2024-09-30 19:36

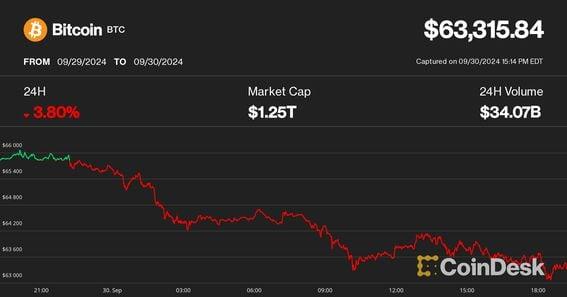

Despite October being a historically strong month for crypto assets, options traders expect further downside over the next few weeks, with a rally coming post-election, Wintermute said. Bitcoin dipped 3.7% over the past 24 hours while XRP, ADA, DOT and LINK plunged over 5%. SOL, ETH outperformed. Even with the decline, BTC is on track to finish September with a nearly 7% return, its best performance since 2013. ByteTree's Charlie Morris contemplated whether the expectation for a strong October is so widespread that it may upend the trend. Cryptocurrencies fell sharply on Monday with bitcoin (BTC) nearing the $63,000 level during the U.S. session, finishing on a sour note of what otherwise was a surprisingly stellar September for digital assets. BTC dipped 3.7% over the past 24 hours, while ether (ETH) and solana (SOL) held up relatively well with 2.8% and 1.9% declines, respectively. Several altcoin majors in the broad-market CoinDesk 20 index tumbled more than 5% during the same period, including Ripple (XRP), Cardano (ADA), Polkadot (DOT) and Chainlink (LINK). Crypto-related stocks also got slammed lower, with multiple bitcoin miners including Marathon Digital (MARA), Bitdeer (BTDR), Hut 8 (HUT) and CleanSpark (CLSK) plunging 5%-10%. Crypto exchange Coinbase (COIN) fell over 6%, while MicroStrategy (MSTR) was more than 3% lower shortly before the close of trade. A look at traditional markets show U.S. equity indexes flatlined for most of the day before heading lower towards the later hours of the session, while key European markets sold off 1%-2%. Japan's incoming prime minister Shigeru Ishiba said that "monetary policy must remain accommodative as a trend," according to a Reuters report. His comments came after his surprise weekend elevation to the PM role set off a 5% plunge in the Nikkei on Monday. In the U.S., Federal Reserve Chair Jerome Powell tempered expectations on Monday that future rate cuts will be as aggressive as September's 50 basis point cut. “Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course,” Powell said. “The risks are two-sided, and we will continue to make our decisions meeting by meeting.” “Overall, the economy is in solid shape," he added. "We intend to use our tools to keep it there." When might bitcoin truly break out? Even with today's dip in crypto prices, bitcoin is on track to finish with a solid positive return in September despite its reputation for being an adverse month. BTC was up just shy of 7% through the month at prices a few hours before UTC midnight, booking its best September performance since 2013, per CoinGlass data. September's positive return could bode well for October, with every previous green September having been followed by more gains the next month. October is also historically one of the strongest months for bitcoin, earning its nickname "Uptober," by recording positive monthly returns 9 times out of 11 since 2013. However, Charlie Morris, founder of investment manager ByteTree, contemplated whether the expectation of a strong October is so widespread that it may throw a curveball to investors. "The contrarian will always be cautious of an idea that has become too popular because popularity means the money is already invested ahead of the event," Morris wrote in a Monday report. His report further noted that BTC's price historically consolidated for roughly six months after halvings before making new highs, and the current price action is in line with that pattern. Given that this year's event happened on April 19, a breakout to new highs may happen towards the end of October if the pattern holds up. Options traders, however, expect that a bigger rally will only come after the U.S. elections in November, and are thus positioning for further weakness in the coming weeks, according to Jake Ostrovskis, OTC trader at crypto market maker Wintermute. "With spot trading dipping below $65,000, the volatility surface indicates a bias toward the downside until late October and November, when the market begins to favor calls over put protection," Ostrovskis said. "Current positioning suggests support for a post-election rally." https://www.coindesk.com/markets/2024/09/30/bitcoin-ends-historic-september-with-a-dip-but-breakout-may-not-come-before-us-election/

2024-09-30 16:40

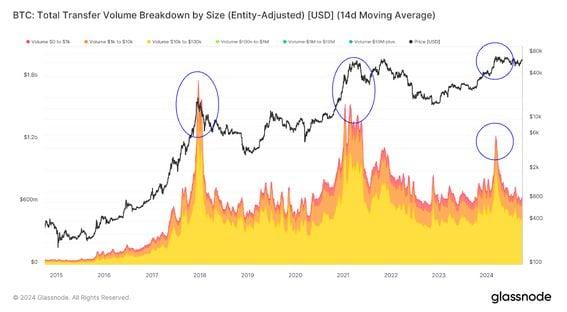

Big upticks in retail interest are commonly thought to be a topping indicator, so the current relative lack of involvement could hint at potential further price increases. In previous crypto bull markets in 2017 and 2021, the Coinbase app was ranked number one in downloads versus the current 438. The amount of bitcoin owned by short-term holders is approximately 2.5 million tokens, a level typically associated with bear markets. NFT- related gas usage on the ether network has fallen to 2%, down significantly from its peak of around 40% in 2021. One of the biggest questions in the crypto industry is whether retail is participating in this current rally. Retail entrance often marks a sign of euphoria or greed and, in some cases, is thought to be a leading indicator of a top in the market. With bitcoin (BTC) gaining of late to within 15% of its record high, this article will explore what the retail activity is indicating. Coinbase Rankings One important indicator of retail participation is to check where crypto exchange Coinbase's (COIN) app ranks in app store downloads. In the 2017 and 2021 bull markets, Coinbase became the number one downloaded app near those tops, and at bitcoin's recent market peak in March of this year, it ranked in the top 5,, according to @CoinbaseAppRankBot. Coinbase currently is ranked just 438, not far above its lowest level of the year of about 500, indicating a continued lack of retail interest. On-chain shows very little retail life Investors who have bought bitcoin within the past 155 days are considered short-term holders (STHs). This cohort tends to be those chasing the market, buying as the price starts to climb, and history shows peaks tend to correlate with high STH supply. Indeed, five recent major tops in bitcoin going back more than a decade have coincided with peaks in STH supply. This current rally, though, has come alongside a decline in STH supply, suggesting no top as of yet. Retail activity by volume Looking at transfer volumes by size, values below $100,000 are typically considered retail volume and anything above that level can be considered institutional. Analyzing the past three bull runs, peak retail volume typically coincides at the top of bull markets. Currently, total retail transfer volume is only around half of what was seen in the 2024 peak. Glassnode data also confirms that bitcoin fees are at cycle lows, roughly generating only $500k daily, while active addresses are below the 365-day moving average which shows a lack of daily active users. NFT gas usage on ether is a ghost-town Speculative trading on-chain, either through inscriptions on bitcoin, or transactions interacting with non-fungible tokens (NFTs) on ether {ETH}}, is another retail participation indicator. In bull markets, we tend to see high fee levels as investors speculate on-chain, with the 2021 market top being a prime example. Currently, however, NFT gas usage on ether is only around 2% versus 2021 when the percentage of gas consumed was at 40%, according to Glassnode data. Memecoin activity is surging A different picture is suggested by the action in memecoins, where things are exploding. These tokens are largely a retail-driven category, according to X account @MustStopMurad, which did a presentation on the subject at Token 2049. Murad shows that new memes are up on aggregate by 2,040% and old memes as a whole are up 105% year-to-date. https://www.coindesk.com/markets/2024/09/30/bitcoin-retail-activity-remains-low-despite-recent-rally/

2024-09-30 15:51

The self-described Bitcoin development company currently holds 252,220 bitcoins, but has more than $1 billion in dry powder with which to purchase additional tokens. MicroStrategy mights soon hold more bitcoin than Grayscale. The company has used capital markets to continually raise money for additional bitcoin buys, while Grayscale has seen a large exit of tokens since the U.S. spot ETFs were introduced in January. MicroStrategy (MSTR) could soon have bigger bitcoin (BTC) pockets than Grayscale. The company held a total of 252,220 bitcoins, or 1.2% of the total supply which is capped at 21 million, per its latest regulatory filing on Sept. 20. Grayscale, which held upwards of 620,000 in its Bitcoin Trust (GBTC) prior to the launch of the U.S. spot ETFs in January, currently holds just over 254,000 tokens split between GBTC and its newer lower-fee Bitcoin Mini Trust (BTC). Recent capital raises, though, have left MicroStrategy with more than $1 billion which the company has yet to put to work (or at least has not yet announced). Presumably, these funds will be used for more bitcoin, which would add thousands of more coins to its balance sheet and bring its holdings far above that of Grayscale. This would also make MicroStrategy the fifth largest holder of the cryptocurrency, trailing only BlackRock, Binance, Satoshi Nakamoto and Coinbase. An important distinction, of course, is that BlackRock, Binance and Coinbase hold bitcoins for clients, not for their own account. Under the leadership of then CEO and now Executive Chairman Michael Saylor, MicroStrategy started purchasing bitcoin with cash from its balance sheet in August 2020. Since, it has aggressively used the capital markets to raise billions with which to continually add to holdings. The company's average purchase price is just over $39,000 versus bitcoin's current price of around $64,000. The stack today is worth about $16 billion. As for Grayscale, which pioneered public access to bitcoin via funds, it chose to keep the fee for its GBTC at a relatively high 1.50% – more than 100 basis points above all competitors – following the conversion to a spot ETF. The result has been a fast bleed in its assets. The Bitcoin Mini Trust, which carries a far more competitive 0.15% fee, has managed to add assets, but holdings stood at just 33,753 tokens as of the end of last week. https://www.coindesk.com/markets/2024/09/30/microstrategys-next-bitcoin-purchase-is-likely-to-take-its-holdings-above-grayscales-gbtc/

2024-09-30 15:17

Fund tokenization is one of the frontiers of bringing real-world assets (RWAs) to blockchain rails in pursuit of greater efficiency, lower costs and faster settlements. The fund holds real estate trust deed positions, offering 14%-15% target yield for institutional investors. Chintai is a blockchain focused on real-world assets (RWAs), regulated and licensed by the Monetary Authority of Singapore for dealing in capital markets products. Asset manager Kin Capital is launching a $100 million tokenized real estate debt fund on the real world asset-centric network Chintai, the parties told CoinDesk exclusively. The fund holds first performing real estate trust deeds, which are agreements between borrower and lender to have the property held in a neutral, independent third-party trust until the loan is paid off. The initial offering is a $5 million tranche, with additional offerings planned through 2024 and early 2025. The fund is accessible to accredited investors with a minimum investment limit of $50,000. The projected return of the fund is 14%-15% annually with quarterly distributions to investors. Fund tokenization is one of the frontiers of bringing traditional investment vehicles, also referred to as real-world assets (RWA), to blockchain rails in pursuit of greater efficiency, lower costs and instant, around-the-clock settlements. Reports by Boston Consulting Group and 21Shares forecast over $10 trillion of tokenized assets by the end of the decade in their optimistic scenarios, while McKinsey has predicted $2 trillion by then in its base case with broad-scale adoption still being far. Chintai is a layer-1 blockchain for tokenized real-world assets, with its native token CHEX powering the network. Chintai Network Services Pte Ltd, the network's ecosystem development firm, is regulated and licensed by the Monetary Authority of Singapore (MAS) to act as a Capital Markets Services provider and a Recognized Market Operator for primary issuance and secondary market trading in digital securities, according to the project's white paper. The network's other business unit, Chintai Nexus, is based on the British Virgin Islands and deals in issuing non-security tokens. Kin Capital operates a blockchain-based marketplace for real-estate focused investment funds. "This collaboration not only bridges the gap between traditional finance and blockchain innovation but also provides accredited investors with unique opportunities to achieve stable and attractive returns in a rapidly evolving digital landscape," said David Packham, CEO of Chintai. https://www.coindesk.com/business/2024/09/30/digital-asset-manager-kin-launches-100m-tokenized-real-estate-fund-on-chintai-network/

2024-09-30 14:43

Kamala Harris only leads by one percentage point on the prediction market, but is expected to carry most of the swing states. This week in prediction markets: $1 billion has been traded on Polymarket's Trump vs. Harris market, with the vice president in the lead. Market is skeptical bitcoin's rally will last. "Black Myth: Wukong" was a major hit for China's game industry. But the market doubts it will win Game of the Year. Polymarket bettors have now put over $1 billion on the question of whether Donald Trump or Kamala Harris will take the White House in November. While Trump appears to be closing the gap – Harris now only leads by one point – swing state markets are telling a different story. Data from the prediction market site gives Harris a greater chance of winning four of the six key swing states, which is unsurprising as those four have historically leaned Democrat. Data from poll aggregator 270ToWin shows that Pennsylvania and Michigan went to the Democrats in the last seven elections, with the exception of 2016, where they voted Republican. In the 1980s, these two states were consistently red given the popularity of Ronald Reagan, which led to a clear victory for his vice president and successor, George H.W. Bush. Wisconsin has caught the interest of many poll watchers who call it one of the more competitive states. Wisconsin voted for Donald Trump in 2016, breaking a streak of Democratic wins, and has often shown tighter races between the two parties. A recent New York Times/Siena College poll shows that the race in Wisconsin is extremely close, with Harris at 49% and Trump at 47%. Polymarket, however, gives Harris a clean lead in the Badger State, pricing her at 56 cents a share compared to 44 cents for Trump. Each share pays out $1 (in USDC, a cryptocurrency that trades 1:1 for dollars) if the candidate wins, and nothing if it doesn't, so the market is signaling Harris has a 56% chance of carrying Wisconsin. It's also important to note that polling in Wisconsin often misses the mark, and the state has been decided by less than a point in four of the last six presidential elections. So the question could be, which is more accurate: unreliable pollsters or political gamblers? Now that Polymarket has cracked the Apple App Store's list of top magazine and newspaper apps, let's see if these degen politics junkies can give pollsters a run for their money in these swing states. Doubts about Bitcoin rally There's a strong bullish case for bitcoin, given the Fed's recent rate cut, the People's Bank of China's liquidity injection, and consistent inflows into spot bitcoin exchange-traded funds. Some market observers are basing their bullishness for bitcoin based on the increased buying of call options priced at $75,000 combined with increased sales of puts. A call option gives the holder the right to buy bitcoin at a set price later, signaling bullish sentiment, while put buying reflects bearish hedging. However, traders on Polymarket are skeptical about all of this, only giving a 41% chance the cryptocurrency will trade above $65,000 on Oct. 4. Traders could be considering the possibility that bitcoin is drifting into "overbought" territory, a product of a price surge that ran a bit too hot. CoinDesk reported Monday that this perception, reflected in the Crypto Greed and Fear Index, suggests a potential pullback is in the works, especially with the upcoming U.S. ISM Manufacturing data, which has historically triggered price drops if it signals weaker economic conditions. Over on Kalshi, the U.S.-regulated, dollar-denominated prediction market, bettors remain generally optimistic for bitcoin's price stability, giving it a 47% chance of finishing the year above $75,000 and a 34% chance of it topping $80,000. Traders are also confident that it will cross its previous all-time high of $73,200 this year, giving this a 58% chance of happening. Gambling on gaming The video game Black Myth: Wukong has found success worldwide – a notable achievement for a Chinese gaming industry that was nearly suffocated by Beijing's regulation. But Kalshi bettors doubt it will win Game of the Year at the 2024 Game Awards. Bettors on the platform are giving only a 23% chance of the game claiming the title, instead putting their money behind Astro Bot, with a 64% chance. While Astro Bot has garnered rave reviews, it's not the cultural phenomenon that Black Myth: Wukong is. Beijing put the brakes on its fast-growing domestic gaming industry in 2021, refusing to grant licenses for new titles after calling the medium "spiritual opium." The government had grown progressively more annoyed with the industry's reliance on "loot boxes," in-game spending, and incentives for players to log in daily. The industry was unfrozen in 2022 after promising to reform itself and move away from freemium titles reliant on cash grabs. That's when Black Myth: Wukong was born. Unlike the games China's industry was known for, Black Myth is a narrative-driven role-playing game inspired by the classical Chinese novel Journey to the West (which holds the same weight in China's literary canon as Homer's Odyssey does in the West). It's designed to be a slow burn. The game is a massive hit in China, selling over 4.5 million copies in-country in its first week, and has found a following on the international digital game store Steam where it's the fifth most popular game, with nearly 250,000 concurrent players. Even Tron's Justin Sun was a fan of the game, changing his profile picture on X to its protagonist monkey. Which, of course, led to memecoins. But this doesn't make it game-of-the-year material for Kalshi's bettors. https://www.coindesk.com/markets/2024/09/30/trump-inches-closer-to-harris-on-polymarket-as-betting-passes-1-billion/

2024-09-30 12:35

Overbought conditions also surely played a role in bitcoin's Monday decline. A surprise choice as Japan's next prime minister renewed fears of BOJ tightening, sending markets lower. Overbought conditions left bitcoin vulnerable to a selloff. This week brings a number of key U.S. economic reports and Fedspeak which could affect the outlook for rates and prices. After a quick roughly 14% run higher following the U.S. Federal Reserve's 50 basis point rate cut nearly two weeks ago, conditions seemed ripe for something to set off a sizable selloff in bitcoin (BTC), and the selection of a new prime minister in Japan over the weekend appeared to be the trigger. In a surprise choice, that country's ruling party selected Shigeru Ishiba to be its next prime minister. Without getting too much into the inside baseball of Japan's Liberal Democratic party, it's commonly believed that Ishiba is supportive of the Bank of Japan's plan to return monetary policy to normalcy, i.e. higher interest rates. Following his selection as prime minister, Ishiba called for snap elections to be held in late October. Recall, it was the BOJ's very modest rate hike in late July that caused a violent unwind in the so-called yen carry trade and subsequent global panic in financial markets, sending bitcoin plunging from about $70,000 to below $50,000 in the space of a few days. The selling was so ugly that the BOJ had to send out a former official to try and calm markets by saying the bank wasn't going to hike rates again in 2024. The selection of Ishiba over the weekend, however, triggered another rise in the yen and a quick 5% decline in Japan's Nikkei stock average, with the selling apparently spreading to bitcoin, which quickly fell from about the $66,000 to as low as $63,300. It's bounced to $63,800 at press time, down about 3% from late Friday. European stocks are lower by roughly 1% at midday and U.S. stock index futures are showing just modest losses. Bitcoin vulnerable after big run higher Prior to the weekend action, bitcoin had been enjoying a strong bull run since the Fed slashed its benchmark interest rate by 50 basis points in mid-September. Helping the move was China launching its own wave of monetary and fiscal stimulus to help boost that country's economy and markets. After enjoying its best week in more than a decade, the Shanghai Composite soared another 8% on Monday. A number of indicators late last week, pointed to overbought conditions, among them, said CoinDesk analyst James Van Straten, were perpetual funding rates for bitcoin futures. Van Straten noted that they've risen to levels near those seen just prior to the late July and last August selloffs. Looking ahead This week brings the start of a new month and with it a number of key economic reports and central bank talk. Later on Monday, Fed Chair Jerome Powell could comment on the economic and monetary policy outlook in a speech at the annual meeting for the National Association for Business Economics. Tuesday and Thursday will see U.S. manufacturing and service sector reports from the Institute for Supply Management (ISM) and the main event will be Friday with the September jobs report. The data could go a long way in influencing the Fed's rate decision at its next policy meeting in early November (right after the presidential election). At the moment, markets are giving about a two-in-three chance of a 25 basis point Fed rate cut, according to CME FedWatch. It was the Fed somewhat surprisingly moving 50 instead of 25 at its September meeting which triggered this most recent bull move. A sizable change in the November rate cut odds might again affect the price path. https://www.coindesk.com/markets/2024/09/30/bitcoin-tumbles-back-below-64k-as-surprise-japan-prime-minister-choice-triggers-5-plunge-in-nikkei/