2025-09-01 07:01

Putin scolds West over NATO enlargement Putin says a fair security balance needed Putin: 'root causes' of the war must be eliminated Putin says Trump summit understandings opened a way to peace TIANJIN, Sept 1 (Reuters) - Russian President Vladimir Putin, after talking with China's Xi Jinping and India's Narendra Modi, said on Monday the issue of NATO's eastward enlargement would have to be addressed for there to be sustainable peace in Ukraine. Putin ordered tens of thousands of troops to invade Ukraine in February 2022 after eight years of fighting in eastern Ukraine between Russian-backed separatists and Ukrainian troops. Russia currently controls a little under one fifth of Ukraine. Sign up here. Ukraine and Western European powers describe the invasion as a brutal imperial-style land grab. Putin casts the war as a battle with a declining West, which he says humiliated Russia after the Berlin Wall fell in 1989 by enlarging NATO eastwards. On the sidelines of the Shanghai Cooperation Organisation (SCO) meeting in Tianjin, Modi held Putin's hand as they walked towards Chinese President Xi. All three smiled as they spoke, surrounded by translators. Speaking at the summit, Putin said the West had tried to bring Ukraine into the West's orbit and then sought to entice the former Soviet republic into the U.S.-led NATO military alliance. "In order for a Ukrainian settlement to be sustainable and long-term, the root causes of the crisis, which I have just mentioned and which I have repeatedly mentioned before, must be eliminated," Putin said. "A fair balance in the security sphere" must be also restored, Putin said, shorthand for a series of Russian demands about NATO and European security. At the 2008 Bucharest summit, NATO leaders agreed that Ukraine and Georgia would one day become members. Ukraine in 2019 amended its constitution committing to the path of full membership of NATO and the European Union. Reuters reported in May that Putin's conditions for ending the war include a demand that Western leaders pledge in writing to stop enlarging NATO eastwards and lift a chunk of sanctions on Russia. Putin said that "understandings" he reached with U.S. President Donald Trump at a summit in Alaska in August opened a way to peace in Ukraine, which he would discuss with leaders attending the regional summit in China. "We highly appreciate the efforts and proposals from China and India aimed at facilitating the resolution of the Ukrainian crisis," Putin told the forum. "The understandings reached at the recent Russia–U.S. meeting in Alaska, I hope, also contribute toward this goal." He said he had detailed to Xi on Sunday the achievements of his talks with Trump and the work "already underway" to resolve the conflict and would provide more detail in two-way meetings with the Chinese leader and others. China and India are by far the biggest purchasers of crude from Russia, the world's second largest exporter. Trump has imposed additional tariffs on India over the purchases but there is no sign yet that either India or China are going to stop purchasing Russian oil, a key export of Russia's war economy. (This story has been refiled to fix the byline) https://www.reuters.com/world/china/after-talks-with-xi-modi-putin-says-nato-enlargement-has-be-addressed-ukraine-2025-09-01/

2025-09-01 06:54

Fed's Daly says it'll soon be time to recalibrate policy Silver rises more than 2% to trade above $40 per ounce Platinum up more than 1% Sept 1 (Reuters) - Gold hit a more than four-month high on Monday, as increased bets for a U.S. Federal Reserve interest rate cut this month lifted bullion's allure, while silver rose above $40 per ounce for the first time in more than a decade. Spot gold rose 1.2% to $3,486.86 per ounce by 0641 GMT, hitting its highest point since April 23. U.S. gold futures for December delivery gained 1.1% to $3,554.60. Sign up here. "Dovish comments from San Francisco Fed President Mary Daly helped traders looked past a higher core PCE (Personal Consumption Expenditures) read on Friday, and kept the door open for a 25-basis-point rate cut this month," City Index senior analyst Matt Simpson said. A U.S. appeals court has also deemed most of U.S. President Donald Trump's tariffs illegal, weighing further on the dollar and sending gold to a four-month high, Simpson said. Data showed that the U.S. PCE price index rose 0.2% month-on-month, and 2.6% year-on-year, both in line with expectations. In a social media post on Friday, Daly reiterated her support for a rate cut, given the risks to the labour market. Non-yielding gold typically performs well in a low-interest-rate environment. On the trade front, U.S. Trade Representative Jamieson Greer said on Sunday the Trump administration is continuing its talks with trading partners despite a U.S. appeals court ruling that most of Trump's tariffs are illegal. Spot silver jumped 2.2% to $40.56 per ounce, the highest level since September 2011. "The U.S. bank holiday is contributing to thinner liquidity, which is also exacerbating some of the moves in gold and silver," said KCM Trade's chief market analyst, Tim Waterer. "Silver is making a move higher in response to expectations of lower U.S. rates, while a tight supply market is helping to maintain an upward bias." Platinum gained 1.5% to $1,384.68 and palladium climbed 0.8% to $1,118.06. https://www.reuters.com/world/india/gold-climbs-us-rate-cut-bets-silver-hits-14-year-high-2025-09-01/

2025-09-01 06:52

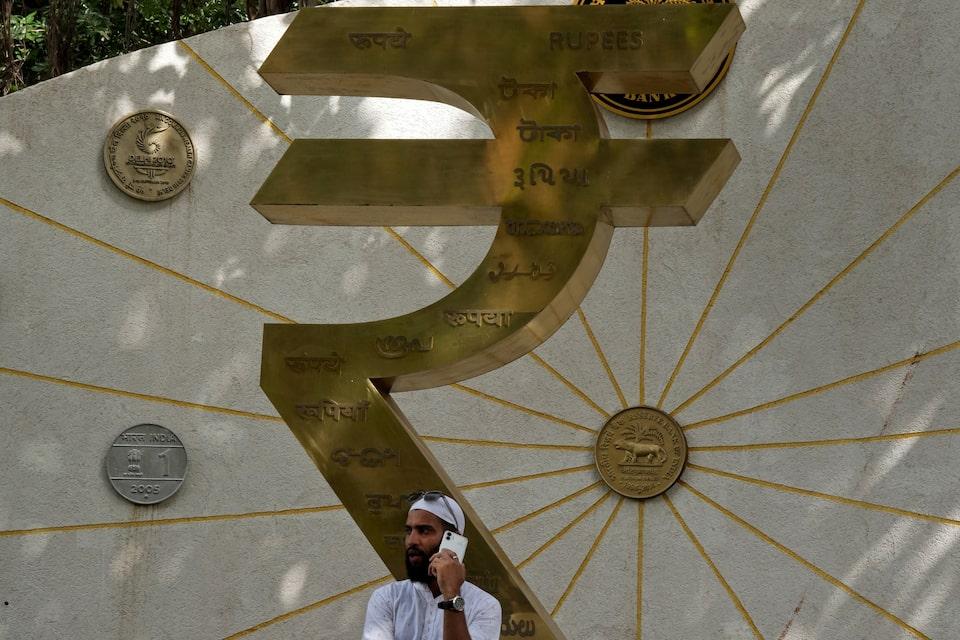

MUMBAI, Sept 1 (Reuters) - The Indian rupee dipped on Monday, hovering near an all-time low, with analysts expecting its underperformance versus other Asian currencies to persist amid high U.S. tariffs. The rupee was quoting at 88.27 to the U.S. dollar, just shy of its lifetime low of 88.3075 hit on Friday. The unit is the worst performing Asian currency year-to-date, down about 3% against the dollar. Sign up here. In comparison, the Thai baht, Singapore dollar, and Korean won have rallied more than 6% and the offshore Chinese yuan has risen 3%. The rupee's underperformance is expected to continue as India faces the highest U.S. tariffs on its exports among Asian countries. With "the latest U.S. tariff developments, their macroeconomic impact, and the flow picture, we think the rupee should remain under pressure and underperform other carry candidates" and its Asian peers in the near-term, Goldman Sachs said in a note. Economists at Goldman Sachs estimate that the total effective U.S. tariff rate is now around 32% on India goods. The tariffs could widen the trade deficit by constraining shipments in key sectors such as textiles and gems and jewellery. Slower export growth could dampen GDP growth, which in turn would hurt portfolio flows and amplify pressure on the rupee. Foreign investors have pulled out $2.4 billion from Indian equities over the past three sessions, including nearly $950 million on Friday, when the rupee hit a record low of 88.3075. Continued outflows are expected to exacerbate volatility in the currency and equity markets. https://www.reuters.com/world/india/rupee-hovers-near-all-time-low-likely-keep-underperforming-asia-2025-09-01/

2025-09-01 06:41

Equinor supports Orsted's rights issue Will subscribe for shares worth up to $941 million Equinor sees value in strategic collaboration with Orsted Will nominate candidate to Orsted’s board COPENHAGEN, Sept 1 (Reuters) - Norway's Equinor (EQNR.OL) , opens new tab pledged on Monday to support Orsted's (ORSTED.CO) , opens new tab planned $9.4 billion rights issue as the Danish offshore wind developer seeks to bolster its balance sheet in the face of President Donald Trump's hostility to wind power. The move by the Norwegian energy group, in which the state owns a 67% stake, signals its ambition to strengthen ties with Orsted as both companies navigate regulatory hurdles in the U.S. offshore wind market. Sign up here. "In response to the challenges facing offshore wind, the industry will see consolidation and new business models," Equinor said in a statement. "Equinor believes that a closer industrial and strategic collaboration between Orsted and Equinor can create value for all shareholders in both companies," it added. Orsted will ask shareholders at an extraordinary general meeting on Friday to approve the capital raise, citing "material adverse developments" in the U.S. sector. Equinor, which holds a 10% stake in Orsted, said it plans to subscribe for new shares worth up to 6 billion Danish crowns ($941 million) and expressed confidence in Orsted’s business and the competitiveness of offshore wind energy. Equinor also plans to nominate a candidate to Orsted’s board ahead of its next annual general meeting. The U.S. Bureau of Ocean Energy Management (BOEM) last month issued a work-stop order for Orsted's $1.5 billion Revolution Wind project, which was 80% complete, marking its second major suspension of an offshore wind project this year. BOEM previously halted Equinor's Empire Wind 1 project off New York in April. Equinor said it was monitoring the situation in the U.S. closely and will remain in dialogue with Orsted as developments unfold. Despite the U.S. setback, Orsted, which is 50.1% owned by the Danish state, reiterated plans for the rights issue, and the Danish finance ministry has confirmed its commitment to participate. ($1 = 6.3751 Danish crowns) https://www.reuters.com/sustainability/climate-energy/norways-equinor-backs-orsteds-plans-raise-capital-following-us-offshore-wind-2025-09-01/

2025-09-01 06:24

LONDON, Sept 1 (Reuters) - British house prices unexpectedly fell in August as buyers struggled to afford high valuations, mortgage lender Nationwide Building Society said on Monday. Property prices slipped by 0.1% last month from July, Nationwide said, the third month-on-month fall since April when a tax break expired for buyers of many lower-value homes. Sign up here. Compared with 12 months earlier, prices in August were up by 2.1%, the joint weakest rate of growth since June of last year. Economists polled by Reuters had forecast a 0.2% monthly rise and a 2.8% annual increase. Prices were rising by almost 5% in annual terms at the end of last year ahead of the end of the stamp duty land tax exemption. "The relatively subdued pace of house price growth is perhaps understandable, given that affordability remains stretched relative to long-term norms," Nationwide Chief Economist Robert Gardner said. An average earner buying a typical first-time home with a 20% deposit currently faces a monthly mortgage payment equivalent to around 35% of take-home pay, well above the long run average of 30%, he said. The Bank of England cut its benchmark interest rate to 4% from 4.25% on August 7 but it also signalled concern about inflation pressures in the economy that could slow the pace of further reductions in borrowing costs. Last month, the Royal Institution of Chartered Surveyors said a recovery in the housing market had lost steam as some buyers worried about possible tax increases in finance minister Rachel Reeves' next budget. "The risk is that speculation over possible property tax rises in the autumn Budget, such as a mansion tax, hits buyer sentiment further in the coming months," Ashley Webb, UK economist with consultancy Capital Economics, said. ($1 = 0.7572 pounds) https://www.reuters.com/business/finance/uk-house-prices-unexpectedly-fell-august-nationwide-data-shows-2025-09-01/

2025-09-01 06:09

Rescuers comb rubble of homes in remote mountainous area Helicopters ferry the injured to hospital Midnight quake hit at a depth of 10 km (6 miles) KABUL, Sept 1 (Reuters) - About 622 people were killed and more than 1,500 injured in an earthquake that struck eastern Afghanistan, authorities said on Monday, as helicopters ferried the wounded to safety from rubble being combed in the hunt for survivors. The disaster will further stretch the resources of the South Asian nation already grappling with humanitarian crises, from a sharp drop in aid to a huge pushback of its citizens from neighbouring countries. Sign up here. The quake of magnitude 6 injured more than 1,500, the Taliban-run Afghan interior ministry said in a statement that put the death toll at 622. Earlier state-run broadcaster Radio Television Afghanistan (RTA) put the toll at about 500. In Kabul, the capital, health authorities said rescuers were racing to reach remote hamlets dotting an area with a long history of earthquakes and floods. "Figures from just a few clinics show over 400 injured and dozens of fatalities," ministry spokesperson Sharafat Zaman said in a statement that warned of higher casualties. Images from Reuters Television showed helicopters ferrying out the affected, while residents helped soldiers and medics carry the wounded to ambulances. Three villages were razed in the province of Kunar, with substantial damage in many others, the health ministry said. Reports showed 250 dead and 500 injured, said Najibullah Hanif, the provincial information head of Kunar, adding that the tally could change. Early reports showed 30 dead in a single village, with hundreds of injured taken to hospital, authorities said. Rescuers were scrambling to find survivors in the area bordering Pakistan's Khyber Pakhtunkhwa region, where homes of mud and stone were levelled by the midnight quake hit at a depth of 10 km (6 miles). "So far, no foreign governments have reached out to provide support for rescue or relief work," a foreign office spokesperson said. Afghanistan is prone to deadly earthquakes, particularly in the Hindu Kush mountain range, where the Indian and Eurasian tectonic plates meet. A series of earthquakes in its west killed more than 1,000 people last year, underscoring the vulnerability of one of the world's poorest countries to natural disasters. https://www.reuters.com/world/asia-pacific/afghanistan-earthquake-kills-622-with-more-than-1500-injured-2025-09-01/