2024-10-01 21:24

Ripple's XRP barely budged after the Delaware filing was confirmed. Crypto native asset manager Bitwise is moving toward creating an exchange-traded fund tracking (XRP), the token closely associated with crypto company Ripple. The firm registered a trust entity in the state of Delaware on Tuesday, which appeared on the state’s Division of Corporations website. Registering a trust entity is a first step toward filing to list and trade shares of an ETF; companies like Bitwise, Blackrock and Fidelity all filed trust entities for bitcoin (BTC) and Ethereum's ether (ETH) ahead of filing for ETFs following those tokens. A spokesperson for Bitwise confirmed that the filing was real. “We can now confirm that this is both legitimate and from Bitwise,” the spokesperson said. This isn’t the first time that rumors about a potential XRP ETF have circulated. Similar filings, which later turned out to be illegitimate, have previously been uploaded to the website in an attempt to pump the token's price. In November, for example, a filing for an apparent BlackRock XRP ETF appeared on the website, which was later confirmed by the asset manager to be false. Despite the news, XRP's price has not fluctuated much Tuesday, though much of the broader market fell heavily over the past 24 hours. https://www.coindesk.com/policy/2024/10/01/bitwise-takes-a-step-toward-xrp-etf/

2024-10-01 18:51

The unlikely pair already share a cell. Now they share a lawyer. Sean “Diddy” Combs has hired Sam Bankman-Fried’s lawyer, Alexandra Shapiro, to appeal a New York judge’s decision to keep him locked up while he awaits trial for racketeering and sex trafficking charges. Bankman-Fried, who was sentenced to 25 years in prison in March for the collapse of his crypto exchange, FTX, hired Shapiro to handle his appeal shortly after his conviction. Last month, she filed a 102-page appeal in the Second Circuit, requesting a new trial for Bankman-Fried and accusing the judge overseeing his case of being unfairly biased against him. Lawyers interviewed by CoinDesk are largely skeptical of the appeal’s chance of success. The fraudster is currently six months into his sentence, and has chosen to remain in Brooklyn’s notoriously dangerous Metropolitan Detention Center (MDC) while he awaits the outcome of his appeal, rather than be moved to a low-security prison near his family in California. The unlikely result of Bankman-Fried’s decision to stay in MDC is that he’s now roommates with Diddy. According to a recent report from the New York Times citing sources familiar, Bankman-Fried and the rapper are both living in the same unit of the jail, sleeping in a “dormitory-style room” with other inmates. On Sep. 12, New York prosecutors charged Diddy with racketeering conspiracy, sex trafficking of children by force, fraud or coercion and transporting for prostitution. The sex trafficking charge alone carries a maximum sentence of life in prison, with minimum sentences of 10-15 years depending on the ages of the victims. The racketeering conspiracy charge and the transportation for prostitution charge carry maximum sentences of 20 and 25 years in prison, respectively. https://www.coindesk.com/policy/2024/10/01/diddy-hires-sam-bankman-frieds-new-lawyer/

2024-10-01 15:51

The trading app will let customers deposit and withdraw over 20 cryptocurrencies, including bitcoin, ether, solana and USD coin. Robinhood is now offering crypto transfers in and out of its app to customers in the European Union. The trading app launched in the EU in December as more and more U.S. exchanges look to expand in the trading bloc. Robinhood (HOOD) customers in the European Union can now transfer more than 20 cryptocurrencies, including include bitcoin (BTC), ether (ETH), solana (SOL) and USD coin (USDC), in and out of the trading app. The California-based company is expanding its offerings as the bloc's crypto laws known as Markets in Crypto Assets (MiCA) come into effect. “With the launch of crypto transfers in Europe, we’re making self-custody and entering DeFi simpler and more accessible for our customers,” Johann Kerbrat, VP and general manger of Robinhood Crypto, said in a statement. “Support for deposits and withdrawals gives customers more control over their crypto, while ensuring they have the same safe, low-cost, and reliable experience they expect from Robinhood.” The new capability comes 10 months after the trading app started letting customers in the EU trade crypto, saying the region has one of the world’s most comprehensive policies for crypto asset regulation. In March, the company fully rolled out its brokerage operations in the U.K. It began to onboard customers in the non-EU country a year ago after an earlier attempt failed due to a shift of focus during the Covid pandemic. Many U.S.-based crypto exchanges have doubled down their operations in Europe after the advent of MiCA, which will come into effect this year. Coinbase (COIN), the largest U.S. exchange, is looking to offer derivatives in the European Union, it announced in January, while Kraken recently acquired a German crypto service provider to expand its footprint in the region. https://www.coindesk.com/business/2024/10/01/robinhood-introduces-crypto-transfers-in-eu-as-it-doubles-down-on-expansion/

2024-10-01 14:56

The S&P 500 and the Nasdaq also fell on a report that Iran was preparing an imminent missile attack on Israel. Bitcoin was down 3% over the past 24 hours, while altcoin majors such as SOL, AVAX, DOT and NEAR racked up 5%-10% losses. "War news" rarely have sustainable negative impact on asset prices, Swissblock analysts wrote. Cryptocurrencies tumbled during the Tuesday U.S. session as headlines of escalating tension in the Middle East prompted investors to flee risk assets. Bitcoin (BTC), the largest digital asset by market cap, climbed to around $64,000 during European hours before quickly tumbling to $62,500 as Axios reported the White House as having indications Iran was prepping an imminent ballistic missile attack against Israel. Another leg down followed to $61,000 when the Israel Defense Forces (IDF) said that Iran launched missiles at the country. A late-afternoon move lower brought bitcoin's price to just above the $60,000 level, now having given up nearly all of the gains seen after the U.S. Federal Reserve sparked a big rally with a 50 basis point interest rate cut in mid-September. The broad-market digital asset benchmark CoinDesk 20 Index was down nearly 5% over the same period, with ether (ETH) faring a bit better with a 3.8% loss at just above $2,500. Altcoin majors suffered even deeper pullbacks, as Solana (SOL), Polkadot (DOT), Avalanche (AVAX), Uniswap (UNI), Render (RNDR), Polygon {{POL}} and Hedera (HBAR) endured 5%-10% declines. Key U.S. stock indexes opened the day lower, with the S&P 500 and the tech-heavy Nasdaq trading 1% and 1.7% lower, respectively, in the later hours of the session. Gold jumped 1% to $2,690 per ounce and neared its record high just above $2,700 set last week, while WTI crude oil surged 3% to over $70 per barrel. The diverging price action of gold and bitcoin highlighted the leading digital asset's high correlation with risk-on assets like stocks, not to mention gold fulfilling its traditional role as a safe-haven asset. The 30-day rolling correlation between BTC and the S&P 500 is now approaching yearly highs at 0.62, K33 Research noted in a Tuesday report. Bitcoin's Tuesday drop was also reminiscent of the price action at the start of this current Middle East tumult nearly one year ago today, not to mention similar instances earlier this year in April and July when crypto assets knee-jerked lower in reaction to headlines from that region. Swissblock analysts reiterated its bullish outlook for digital assets in a Telegram market update, saying that "'war news' like those pressing on markets today rarely turn out to have a sustainable negative impact on asset prices." "We stay bullish," they added. https://www.coindesk.com/markets/2024/10/01/bitcoin-slides-below-63k-diverging-from-gold-as-middle-east-tensions-flare-up/

2024-10-01 14:20

Retail investors may not be as plentiful in the current cycle, but they've become increasingly sophisticated, says CoinDesk senior analyst James Van Straten. In 2021, daily liquidations worth billions of dollars occurred due to retail mania, with 80% of futures trading collateral margin in bitcoin. Retail investors are now more "smart money," having evolved to strategically buy the dips and sell the peaks in bitcoin. Retail investors currently hold approximately 15% of the circulating bitcoin supply, equating to around 3 million bitcoin. Retail investors were a big factor in the last crypto bull run, helping drive up prices and enthusiasm around digital assets. Many tasted crypto for the first during the COVID lockdowns of 2021 and 2022. And crypto companies were keen to drive interest among regular folk. The result: Super Bowl ads, celebrity endorsements and stadium sponsorship deals. Then came the crash. This cycle, starting mid-way through 2023, has been more institution-led. These days, the big narratives are around ETFs and slow-but-steady TradFi adoption. And, as yet, retail investors have yet to return in the same numbers. (Memecoins are an exception, which I discussed here.) I took a deep dive in market data from last year, trying to understand the retail/institutional split, and how the behavior of retail investors has changed from three years ago. Here are my top takeaways. The evolution of retail We can split retail investors into two categories: shrimps, who hold less than one bitcoin (BTC), and crabs, who hold anywhere between one and ten bitcoin. In the last six months of 2017, bitcoin soared from $2,000 to $20,000. As hundreds of thousands of bitcoins were accumulated by retail, the price started to climb higher, showing they were chasing the market as crypto hit the mainstream media. However, coming out of a prolonged bear market in 2018 and 2019, bitcoin moved again in late-2020 into early 2021 as the price climbed from roughly $10,000 to $60,000. However, we can see that this cohort was selling bitcoin during the entire period, locking in those gains as they were buyers in the previous bear market instead of buying the top they were selling. Then came the Luna and FTX collapses in 2022, where retail investors really showed their intelligence, accumulating the most bitcoin on record. In June 2022, they accumulated over 300k bitcoins, while during the FTX collapse, it was over 525k bitcoins. Even as recently as the March 2024 peak, they were selling into the bull. Retail investors are perpetual buyers The second takeaway is that as retail has evolved into “smart money.” There is increasing adoption of a dollar-cost averaging approach or been seen as a perpetual buyer. Again, taking less than ten bitcoins as retail, they currently hold around 15% of the circulating supply, translating to around 3 million bitcoin. But, as a cohort, they continue to increase their holdings with very little sell-side pressure. The data suggests they are the dollar-cost average cohort, and it would be fitting to categorize them as smart money as they continue to grow their bitcoin holdings and not be shaken out by price corrections. This behaviour and mindset are similar to that of an ETF buyer or a passive investor who buys index funds each month. If we look at the iShares Bitcoin Trust ETF (IBIT), which has seen $21.5 billion of net inflows since launch, there have been only three trading days of net outflows, which is remarkable given bitcoin's volatility. Notably, during the yen carry trade unwind on Aug. 5 and 6., IBIT registered $0 of outflows. The ETF cohort has been underwater several times this year due to bitcoin's multiple bull market corrections. However, they remained unfazed and continued buying. The current average price of the ETF investors is around $58k, so they are currently up 8% on their investment. Liquidations are now a fraction of 2021 Lastly, retail isn't being liquidated as much as 2021, when the government gave out cash stimulus on top of everyone being at home, which coincided with peak retail mania. As we can see in the data, liquidations were plentiful in the futures market in 2021, with billions of dollars worth of monthly liquidations becoming a regular occurrence. One of the main reasons for this is that a large percentage of futures contracts were margined in bitcoin and not dollars. So, the underlying collateral used for futures trading was bitcoin, which is volatile by nature. This got as high as 70% in 2021. As you can see below, the use of crypto-margin has continued to drop, with the majority of margin-trading in futures now being cash, which is not volatile by nature. As investors matured and the cycle progressed, liquidations have became a feature, but considerably smaller than in 2021. Over the last couple of years, retail investors have become much savvier when investing in bitcoin and have similarities with ETF buyers. As the bitcoin market evolves, the next step is an options market to be traded on the ETFs, bringing a new sophisticated investor into the market and further enhancing retail intelligence. https://www.coindesk.com/opinion/2024/10/01/how-the-crypto-retail-market-has-changed/

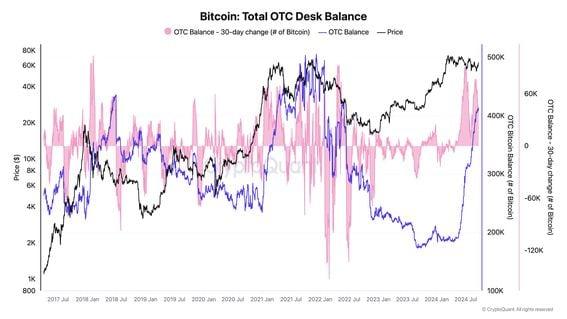

2024-10-01 14:15

The amount of bitcoins on OTC desks has doubled over the past five months to the highest level since May 2022. The OTC bitcoin balance has reached a 2.5 year high of 410,000 tokens. The run-up is similar to that which took place during the bull run of late 2020 into early 2021. A decline in bitcoin balances will likely be necessary for a continuation of the recent bull run. One possible headwind to the idea of 'Uptober' and a general fourth quarter rally for bitcoin (BTC) is the recent surge in tokens moving to over-the-counter (OTC) desks. Data from CryptoQuant suggests there are over 410,000 bitcoins in total on OTC desks, the highest since May 2022 and more than double the 185,000 seen back in March. The balance can indicate the amount of liquidity available at an OTC desk for purchase or sale, with a high balance showing strong liquidity and the ability for trading desks to fulfill large orders. A lower balance is the opposite and may indicate more difficulty in making trades. Who uses OTC desks? Clients are mainly high-net-worth individuals or institutions outside retail exchanges. Making trades OTC allows sizable buys and sells without impacting the price of bitcoin on traditional exchanges. The data show that the OTC balance has shot up in the past six months while bitcoin has been ranging in a downwards channel from its all-time high above $73,500 in March. The run-up in balances is fairly similar to that seen in late 2020 into early 2021 when the OTC balance shot up from 235,000 to 435,000 tokens in six months. The difference is that bitcoin's price was on the rise then, but modestly downward now. In the bear market of 2022, the OTC balance dropped alongside the decline in bitcoin's price, suggesting net buying. If bitcoin is to continue its bull run into the fourth quarter, one factor will likely be the need to see a drop in OTC desk balances. https://www.coindesk.com/markets/2024/10/01/bitcoin-bull-run-in-question-as-balances-on-otc-desks-rise-to-410k/