2024-10-01 13:34

U.S. Rep. Rich McCormick, the congressman from Gambaryan’s district, alleged in the “Designated” podcast that Nigeria is holding him as a “hostage” and argued that all of America’s cards “should be on the table.” “The other day, I took them (kids) to a nearby park and my son saw an airplane in the sky and said, ‘Mommy, look there’s an airplane. Is Daddy on the airplane?’” said Yuki Gambaryan, the wife of the Binance executive Tigran Gambaryan. Yuki was speaking to Illicit Edge’s new podcast “Designated” which will focus on stories related to financial crimes. Tigran Gambaryan has been detained since February in Nigeria, where he was invited as Binance’s head of financial crime compliance to discuss the nation’s dispute with the world’s largest cryptocurrency exchange. Since then, his health has deteriorated. He has been suffering from malaria and a herniated disc, which has left him struggling to walk with a crutch. “It was heartbreaking,” she said, illustrating how hard it is to “keep things from” her two children, 5 and 10 years old. “I'm not doing well mentally or physically. I am having this constant fear of losing Tigran. What if he gets another malaria and die(s)?” Gambaryan isn’t just any crypto industry executive. He’s a former investigator with the Internal Revenue Service, who became a “kind of legendary figure within this crypto crime investigation world” as the “agent at the center of so many cases,” said WIRED’s senior writer Andy Greenberg in part two of the podcast. This is the “reason that Tigran is the protagonist of my book,” Tracers in the Dark: The Global Hunt for the Crime Lords of Cryptocurrency, he said. Gambaryan’s background as a federal employee has perhaps contributed to the case becoming a legal, diplomatic and business quagmire, with Nigeria playing hardball with Binance and, in particular, the U.S. “This is an obvious case of holding somebody hostage to punish a business they have a problem with,” said U.S. Rep. Rich McCormick, (R-GA) in whose district the Gambaryan family lives. “He's just being treated absolutely horribly and he is an American citizen, and that should be taken very seriously by our government. America has a tremendous amount of leverage over the country. "All cards should be on the table,” McCormick said on the podcast. Gambaryan faces money laundering charges. Binance is facing a tax-evasion trial in the country, which is demanding $10 billion in penalties for enabling some $26 billion of untraceable funds. This and other alleged facilitation of illegal capital outflows by the crypto industry at large purportedly led to the Nigerian naira weakening to record lows against the dollar. “He is being held as a hostage, as leverage, to make Binance pay or to find a scapegoat for Nigeria's own inability to manage its national currency,” Greenberg said. Gambaryan’s wife Yuki said, “They can pursue any legal actions whatever to solve this issue they're having with Binance. But they just don't need Tigran there.” She also said that her husband had previously been in Nigeria in January and at that time “he had almost got detained.” “He and his team attended some meetings, and it went hostile. They basically told them that they would confiscate their passports. So, Tigran and his team just immediately got out of the country. So, it was a close call.” On the second trip, she said, my understanding is that Tigran was assured things would be okay. Nigeria’s authorities did not immediately respond to a CoinDesk request for comment. The Designated podcast is presented in partnership with blockchain analytics company, Chainalysis, and is supported by the Crypto Council for Innovation. Read More: Former Government Employees, Compliance Officers Rally for Detained Binance Executive https://www.coindesk.com/policy/2024/10/01/is-daddy-on-the-airplane-jailed-binance-exec-gambaryan-familys-ordeal-in-new-podcast/

2024-10-01 11:07

Recent activities include minting significant amounts of RLUSD, suggesting the testing phase might be wrapping up or moving into a more active phase of development. Open interest in XRP has surged past $1 billion amid growing enthusiasm for Ripple's forthcoming RLUSD stablecoin, currently in private beta testing on both XRP Ledger and the Ethereum blockchain. Bets on XRP futures grew to over $1 billion over the weekend, a level last seen in March and June last year. Open interest in xrp (XRP) tokens has zoomed in the past few days with enthusiasm buoyed by tests of RLUSD, a stablecoin being developed by closely related Ripple Labs. Recent activities include minting significant amounts of RLUSD, suggesting that the testing phase might be wrapping up or moving into a more active phase of development. This has created speculative buzz around RLUSD on platforms like X, with users tracking the minting activities closely. Open Interest (OI) refers to the total number of outstanding derivative contracts not settled for an asset. An increase in OI and a price increase typically indicate that new money is coming into the market. On the other hand, if the price rises but OI falls, the rally might be driven by short covering rather than new buying, potentially signaling a weaker trend. On Monday, Ripple reiterated that RLUSD remains in private beta on XRP Ledger and the Ethereum blockchain. In a post on X, it warned of scams using the stablecoin as bait. Ripple plans to use RLUSD in its cross-border payments product, providing liquidity, facilitating faster and cheaper transactions, and potentially integrating with various decentralized finance (DeFi) protocols across multiple blockchains. Bets on XRP futures grew to over $1 billion over the weekend, a level last seen in March and June last year. Crypto exchanges Binance and Bybit account for almost half of the placed bets, open interest data tracked by Coinglass show. Spot trading volumes more than doubled in the past week to as high as $2.5 billion on Sunday, data shows. The xrp price has added 7.4% in the past seven days, beating a flat bitcoin (BTC) and a 2.7% gain in the broader crypto market tracked by the liquid CoinDesk 20 index (CD20). https://www.coindesk.com/markets/2024/10/01/open-interest-in-xrp-zooms-to-1b-as-ripple-tests-rlusd-stablecoin/

2024-10-01 11:03

Data from crypto exchanges OKX and Binance, popular with retail traders, show subdued activity relative to the bull markets of 2021 and 2022 and less even than the 2019-2020 bear market. Retail trader activity for bitcoin is at normal levels, lower than observed during past bull and bear markets, data from crypto exchanges like OKX and Binance indicates. The market might be in a phase where it's waiting for retail investors to provide exit liquidity even as new whales accumulate BTC from older ones, according to some observers. This behavior typically precedes retail traders entering en masse when bitcoin prices approach new highs. Retail investors are lagging behind institutions in ramping up purchases of bitcoin (BTC) at the start of October, a month that's historically been bullish for the largest cryptocurrency by market cap. Net inflows from smaller investors are still at levels considered normal even as bigger investors are increasing purchases. Data from crypto exchanges OKX and Binance, popular with retail market participants, show minimal activity compared with bull markets in 2021 and 2022, and less even than during the bear market of 2019-2020. The restraint is remarkable because, since 2013, October has only twice ended in the red, chalking gains of as high as 60% and an average of 22% to make it the most best month for investor returns. In recent months, fewer than 40,000 wallets have been active each day on the two exchanges. That's less even than during the bear market when the BTC was below $10,000 and active wallets numbered around 50,000 a day. The data is in line with other indicators such as popularity of the Coinbase mobile application and on-chain usage, as reported. “We’re in the middle of a bull cycle, waiting for retail exit liquidity, while new whales are accumulating BTC from old whales,” CryptoQuant founder Ki Young Ju said in an X post Tuesday. Retail traders, often referred to as individual traders, buy or sell assets for personal accounts. Institutional traders buy and sell for accounts they manage for a group or institution and are colloquially referred to as “whales” due to their sizable influence in the market. Retail traders are often seen as less informed or more emotion-driven than institutional investors. A significant influx of retail money can indicate bullish sentiment – a general belief is that prices will rise. However, extremely high retail inflows might signal an overheating market, potentially nearing the end of a rally or market cycle. Early signs of increasing retail inflow might suggest the end of a bear market and the beginning of an accumulation phase. Sudden spikes in retail buying can sometimes precede market peaks, followed by corrections when these investors start selling out of fear or profit-taking. Retail traders “usually enter when the BTC price is skyrocketing and reaching an all-time high,” Ki said. https://www.coindesk.com/markets/2024/10/01/bitcoin-retail-inflows-hold-steady-as-whales-pile-in-at-start-of-historically-bullish-october/

2024-10-01 10:42

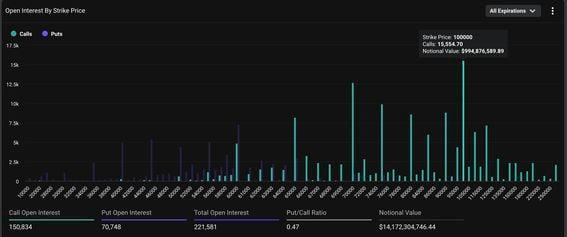

The $100,000 call is the most popular bitcoin option on Deribit. Traders have locked in over $990 million in BTC $100,000 call option, according to Deribit. The $45,000 put is most popular among the U.S. elections expiry options. Traders over Polymarket see only 15% chance of prices rising to $100,000 by the year end. Need evidence of just how bullish the bitcoin (BTC) market sentiment is? Look no further than crypto exchange Deribit, where traders have locked in nearly $1 billion in call options at a $100,000 strike, providing buyers with an asymmetric upside above the said level. As of writing, the dollar value of the number of active call options contracts at the $100,000 strike price was over $993 million, the highest among all other BTC options listed on the exchange, according to data source Deribit Metrics. On Deribit, one options contract represents one BTC. The second most popular option was the $70,000 call, boasting an open interest of over $800 million. More importantly, call options accounted for over 50% of the total BTC options open interest of $14.15 billion on the exchange. "The highest open interest across all expirations appears at $100K and $70K for bitcoin, which some market participants interpret as supporting the bullish sentiment that seems to be pervading the market," crypto trading firm Wintermute said in a note shared with CoinDesk. A call buyer has the right but not the obligation to purchase the underlying asset at a predetermined price on or before a specific date and is implicitly bullish on the market. Traders, anticipating price rallies, often buy cheap out-of-the-money options like the $100,000 call, which are relatively cheaper than those closer to the ongoing spot price. U.S. elections options BTC options expiring on Nov. 8, the day when the results of U.S. election results will be announced, boast a cumulative open interest of $938 million, with $117 million concentrated in the $45,000 strike put options. The popularity of the $45,000 points is consistent with the tendency of traders to seek downside hedges ahead of a binary event like the election results. "The volatility surface indicates a bias toward the downside until late October/November when the market begins to favor calls over put protection. Current positioning suggests support for a post-election rally," Jake Ostrovskis, OTC Trader at Wintermute, told CoinDesk in an email. Open interest in December expiry is concentrated heavily in call options, with the $100,000 strike being the most popular in a sign of expectations of a year-end surge. Polymarket traders are unsure Traders over decentralized betting platform Polymarket see a low probability of the cryptocurrency tapping the !00,000 mark by the end of the year. At press time, the Yes side shares in the "Will Bitcoin Hit $100K in 2024" contract traded at 15 cents, representing a minuscule probability of a rally into six figures. The contract will automatically resolve to yes should BTC's price Coinbase hit a high of $100,000 on or before Dec. 31. Meanwhile, traders see just over 50% chance of bitcoin surpassing the record high of $73,798 by the year's end. https://www.coindesk.com/markets/2024/10/01/bitcoin-100k-bullish-bet-draws-nearly-1b-open-interest-on-deribit/

2024-10-01 09:19

The firm now holds over 500 bitcoin after a first tranche of purchases in April. Metaplanet has acquired an additional 107 BTC at an average price of $64,168 per bitcoin, totaling $6.9 million, funded by a loan from MMXX Ventures. The company now holds over 500 BTC, using it as a strategic reserve to hedge against yen volatility and Japan's debt, leading to a significant 420% increase in its stock price since starting its bitcoin investments in April. Japanese firm Metaplanet said earlier Tuesday it had purchased an additional 107 bitcoin (BTC), worth $6.9 million at current prices, at an average price of 9.26 million yen ($64,168) per BTC. The firm had arranged a $6.8 million loan in early August to add to its existing BTC coffers, as reported. The Tokyo-based company said it borrowed the money from shareholder British Virgin Islands-based MMXX Ventures "with the entire amount allocated for purchasing bitcoin.” In May, Metaplanet adopted bitcoin as a strategic reserve asset and a hedge against Japan's debt burden and the resulting volatility in the yen. It started buying bitcoin in April with initial transactions of 117.7 BTC, or $7.19 million at the time. The firm now holds over 500 BTC and is the largest holder among publicly-traded Asian firms after Hong Kong-based Meitu, Bitcoin Treasuries data show. The holdings were accumulated at an average price 9,373,557 yen per Bitcoin, or $64,931. Meanwhile, the move has helped bump the company’s stock prices, bringing a market capitalization to holdings ratio to joint highest of 20% on Tuesday. Share price have increased by over 420% since the firm’s April purchases, while bitcoin is down 3%. The increase of bitcoin per share monthly continues to be accretive for shareholders. (CoinDesk's James Van Straten contributed insights to this story.) https://www.coindesk.com/markets/2024/10/01/metaplanet-buys-another-107-bitcoin-pushing-stock-btc-ratio-to-20/

2024-10-01 08:48

The partnership appears set to cover the Asia Pacific region since Carnegie's company has offices in Australia and Singapore. Circle has signaled plans to bring its USDC stablecoin into Australia and beyond. The stablecoin giant has partnered with venture capitalist Mark Carnegie. Circle has signaled its plans to bring its stablecoin USDC to Australia and beyond with the unveiling of a partnership with venture capitalist Mark Carnegie's MHC Digital Group, the companies announced on Tuesday. The partnership appears set to cover the Asia Pacific region since Carnegie's company has offices in Australia and Singapore aiming to increase the distribution of USDC in the region and "exploring institutional use cases." “With its young, mobile-first and digital wallet ready population, the Asia Pacific region is ahead of the curve when it comes to digital asset adoption," said Chief Business Officer for Circle Kash Razzaghi. "We are excited to work with MHC Digital to pave the way for a new era in digital finance in Australia and beyond.” Circle's expansion has been evident in recent times as it moved its headquarters to New York City's iconic One World Trade Center, ahead of its planned initial public offering at a valuation of around $5 billion. Earlier this month, its USDC stablecoin was made available to investors in Mexico and Brazil, through the banking system, not just through crypto exchanges. It also became the first global stablecoin issuer to get licensed to offer dollar- and euro-pegged crypto tokens in the European Union (EU). Circle's USDC, the second-largest stablecoin behind Tether's USDT, has a market cap of $35 billion and a 24-hour trading volume of $7.87 billion, according to CoinDesk price data. Carnegie's MHC Digital Group will work with Circle to provide USDC access to wholesale clients across Australia. The move could help superannuation funds avoid big bank fees and the partnership may extend to creating an Australian dollar stablecoin in the future, Carnegie told The Australian Financial Review. “People claim there is no use case for crypto, yet hundreds of billions move globally at a fraction of the cost of traditional payment infrastructure, said Founder and Executive Chairman of MHC Digital Group Mark Carnegie. "Crypto is simply a better mouse trap for the vast majority of international payments. Circle is the obvious candidate to be the long-term winner in the regulated stablecoin space, and we are very excited to work together to expand access to USDC in Australia and beyond.” Read More: Circle's USDC in Brazil and Mexico Now Available to Businesses Via Banking System https://www.coindesk.com/policy/2024/10/01/circle-signals-plans-to-bring-usdc-to-australia-with-venture-capitalist-mark-carnegie/