto critic Sen. Elizabeth Warren (D-Mass.) And Garlinghouse gave $50,000 to a super-PAC aimed at building a Republican majority in the Senate, according to FEC filings. https://www.coindesk.com/policy/2024/10/21/ripple-co-founder-larsen-flooding-kamala-harris-election-effort-with-xrp/

2024-10-21 19:00

Automating and standardizing corporate actions data could help significantly reduce operational inefficiencies that currently cost businesses millions of dollars every year due to errors and manual data processing, the report said. A new Chainlink (LINK) initiative aims to standardize the process of collecting and distributing information about key actions taken by corporations such as mergers, dividends and stock splits – vital data that is currently fragmented across countries. Key participants included Euroclear (a major clearing and settlement firm in traditional finance), Swift (the messaging platform that connects banks around the world) and Franklin Templeton (the asset manager), while crypto projects Avalanche (AVAX), ZKsync (ZK) and Hyperledger Besu also contribute. The process can "dramatically reduce the manual processes required, enabling significant potential operational efficiency and cost reduction," Wellington Management's digital asset and tokenization head said. Data provider Chainlink (LINK), with major financial market participants including Euroclear, Swift and Franklin Templeton, announced Monday that it started an initiative to make corporate actions data more accessible and standardized using artificial intelligence and blockchain tech. The project aims to address a long-standing challenge in the financial world: the lack of standardized and real-time data for corporate actions such as mergers, dividends and stock splits, which are notoriously fragmented in markets like Europe, Chainlink's report said. Automating and standardizing this information could help significantly reduce operational inefficiencies that currently cost businesses millions of dollars every year due to errors and manual data processing, according to the report. The data is commonly used by investors. "Turning various pieces of disconnected corporate actions data into unified 'golden records' that can then be relied on by hundreds of market participants as a definitive, single source of truth is truly a huge step forward," Chainlink co-founder Sergey Nazarov said. "This will help financial markets synchronize faster, reduce errors and cut costs." The initiative's first phase focused on corporate actions data of equity and fixed-income securities across six European countries. Chainlink connected its decentralized oracles with large language models (LLMs) like OpenAI's ChatGPT, Google's Gemini and Anthropic's Claude to extract corporate actions data from various sources and transform it into a structured format called "Golden Records" that comply with global financial standards like the ISO 20022 and the Securities Market Practice Group (SMPG) guidelines. Then, it used Chainlink's Cross-Chain Interoperability Protocol (CCIP) to publish and distribute data across different blockchains. Later stages, for example, will explore ways to integrate this framework with existing financial systems like Swift messaging standards for broader industry adoption, the report said. Participants in the initiative include Euroclear, Swift, UBS, Franklin Templeton, Wellington Management, CACEIS, Vontobel and Sygnum Bank. Blockchain ecosystem partners Avalanche (AVAX), ZKsync (ZK) and Hyperledger Besu networks also contributed. "By leveraging AI and Chainlink oracles to interpret, standardize, and deliver high-value unstructured data, we can dramatically reduce the manual processes required, enabling significant potential operational efficiency and cost reduction," said Mark Garabedian, Wellington Management's director of digital assets and tokenization strategy. https://www.coindesk.com/business/2024/10/21/chainlink-partners-with-major-financial-players-to-improve-corporate-actions-data-reporting-using-ai-and-blockchain/

2024-10-21 18:51

Several prospective issuers have filed to launch exchange-traded funds tracking smaller coins like Ripple's XRP or Solana (SOL), but the trajectory of those applications may lie with American voters. Crypto ETFs beyond bitcoin (BTC) and Ethereum's ether (ETH) are unlikely to be approved under a Kamala Harris presidency, two ETF experts say. There are applications for ETFs tracking Ripple's XRP and Solana (SOL), and if Donald Trump wins the U.S. presidential election, their approval odds could improve significantly, the analysts said. Several firms recently began seeking approval to create U.S. exchange-traded funds that track cryptocurrencies beyond the already-approved bitcoin (BTC) and ether (ETH) products. Those applications will probably go nowhere if Democratic Presidential nominee Kamala Harris wins the election in November, according to two ETF experts. The approval of spot bitcoin and ether ETFs earlier this year was seen as a huge win for the industry after issuers fought for years to introduce such funds. One issuer, Grayscale, even sued the U.S. Securities and Exchange Commission to overcome the regulator's rejection – and won. Billions of dollars have poured into the new ETFs. Since then, issuers have been taking stabs at the next big crypto ETF launch, with applications currently in process for a fund tracking Ripple's XRP (XRP) token and the native cryptocurrency of the Solana blockchain, SOL (SOL). "It won't happen if Harris wins, regardless of the issuer," said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. Some industry experts believed that when asset management giant BlackRock joined the race to list bitcoin and ether ETFs, that significantly improved the chances the SEC would approve them – though it's unclear how big a factor BlackRock actually played. If former President Donald Trump wins the election, however, there'd be a "decent chance" for more crypto ETFs, regardless of whether BlackRock joins Bitwise, VanEck and others that want to expand crypto ETFs beyond bitcoin and Ethereum's ether, according to Balchunas. Nate Geraci, president of the ETF Store, echoes this outlook. "It seems highly unlikely that a Harris administration would approve additional spot crypto ETFs, at least not anytime soon after the election," he said. Seeing how current President Joe Biden's administration has approached crypto, which Geraci characterized as "combative, overall," and taking into account Harris' powerful position in that administration, it is fair to assume that the status quo would continue under her leadership, according to Geraci. Trump's odds of winning the election have surged to 62.4%, the highest in months, according to prices on the leading prediction market, Polymarket. The former president has won support from the crypto community in recent months after taking a favorable stance toward the industry. He appeared at a prominent Bitcoin conference, endorsed a DeFi platform and visited a Bitcoin bar in New York ever since making crypto support a big part of his campaign. Harris, on the other hand, has been much less vocal about the sector and has only recently unveiled plans to establish a regulatory framework for cryptocurrency and digital assets, which she aimed toward Black men, who her campaign noted are more likely to own crypto. However, details on how she'd support crypto are still scarce. https://www.coindesk.com/business/2024/10/21/crypto-etfs-look-unlikely-to-expand-beyond-bitcoin-ether-under-kamala-harris-experts-say/

2024-10-21 16:20

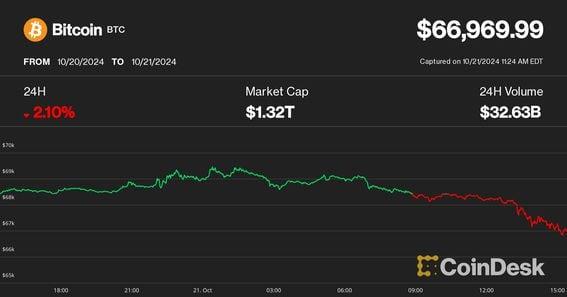

It's been an excruciating seven-plus months for the bulls as upside price breakouts have continually been reversed. Following a failed challenge of the $70,000 level during early Monday trading hours in Asia, bitcoin (BTC) fell below $67,000 in U.S. morning action. Recently, bitcoin's price was lower 2.3% over the past 24 hours, underperforming the broad-market CoinDesk 20 Index's 1% loss during the same period. Ethereum's ether (ETH) was also down nearly 1%, while litecoin (LTC), polkadot (DOT) and the internet Computer Protocol's token (ICP) led losses with 4%-5% declines. A notable outperformer was Solana (SOL) with 2.4% gain to $163, though still down from its $170 weekend high. Bitcoin mining stocks also suffered, but one outlier was TeraWulf (WULF), which recently pivoted to high-performance computing to power artificial intelligence (AI) data centers. It's higher by 12% on Monday. Checking possible catalysts for today's action, one need look no further than the recent price movement: bitcoin had risen in near-continuous fashion since dipping to just under $60,000 eleven days ago – a modest reversal was surely in the cards at some point. There's also been a sharp rise in interest rates across Western economies on Monday, among them 10 basis point gains in both the U.S. 10-year Treasury yield and the German 10-year Bund yield. Other things being equal, higher rates can often pressure prices of risk assets, bitcoin among them. Zooming out a bit further, bitcoin – for the moment – remains in the same flat-to-down price channel its been in since recording a record high of $73,700 more than seven months ago. Prior to today, the most recent challenge of the $70,000 level was in late July. It too failed and bitcoin had sunk to under $52,000 days later. "Wouldn't be unreasonable to get another HL [higher low] potentially with a sweep of $66K, probably where the next opportunity is," well-followed analyst Skew said in an X post. Upcoming quarterly earnings reports this week for U.S. public companies may weigh on investors' risk appetite at the stock market, and consequently on cryptocurrencies due to the strong correlation between the asset classes, crypto trading firm Wincent noted. "It's a risk off week given the recent performance of BTC and the earnings week in the U.S. adding to a risk off mentality," a Wincent spokesperson said in a Telegram message. "We can expect a brief pullback this week and then watch out for a potential rally and all-time highs as we push into the U.S. elections." https://www.coindesk.com/markets/2024/10/21/bitcoin-pulls-back-below-67k-is-another-crypto-rally-failing/

2024-10-21 14:58

Transak, a so-called "onramp" used by crypto platforms like Metamask, Binance and Trust Wallet allowing customers to buy cryptocurrencies, says the leak was limited to "names" and "basic identity information." The attack is being categorized as "mild or moderate" since it didn't involve social-security numbers or credit-card details. A ransomware group is making demands. The employee reportedly responsible for the breach has been "exited," Transak officials told CoinDesk. A crypto-industry employee's use of a laptop for non-work purposes is reportedly at the heart of a data breach involving some 93,000 unique users – and now a ransomware group is attempting to negotiate with the company that was targeted. Transak, an "onramp" used by a number of popular blockchain companies to allow customers to buy cryptocurrencies, disclosed in a blog post on Monday that it had fallen victim to a data breach. According to Transak, the leaked data was limited to "names" and "basic identity information." In an interview with CoinDesk, Transak CEO Sami Start said that 93,000 people were impacted by the breach, which included passports, ID cards and selfies used by customers to verify their identities with crypto financial products. The team is categorizing the incident as "mild or moderate," Start said, since it did not involve more sensitive information that might bring greater risk. Additionally, according to the company, only 1.14% of the user base was affected. "There's no bank statements, there's no social security numbers, there's no credit card information, there's not even any emails or passwords that were accessed, which limits the severity of this incident significantly," he said. Ransomware group claims responsibility The CEO said Transak was reaching out to customers and had notified law enforcement as well as data regulators. But the company is also in the position of being asked to negotiate for mitigation measures with a ransomware group that claimed responsibility for the attack, who has already ridiculed a purported $30,000 offer to delete the stolen data. The ransomware group says the data came from a larger subset of Transak's customers and did include some financial data. "This breach has impacted all KYC [know your customer] DATA processed through Transak's infrastructure," the ransomware group claimed in a public Telegram group that it operates. "We have extracted more than 300GB of data, which includes sensitive personal documents such as government-issued IDs, proof of address, financial statements, and user selfies." The ransomware group claims it has only released a subset of the stolen data it has on hand. If Transak fails to pay a ransom, the group threatened to "leak the remaining data or sell it to the highest bidder." Popular onramp Transak provides developers with tools to bridge users from fiat to crypto, such as by allowing them to purchase cryptocurrencies via credit card. According to its website, Transak has been integrated into major blockchain wallets like Metamask and Trust Wallet, among others. Crypto exchanges like Coinbase and Binance.US also use Transak's services. Start told CoinDesk that Transak is not interested in negotiating with the ransomware group. "We don't know if they necessarily did this or if they're just claiming credit for it," said Start. "They've released this evidence where they've shown some screenshots from our KYC vendor, but it's possible that someone else posted that somewhere else and they've just taken credit for it." According to Start, the data breach occurred because an employee "used their laptop for things other than work." "They've been exited from the company," said the Transak CEO. "They did some non-work related activities on their laptop that caused them to run a script – a malicious script – that gave access to their system." The access enabled hackers to gain access to one of Transak's third-party user authentication, or KYC (know-your-customer), services. According to Start, this particular vendor had a "vulnerability" in its system, which enabled the attacker to download a subset of Transak's user data via the compromised device. In his interview with CoinDesk, Start insisted that the data breach was limited exclusively to this KYC service. "Any rumors about accessing any other systems are not true," Start said. The attackers "may have gotten some screenshots that were in the employee's download folder – maybe one or two screenshots of some other system – but they only accessed this one vendor, and they only accessed the users that I mentioned. I challenge anyone to show otherwise." https://www.coindesk.com/tech/2024/10/21/crypto-on-ramp-service-transak-targeted-in-data-breach/

2024-10-21 13:45

Bridge, which has raised $54 million in funding, previously said it aspired to become the blockchain version of Stripe, operating a global system in which other developers could integrate Looking to advance its cryptocurrency ambitions, payments processor Stripe has finalized a deal to buy stablecoin platform Bridge for $1.1 billion, according to a Sunday X post from TechCrunch founder Michael Arrington and later confirmed by Stripe and Bridge. Bridge, which has raised $54 million in funding, was founded by Square and Coinbase alumni Zach Abrams and Sean Yu, and counts SpaceX and Coinbase (COIN) among its customers. The startup previously said it aspired to become the blockchain version of Stripe, operating a global system in which other developers could integrate. Stripe, which enables companies to accept payments online or in-person, has this year been exploring extending its offering to cryptocurrency through Circle's USDC stablecoin. CoinDesk reached out to Stripe and Bridge for comment but had not received a response by press time. Read More: Stablecoins Increasingly Used for Savings, Payments in Emerging Countries, but Crypto Trading Still Leads: Report Updated (14:40 UTC, Oct. 21): Adds confirmation by the two companies and posting by Stripe CEO Patrick Collison https://www.coindesk.com/business/2024/10/21/stripe-in-11b-acquisition-deal-for-stablecoin-platform-bridge-report/