2024-10-08 08:01

New information over the weekend shattered the consensus on who Satoshi Nakamoto might be. Len Sassaman, once a favorite with Polymarket bettors as a possible contender to be Nakamoto, is out of the lead. The consensus amongst Polymarket bettors is that it's someone not on the list. The odds of the late Len Sassaman being revealed as the elusive pseudonymous founder of Bitcoin, Satoshi Nakamoto, in an HBO documentary slumped to 14% after his wife, Meredith L. Patterson, said he was not and that the company had not approached her when making the documentary. A Polymarket contract asking bettors who the documentary would name saw the odds on Sassaman, who died in 2011, as high as 55% over the weekend. They dropped sharply after DLNews published an interview with Patterson. The program will be screened at 02:00 UTC on Wednesday (9 p.m. Tuesday ET). “I kind of wonder whether I’m screwing with the prediction markets by answering honestly when people ask me questions, but long story short, f*ck em,” Patterson told DL News. The early speculation on Sassaman led to a number of memecoins named after him, and some even after his cat, trending on social media and within crypto circles focused on various blockchains. Some people contacted Patterson for confirmation and received an address on the Solana blockchain for token donations in return. Patterson was not the only contender. Bitcoin proponent and businessman Samsow Mow said Blockstream CEO and early Bitcoin developer Adam Back would be unveiled as Nakamoto. Another, smart-contracts pioneer Nick Szabo, briefly led odds on Polymarket in the late U.S. hours Monday, before Sassaman retook the flag. Back refuted Mow's assertion, calling it a joke and tweeting a denial, saying he doesn’t know who Satoshi is. Mow is expected to appear in the documentary. Despite no conclusive leak of the reveal, the deluge of rumors and speculaton was enough to move millions of dollars among various candidates on Polymarket in the past 24 hours. As of Tuesday afternoon Hong Kong time, “Other/Multiple” has over 56%, with Sassaman taking 13%, ahead of Back who has just over 11%, with over $13 million bet on the question. https://www.coindesk.com/markets/2024/10/08/polymarket-bettors-shuffle-odds-of-bitcoins-creator-reveal-ahead-of-hbo-documentary/

2024-10-08 06:45

"Either the strong positive correlation between BTC and the S&P 500 is about to break and flip negative, or one of these markets is mispriced. The excitement lies in the uncertainty" Short-term BTC options show a bias for calls, indicating positive outlook around the U.S. election, due Nov. 4. The S&P 500 options suggest otherwise, according to data tracked by Block Scholes, and some crypto traders have been "selling volatility. The idea that bitcoin (BTC) typically moves in lockstep with the S&P 500 is generally accepted by now. The positive correlation, however, may be tested in the lead-up to the U.S. elections as options market pricing points to diverging trends. On Monday, bitcoin options listed on dominant crypto exchange Deribit exhibited a noticeable skew (bias) for short-term calls relative to puts, capturing the U.S. election and its result, due Nov. 8, according to data tracked by analytics platform Block Scholes. Meanwhile, short-term options tied to Wall Street's benchmark equity index, the S&P 500, showed a bias for put options. The relatively stronger demand for bitcoin calls is a sign of traders anticipating upside volatility or higher price movements around election time. A call option gives the buyer an asymmetric upside, allowing the entity to hedge against or profit from a price rally. The bias for the S&P 500 puts suggests fears of downside volatility because a put option offers protection from price losses. Note that it's common for the index options skew to show a bias for puts due to several reasons, including tail risk hedging by portfolio managers. Still, the divergence between bitcoin and S&P 500 options is "setting the stage for something big," according to Block Scholes' CEO and Founder Eamonn Gashier. "Either the strong positive correlation between BTC and the S&P 500 is about to break and flip negative, or one of these markets is mispriced. The excitement lies in the uncertainty -- are we on the brink of seeing Bitcoin decouple from equities, or are traders in one market about to get caught off-guard?," Gashier told CoinDesk. Some crypto traders "sell volatility" It may seem counterintuitive to bet on a dull price action or volatility drop ahead of a binary event like the U.S. election, but some traders have been doing just that. The implied volatility (IV) for the Nov. 8 election expiry options trading on Deribit has declined from an annualized 62% to 55%, according to data tracked by crypto liquidity provider Wintermute. That's a sign of traders setting up volatility-bearish strategies. The IV is influenced by the demand for options. "Traders have sold volatility here via strangles and straddles and volatility spreads. Most of this positioning is around the $65,000 strike," Jake Ostrovskis, OTC Trader at Wintermute, told CoinDesk. "All of these trades benefit from reduced volatility – thus betting realized trades under implied as these events have done in recent history," Ostrovskis added. Selling straddles and strangles means selling both call and put options in a bet that the underlying asset's price will remain largely rangebound. The seller collects the premium, which is retained if the price stays in a narrow range till expiry. However, it's a risky strategy that is better suited to savvy traders with ample capital supply because if the volatility spikes, losses can quickly mount, far exceeding the premium received. According to FT, the tight presidential race has the S&P 500 and the CBOE Volatility Index, or VIX, traders betting on a volatility boom through the VIX call options. https://www.coindesk.com/markets/2024/10/08/us-election-2024-bitcoin-and-sp-500-options-show-divergent-trends/

2024-10-08 05:57

The lack of new measures and announcements of new stimulus at a Chinese briefing today pared hopes of a long-drawn stimulus package - one that contributed to a bitcoin run in the past few weeks. BTC is down 1.5% as the market was underwhelmed by stimulus measures announced by Beijing. Crypto traders are looking to an upcoming Federal Reserve meeting for clues on where BTC might move next. A September rally in Chinese stocks fizzled Tuesday as traders returned to the market following a weeklong holiday, with bitcoin (BTC) sliding in early Asian hours as broader market investors reacted. Bitcoin dropped as low as $62,000 in late U.S. hours Monday before rising to $62,700 in early Asian hours to pare nearly all gains over a seven-day period. Major tokens Solana's SOL (SOL), ether (ETH), XRP (XRP) and BNB (BNB) fell up to 4%, paring Monday's gains. The broad-based CoinDesk 20 (CD20), a liquid fund tracking the largest tokens by market capitalization, lost 2.18%. Investors widely expected the National Development and Reform Commission (NDRC) to outline more stimulus measures in a Tuesday briefing after the Chinese Golden Week holiday, adding to the government’s September plans of rate cuts and liquidity support for the market to rile up a slowing economy. There were expectations of a big rally when Chinese markets re-opened on Tuesday, part of which could spill over to crypto markets. However, the briefing’s general lack of urgency and specifics, and no plans for further stimulus underwhelmed investors - denting market sentiment as concerns around conflicts in the Middle East remain. At the same time, many felt an urge to take profit from the rally. China’s premier index, the Shanghai Composite, jumped 4% after opening but fell through the day as investors digested new comments. Hong Kong’s tech-heavy Hang Seng fell nearly 7%, reversing gains from Monday and Friday. Some analysts previously warned of a late September rally having legs to keep the momentum going, as the latest stimulus appeared sanguine compared to the 2015 cycle, which buoyed asset prices for a longer period. As such, NDRC Chairman Zheng Shanjie described China’s economy as “stable” and showing “progress,” saying fundamentals are unchanged and there’s confidence in meeting its economic growth target of around 5%, per Bloomberg. Meanwhile, crypto traders continue to look to Federal Reserve meetings scheduled for later this week for clues on further positioning. The agency is expected to release FOMC minutes and key economic figures from August that track growth. https://www.coindesk.com/markets/2024/10/08/bullish-bitcoin-hopes-dented-as-china-eases-stimulus-plans/

2024-10-08 05:19

HKVAX is the latest exchange to receive approval. SFC CEO Julia Leung said 11 applicants had undergone an on-site review. HKVAX received regulatory approval last week, the third exchange in Hong Kong to do so. The Hong Kong Securities and Futures Commission (SFC) plans to approve more cryptocurrency exchanges to operate in Hong Kong by the end of the year, according to its CEO Julia Leung. Speaking on Oct. 6 with local outlet HK01, Leung said that 11 of the platforms that have applied for a license have now undergone on-site reviews. She expects further progress in their applications by the end of the year. Her comments came following the approval of local exchange HKVAX’s application last week. The company, which aims to launch its platform in Q4 this year, is the third exchange in the city to receive regulatory approval. HashKey and OSL also have operating licenses, which were upgraded from licenses they already held under the previous regulatory regime. Bullish, the parent company of CoinDesk, has also applied for a license. The SFC did not respond to a request for clarification about how many platforms have applied. One page on its website lists 11 applicants for the licensing regime, while another lists 16. The promise of future approvals comes after criticism that Hong Kong’s current regime is too strict, potentially damaging the city’s goal of becoming a crypto and web3 hub. In August, a report suggested the regulator had found “unsatisfactory practices” at some exchanges. In particular, it stated that "some of the crypto firms are overly reliant on a handful of executives to oversee the custody of client assets, while others aren’t properly guarding against cybercrime risks." After failing to secure applications from big names like Coinbase – despite the exchange being personally invited to set up in Hong Kong by Legislative Council member Johnny Ng – other international companies have withdrawn their applications. (One exception is Crypto.com, which remains on the applicant list.) Among those who withdrew are OKX and Bybit, both of which canceled their applications in May and did not disclose the reasons for doing so. The South China Morning Post reported that one major factor may have been an SFC notice that they must prevent mainland Chinese residents from accessing their services. In an opinion piece in the Hong Kong Economic Journal shortly after OKX withdrew its application, lawmaker Duncan Chiu warned that the approval conditions borrowed concepts from traditional finance that he believed were too strict to apply to web3. He added that the remaining applicants were “small in scale.” At the same time, lawmakers have argued that the SFC also bears the brunt of criticism when scam exchanges exploit Hongkongers. It came under fire last year for the collapse of JPEX, a rogue exchange that has left over 2,600 Hongkongers some $200 million out of pocket. Over 70 people have been arrested as part of a police investigation into the exchange but to date nobody has been charged. JPEX’s shutdown led to changes in how the SFC shares information about exchanges with the public. Among these changes, it started publishing lists of which companies had applied for licenses – something they had previously declined to reveal – and listing suspicious platforms on its website. Along with JPEX, several chains of OTC crypto trading storefronts linked to it were raided and shut down by the police, prompting calls to regulate OTC trading. Leung said the SFC has also been seeking industry opinion on licensing for cryptocurrency OTC and custody services. https://www.coindesk.com/policy/2024/10/08/hong-kong-gearing-up-to-approve-more-cryptocurrency-exchange-licenses-by-year-end-sfc/

2024-10-07 20:49

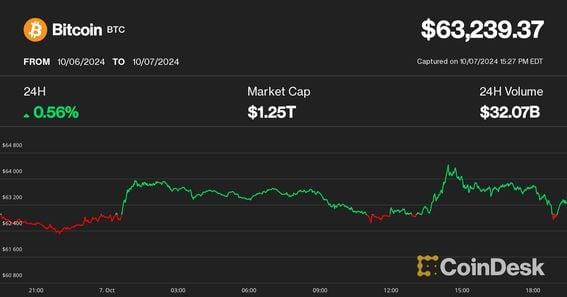

NEAR, UNI and APT led crypto gains, while bitcoin faded after pushing through $64,000 earlier in the day. The S&P 500 and Nasdaq tumbled over 1% and closed the day near their lows, possibly pushing down crypto prices, which shed much of their earlier gains. Over $215 million in leveraged crypto positions were liquidated during the day, hitting longs and shorts equally. MicroStrategy (MSTR) surged 5.5%, its possible overvaluation to bitcoin rising even more and maybe setting the stage for more debt offerings, creating a continued positive feedback loop with its stock, 10x Research noted. The crypto rally stumbled during the Monday U.S. trading session with bitcoin (BTC) slipping to $62,800 from near $64,000 within an hour along with an abrupt nosedive in the stock market. The quick volatility burst happened without any immediately apparent reasons, sending the S&P 500 and the Nasdaq tumbling over 1% during the afternoon session, while the volatility index VIX spiked 19% to its highest reading in a month. Stock indices closed the day around their lows, but bitcoin quickly recovered some of the losses, recently changing hands at $63,300, up 0.7% over the past 24 hours, but down nearly 2% from its daily high of $64,400. The broad-based benchmark CoinDesk 20 Index gained 0.3% over the same time period. Ether (ETH) underperformed with minor losses, while tokens of Near Protocol (NEAR), Uniswap (UNI) and Aptos (APT) showed relative strength with 5%-8% advances. The rollercoaster in prices hit bulls and bears equally, liquidating over $210 million worth of leveraged derivatives trading positions across all digital assets, CoinGlass data shows. Some $110 million of liquidations were longs betting on higher prices, while $105 million worth of positions were shorts anticipating price weakness. What may have helped cryptocurrencies to recover quicker versus the stock market is that a U.S. judge approved FTX's bankruptcy plan, opening the way to repay creditors of the imploded crypto exchange. Still, Monday's price action meant that BTC briefly reclaimed the 200-day moving average, which currently sits at $63,575 per TradingView data, but ultimately failed to hold above it. Moving and holding past that key level would reaffirm bitcoin's uptrend since the lows of around $52,000 hit in the first week in September. Digital asset investment product issuer ETC Group – recently acquired by Bitwise – noted that bitcoin's rise over the past few days coincided with increasing odds of Donald Trump winning the U.S. presidential election in November. Bettors on blockchain-based prediction marketplace Polymarket see 53.5% odds for a Trump win versus Kamala Harris, up from equal chances on Friday. MSTR is overvalued vs. BTC, but could rally more MicroStrategy (MSTR) was a notable outlier amid a weak stock market, with shares surging to $190 for the first time since late March and closing the day 5.5% higher. The company is the largest public corporate owner of bitcoin, holding nearly $16 billion of the asset. Markus Thielen, founder of 10x Research, noted in a report before Monday market open that a breakout above the $180 price level could beget more strength, even though his regression analysis showed the stock was already 44% overvalued versus BTC. "Market makers may be forced to hedge their short gamma exposure as they likely sold calls to retail investors), and hedge funds holding $4.6 billion in short positions on MicroStrategy shares could face pressure to cover those shorts if the price surpasses the $180 mark," Thielen wrote. The rally could induce MicroStrategy to raise even more debt for acquiring bitcoin, as demand for the company's notes have been strong with consistently upsizing the issuance, Thielen said in the report. "Raising even more debt to purchase bitcoin seems logical," he wrote. "A breakout in MicroStrategy’s stock could have a 'tail wags the dog' effect, where the momentum in its shares positively impacts Bitcoin’s price, creating a feedback loop." https://www.coindesk.com/markets/2024/10/07/microstrategy-surges-to-6-month-high-as-bitcoin-wrestles-with-key-moving-average/

2024-10-07 16:39

The proposal, designated EIP-7781, would reduce slot times to eight seconds from 12 and has already earned some key supporters. The new Ethereum improvement proposal, officially EIP-7781, would increase throughput by 50%. The submission from Illyriad Games co-founder Ben Adams follows earlier proposals by Ethereum co-founder Vitalik Buterin and others for improving the blockchain's overall processing capacity. Ethereum has faced growing criticism that it has failed to scale the main blockchain, since it has mainly pushed in recent years to enable the proliferation of affiliated layer-2 networks that are optimized for higher transaction execution. Drawbacks include the possibility that validators might need additional resources to support the higher throughput. A new upgrade proposal for Ethereum could improve network throughput by 50%, enhancing its ability to compete with speed-focused blockchains like Solana. Initially proposed on Oct. 5 by Ben Adams, co-founder of Illyriad Games, the Ethereum improvement proposal (EIP) would reduce slot times from 12 seconds to eight seconds, allowing the network to process more transactions over time. The upgrade, officially designated EIP-7781, would also ramp up the blockchain's capacity to handle blobs, which are dedicated data-storage chambers used by affiliated layer-2 networks to stash transaction records. The change would effectively increase the number of blobs per block to nine from six, providing more space for layer-2 chains like Arbitrum and Optimism to post data to Ethereum. In Ethereum’s proof-of-stake consensus mechanism, slots refer to specific time intervals during which a block can be proposed. A validator is selected for each slot to propose a block, and if successful, the block is added to the blockchain. The upgrade proposal will need to work its way through the Ethereum open-source development system, but it's already earned some key supporters. Vitalik Buterin's proposal Ethereum Foundation researcher Justin Drake noted on Github that reducing block times to eight seconds would make decentralized exchange (DEX) platforms like Uniswap 1.22 times more efficient. The change could help close pricing gaps between on-chain and off-chain trading venues, saving users up to $100 million per year, according to Drake. The Ethereum blockchain is praised for having strong security and a high degree of decentralization relative to most other blockchains, but its benefits have historically come at the cost of relatively high fees and slow speeds – at least in comparison to newer blockchains like Solana. Ethereum co-founder Vitalik Buterin proposed in January to increase the blockchain's "gas limit" – the total size of transactions that can be squeezed into each block – as a way of boosting the overall network throughput. EIP-7781 would be tantamount to an "effective increase to a 45M gas limit and 9 blob limit," which "roughly aligns with the proposed 40M gas limit by pumpthegas.org and the 8 blob limit by Vitalik and others,” according to Drake. Over the past few years, upgrades to the Ethereum blockchain have primarily focused on paving the way for the development of third-party layer-2 "rollup" networks like Arbitrum and Optimism. These independent blockchain networks officially settle their transactions on Ethereum's ledger, but they offer users higher speeds and lower fees and have rapidly become the primary venue through which users interact with the Ethereum ecosystem. Data blobs were added to Ethereum in March to allow the blockchain to hold arbitrary bits of data in a separate, dedicated space that's cheaper than regular block space on the network. Compared to regular transactions, blobs are better optimized for layer-2 networks, which bundle together big groups of transactions and post them to Ethereum all at once. EIP-7781 could help make it faster (and cheaper) for layer-2 networks to post data to the chain by increasing the number of blobs, but it is also the first upgrade in some time to focus directly on improving speeds on the base Ethereum blockchain. Reducing slot times to eight seconds from 12 would directly translate to faster transactions for end-users, but it risks adding strain for validators, who might need additional hardware resources. The news was reported earlier in CoinTelegraph. https://www.coindesk.com/tech/2024/10/07/ethereum-proposal-could-increase-throughput-by-50/