2024-10-07 06:18

Even with a 3-5% cost to convert [stablecoin] USDT into equities, the potential upside of 50-70% in China's stocks makes this a strategic move, one observer said. Since late September, BTC has held largely flat amid the stimulus-led 20% surge in the Chinese stocks. The rebound in the battered Chinese equities could be sucking out capital from crypto and Asian equity markets. The capital rotation may be short-lived. China's battered stock market has experienced a resurgence since late September powered by the barrage of stimulus by Beijing. But this surge could be sucking capital out of the crypto market, capping the upside in bitcoin, the leading cryptocurrency by market value, and other Asian markets, according to observers. "The current surge in Chinese stocks, driven by the stimulus package and investor activity during the national holiday week, represents a calculated risk-reward trade for savvy investors. Even with a 3-5% cost to convert [stablecoin] USDT into equities, the potential upside of 50-70% makes this a strategic move," Danny Chong, co-founder of multi-staking protocol Tranchess and co-founder of Digital Assets Association Singapore, told CoinDesk in an email. Since Sept. 24, the Shanghai Composite Index has jumped over 20%, reaching its highest since May 2023. The Hang Seng China Enterprises Index, which constitutes Chinese stocks listed in Hong Kong, has jumped over 25%, according to data source TradingView. The rally follows stimulus announcements that included interest rate cuts, liquidity support for stocks, banking system capital injections, and a promise to support property prices. The enormous stimulus, estimated to be over 7.5 trillion yuan (CNY), has been widely perceived as uber-bullish for bitcoin and other risk assets. Bitcoin, however, remains flat-lined at around $64,000 in the wake of the China stimulus, extending a six-month-long consolidation between $50,000 and $70,000. Beijing's Bazooka is also drawing capital from other Asian equity markets. "We are trimming our long positions across Asia to fund China purchases," Eric Yee, senior portfolio manager at Atlantis Investment Management in Singapore, told Bloomberg. Temporary shift According to Chong, the capital shift is likely to be temporary and investors will eventually refocus on cryptocurrencies. "This shift is likely to be temporary. Once the peak of the recent upward move in Chinese equities stabilizes, we can expect to see a redeployment of capital back into crypto. This is a prime example of the maturing mindset of investors who are willing to move across asset classes to optimize their returns," Chong said. Traditional market analysts believe Bejing's latest stimulus falls short of addressing the real economic issues and may not lead to a long-lasting rally in Chinese stocks. "Looking beyond the near-term sentiment boost, the effectiveness of the measures could fade unless some fundamental issues are addressed. The key one is fixing damaged balance sheets – especially those of the banks. Until that happens, any attempts to boost borrowing and leveraged risk-taking are likely to fail," TS Lombard said in a note to clients on Oct. 2. The firm added that the latest measures are only 1.5% of China's gross domestic product, as opposed to 32% in 2008 and 22% in 2015-16, saying the spillovers from the stimulus are unlikely to be large this time. BCA Research voiced a similar opinion last week, saying the rally in China's stocks may not have legs. https://www.coindesk.com/markets/2024/10/07/bitcoin-asian-equities-may-be-losing-capital-to-china-stocks/

2024-10-07 04:35

Memecoins have been one of the best-performing crypto sectors in the past year, buoyed by vibrant social communities and attention in the market. Bitcoin (BTC) neared $64,000 in early Asian hours Monday ahead of a busy U.S. data week that sees the Federal Reserve release FOMC minutes and key economic figures from August that track the economy's growth. BTC rose 3%, putting in motion a market-wide jump that saw majors from ether (ETH) to dogecoin (DOGE) jump as much as 4%. The broad-based CoinDesk 20 (CD20), a liquid fund tracking the largest tokens, added 3.26%. Frog-themed Pepe (PEPE) rose 14%. The Bureau of Labor Statistics (BLS) will release the unadjusted CPI annual rate in September, the PPI annual rate in September, and the number of initial jobless claims for the week ending October 5. Asian stocks rose on Monday, with the tech-heavy Hang Seng index jumping 3% and Korea’s KOSPI adding 1%. The People’s Bank of China, the nation’s central bank, has announced several stimulus measures over the past two weeks, boosting sentiment in the region. China is expected to announce further measures to stimulate the economy at a press conference on Tuesday morning local time. Bittensor’s TAO led gains among mid-cap tokens of less than a $5 billion market cap with a 14% jump in increased social sentiment and growth in artificial intelligence tokens over the past week. Overall, the category on CoinGecko is up 7.5%, with AI tokens like (NEAR) and Internet Computer (ICP) also in the green. Memecoins rose higher over the weekend as social sentiment and riskier behavior among crypto traders grew. Talks and posts of the so-called “memecoin supercycle,” a prediction that memes will lead the next crypto bull market, trended on social app X. Solana-based popcat (POPCAT) and Ethereum-based mog (MOG) jumped over 12% in the past 24 hours, while BNB Chain-based simon’s cat (CAT) rose 10%. Smaller tokens GIGA, SPX6900 (a parody of the U.S. index S&P500) and Fwog surged more than 20%. Cat-themed memecoins continue to lead over their dog-themed counterparts and remain the preferred choice for riskier memecoin bets, as CoinDesk flagged previously. Interest in memecoins comes amid low market volatility in more serious crypto sectors, such as layer-2s or storage, and rising negative sentiment around tokens backed by venture capital funds – which are increasingly perceived as overpriced and a bad bet for retail traders. One market participant known as Kaiwen0x, who penned an essay on the memecoin supercycle, noted that they are bearish on memecoins if Donald Trump wins the 2024 election as it might bring regulatory clarity to the U.S, causing "capital to rotate toward utility tokens." https://www.coindesk.com/markets/2024/10/07/bitcoin-nears-64k-memecoin-supercycle-trends-as-mog-popcat-surge/

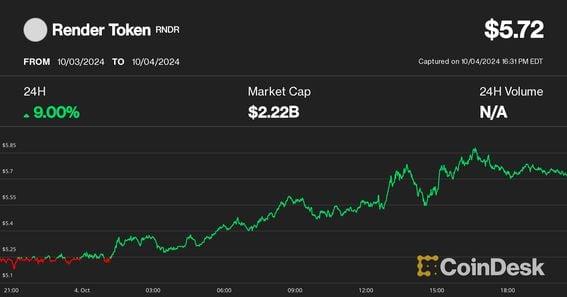

2024-10-04 20:37

Bitcoin may have bottomed at $60,000 earlier this week, and the Fed easing into a strong economy points to more upside, Will Clement said. Alternative cryptocurrencies, or altcoins, lead the digital asset market's charge higher on Friday after geopolitical worries subsided and a blowout U.S. jobs report put recession fears to bed for now. Artificial intelligence-focused protocol Bittensor's {{TAO}}, Render's (RNDR) tokens rallied 14% and 8% over the past 24 hours, while the CoinDesk Computing Index, which tracks several AI-related tokens, was the biggest gainer among crypto sectors. Notably, asset manager Grayscale upsized the weight of TAO in its decentralized AI-focused crypto fund to 27% from 3% in July, while adding the Graph (GRT), replacing Livepeer (LPT). Bitcoin steadily climbed during the U.S. trading hours to $62,300, up 2.2% during the day. The broad-market crypto benchmark Coindesk 20 Index rose 4.2% during the same period, underscoring that altcoins outperformed BTC. Perhaps helping the move was a much stronger-than-anticipated U.S. labor market report, which added 251,000 jobs in September, blowing past estimates for 140,000. The unemployment rate decreased to 4.1%, quieting concerns of an imminent recession. The positive sentiment rippled through the stock market as well, with the S&P 500 and Nasdaq indexes closing the day 0.9% and 1.2% higher, respecitvely. The U.S. 10-year Treasury bond yield jumped 13 basis points to just shy of 4%, while the U.S. dollar index rose to its strongest level since mid-August. Following the report, investors now overwhelmingly expect a smaller 25 basis point interest cut from the Federal Reserve in November. "Bitcoin and the longer tail of crypto assets are sensitive to labor market data because it influences the Fed’s decision on rate cuts, which in turn have a positive impact on BTC as borrowing costs fall," Leena ElDeeb, said research analyst at digital asset manager 21Shares. "We expect flows to start recovering following the escalation of geopolitical tensions that shook the market over the past week.” Bitcoin bottom likely in Markus Thielen, founder of 10x Research, said that the early October sell-off is likely over, with prices likely to grind higher in the coming weeks. Derivatives markets data suggest that investors aren't looking for hedges against further downside, added, Thielen, while large liquidations cascades as happened earlier this week often marked local price bottoms. "As long as the U.S. economy stays strong, stocks and crypto should have room to rise," Thielen said. Will Clemente, founder of Reflexivity Research, said that the Fed easing monetary policy into a strong economy bodes well for bitcoin after this week's leverage flush. "People puked their positions because they were over-leveraged or fell for the Iran bottle rockets for a second time," Clemente said in an X post. "Now with this morning’s great jobs report, the economy is confirmed strong while we just started a global easing cycle and now we just got a positioning reset." "Lots of worry, but BTC keeps grinding up," he added in a follow-up post. https://www.coindesk.com/markets/2024/10/04/ai-tokens-lead-crypto-rebound-amid-strong-us-economy/

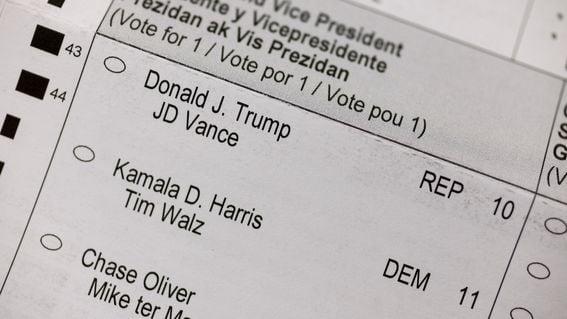

2024-10-04 19:08

With a month to go before Election Day, Kalshi and Interactive Brokers have listed prediction markets on the race for the White House. Two U.S.-regulated, dollar-denominated prediction markets began taking bets on the presidential race this week, with a month to go before Election Day. Kalshi, which fought a long legal battle with the Commodity Futures Trading Commission to offer election contracts in the U.S., launched its presidential markets on Friday, following Wall Street powerhouse Interactive Brokers' (IAB's) ForecastEx, which did so the day before. So far volumes are modest at both CFTC-supervised exchanges, with $344,101 worth of contracts traded on Kalshi and $346,000 on ForecastEx. By comparison, more than $1.2 billion has been staked on the race between Kamala Harris and Donald Trump at Polymarket, the crypto-powered prediction market platform, which, despite prohibiting U.S. users under a CFTC settlement, has reaped record volumes this year while Kalshi and IAB sat on the sidelines awaiting legal clarity. "It will be hard for the two sites to catch up, but that is not entirely impossible," said Koleman Strumpf, an economics professor at Wake Forest University in North Carolina. For one thing, "some traders may switch from Polymarket to the other sites," he told CoinDesk. (Despite geofencing, American traders have reportedly been using VPNs to access Polymarket.) Moreover, "more than half of all trades will happen between now and election day if history is any guide (and there is more volume for close races which this looks to be)," said Strumpf, who has studied the history of election markets. However, Aaron Brogan, a managing attorney at Brogan Law, said that Polymarket has two advantages beyond being the first mover. "Polymarket is theoretically accessible to people all over the world. In contrast, Kalshi's products aren't available to 'foreign nationals' and certain other excluded groups," he said. "Second, Polymarket doesn't have explicit position limits, but Kalshi's rules do. In this case, the limit is quite high, but it's conceivable that this could be a limiting factor on total market size." Price differences Early afternoon Friday in New York, prices of "yes" shares for Harris were trading at 51 cents, signaling traders give her a 51% chance of winning. Trump's odds on Kalshi were at 50%. Harris was also leading Trump on ForecastEx, but by a wider margin, 53-47. Meanwhile, on Polymarket, the two candidates were neck and neck, at 49% each. Harry Crane, a statistics professor at Rutgers University in New Jersey, said these differences were not very meaningful. "We're used to using polls in election forecasting, and with polls, there's a well-understood margin of error, three percentage points usually, depending on sample size," he said. Similarly, in markets there is sometimes a "margin of inefficiency" where any profits to be made from arbitraging price differences are not worth the effort. "There's no sufficient incentive for anyone to scoop up the penny that the difference might present." But prediction markets "don't need to be identical to be useful for forecasting," Crane said. Over time, observers can collect data on these markets, determine which ones had stronger predictive track records, and come up with a consensus forecast that might put more weight on one market than another, he said. Unfinished business Kalshi sued the CFTC last year after the agency denied its application to list contracts on which party would control each house of Congress. The company won the case (which the CFTC is appealing) and listed the congressional contracts on Sept. 13. They traded for only a few hours before the appeals court granted the CFTC an administrative stay freezing the contracts, which it lifted Wednesday. Emboldened, the company not only revived the congressional contracts but self-certified the presidential one. Self-certification is the process whereby CFTC-regulated entities list products without the agency's prior approval. IAB, which started ForecastEx over the summer, quickly followed suit. The CFTC, which is also considering a proposal to ban political event contracts at the exchanges on its watch, has asked the appeals court to expedite the case. Among other reasons, the agency said its proposed regulation "may be substantially impacted by this Court's decision on the merits." But it's apparently given up on stopping these contracts from trading before the election. Its proposed timetable would have briefs filed by Nov. 22 (more than two weeks after Americans cast their votes) and oral arguments heard on Dec. 2. https://www.coindesk.com/business/2024/10/04/us-election-betting-regulated-presidential-markets-are-live-and-tiny-compared-to-polymarkets/

2024-10-04 18:41

A new documentary claims to unmask the creator of Bitcoin. HBO says it knows who Satoshi is. The television network is releasing a documentary, "Money Electric: the Bitcoin Mystery," on Tuesday, with the claim that it will unveil the true identity of Satoshi Nakamoto, the pseudonymous creator of Bitcoin. The documentary is directed by investigative filmmaker Cullen Hoback, who made a name for himself unmasking the leader of the QAnon conspiracy theory as 8kun site administrator Ron Watkins in a 2021 documentary series for HBO. (Watkins has denied being Q, but two separate linguistic studies found that he was, after taking the mantle from South African computer programmer Paul Furber.) If Hoback really has the investigative chops to sniff out Satoshi’s true identity, too, it would put an end to a mystery as old as Bitcoin itself. But past efforts by investigative journalists to find the true identity of Satoshi have failed. In 2014, Newsweek journalist Leah McGrath Goodman published a story called “The Face Behind Bitcoin,” identifying a California-based Japanese-American man named Dorian Satoshi Nakamoto as the creator of Bitcoin. But Dorian Nakamoto denied that he’d ever heard of Bitcoin, and categorically denied being its creator. Goodman’s story was then thoroughly debunked by other journalists. The following year, tech publication WIRED published a (now heavily-updated) article suggesting that Australian computer scientist Craig Wright could be the inventor of Bitcoin. After the article came out, Wright went on a media blitz, telling publications like the BBC, the Economist and GQ that he was Satoshi. But it didn’t take long for Wright’s story to begin unraveling – and it became clear that Wright, who has a history of questionable business dealings and behavior – was making the whole thing up, likely as a cover for his still-ongoing issues with the Australian Tax Office, as well as to make money (and a name for himself) by copyrighting the Bitcoin white paper. Wright also went on a lawsuit spree, suing bitcoin developers and the family of a former collaborator in an effort to gain court-ordered access to Satoshi’s trove of untouched 1.1 million bitcoin (which he claimed to have lost access to by stomping on the hard drive that contained his private keys). He also sued – and threatened to sue – anyone who suggested that he was a fraud, including podcaster Peter McCormack and former public school teacher Magnus Granath (aka Hodlnaut). But Wright was, in fact, a fraud, according to a U.K. court that definitively ruled earlier this year that Wright was not Satoshi Nakamoto, and ordered Wright to publicly post admissions he was not the creator of Bitcoin on both his website and social media accounts. Wright has pledged (to his ever-dwindling number of supporters) to appeal the decision. Wary of another public failure, the media has – until now – been reticent to publicly name another Satoshi candidate. And, in the meantime, the crypto industry itself has largely come to a consensus that the identity of Satoshi is better left a mystery. American crypto exchange Coinbase even cited the unmasking of Satoshi as a potential business risk in its S-1 prospectus filed ahead of going public. But that doesn’t mean that the public’s curiosity over the true identity of Satoshi has abated. There have been convincing arguments made that any one of a number of early cypherpunks could be the creator of Bitcoin. Some of the most commonly suggested Satoshi potentials are computer programmer Hal Finney (who died in 2014, and lived near Dorian Satoshi Nakamoto), Bit Gold creator Nick Szabo, Hash Cash developer Adam Back, and b-money creator Wei Dai. All of them have denied being Satoshi. Less common theories point to former programmer and criminal cartel boss Paul Le Roux (who is currently in prison) or the Central Intelligence Agency (CIA). Still others believe Satoshi was not an individual, but a group of coders working together. Among Polymarket bettors, 46% have put their money on another candidate: computer programmer and cypherpunk Len Sassaman, who killed himself in 2011, shortly after Satoshi stopped posting on BTCTalk, an early forum for crypto discussions. Galaxy Digital’s Alex Thorn posted on X that if Sassaman was indeed identified as Satoshi in the HBO documentary, it would be “neutral to positive” for BTC given that Sassaman has since died. (If Satoshi is still alive and has access to the 1.1 million BTC tied to him/her/them, if that stockpile were ever sold, that could in theory crater the asset's price.) Like Finney, Szabo, Back and the others, there have been convincing arguments made that Sassaman could be Satoshi. A convincing argument, however, is not the same thing as proof. Though the new HBO documentary teases “never before seen clues,” the real smoking gun would be the movement of Satoshi’s coins – something that no claimant has been able to do. If Satoshi is dead, or unwilling to go public – even to access the treasure trove of bitcoins worth roughly $68 billion at today’s value – that proof may never come. https://www.coindesk.com/policy/2024/10/04/hbo-is-joining-search-for-bitcoins-satoshi-past-attempts-havent-turned-out-great/

2024-10-04 14:59

The asset manager said the launch of the spot crypto exchange-traded funds this year has made futures-based crypto products less compelling. Bitwise is converting three of its futures-based exchange-traded products into a single fund. The fund, called the Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF, will rotate between 100% exposure to crypto futures contracts and 100% exposure to U.S. Treasuries. The conversion will take place on Dec. 3, the asset manager said. Bitwise was one of the money managers who joined the spot bitcoin ETF revolution earlier this year, introducing a fund that now holds $2 billion of the cryptocurrency. But that plus the subsequent introduction of exchange-traded funds for Ethereum's ether (ETH) diminished interest in three older Bitwise products that gave investors bitcoin (BTC) and ether exposure in a way now deemed less appealing. This prompted the company to merge that trio of funds, which held futures contracts tied to the cryptocurrencies, into a single product that takes a slightly different tack involving U.S. Treasures. Bitwise announced the Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC) on Friday, a fund that combines the Bitwise Bitcoin Strategy Optm Roll ETF (BITC), Bitwise Ethereum Strategy ETF (AETH) and Bitwise Bitcoin and Eth Eq Wgh Str ETF (BTOP). In a statement, Bitwise said that the launch of the spot bitcoin and ethereum ETFs earlier this year has made futures-based crypto funds less compelling for investors looking for long-term capital appreciation. With the new fund, the asset manager can better manage the volatility of the crypto market by rotating between 100% exposure to crypto futures contracts and 100% exposure to U.S. Treasuries based on market trends. "Bitwise is likely just catering to things they're hearing from clients and potential clients," said James Seyffart, ETF analyst at Bloomberg Intelligence. "They have an actively managed division within Bitwise, so it makes sense to give it a try. We know there are investors looking to invest in bitcoin but who want to limit the volatility and particularly the downside volatility/drawdowns. I think that's what this will aim to do. Whether or not it will be successful is something we will learn in the coming years, but timing the market is extremely hard." The conversion will likely take place on Dec. 3, the asset manager said. The new fund will charge investors a 0.85% expense ratio. https://www.coindesk.com/business/2024/10/04/spot-crypto-etfs-prompted-bitwise-to-rethink-its-fund-lineup/