2024-10-15 12:00

Ripple's upcoming stablecoin will leverage its established position for payments and be a key bridge for real-world asset tokenization, Ripple Labs President Monica Long told CoinDesk in an interview. Ripple Labs named exchange partners and market makers for its RLUSD gearing up towards the public rollout of its RLUSD stablecoin. The token is "operationally ready," awaiting regulatory approval by the New York Department of Financial Services, Ripple Labs' president said. The company added former FDIC Chair Sheila Bair and ex-CEO of Centre, David Puth, to the advisory board for its stablecoin operation. MIAMI, U.S. – Ripple named exchange and market maker partners for its upcoming dollar-pegged stablecoin, RLUSD, on Tuesday at the Ripple Swell 2024 conference in Miami, Florida. The firm also added ex-Federal Deposit Insurance Corporation (FDIC) chair, Sheila Bair, and David Puth, the former CEO of Centre, a consortium which set standards for USD Coin (USDC), to the advisory board for its stablecoin. Ripple is an enterprise-focused blockchain service closely related to the XRP Ledger (XRP). The firm partnered with exchanges Bitstamp, Bitso, Bullish, CoinMENA, Independent Reserve, MoonPay and Uphold for distributing RLUSD at the start, while crypto trading firms Keyrock and B2C2 will serve as market makers for the token. Bullish is the parent company of CoinDesk. The firm is waiting for regulatory approval from the New York Department of Financial Services for the public rollout of RLUSD, President of Ripple Labs, Monica Long, said in an interview with CoinDesk. "From our side, we are operationally ready," Long added. The announcement comes as Ripple laid out plans earlier this year to issue its own stablecoin vying for a piece in the $170 billion and rapidly growing market of stablecoins. Stablecoins are a key piece of infrastructure within the crypto economy, serving as a bridge between traditional government-issued money and blockchain-based digital assets. They are getting increasingly popular for cross-border transactions and as payment vehicles for goods and services, especially in the emerging markets. With the stablecoin, Ripple aims to leverage the company's established position for payments and be a key bridge for tokenization of real-world assets, Long told CoinDesk. "For RLUSD and stablecoins generally, we definitely have validated the utility of them with payments," Long said. "We're also believers in this broader trend of real-world asset tokenization. When we think beyond tokenizing money to different instruments and capital markets like securities and bonds, real estate and other assets, you need a stable coin that's trusted and very reliable, very robustly managed for on and offramps as well." RLUSD's value will be backed by short term U.S. Treasuries, dollar deposits and cash equivalents, and is currently in test mode on the XRP Ledger and Ethereum networks. The company will release independent monthly attestations about its reserves, which will be prepared by San Francisco-based accounting firm BPM. Brad Garlinghouse, CEO of Ripple Labs, said last month at Korea Blockchain Week that RLUSD could launch in "weeks, not months." https://www.coindesk.com/business/2024/10/15/ripple-names-exchange-partners-for-stablecoin-rlusd-awaits-nydfs-approval/

2024-10-15 11:55

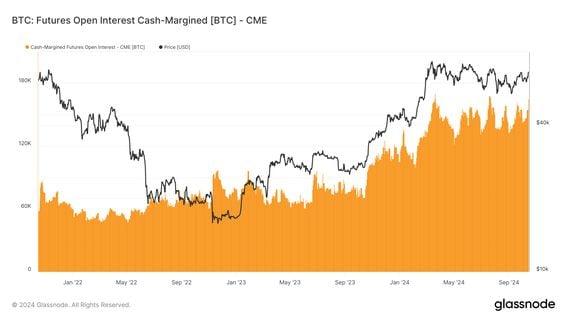

CME futures open interest nears all-time high with 165k BTC, signaling a maturing and stable market. Bitcoin Futures open interest is nearing all-time highs, currently valued at approximately 478k BTC ($31.8 billion). Open interest in cash-margined futures has reached an all-time high of 384k BTC ($25.5 billion), driven primarily by institutional activity on the CME. Crypto-margin as a percentage of total open interest is approaching an all-time low, currently around 18.5%. Cash-margined bitcoin (BTC) futures contracts are more popular than ever. Open interest in cash-margined futures hit an all-time high of 384,000 BTC ($25.5 billion) on Monday, surpassing the November 2022 peak of 376,000 BTC, when bitcoin traded near $16,000, according to data source Glassnode. The CME futures accounted for 40% of the cash-margined tally on Monday. Glassnode's cash and crypto-margin charts include standard futures data (excluding perpetuals) from Binance, Bitfinex, BitMEX, Bybit, CME, Deribit, Huobi, Kraken and OKX. Cash-margined open interest has been steadily increasing for the last two years, while open interest in crypto-margined has steadily declined from 210,000 BTC to 87,000 BTC, now accounting for just 18.2% of the total open interest of 478,000 BTC. Glassnode defines crypto-margin as "the total amount of futures contracts open interest that is margined in the native coin (e.g., BTC) and not in USD or stablecoin." The firm defines cash-margin as "the total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins. Stablecoins include USDT and BUSD." Open interest (OI) refers to the number of active or open futures contracts at a given time. An uptick in open interest is said to represent an inflow of money and preference for leveraged products. Open interest can be measured in native token terms and notional terms. The latter is influenced by the underlying asset's price and can be misleading. Cash-margined contracts breed less volatility In cash-margined contracts, the underlying collateral being used is stablecoins and/or dollars, which are more stable than tokens used as margin in the crypto-collaterized futures. As such, cash-margined contracts are relatively less vulnerable to forced liquidations and breed less volatility. Ultimately, this could provide a more sustainable bull run moving into 2025. The CME's leadership in cash-margined segment suggests increasing institutional activity in the derivatives market. Sophisticated investors might be using CME futures to hedge their directional plays or set up the market-neutral basis trade. In October 2023, CME became the largest futures exchange for the first time, capturing over 30% of the market share and overtaking Binance. This increase was most likely driven by traders pricing the expected debut of the U.S.-based spot ETFs, which went live in January. https://www.coindesk.com/markets/2024/10/15/cash-margined-bitcoin-futures-are-more-popular-than-ever-as-open-interest-reaches-new-highs/

2024-10-15 11:00

The three projects' tokens will consolidate into Singularity Finance (SFI). SingularityDAO, Cogito Finance and SelfKey plan to merge into a combined project focused on tokenizing the artificial intelligence economy. SingularityNET, the protocol from which SingularityDAO emerged, completed a similar merger in June with fellow AI-focused projects Fetch.ai and Ocean Protocol. SingularityDAO plans to merge with Cogito Finance and SelfKey to form a combined project focused on tokenizing the artificial intelligence (AI) economy. The new entity, Singularity Finance, will provide a layer-2 network for tokenizing assets like GPUs and offer AI-powered financial tools, according to an announcement shared with CoinDesk on Tuesday. The planned consolidation will see SelfKey's existing token KEY become Singularity Finance's new token SFI. SingularityDAO's SDAO and Cogito's CGV will merge into SFI at ratios of 1:80.353 and 1:10.89 respectively. This process will be subject to change based on stakeholder discussions. SingularityNET, the protocol from which SingularityDAO emerged, completed a similar merger in June with fellow AI-focused projects Fetch.ai and Ocean Protocol to form the Artificial Superintelligence Alliance token (ASI). Read More: Decentralized AI Society Launched to Fight Tech Giants Who 'Own the Regulators' https://www.coindesk.com/business/2024/10/15/singularitydao-plans-to-merge-with-cogito-finance-selfkey-to-form-ai-focused-layer-2/

2024-10-15 07:44

Friday contracts debuted on Sept. 30 with a bang, becoming CME's most successful crypto futures launch ever. News-driven traders can set targeted strategies with CME's Bitcoin Friday futures (BFF) contracts. The weekly expiry limits basis and caps rollover costs, facilitating improved profitability. Chicago Mercantile Exchange's (CME) bitcoin (BTC) futures that expire on Friday are ideally suited for news traders looking to bet on key U.S. economic data releases, CF Benchmarks' CEO Sui Chung said, explaining the performance of the recently launched contracts. The CME debuted cash-settled Friday futures, sized at one-50th of one BTC with lower margin requirements, on Sept. 30 to make the futures product accessible to retail investors. The so-called BFF contract settles every Friday at 16:00 New York Time and tracks Cf Benchmark's Bitcoin Reference Rate - New York (BRRNY) variant. A new contract is listed Thursday at 18:00 New York time, allowing market participants to trade the nearest two Fridays at any point in time. The global derivatives giant registered a first-day trading volume of over 31,000 contracts across two different contract weeks, becoming the exchange's most successful crypto futures launch ever. "Unlike monthly contracts, which are influenced by a wide range of events over four weeks, the weekly contracts allow investors to better express views on Bitcoin's reaction to specific events, such as U.S. macro data releases," Chung told CoinDesk in an interview. Bitcoin has emerged as a macro asset since the coronavirus-induced crash of 2020, with short-term traders/speculators making bets by following notable news announcements and data releases like the monthly U.S. inflation figures and the nonfarm payrolls data. The Friday futures provide several benefits to news traders, including low basis or price differential relative to spot prices, lower rollover costs and more targeted trading strategies. The shorter duration limits the gap between futures and spot prices, ensuring a lower premium than monthly standard and micro futures contracts. The lower premium means the contango bleed, or the cost incurred from moving positions from the impending expiry to the following Friday expiry, is relatively less than extended duration contracts, leading to improved profitability. "The reduced time horizon of the weekly contracts generally results in a low basis compared to their monthly counterparts, simplifying analysis for retail traders," Chung said. Chung added that the alignment between the Friday futures expiry and the daily NAV calculation of U.S.-listed spot ETFs, most of which refer to the BRRNY, enhances market liquidity. The more liquidity, the easier it is to execute large orders at stable prices, and the more efficient the price discovery mechanism. Note that on offshore unregulated exchanges, retail traders prefer perpetual futures, which use the funding rate mechanism to keep prices aligned with the spot market. The funding fee is collected from traders every eight hours. These rates are volatile, adding an element of uncertainty and unpredictability. https://www.coindesk.com/markets/2024/10/15/cmes-bitcoin-friday-futures-are-ideal-for-news-traders-cf-benchmarks/

2024-10-15 06:41

Weekly inflows might challenge records as technical pointers suggest a BTC rally in the works. BTC posted inflows of $555.86 during the Monday trading day, which is a multi-month high. Traders are becoming increasingly optimistic that BTC will challenge its all-time high by the end of the year. Bitcoin (BTC) exchange-traded funds (ETFs) posted inflows of $555.86 million on Monday, according to data provider SoSoValue, amid signs of a possible bitcoin rally. This is a multi-month record for ETF inflows, as the last time the asset class posted higher inflows was on June 4, when it hit $886.75 million. BTC is up 2.2% in the last 24 hours, according to CoinDesk Indices data, matching the CoinDesk 20, an index tracking the performance of the largest digital assets. As CoinDesk reported earlier, one technical indicator called the "three-line break chart" shows Bitcoin could be on track to break past $73,000, signaling a return to an upward trend after months of back-and-forth price movement. Prediction market traders have become more optimistic about BTC's price potential in the last week. On Polymarket, the 'yes' side of a contract that asks if BTC will hit a new all-time high in 2024 is trading at 64% up 9 percentage points in the last week. On Kalshi, bettors are giving a 46% chance that bitcoin's price hits $75,000 this year, up 7 percentage points. Bitcoin hit an all-time high of over $71,000 in March of this year. However, historical data from Glassnode shows that when bitcoin ETF inflows exceed $450 million, it signals a local top in the market. For example on Mar. 12, there was an inflow of $905 million before bitcoin reached its all-time high. Other dates include Mar. 29 ($760 million), June 3 ($1.2 billion), July 22 ($579 million) and Sept. 27 ($454 million), where inflows over $450 million coincided with local tops. https://www.coindesk.com/markets/2024/10/15/bitcoin-etf-daily-inflow-hits-556m-as-btc-appears-primed-for-breakout/

2024-10-15 04:40

The "three-line break" chart, which filters out noise and erratic price movements, suggests the broader bull run has begun. BTC's "three-line break chart" suggests a bullish resolution of the seven-month-long corrective trend and scope for a move to record highs. Candlesticks indicate stiff resistance at around $70,000. Traders fixated on bitcoin's (BTC) daily candlesticks chart may be bored, as, despite Monday's rally, prices remain locked in a prolonged directionless channel. However, a lesser-tracked "three-line break chart" now suggests a bullish outlook favoring a move to record highs. The leading cryptocurrency by market value rose over 5% to $66,000, registering its biggest single-day gain since Aug. 23, according to CoinDesk Indices data. Still, the daily candlesticks chart suggests a neutral outlook, as BTC remains trapped within a seven-month-long corrective descending channel, identified by trendlines connecting highs reached in March and June and lows registered in May and July. However, the three-line break chart shows that the breakout of the prolonged descending channel happened on Monday and the broader uptrend from October 2023 lows near $30,000 has resumed. The bull victory could lead to record highs above $73,000. The three-line break chart might look like the candlesticks chart but focuses on price movements and changes in trend while ignoring time, helping traders filter out erratic price movements and noise while gauging the ongoing trend and potential trend reversals. "A Japanese trader described the three-line break chart as a more subtle form of point and figure charts where reversals are decided by the market and not by arbitrary rules, that means we can gear it to the strength and dynamism of the market," chartered market technician Steve Nison said in his book "Beyond Candlesticks". The line break chart consists of vertical blocks called lines or bars (green and red). A bullish reversal, represented by a new lineup (green bar), happens when the price moves higher than the highest point of the last three red lines. A new red line (bearish reversal) occurs when the price moves below the lowest point for the previous three green lines. A bullish continuation occurs when the price moves above the previous green line, confirming an extension of the already-established uptrend. That's precisely what happened on Monday, with the green bar cutting through the trendline off March and April highs, as seen below. While the breakout on the line break chart indicates the scope for a rally to new peaks, traders should be watchful of two things, the first being the candlestick chart, which shows bulls have consistently failed to secure a foothold above $70,000 since March. Prices could again encounter stiff resistance around that level. The second thing to watch out for is bullish invalidation on the line break chart, represented by a new red bar taking prices back inside the channel. Failed breakouts often lead to deeper price slides as observed in late September. https://www.coindesk.com/markets/2024/10/15/this-chart-indicates-bitcoin-may-be-headed-for-record-highs-above-73k/