2024-10-02 15:50

The token has dropped from $4.39 to $3.57 since it went live. EigenLayer his been hit by criticism after it was revealed that staking rewards received by early investors are not restricted by token lock-ups. The situation echoes Celestia's token launch, which was followed by a 75% plunge as investors could sell staking rewards. The EIGEN token initially rose to $4.39 and has since slumped by more than 20% to $3.57. In some ways, the release of EigenLayer's native EIGEN token this week went as expected. The price surged moments after it was listed on exchanges, leading to a price discovery period culminating in a 22% slide from its momentary record high. But there appears to be a more serious issue brewing, with investors and community members complaining about a lack of transparency regarding token supply. EIGEN's total supply is fixed at 1.68 billion and its circulating supply is 186 million. These figures give the asset a fully diluted value of $5.8 billion and a market cap, excluding tokens not in circulation, of $650 million. The issue many community members raise stems from a portion of those locked tokens, which belong to early investors that bought during heavily-discounted funding rounds. Investors that bought in EigenLayer's $14.4 million seed round, $50 million Series A and most recent $100 million raise in February now can stake their locked tokens to yield rewards. As it stands, there are 130 million EIGEN tokens staked. Many believed these were all a part of the claimed tokens but in fact, 70 million of these tokens belong to this small group of early investors. Data availability protocol Celestia suffered a similar issue following its token launch, as early investors staked their dominant TIA stacks to receive tradable rewards, which many then traded away. TIA has plunged 75% since February. EigenLayer investor TardFiWhale.eth wrote on X that the project recently updated its documents to state that "Eigen Labs investors are not restricted from staking" and that rewards are not subject to lock-ups. The X post claims this information wasn't in an archived document from mid-September. EigenLayer's blog post on "token disclosures" was last revised on Sept. 30. "Transparency will enable us to engage in more honest and open discussions about these issues," TardFiWhale.eth wrote. "I personally believe that allowing investors with locked EIGEN to stake makes sense from a governance perspective, given the complexity and goals of Eigenlayer. However, I also believe that the rewards earned from staking should be locked until the cliff is reached" at the end of the 12-month vesting period. EigenLayer allocated 86 million tokens to early adopters including node operators and stakers, but even this has led to criticism as whales were able to receive disproportionate rewards compared to the general population. Tron founder Justin Sun received an airdrop worth $8.75 million, almost all of which was deposited to HTX, the exchange formerly known as Huobi, according to data provider Arkham. EIGEN recently traded at $3.57, having initially surged as high as $4.39, CoinMarketCap data shows. An EigenLayer spokesperson offered no comment by press time. https://www.coindesk.com/business/2024/10/02/eigenlayers-token-launch-draws-scrutiny-over-supply-concerns/

2024-10-02 14:52

Interactive Brokers' ForecastEx is also preparing presidential and Congressional contracts following the latest court defeat for the CFTC. With a month to go before the U.S. election, prediction market Kalshi resumed listing its contracts on which party will control each house of Congress after an appeal court lifted its order pausing the activity. The company is also preparing to list a contract on the presidency, according to a regulatory filing late Wednesday. Another U.S.-regulated prediction market, Interactive Brokers' ForecastEx, is getting ready to launch congressional and presidential markets, according to its filings. On Wednesday, the U.S. Court of Appeals for the District of Columbia denied a motion by the Commodity Futures Trading Commission to halt the contracts pending the agency's appeal of the case it lost to Kalshi in a lower court last month. "The Commission has failed to demonstrate that it or the public will suffer irreparable injury absent a stay pending appeal, and therefore its motion for a stay is denied without prejudice to renewal should substantiating evidence arise," wrote Circuit Judge Patricia Millett. "The administrative stay is hereby dissolved." Apparently emboldened by the decision, Kalshi self-certified the contract "Will pres candidate or another party Representative win the Presidency by being the first inaugurated as President for the year Term of Office?" with the CFTC, according to a notice on the regulator's website. Self-certification is the process whereby entities regulated by the CFTC list products without the agency's prior approval. Kalshi co-founder Luana Lopes Lara also teased this market in a post on X. A clock on Kalshi's website indicates the presidential contract will launch Thursday afternoon U.S. hours. On the relaunched contract "Which party will win the Senate?" shares in the Republicans were trading at 75 cents Wednesday afternoon in New York and Democrats at 25 cents. Each share pays out $1 if the prediction comes true and zilch if it does not, so a 75 cent price means the market sees a 75% chance of the GOP taking control of the chamber. A separate contract on control of the House of Representatives gives a 63% chance of the Democrats regaining it and 37% for Republican retaining it. Kalshi was until recently the sole U.S.-regulated prediction market until ForecastEx joined the ranks in June. The unit of Interactive Brokers self-certified congressional control contracts, a presidential contract, and one on individual Senate races, according to its Wednesday filings with the CFTC. A long battle Kalshi sued the CFTC last year after the agency denied its application to list election contracts, on the grounds that they constituted gaming and would be contrary to the public interest. Following its long-sought victory in the lower court in September, Kalshi listed the contracts on Sept. 13. They traded for only a few hours before the appeals court granted an administrative stay, which it lifted Wednesday. "While the question on the merits is close and difficult, the Commission cannot obtain a stay at this time because it has not demonstrated that it or the public will be irreparably harmed while its appeal is heard," Judge Millett wrote. "That failure is fatal to the Commission’s stay request because a showing of irreparable harm is a necessary prerequisite for a stay." Dwarfed by Polymarket While it's been fighting the agency in court, New York-based Kalshi, which settles bets in dollars, has watched crypto-powered rival Polymarket, which is barred from doing business in the U.S., nevertheless rack up record volumes during this election year. Over $1 billion alone has been staked on Polymarket's contract on who will win the presidency. Volumes were comparably modest Wednesday for Kalshi's relaunched Congressional contracts, which had 45,000 contracts traded (worth as much in dollar payouts) for the Senate and $25,000 for the House. Kalshi caters to institutional investors, and one of the objections to the Congressional contracts throughout the court case was that they allow positions as large as $100 million, which critics said would create strong financial incentives to interfere with elections. Regulation pending The CFTC has separately been considering, but has not finalized, a proposed rule that would ban election betting at all the futures exchanges on its watch. In her order Wednesday, Judge Millett suggested that rulemaking was the one way the agency could stop election betting at federally regulated futures exchanges. "[I]f the Commission felt the risks of election contracts were as concrete and pressing as it argues here, it has long had—and still has—the power to forbid them on the exchanges it regulates," she wrote. "Specifically, the Special Rule [in the Commodity Exchange Act] empowers the Commission to find through a formal rule or notice-and-comment rulemaking that certain types of event contracts—such as election contracts—are 'contrary to the public interest' and to forbid them." In its arguments before the court, the CFTC warned election contracts would incentivize the spreading of misinformation, and cited as evidence of the risks an apparently fake poll from 2017 that showed the rapper Kid Rock leading Sen. Debbie Stabenow in the 2018 Michigan Senate seat race. (He didn't run, and she won reelection.) "Yet in the seven years since the fake Kid Rock poll was used, the Commission has not invoked the very tool Congress gave it to head off such harms," Judge Millett wrote Wednesday. CORRECTION (Oct. 2, 2024, 16:24 UTC): Corrects time element throughout (order was issued Wednesday, not Tuesday). CORRECTION (Oct. 2, 2024, 17:08 UTC): Corrects outdated information. Kalshi is no longer the "sole" U.S.-regulated prediction market, now that Interactive Brokers' ForecastEx has opened. https://www.coindesk.com/policy/2024/10/02/us-election-betting-court-ends-pause-on-kalshis-congressional-contracts/

2024-10-02 14:32

The asset manager's S-1 comes a day after it registered a trust entity with the state of Delaware. Bitwise submitted an S-1 filing to the U.S. Securities and Exchange Commission for an exchange-traded fund tied to the price of Ripple's XRP. The filing comes after the asset manager on Tuesday registered a trust with the state of Delaware, the first hint of its intentions. Bitwise took a big step toward launching an exchange-traded fund tied to XRP (XRP), the Ripple-associated token that's among the biggest cryptocurrencies in the world. On Wednesday, the asset manager submitted an S-1 form to the U.S. Securities and Exchange Commission, a requirement for companies seeking to issue a new security and be listed on a public stock exchange. "Today we filed an S-1 for a Bitwise XRP ETP!" Bitwise CEO Hunter Horsley wrote in a post on X. "For more than a decade, XRP has been an enduring crypto asset that many investors want exposure to." The move comes a day after Bitwise registered a trust entity titled "XRP ETF" with the state of Delaware; many companies list their legal entities in that state, and crypto ETF issuers have more than once tipped off their plans through Delaware filings. XRP is the seventh-largest cryptocurrency by market capitalization at $33 billion, according to CoinDesk data. Its bigger rivals, bitcoin (BTC) and Ethereum's ether (ETH), have since earlier this year both been available to investors as an ETF, a wildly popular type of product in traditional finance. While the submission of an S-1 filing is the first step in introducing a fund, the document is basically meaningless if it isn't followed by another filing, called the 19b-4, which is required to signal a requisite rule change at the stock exchange seeking to list the investment Unlike the 19b-4, which ties the SEC's decision to approve or deny the filing to a strict timeline, the regulator has no such obligation to respond to the S-1, meaning that it could take years for Bitwise to receive approval. VanEck, for example, filed an S-1 to launch an ether ETF in 2021, but the fund didn't hit the market until July 2024, over three years later. Bitwise's effort to create a fund tracking XRP, however, is "highly noteworthy," said one industry expert, Nate Geraci, president of the ETF Store, in response to Tuesday's filing. "Bitwise is a highly credible crypto-native fund firm that doesn't just throw stuff at the wall," he added. https://www.coindesk.com/business/2024/10/02/bitwise-makes-xrp-etf-plans-official-with-sec-filing/

2024-10-02 12:31

Geopolitical tensions triggered consecutive daily declines of almost 4% in bitcoin’s price. Bitcoin recorded back-to-back daily declines of 3.7% as tensions in the Middle East escalated. Short-term holders sent $3 billion worth of bitcoin to exchanges at a loss over the past two days. In the past two days, Sept. 30-Oct. 1, bitcoin (BTC) registered consecutive declines of 3.7% as geopolitical tensions ramped up in the Middle East, culminating in Iran's 200 ballistic- missile attack on Israel on Tuesday. With the largest cryptocurrency little changed on Wednesday, this year marks the worst-ever start to an October, a month that's historically provided positive returns. One headwind comes from so-called short-term holders, which Glassnode defines as investors who have held bitcoin for less than 155 days. This is a group that tends to panic-sell when the BTC price drops below their cost basis. Glassnode data shows this cohort has bought roughly 100,000 bitcoin since Sept. 19, when bitcoin was trading at $62,000. By Sept. 27, bitcoin had surged to above $66,000, and, as the chart shows, this group was buying aggressively as the price increased. However, they started dumping their holdings as the price started to fall. In the past two days, short-term holders have sent roughly 64,000 bitcoin to exchanges, the equivalent of $4 billion. Of that, some $3 billion was sent at a loss, meaning it was sent when the price was lower than the entity's average on-chain acquisition price. This is the highest amount of loss sent to exchanges by the group since Aug. 5, during the yen carry trade unwind, which saw $2.5 billion of losses sent in one day. Long-term holders, on the other hand, seem to be holding their nerve. As a group, they sent just 100 bitcoin at a loss to exchanges over the same time frame. https://www.coindesk.com/markets/2024/10/02/short-term-holders-send-3b-in-bitcoin-to-exchanges-at-a-loss-as-mideast-tensions-rise/

2024-10-02 12:18

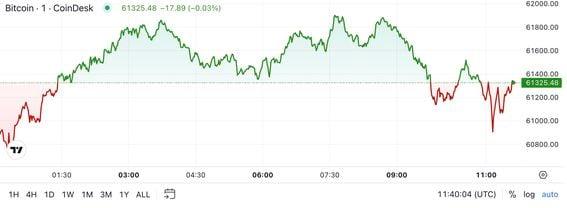

The latest price moves in crypto markets in context for Oct. 2, 2024. Latest Prices CoinDesk 20 Index: 1,937.99 -6.61% Bitcoin (BTC): $61,262.66 -3.99% Ether (ETH): $2,459.36 -6.58% S&P 500: 5,708.75 -0.93% Gold: $2,651.59 -0.33% Nikkei 225: 37,808.76 -2.18% Top Stories Bitcoin reclaimed $61,000 after dropping as low as $60,300 on Tuesday amid an acute sharpening of tensions in the Middle East. Iran fired around 200 ballistic missiles in retaliation for Israel's recent attacks on Hezbollah, designated a terror group by more than 60 countries and organizations. Polymarket bettors are giving a 49% chance that Israel will retaliate against Iran by the end of the week. Bitcoin's slide dented hopes of a rally to kick off October, a traditionally bullish month for the world's largest cryptocurrency. BTC is currently over 4% lower in the last 24 hours, while the broader digital asset market has lost 6%, as measured by the CoinDesk 20 Index. Some observers have noted the differing performances of bitcoin and gold as a measurement of the two assets' respective maturities. Gold, traditionally seen as a risk-off asset, gained 0.8% in the aftermath of Iran's attack on Israel while BTC lost 4%, despite often being referred to as a form of digital gold. “Gold is a much more mature asset, with a 5,000 year history as a store of value, so there’s not much room left for incremental network effects," Presto Research said. "BTC [has] only a 15-year history. This means it’s in the early stages of mainstream adoption, and its narrative is still poorly understood." At the time of writing, gold is 0.3% lower in the last 24 hours at $2,652.56 per ounce. Crypto futures saw over $450 million in long liquidations in the past 24 hours as the bitcoin plunge led to losses among major tokens. CoinGlass data shows that bitcoin traders betting on higher prices lost more than $122 million, while bets on ether lost nearly $100 million. Smaller altcoins recorded over $85 million in liquidations – the most since July – with memecoin PEPE posting an unusually high $10 million. The data shows that nearly 86% of all futures bets were bullish. Traders were positioning for higher prices in the weeks ahead as October traditionally favors BTC, with negative returns only twice since 2013. Chart of the Day Short-term holders (STHs) have sent $3 billion worth of bitcoin to exchanges at a loss over the past two days, which coincides with consecutive 3.7% daily declines in BTC's price. Sales from addresses that have held the BTC for less than 155 days are a bitcoin headwind because those addresses tend to panic-sell when the BTC price dips below their cost basis. STHs have acquired roughly 100,000 BTC since Sept. 19, when bitcoin was trading at around $62,000. Source: Glasssnode - Omkar Godbole Trending Posts How North Korea Infiltrated the Crypto Industry Tokenization Allows More Efficient Collateral Transfers, Digital Asset, Euroclear and World Gold Council Found in Pilot Project The Spectre of Sam Bankman-Fried Overshadowed Caroline Ellison's Sentencing https://www.coindesk.com/markets/2024/10/02/first-mover-americas-bitcoin-returns-to-61k-after-tuesdays-dump/

2024-10-02 10:32

Grayscale’s fee revenue from GBTC is nearly five times higher than BlackRock’s from IBIT even after a 50% decline in assets under management. Assets under management at Grayscale's GBTC have slumped 50% due to aggressive outflows since it became an exchange-traded fund. Even so, Grayscale is making five times the amount BlackRock is from IBIT, CoinDesk calculations show. That's down to GBTC's expense ratio of 1.50%, compared with IBIT's 0.25%. Grayscale's bitcoin (BTC) exchange-traded fund (ETF) is reaping higher income than its rivals even as investors exit the vehicle for lower-cost options. The Grayscale Bitcoin Trust (GBTC), with almost $14 billion in assets under management (AUM), is earning about $205 million a year, CoinDesk calculations show. The figure is roughly five times larger than at rival BlackRock iShares Bitcoin Trust (IBIT), with $17 billion in AUM, which is raking in just $42.5 million. The discrepancy is mainly down to fees, known as the expense ratio. Before the funds opened for trading on Jan. 11, operators jostling for customers started a price war that saw most settling on an expense ratio below 0.40%. GBTC, which existed as a trust before converting to an ETF, stood out, cutting the ratio just half a percentage point to 1.5%. At the January launch, that compared with 0.20% at Bitwise Bitcoin ETF (BITB), the lowest among the five biggest issuers by assets under management. Ark 21 Shares Bitcoin ETF (ARKB) went to 0.21% while IBIT and Fidelity Wise Origin Bitcoin Fund (FBTC) set it at 0.25%. Grayscale's Bitcoin Mini Trust (BTC), which started up July 31, now trumps BITB with a 0.15% charge. Even as investors have withdrawn funds in search of platforms with lower expense ratios, GBTC's head start means the cash is still flowing in. In January, it had AUM of $29 billion, according to YCharts, a financial analysis platform, and roughly 600,000 bitcoin. The figure's shrunk to $13.65 billion, based on multiplying net assets value (NAV) per share of $49.12 by the 278 million shares outstanding. It now holds about 220,000 bitcoin. IBIT, which holds 366,000 bitcoin, has 642 million shares outstanding and a NAV per share value of $35.13, giving AUM of $17 billion. BlackRock did not respond to an email requesting comment. https://www.coindesk.com/markets/2024/10/02/grayscales-high-etf-fee-keeps-the-cash-flowing-in-even-as-investors-withdraw/