2024-10-10 19:06

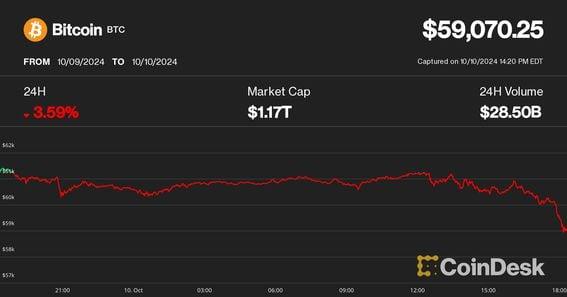

Uniswap's UNI token was the only CoinDesk 20 constituent in the green over the past 24 hours. Crypto prices are sharply lower on Thursday, led by bitcoin's 4% decline. A re-acceleration in inflation pressure in September initially sent markets lower. Declines grew after an SEC lawsuit against digital asset market maker Cumberland DRW. BTC will likely trade range-bound until the U.S. election, Lekker Capital's Quinn Thompson said in a Telegram interview. Cryptocurrencies continue to face headwinds on a number of fronts, with Thursday bringing a faster-than-hoped inflation report for September and yet another U.S. government regulatory action against a sector participant. In mid-afternoon U.S. trading, bitcoin (BTC) was lower by about 4% over the past 24 hours. At $59,000, the price has returned to levels not seen since the U.S. Federal Reserve unexpectedly slashed its benchmark interest rate by 50 basis points in mid-September. Altcoins outperformed somewhat, with the broad-based crypto benchmark CoinDesk 20 Index declining just under 3% during the same period. Ether (ETH) dropped 3.5%, while only decentralized exchange Uniswaps's token (UNI) had positive return during the day on news about the platform's own layer-2 plans. Crypto began the day on a weak foot after the U.S. Consumer Price Index report showed an unexpected re-acceleration of inflation in September. The news seemingly drove a stake through any idea that the Fed could cut interest rates another 50 basis points in November, with some market participants now wondering if the U.S. central bank might even decide to pause its rate-cutting cycle at that meeting. "Hot CPI and oil price spike due to Middle East tensions have created a fear that the Fed will not cut as much as the market previously thought," Quinn Thompson, founder of hedge fund Lekker Capital, said in a Telegram message. "Mix in [Atlanta Fed President] Bostic's hawkish comments today regarding a potential pause and that's the tinder to run the levered traders' stops." Indeed, the sell-off liquidated some $147 million of leveraged long positions betting on higher prices across crypto derivatives markets, CoinGlass data shows. Prices dived even lower during afternoon hours following news that the U.S. Securities and Exchange Commission (SEC) sued major digital asset market maker Cumberland DRW, raising concerns once again about the challenging regulatory environment for U.S. crypto firms. The SEC alleged DRW traded crypto assets that were sold as securities without registering as a securities dealer. Cumberland pushed back against the lawsuit in an X post, saying that "we are not making any changes to our business operations or the assets in which we provide liquidity as a result of this action by the SEC." The SEC lawsuit was only the latest regulatory action by the U.S. government against crytpo this week. On Wednesday, the Department of Justice charged four market makers and more than a dozen individuals over market manipulation charges. Also Wednesday, SEC Chair Gary Gensler was very dismissive about the idea that bitcoin or crypto might catch on in any sort of significant way as a means of payment. He called out the crypto industry for being filled with "fraudsters," and asserted that the "leading lights" of the sector were either in jail or soon to be on their way behind bars. "There's going to be a lot of noise between now and [the U.S.] election [in November] and it's likely bitcoin is just range bound until then," Lekker's Thompson added. https://www.coindesk.com/markets/2024/10/10/bitcoin-tumbles-below-59k-amid-inflation-worry-regulatory-onslaught-on-crypto/

2024-10-10 17:17

The regulator alleged the company "bought and sold" crypto assets that were sold as securities, but did not register as a securities dealer. The U.S. Securities and Exchange Commission (SEC) said Cumberland DRW was an unregistered securities dealer in a lawsuit Thursday, alleging the crypto market maker "bought and sold" cryptocurrencies that were sold as unregistered securities. The SEC alleged that Cumberland used its research reports and update emails to promote investments in different cryptocurrencies, naming Polygon's {{POL}} (formerly MATIC), Solana's (SOL), Cosmos' (ATOM), Algorand's (ALGO) and Filecoin's (FIL) as "a non-exhaustive list" of cryptos that were sold as securities. "Public statements by the issuers and promoters of the Cumberland-Traded Assets – including statements retransmitted by Cumberland and by the third-party crypto asset trading platforms that Cumberland uses – would have led objective investors to reasonably view the offer to purchase or sell of each of the Cumberland-Traded Assets as offers to purchase and sell investment contracts, which are securities pursuant to the federal securities laws," the SEC's complaint said. These investors expected to profit, the SEC alleged. However, Cumberland did not register as a securities dealer. The SEC, as it has in a few previous suits, went through the five example cryptocurrencies and laid out its arguments for how these assets look like securities, pointing to public statements from the projects' founders and white papers and Cumberland's own statements about the different assets. As one example, the SEC alleged, Cumberland promoted ATOM through, "An email sent to counterparties on February 20, 2023 stated: 'At the moment, one of the smaller gainers in the sector, outside of ETH and EOS, has been ATOM. ATOM is up ‘only’ 53% YTD, despite strong fundamentals and a healthy developer community; it’s a name where we expect to see a catchup rally if crypto remain buoyant.'" The SEC is seeking a permanent injunction and disgorgement of proceeds, the suit said. However, Cumberland pushed back against the suit on a social media post on X. "We are not making any changes to our business operations or the assets in which we provide liquidity as a result of this action by the SEC." "We are confident in our strong compliance framework and disciplined adherence to all known rules and regulations - even as they have been a moving target (it wasn't long ago ETH was claimed to be a security)," the post said. https://www.coindesk.com/policy/2024/10/10/sec-sues-crypto-market-maker-cumberland-drw/

2024-10-10 15:08

Heather Morgan, who was accused of helping launder proceeds from a 2016 Bitfinex hack, provided “substantial assistance” to prosecutors, according to the government’s sentencing memo. Prosecutors have requested that Heather Morgan – better known by her rap moniker “Razzlekhan” – be sentenced to just 18 months behind bars for her role in laundering 120,000 bitcoins stolen from Bitfinex in a 2016 hack. In August 2023, Morgan pleaded guilty to one count of money laundering conspiracy and one count of conspiracy to defraud the United States, each of which carries a maximum sentence of five years in prison. Though Morgan and her husband Ilya Lichtenstein were first believed to only have laundered the proceeds of the hack (worth approximately $7.5 billion at today’s value), Lichtenstein later admitted to being the original hacker and pleaded guilty to one count of conspiracy to commit money laundering, which carries a maximum sentence of 20 years in prison. According to court documents, Lichtenstein carried out the hack alone in 2016, and did not tell his wife or enlist her help with laundering the money until four years later, in 2020, making her only an accessory to the crime after it had already occurred. “She was in some ways thrust into the middle of a serious criminal scheme without her initial consent, and undoubtedly felt compelled to support it out of a sense of loyalty to her husband and desire to preserve their life together,” prosecutors wrote in the memo. “That does negate the seriousness of her conduct, as she did ultimately join her husband’s conspiracy and use her own skillset to aid and enhance his criminal endeavors.” Prosecutors have suggested a lenient sentence for Morgan in light of her early acceptance of responsibility and apparently “substantial assistance to law enforcement,” as well as the fact that she herself spent very little of the criminal proceeds. However, they also urged the judge to take into account that, at several points during the investigation, Morgan attempted to obstruct justice by destroying evidence – throwing a computer down a garbage chute, deleting data from devices, and, during law enforcement’s execution of a search warrant at her and Lichtenstein’s Manhattan apartment, pretended to be grabbing her cat from under the bed while secretly shutting off her phone. In addition to requesting jail time for Morgan, prosecutors have asked the court to order her to “return the cryptocurrencies seized by the government directly from the Bitfinex Hack Wallet – including approximately 94,643.29837084 BTC, 117,376.52651940 Bitcoin Cash (BCH), 117,376.58178024 Bitcoin Satoshi Vision (BSV), and 118,102.03258447 in Bitcoin Gold (BTG) valued at more than $6 billion at current prices – as in-kind restitution to Bitfinex.” Morgan is set to be sentenced on Nov. 15 at 2:00 PM in Washington, D.C., one day after Lichtenstein is sentenced. https://www.coindesk.com/policy/2024/10/10/heather-razzlekhan-morgan-should-spend-18-months-in-prison-prosecutors-tell-court/

2024-10-10 14:29

The new features could allow companies to tokenize and manage real-world assets as well as other cryptocurrencies on XRPL. Ripple, a provider of digital asset infrastructure, has introduced new functionality to its custody service The company is associated with the XRP token, which rose as much as 3.75% Thursday, its biggest intraday gain in almost two weeks, Coindesk Indices data show. Ripple, a provider of digital asset infrastructure, added functionality to its custody service to offer crypto businesses "bank-grade" technology for securing digital assets. The new features include integration with the XRP Ledger, whose developers went on to help found Ripple, expanding liquidity through the provision of XRPL-based tokens and a native decentralized exchange (DEX), which could allow companies to tokenize and manage real-world assets (RWAs) as well as other cryptocurrencies on XRPL. Ripple aims is to bring "the benefits of bank-grade custody technology to fintechs and crypto businesses," the company said Thursday. "The amount of crypto assets custodied is expected to reach at least $16T by 2030, and moreover, 10% of the world’s GDP is expected to be tokenized by 2030. As such, companies need secure, compliant and flexible options to store their crypto." The company bought Switzerland-based crypto custody provider Metaco for $250 million last year. It agreed to buy Standard Custody & Trust Co. in February. XRPL's native token, XRP, rose as much as 3.75% Thursday, its biggest intraday gain since Sept. 29, Coindesk Indices data show. The token subsequently pulled back, but remains over 1.8% higher since midnight UTC, comfortably outperforming the wider crypto market, which has gained just 0.2%, as measured by the CoinDesk 20 Index (CD20). Read More: Ripple Partners With Brazilian Exchange Mercado Bitcoin to Offer Business-Focused Payments Solution https://www.coindesk.com/business/2024/10/10/ripple-expands-custody-business-to-offer-bank-grade-service-to-crypto-firms/

2024-10-10 12:41

Bitcoin fell, with the news likely to further raise the odds of a Fed pause at the its next policy meeting in November. The CPI rose 0.2% in September and the core CPI rose 0.3%, both numbers stronger than anticipated The data reinforces the notion that not only will the Fed not cut rates 50 basis points in November, but might chose to not trim rates at all. Already under pressure over the past 10 days, the price of bitcoin fell a bit more following the numbers. Inflation came in stronger than expected in the U.S. in September, according to the government's Consumer Price Index report released Thursday morning. The Consumer Price Index (CPI) rose 0.2% in September versus economist forecasts for 0.1% and a 0.2% rise in August. On a year-over-year basis, the CPI was higher by 2.4% against expectations for 2.3% and 2.5% in August. Core CPI – which excludes more volatile food and energy costs – rose 0.3% in September versus forecasts for 0.2% and 0.3% in August. Year-over-year core CPI was higher by 3.3% versus an expected 3.2% and 3.2% in August. Under pressure for much of the past ten days, the price of bitcoin (BTC) fell further following the report, last trading at $60,800, down nearly 2% from 24 hours prior. The U.S. Federal Reserve surprised many in September by beginning its rate-cutting cycle with a larger 50 basis point rate cut instead of the assumed 25 basis point move. The action sparked a sizable rally in crypto prices as investors factored in not just that rate cut but expectations of an equally large move at the Fed's next policy meeting in early November. Thanks to hawkish comments from Fed Chair Jay Powell (and other central bank officials) and a far stronger than expected employment report last Friday, those expectations, however, have undergone a major reversal over the past ten days, perhaps contributing to the big pullback in crypto prices over that time frame. According to CME FedWatch – which does the service of converting pricing in short-term interest rate markets into odds on what the Fed will do at each of its policy meetings – the chances for a 50 basis point rate cut in November have gone to zero. In fact, rate markets prior to this morning's inflation data had priced in a 26% chance the Fed doesn't trim rates at all – up from 0% one week ago. Today's inflation numbers are likely to reinforce the idea that the Fed may pause any rate cuts in November, but offsetting the disappointing CPI might be some weak employment data. Initial jobless claims – which had pretty much flatlined at very low levels for many weeks – shot higher to 258,000 last week from 225,000 previously and versus forecasts for 230,000. It's unclear, though, how much the aftermath of Hurricane Helene might have affected the data. https://www.coindesk.com/markets/2024/10/10/us-september-cpi-disappoints-rising-a-faster-than-expected-02/

2024-10-10 11:39

The action is rare for a region attempting to project itself as a global crypto hub. Dubai's virtual-assets regulator issued cease-and-desist orders and fined seven unidentified crypto entities. The emirate projects itself as a crypto hub, and has recently given licenses to crypto exchanges Binance, OKX and Crypto.com. Dubai's Virtual Assets Regulatory Authority (VARA), one of the bodies overseeing the crypto industry in the United Arab Emirates (UAE), said it fined seven "entities" for operating without the required licenses and for breaching marketing regulations. The regulator also issued cease-and-desist orders to the entities, it announced on Wednesday. VARA did not reveal the names of the entities, and said it is investigating them together with local authorities. The fines imposed range from 50,000 dirhams ($13,600) to 100,000 dirhams each. "All entities in question have been instructed to immediately cease all activities and desist from undertaking any marketing or advertising of virtual asset services," the statement said. The action is rare for a region attempting to project itself as a global crypto hub. Dubai has recently given full regulatory approvals to crypto exchanges OKX, Binance and Crypto.com, among others. Earlier this month, the UAE exempted crypto transactions from paying value-added tax (VAT). In August, a court order appeared to give soft legitimacy to crypto being used to compensate a worker by a company. VARA said its action was also a public warning to all to avoid engaging with any unlicensed firms. Read More: UAE Exempts Crypto Transactions From Value Added Tax https://www.coindesk.com/policy/2024/10/10/dubais-vara-fines-issues-cease-and-desist-orders-against-7-crypto-entities/