2024-10-18 10:23

The ratio's present price pattern resembles late 2020. DOGE/BTC lingers at the depth of a prolonged bear market, undercutting any notion of speculative frenzy. The ratio's present price pattern resembles late 2020. Dogecoin's (DOGE), the world's leading meme cryptocurrency by market value, has surged 24% in one week, outpacing gains in other major tokens, including industry leader bitcoin. However, the broader downtrend in the doge-bitcoin (DOGE/BTC) ratio, which began in May 2021, persists, according to charting platform TradingView. The ratio represents DOGE's BTC-denominated valuation. The key takeaway is that it is probably too early to worry about a 2021-like speculative bubble, and the ongoing bullish trend in bitcoin (BTC) and the wider crypto market may have plenty of steam left. Back in early 2021, DOGE consistently outperformed BTC, resulting in a nearly 1,000% uptrend in the DOGE-BTC ratio in the first four months. The broader market crashed in May 2021, with BTC falling from $60,000 to as low as $30,000. The perception of dogecoin as a highly speculative asset with no intrinsic value means its price surges are often taken as a warning sign of impending market instability. DOGE's latest 24% surge in USD terms comes as long-time crypto fan Elon Musk proposed a government agency named D.O.G.E., triggering speculation of a bigger role for cryptocurrency under the potential Trump administration. The chart shows that DOGE/BTC is looking to recover from the depths of the bear market identified by the trendline connecting highs reached in May 2021 and November 2022. This week, it has bounced over 10%, defending the horizontal support from early February lows amid a bullish shift in momentum signaled by the MACD histogram. The histogram is a moving average-based technical indicator widely tracked to gauge trend changes and strength. A potential move past the trendline would mean the bear market has ended, opening doors for a notable DOGE outperformance ahead. A replay of 2020-21? The present price structure resembles 2020, when the DOGE/BTC ratio was stuck in a prolonged downtrend. The ratio eventually topped the bear market trendline in December as the MACD flipped bullish, entering the so-called speculative frenzy mode. https://www.coindesk.com/markets/2024/10/18/dogebtc-bear-trend-intact-after-dogecoins-24-weekly-gain/

2024-10-18 09:22

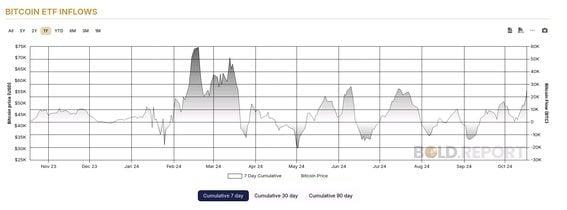

In the past four trading days, Bitcoin ETFs have purchased around 48 days of the mined bitcoin supply. On a seven-day basis, bitcoin ETPs have seen 25,675 BTC ($1.74 billion) in net inflows, the biggest since July. Since Oct. 14, bitcoin ETFs have seen approximately $1.9 billion (21,450 BTC) in net inflows. On Oct. 17, ether saw $48.4 million in net inflows, which is the largest since Sept. 27 Bitcoin's (BTC) ongoing price resurgence has investors worldwide scrambling to take exposure to exchange-traded products (ETPs) tied to the leading cryptocurrency. Global ETPs have registered a cumulative inflow of 25,675 BTC ($1.74 billion) in seven days, the biggest seven-day tally since July, according to bold.report. Bitcoin ETPs now hold 1.1 million BTC, the same amount that Satoshi's wallet holds. ETPs are a collective term that describes other funds, such as exchange-traded funds (ETFs) and exchange-traded notes (ETNs). Bitcoin (BTC) has surged by 15% since the Oct. 10 lows and is just 8% away from the all-time high set in March, CoinDesk data show. The rally is led by several factors, including expectations for Fed rate cuts and rising odds of pro-crypto Donald Trump winning the Nov. 5 U.S. Presidential election. The U.S.-listed spot ETFs have also seen a strong uptake, pulling in nearly $1.9 billion in investor money since Oct. 14, according to data source Farside Investors. In bitcoin terms, that is the equivalent of 21,450 BTC. To put this into perspective, the bitcoin ETF investors have purchased around 48 days of mined supply, as roughly 450 BTC get mined daily. These spot ETFs have now taken over $20 billion in net inflows since inception, an impressive feat as it took Gold ETFs about five years to reach the same number, according to Bloomberg's ETF Analyst Eric Balchunas. Biggest inflow into ether since Sept. 27 The U.S.-listed spot ether (ETH) ETFs saw an inflow of $48.4 million on Oct.17, the largest since Sept. 27. Inflows were spread across issuers, with BlackRock's ETHA raking in $23.6 million, taking the lifetime tally to $1.3 billion. Meanwhile, Fidelity FETH saw a $31.1 million inflow, approaching $500 million in net inflows. https://www.coindesk.com/markets/2024/10/18/global-bitcoin-etps-register-biggest-seven-day-inflow-since-july/

2024-10-18 05:48

The proposed department, abbreviated as D.O.G.E, will seek to make government spending of taxpayer money more efficient while streamlining departments that handle spending. Elon Musk discussed plans for a "Department of Government Efficiency" (D.O.G.E), leading to a 7% surge in Dogecoin's price, pushing it over 13 cents for the first time since late July. Musk's backing of Trump and the potential political implications of D.O.G.E. have sparked increased interest and speculative trading in DOGE. Dogecoin (DOGE) jumped late U.S. hours Thursday as entrepreneur Elon Musk further revealed plans for his proposed “Department of Government Efficiency” at a Pennslyvania town hall. The event encouraged early voting in the crucial state where Republicans and Democrats are in lockheads. DOGE rose 7% to over 13 cents for the first time since late July, beating the broader market and bitcoin’s 1% rise in the past 24 hours. It extended one-week gains to over 22%, the highest among all major tokens. DOGE-denoted open interest - or the number of unsettled futures bets – spiked to over 5 billion tokens in a sign of forthcoming volatility. Higher open interest alongside higher prices suggests that the market trend is strong. Musk has emerged as a key backer of Republican Donald Trump’s presidential campaign in the past months. He has donated over $75 million to the American PAC since July and is scheduled for several campaign appearances in Pennsylvania this month. The proposed department, abbreviated as D.O.G.E, will seek to make government spending of taxpayer money more efficient while streamlining departments that handle spending. Musk suggested the proposed department could be run similarly to a corporate company at the Thursday town hall, with incentives for performers and penalties for those who fail to deliver results. The expectation among crypto traders is that a Trump victory could lead to more chatter of “DOGE,” fueling retail attention and interest in dogecoin in the future if D.O.G.E actually becomes a part of the government. “Elon Musk is simply going to meme the 'Department of Government Efficiency' into existence - with validation from Trump!,” influential X trader @theunipcs said in a Wednesday post, as reported. “And you can expect him to continue to aggressively bullpost the concept until it gets created.” @theunipcs added in a Friday post that DOGE’s popularity could also fuel a rise in floki (FLOKI), a meme ecosystem project initially inspired by the name of Musk’s pet dog. Musk is a long-time dogecoin supporter and DOGE tends to surge on payments-related developments at any Musk-owned companies, such as X or Tesla. https://www.coindesk.com/markets/2024/10/18/dogecoin-jumps-7-as-musk-touts-doge-at-trumps-pennslyvania-campaign/

2024-10-18 05:44

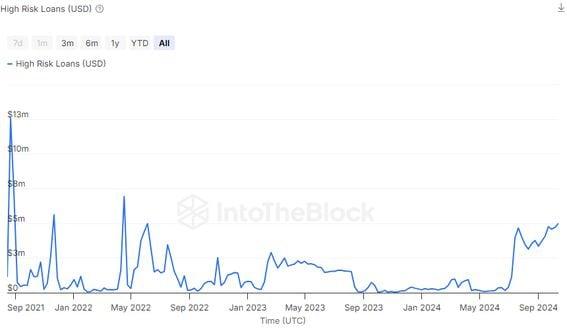

The total amount of crypto-collateralized loans within 5% of their liquidation price is at its highest in over two years. The total amount of crypto-collateralized loans within 5% of their liquidation price is at its highest in over two years on Avalanche's leading decentralized lending platform Benqi, according to IntoTheBlock. The surge in the so-called high-risk loans indicates potential liquidation cascades and market volatility ahead. The decentralized lending market on Avalanche is booming, with "high-risk" loans on decentralized platform Benqi surging to over two-year highs, sparking concerns of liquidation cascades and volatility. The total amount of high-risk loans, defined as those within 5% of their liquidation price, rose to $55 million Wednesday, reaching the highest since June 2022, according to data tracked by analytics firm IntoTheBlock. Crypto traders often draw loans from decentralized lending platforms by locking in collateral in the form of digital assets. The risk here is that if the value of the collateral falls too much, the protocol liquidates the debt by selling off the collateral. A loan within 5% of the liquidation price means if the collateral's price falls by 5%, it will no longer cover the loan, triggering liquidation. Thus, the surge in these risky loans is noteworthy as it can lead to a liquidation cascade. In this self-reinforced process, a series of liquidations happen quickly, lowering crypto prices. That, in turn, causes further liquidations and increased market turbulence. "Large liquidations can impact the collateral value, putting more loans at risk of liquidation, creating a downward price spiral," IntoTheBlock said in a market update. "Rapid market drops may result in insufficient collateral to cover loans, resulting in bad depth and losses to lenders." IntoTheBlock added that bad debt can negatively impact market liquidity, making it difficult to trade large orders at stable prices. "Bad debt can keep lenders from adding new liquidity to prevent potential losses," the firm noted. Oct. 19 3:05 AM: Updates title, bullet and lede to say high-risk loans have surged on Avalanche's Benqi platform. Data provider IntoTheBlock issued a clarification in a message on Telegram. https://www.coindesk.com/markets/2024/10/18/high-risk-crypto-loans-surge-to-a-two-year-high-of-55m/

2024-10-17 16:21

Eric Council Jr. allegedly hijacked the SEC's X account and then handed control to unnamed co-conspirators, whose fake post drove up bitcoin's price. The Federal Bureau of Investigation on Thursday said it arrested a 25-year-old man for his role in the alleged hack of the Securities and Exchange Commission's X account to falsely post the agency had approved bitcoin exchange-traded funds. Eric Council Jr., of Athens, Alabama, conspired with others to take over the X account, according to a Thursday press release from the U.S. government. After gaining access to the account, he passed control off to unnamed co-conspirators who issued the false tweet. On Jan. 9, a post on SEC's X declared "approval for #Bitcoin ETFs for listing on all registered national securities exchanges," causing bitcoin to quickly jump $1,000 in price. The cryptocurrency then cratered $2,000 when the SEC regained control of its account, deleted the post and declared it false. The SEC did end up approving the ETFs the next day. Council was paid in bitcoin (BTC) for orchestrating the account takeover, according to the FBI. https://www.coindesk.com/policy/2024/10/17/fbi-arrests-alleged-sec-hacker-linked-to-fake-tweet-saying-bitcoin-etfs-were-approved/

2024-10-17 15:09

A digital art collection of Elvis Presley, "Elvis Side $Btc," has been minted – inscribed on the Bitcoin blockchain – by OrdinalsBot and IP project Royalty. The King of Rock and Roll has been inscribed on the Bitcoin network. The collection of 1,935 generative images, "Elvis Side $Btc," was minted by Bitcoin-focused IP project Royalty in partnership with inscription service OrdinalsBot. Royalty is using revenue from the collection to form the "Elvis Legacy Council" DAO. Elvis Presley has arrived on Bitcoin thanks to a digital art collection of the King of Rock and Roll inscribed on Ordinals. The collection of 1,935 generative images, "Elvis Side $Btc," has been minted by Bitcoin-focused intellectual property (IP) project Royalty in partnership with inscription service OrdinalsBot, and is inspired by the artwork of Joe Petruccio, an artist licensed by the Elvis Presley Estate. The Ordinals protocol allows data to be "inscribed" onto individual satoshis (the smallest unit of BTC at 1/100,000,000 of a full bitcoin), making them unique and therefore able to attain individual value. In this sense, they are the Bitcoin version of non-fungible tokens (NFTs), which brought Ethereum-based digital art to mainstream prominence in 2021. OrdinalsBot, a platform for minting the inscriptions, has emerged as one of the more influential projects in the Bitcoin development sector. It claims to be responsible for 80% of the 10 biggest files inscribed on the Bitcoin network, including the largest ever block, an inscription of the manifesto of privacy-focused tech stack Logos, which cost 3.5 BTC ($235,000). Such inscriptions are referred to as "four meggers," as their size is close to 4 MB, the maximum size of a Bitcoin block. "We see it as being like acquiring a billboard in Times Square because of the visibility that it gives you within the Bitcoin network and that will last forever," Ordinals co-founder Toby Lewis told CoinDesk in an interview. (The new Elvis-themed series are more of the regular variety of inscriptions, not four meggers.) Royalty is set to publish a litepaper in the coming weeks, detailing how 5% of primary and secondary sales revenue will fund the Elvis Legacy Council, a decentralized autonomous organization (DAO) aimed at "governing the future of Elvis' digital legacy," through a native token. Read More: Gold Arrives on 'Digital Gold' as Bitcoin Gets Tokenized Version of the Metal https://www.coindesk.com/tech/2024/10/17/jailhouse-block-elvis-digital-art-collection-inscribed-on-the-bitcoin-network/