2024-10-09 13:08

Financial authorities have had to prioritize matters such as the nation's budget during an election year, meetings with other nations and the impending World Bank annual meetings. India has yet to release a discussion paper on crypto, which was expected to be published by September. Other matters, like this month's World Bank meetings, have taken priority over stakeholder consultations, which are crucial to framing India's crypto policy stance. India has yet to publish a discussion paper outlining its policy stance on cryptocurrencies because officials are concentrating on other priorities, according to two people familiar with the decision. The document was initially expected by September following consultations with stakeholders including the central bank and the markets regulator. The intention to publish remains, but there is no timeline, said the people, who requested anonymity because the delay hasn't been announced publicly. India, the world's fifth-largest economy, does not have comprehensive crypto legislation and the discussion paper was expected to be a step in that direction. The nation says crypto is unregulated, though it has imposed stiff taxes on the sector and introduced a requirement for crypto entities to be registered with the country's Financial Intelligence Unit (FIU-IND) to adhere to anti-money laundering (AML) and terrorism financing standards set by global bodies such as the Financial Action Task Force (FATF). Officials within India's policy environment faced more pressing demands, including the 2024 annual meetings of the International Monetary Fund (IMF) and the World Bank at the end of this month. They have also had to deal with a number of multilateral and bilateral meetings with other nations as two regional wars – between Russia and Ukraine and between Israel and its enemies in the Middle East – persist. Additionally, the Finance Ministry has had to concentrate on an election year with two budgets, an interim one in February before the July vote and a full budget afterward, together with resulting consultations across the country. Despite a $234 million hack of Indian cryptocurrency exchange WazirX, the authorities do not consider crypto legislation a burning issue like it was two years ago, the people suggested. Read More: India Keeps Controversial Crypto Tax Rules Unchanged, Finance Minister's Budget Speech https://www.coindesk.com/policy/2024/10/09/indias-crypto-discussion-paper-on-hold-due-to-other-priorities/

2024-10-09 12:04

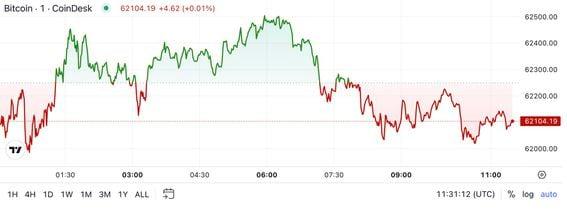

The latest price moves in crypto markets in context for Oct. 9, 2024. Latest Prices CoinDesk 20 Index: 1,918.40 -0.63% Bitcoin (BTC): $62,086.59 -0.68% Ether (ETH): $2,431.18 -0.10% S&P 500: 5,751.13 +0.97% Gold: $2,621.91 -0.01% Nikkei 225: 39,277.96 +0.87% Top Stories The crypto market was little changed following a hotly awaited HBO documentary that promised to shed new light on the identity of Satoshi Nakamoto. "Money Electric: The Bitcoin Mystery" identified Bitcoin developer Peter Todd as the cryptocurrency's pseudonymous creator, a claim Todd had denied even before the broadcast. Positive developments in revealing Satoshi's true identity could, in theory, be a volatility-boosting event for crypto markets. However, HBO's attempt, like all previous ones, proved unfruitful. Bitcoin trades at around $62,150, a drop of about 0.45% in the last 24 hours. The broader digital asset market, as measured by the CoinDesk 20 Index, was also little changed. Spot bitcoin ETFs in the U.S. recorded a cumulative outflow of over $18 million on Monday, SoSoValue data show. Ether ETFs recorded over $8 million in withdrawals. Low volatility in BTC came after a lack of new measures and announcements of new stimulus at a Chinese briefing on Tuesday pared hopes of a long-drawn stimulus package, which had contributed to a bitcoin run in the past few weeks. Stocks in China are deep in the red, with the Shanghai Composite Index down 3.9% and Shenzhen’s Component Index down 4%. Traders, meanwhile, look toward upcoming notes from the September Federal Reserve meeting for clues on where BTC might move next. A large bitcoin options trade anticipates a shift from the present low-volatility regime to a period of heightened price swings, potentially exceeding the $53,000-$87,000 range. The trade saw the entity pay a net premium of over $1 million to purchase 100 contracts of the $66,000 strike call and put options expiring on Nov. 29, according to data confirmed by Lin Chen, head of business development Asia at Deribit. A long straddle is preferred when the market is expected to move far enough in either direction to make the call or the put option worth more than the cumulative premium paid. For the strategy to turn profitable and overcompensate for the premium paid, the bitcoin price needs to move either above $87,000 or below $53,000 by the end of November, Chen told CoinDesk. Chart of the Day The chart shows the total amount of outstanding loans provided by prime brokerages to hedge funds. The tally has risen to over $2 trillion, posing a risk to financial stability, according to Apollo's chief economist, Torsten Sløk. Source: Data for the U.S. Office of Financial Research, Apollo Chief Economist - Omkar Godbole Trending Posts Bitcoin Trapped Between 50 and 200-Day Averages as Bond Market Volatility Spikes, China Stocks Slide The DPRK's Deep Roots in Crypto Bitcoin Protocol Babylon Pulls in $1.5B of Staking Deposits as Cap Lifted https://www.coindesk.com/markets/2024/10/09/first-mover-americas-crypto-market-muted-after-hbo-satoshi-reveal-falls-flat/

2024-10-09 10:56

A long straddle involving the November expiry $66,000 call and put options crossed the tape on Deribit early Wednesday. A large long BTC straddle crossed the tape on Deribit, betting on a volatility explosion by the end of November. To be profitable, the options strategy needs prices to move above $87,000 or below $53,000 by expiry. A large bitcoin (BTC) options trade executed on Deribit early Wednesday anticipates a shift from the present low volatility regime to a period of heightened price swings, potentially exceeding the $53,000-$87,000 range. The trade, a so-called long straddle, saw the entity pay a net premium of over $1 million to purchase 100 contracts of the $66,000 strike call and put options expiring on Nov. 29, according to data confirmed by Lin Chen, head of business development Asia at Deribit. A long straddle is preferred when the market is expected to move far enough in either direction to make the call or the put option worth more than the cumulative premium paid. A call option protects the buyer against price rallies and gains value as the underlying asset's price rises. A put works the other way around, gaining value as prices drop. "When discussing strangles, straddles, and ratioed straddle strategies, it is necessary to understand the buying and selling of 'premium' [options contracts]," options trader Charles M. Cottle wrote in his book "Options Trading: The Hidden Reality." "Sellers of premium want the market to sit still, and buyers of premium [straddle/strangle buyers] want the market to move." For the strategy to turn profitable and overcompensate for the premium paid, the bitcoin price needs to move either above $87,000 or below $53,000 by the end of November, Chen told CoinDesk. In other words, it is a bet on volatility explosion beyond the $53,000-$87,000 range. The trade will bleed money if the price remains between those levels till the end of November, with the maximum loss being the $1 million premium paid. Chen said that November expiry options are seeing above-normal activity, likely in anticipation of a potential post-U.S. election volatility. The U.S. presidential election is due Nov. 5, with results to be declared on Nov. 8. Some traders have recently set up bets on continued range play ahead of the elections. "We have over $1.4 billion open interest in BTC's end-of-November expiry and a put-call ratio of 0.66, which is notably higher than usual. In comparison, the December put-call ratio is 0.39," Chen told CoinDesk. "We are definitely seeing more hedging flow around the U.S. election." https://www.coindesk.com/markets/2024/10/09/whale-alert-1m-btc-trade-bets-on-volatility-expansion-outside-53k-87k-range/

2024-10-09 08:56

ARK added 12,994 COIN shares to its Fintech Innovation ETF in its first purchase of Coinbase stock since Sept. 11. Cathie Wood's investment manager ARK bought nearly $2.2 million worth of Coinbase shares on Tuesday. ARKF contains around $67 million worth of COIN stock, a 7.43% weighting of the fund's total value. Cathie Wood's investment management firm ARK Invest bought nearly $2.2 million worth of Coinbase (COIN) shares in its first purchase of stock in the crypto exchange since Sept. 11. ARK added 12,994 COIN shares to its Fintech Innovation ETF (ARKF) on Tuesday. COIN closed the day 0.73% lower at $167.69. ARKF now contains around $67 million worth of COIN stock, a 7.43% weighting of the fund's total value. COIN has risen around 6.5% since ARK last purchased shares, but remains 20% lower since late August. It is possible that ARK is gearing up for a rally on the back of a surge in BTC's price, as tends to happen in October. ARK also offloaded 135,665 shares of Robinhood (HOOD), worth nearly $3.5 million, to comply with a Securities and Exchange Commission (SEC) rule that forbids funds from having more than 5% exposure to securities in companies that themselves derive more than 15% of their income from the sale of securities. HOOD shares rose nearly 10% on Tuesday to close at $25.61. Read More: Coinbase to Delist Unauthorized Stablecoins in EU by December https://www.coindesk.com/markets/2024/10/09/cathie-woods-ark-invest-buys-22m-of-coinbase-shares/

2024-10-09 08:48

Most crypto spot and futures trading are conducted against stablecoin pairs - and an increase signals capital parked on the sidelines to deploy on favorable catalysts. Stablecoin market capitalization has steadily reached $169 billion led by USDT and USDC, with the increase preceding price movements in past cycles. Historical data suggests a positive correlation between increased stablecoin balances on exchanges and rising Bitcoin prices, with a notable 146% increase in USDT on exchanges since January 2023. There has been a significant increase in large or "whale" transactions on the Bitcoin network, alongside a spike in on-chain volume. A record amount of dollar-backed stablecoins and a spike in large bitcoin (BTC) transactions could form the bedrock for a broader BTC rally in the coming weeks, keeping the asset’s bullish October seasonality intact. Stablecoin liquidity has continued to grow to a record $169 billion in late September, data from CryptoQuant shows, indicating a 31% year-to-date (YTD) increase. The dominant players remain Tether’s USDT, whose market cap increased by $28 billion to nearly $120 billion with 71% of the market share, and Circle’s USDC, which recorded a market cap rise of $11 billion to $36 billion, a 44% increase YTD, with a 21% market share. Stablecoins are a type of cryptocurrency designed to offer price stability by being pegged to a reference asset, which could be fiat money like the US dollar, commodities like gold, or other cryptocurrencies. Each stablecoin is supposed to be backed by an equivalent amount of fiat currency held in reserve. Stablecoins are typically issued against fiat deposits, meaning an increase in stablecoin supply is an increase in actual fiat money placed into the crypto ecosystem. Most crypto spot and futures trading are conducted against stablecoin pairs and an increase in the stablecoin liquidity signals a potential dry powder that can be deployed for crypto purchases. Historic movements show a clear correlation between the number of stablecoins held on crypto exchanges, which has grown 20% this year, and higher bitcoin prices. “Larger balances of stablecoins on exchanges are positively correlated with higher bitcoin and crypto prices,” CryptoQuant head of research Julio Moreno said. “Since January 2023, when the current bull cycle officially started, the total amount of USDT (ERC20) on exchanges has grown from $9.2 billion to $22.7 billion (+146%).” “Notably, these balances have grown by 20%, even as Bitcoin’s price has remained flat,” Moreno said. Bitcoin is down over 6% since the start of October, data shows, a month that has only twice ended in the red since 2013, chalking gains of as high as 60% and an average of 22% to make it the best for investor returns. Price jumps of as high as 16% generally appear after October 15, with the available stablecoin liquidity likely supporting a rise. A key catalyst in the months ahead is the U.S. presidential election, which could set the tone for general monetary and crypto policies for the next four years. Whale Transactions Grow On-chain analytics firm Santiment reported a bump in whale transactions on the Bitcoin network, which has historically preceded a price surge. Whales are a colloquial term referring to large holders of any asset whose market moves can directly influence prices. “Our metrics indicate a major spike in dormant activity on Bitcoin's network to pair with $37.4B in on-chain volume Tuesday, the most in 7 months,” Santiment said in an X post. “Historically, stagnant BTC moving back into regular circulation is a positive for future price movement.” https://www.coindesk.com/markets/2024/10/09/record-stablecoin-liquidity-spike-in-btc-transactions-could-fuel-bitcoin-price-surge/

2024-10-09 05:47

A compelling expose could have impacted bitcoin and the broader market’s prices, but the crypto community is largely brushing off HBO’s hyped documentary. The crypto market shrugged off HBO's 'big reveal' and BTC remains unchanged after Peter Todd was named as Satoshi. China's post-holiday rally has come to a screeching halt with indices well into the red during the morning trading session. Bitcoin (BTC) remains little changed as a hyped HBO documentary turned out to be a market dud, and traders await the latest U.S. economic figures, scheduled for later Wednesday and Thursday, before further positioning. BTC lost just 0.4% in the past 24 hours, with a 0.61% drop in major tokens tracked by the liquid CoinDesk 20 (CD20) index. Ether (ETH) rose 0.3%, BNB Chain’s (BNB), Solana’s (SOL) and XRP (XRP) were little changed. Sui Network’s (SUI) fell 7% after a multi-week run that saw the token gain over 20% since late September. The HBO documentary "Money Electric: The Bitcoin Mystery" sparked significant interest and speculation in the cryptocurrency community about the identity of Bitcoin's pseudonymous creator, Satoshi Nakamoto, in the past week. Nakamoto’s true identity, in theory, could be a sudden volatility-boosting event for crypto markets, and past attempts have been unfruitful. HBO continued that streak by pinning Bitcoin developer Peter Todd as Nakamoto on pieces of online evidence from the network’s early years. Todd denied the claims in an interview with CoinDesk, and the Bitcoin community on X has largely dismissed HBO’s apparent findings. Betting market activity Over $44.3 million was bet on Polymarket as to who would be identified as Satoshi. Most of the volume was split between Len Sassaman and Adam Back, who both caught the eyes of bettors in the market’s early days. Another market that asked bettors if Satoshi’s identity would be proven this year was fairly unchanged despite the documentary hype. The ‘Yes’ side of “Not Proven in 2024” dipped to 82% from 98% when the documentary was announced, but quickly moved back into the 90s within three days. It is currently at 95.5%. ETFs bleed money, China rally wanes On Tuesday, spot bitcoin exchange-traded funds (ETFs) in the U.S. recorded a cumulative outflow of over $18 million, SoSoValue data show, with Fidelity’s FBTC losing over $48 million. ETH ETFs recorded over $8 million in withdrawals, led by a $4.8 million outflow from Bitwise’s ETHW product. Low volatility in BTC came after a lack of new measures and announcements of new stimulus at a Chinese briefing on Tuesday pared hopes of a long-drawn stimulus package – one that contributed to a bitcoin run in the past few weeks. Stocks in China are deep in the red as the stimulus euphoria has seemed to have worn off, with the Shanghai Composite Index down 3.9% and Shenzhen’s Component Index down 4%. Traders, meanwhile, look toward an upcoming Federal Reserve meeting for clues on where BTC might move next. The agency is expected to release FOMC minutes and key economic figures from August that track growth on Wednesday and Thursday – which typically moves prices. Polymarket bettors are forecasting a 25bps decrease for November, while the chance of a 50bps decrease is down to 9%, having fallen from 46% at the end of September. “As the Chinese rally wanes, we anticipate capital reallocation back into crypto, reflecting the industry’s growing maturity as an alternative risk-on asset,” QCP Capital traders said in a Wednesday broadcast. “We foresee near-term downside risk for equities due to upcoming earnings season and CPI release, which may challenge their lofty valuations. Geopolitical tensions further complicate the outlook.” “However, we maintain a medium-term optimistic stance, expecting election headlines to continue driving crypto movement,” QCP added. CORRECTION (Oct. 9, 10:28 UTC): Corrects day in paragraph about ETF flows to Tuesday. https://www.coindesk.com/markets/2024/10/09/crypto-majors-btc-eth-xrp-little-changed-as-hbo-calls-peter-todd-the-bitcoin-creator/