2025-08-29 22:10

Banxico raises 2023 growth forecast to 0.6% from 0.1% Core inflation forecast increased to 3.7% for Q4 2025 Economic weakness was a factor behind this month's rate cut MEXICO CITY, Aug 29 (Reuters) - Mexico's economy is performing better than expected, the Bank of Mexico said on Friday in its quarterly report, while increasing its growth forecast for the rest of the year for Latin America's second largest economy. The report offered a positive, if mixed, assessment: Mexico's economy is showing resilience in the face of an uncertain business environment and on-again, off-again tariffs from the U.S., Mexico's largest trade partner. Sign up here. But Banxico, as Mexico's central bank is known, said economic growth remains sluggish and it projected higher rates of inflation for the rest of the year compared with its previous estimate. It said the economic effects of U.S. tariffs may take more time to become clear. "The Mexican economy has performed better than the external environment would suggest and could continue performing better than anticipated as long as the adverse effects of change in U.S. economy policy take time to materialize," the bank's quarterly report said. Banxico raised its forecast for economic growth this year to 0.6% from its previous estimate of 0.1%. The central bank also increased its outlook for economic growth in 2026 to 1.1% from a prior estimate of 0.9%. "The Mexican economy grew more than expected," Central Bank Governor Victoria Rodriguez said during a presentation of the report. But the bank also highlighted an increase in the price of goods. It now expects annual headline inflation in the fourth quarter to reach 3.7%, versus a prior forecast of 3.3%. Even so, the bank maintained its estimate that headline inflation will converge to its 3% target in the third quarter of 2026. The forecast for annual core inflation, which excludes some volatile goods and is considered a more reliable indicator, was revised upwards to 3.7% for the fourth quarter of 2025, compared with the bank's earlier forecast of 3.4%. Banxico cited the economy's weakness as a factor when it cut its benchmark interest rate earlier this month to 7.75%, bringing the rate to its lowest level in three years. Central banks often cut interest rates to stimulate the economy, although that can also fuel inflation. Deputy Governor Jonathan Heath, who was the only member of the five-member board to vote against lowering the interest rate and cited persistent inflation, again raised concerns during Friday's presentation, singling out higher food prices at taco stands and restaurants. But he said Mexico's economy clearly needs to grow more, saying it's between "lethargy and stagnation." https://www.reuters.com/world/americas/mexicos-central-bank-hikes-economic-forecast-growth-remains-sluggish-2025-08-29/

2025-08-29 21:56

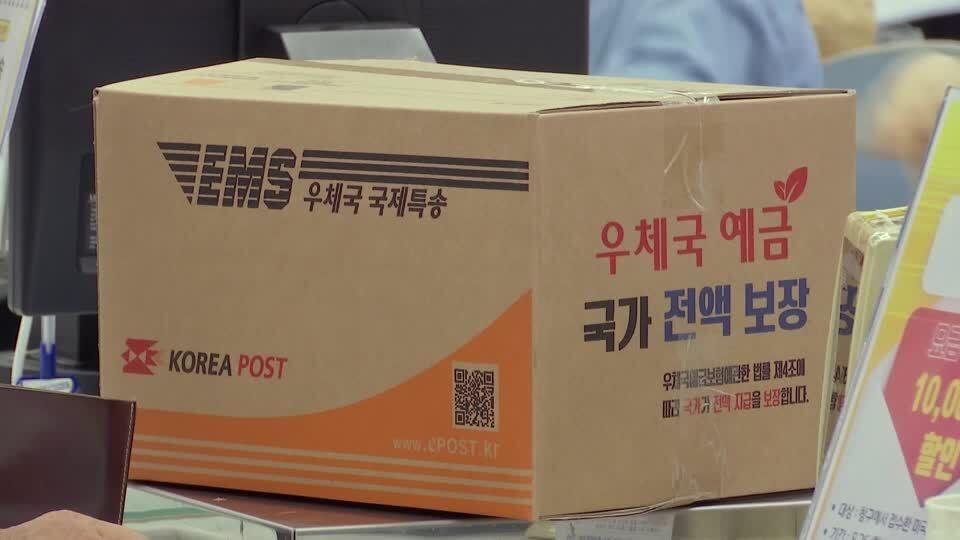

Removal of tariff exemption to disrupt e-commerce, raise costs, analysts say Customs agency collecting duties on all global parcel imports Many postal services suspended shipments of parcels to US Disruptions similar to February's not yet seen, logistics expert says WASHINGTON, Aug 29 (Reuters) - The U.S. ended tariff exemptions for parcel imports on Friday without the logistical hiccups that dogged prior attempts, while consumers, e-commerce companies and small businesses using online marketplaces braced for cost increases and supply chain disruptions. The U.S. Customs and Border Protection agency began collecting normal duty rates on all package shipments valued under $800, regardless of value, country of origin, or mode of transportation. Sign up here. For the first six months, importers can opt to pay a flat-rate duty of $80 to $200 per package shipped from foreign postal agencies. The change broadens the Trump administration's cancellation of the de minimis exemption, already in place for packages from China and Hong Kong since May as part of an effort to halt shipments of fentanyl and its precursor chemicals into the U.S. The customs agency's commissioner, Rodney Scott, said it was ready to enforce the new duty requirements. "For too long, this loophole handed criminal networks a free pass to flood America with fentanyl, fake goods, and illegal shipments. Those days are over." Trump administration officials said the change could boost U.S. customs revenues by $10 billion annually. The de minimis exemption has been in place since 1938, starting at $5 for gift imports, and was raised from $200 to $800 in 2015 to foster small business growth on e-commerce marketplaces. Direct shipments from China surged after President Donald Trump raised tariffs on Chinese goods during his first term, creating a new direct-to-consumer business model for e-commerce firms such as Shein and Temu (PDD.O) , opens new tab. The National Coalition of Textile Organizations hailed a "historic win" for U.S. manufacturing following the closing of a loophole that allowed foreign fast-fashion firms to avoid tariffs and import apparel sometimes made with forced labor, undercutting American jobs. "The administration's executive action closes this channel and delivers long overdue relief to the U.S. textile industry and its workers," the group said. The customs agency has estimated that the number of packages claiming the de minimis exemption jumped nearly 10-fold , opens new tab from 139 million in fiscal 2015 to 1.36 billion in fiscal 2024 - a rate of 4 million per day. More than 25 foreign postal services suspended mail to the U.S. in the run-up to the de minimis deadline, helping the U.S. to avoid a repeat of the chaotic package pile-up that forced the Trump administration to pull back on its first attempt at ending the de minimis exemption for China in February. "I'm not hearing of any huge slowdowns at any of the ports right now, but it's still early," said Bernard Hart, vice president of customs and trade at logistics provider Flexport. "We do believe that industry had enough time to react to this and to move inventory around." The customs agency said 95% of all de minimis shipments are handled by general cargo carriers or express shippers such as FedEx (FDX.N) , opens new tab, UPS (UPS.N) , opens new tab and DHL (DHLn.DE) , opens new tab, which had already adapted to the China changes. Britain's Royal Mail resumed shipments on Thursday. European postal groups including Germany's DHL and Norway's Posten Bring on Friday were seeking ways to handle the new fees and extra paperwork after suspending certain shipments. HIGHER COSTS, MORE PAPERWORK Retail and trade analysts say the end of de minimis is likely to raise prices for many goods sold through e-commerce companies, as those that previously avoided tariffs because of the exemption become subject to duties. This may put such firms on a par with costs for more established retailers like Walmart (WMT.N) , opens new tab that tend to import merchandise in bulk containers that are subject to tariffs. It is also likely to curb trade on peer-to-peer platforms such as eBay (EBAY.O) , opens new tab and Etsy (ETSY.O) , opens new tab, which are used by small businesses to sell secondhand, vintage or handmade items. The customs agency has collected more than $492 million in additional duties on packages shipped from China and Hong Kong since their exemptions were eliminated on May 2, another Trump administration official said. Foreign postal agencies can opt to collect and process the duties based on the value of the package contents, or they can collect a flat tax calculated from the tariff rate in effect for the country of origin. Based on the agency's guidance , opens new tab issued on Thursday, parcels would be charged $80 from countries with Trump-imposed duty rates below 16%, such as Britain and the European Union; $160 from countries between 16% and 25%, such as Indonesia and Vietnam; and, $200 from countries above 25%, including Brazil, Canada, China and India. https://www.reuters.com/world/china/us-tariff-exemption-low-value-packages-ends-with-few-hiccups-higher-costs-loom-2025-08-29/

2025-08-29 21:55

Appeals court on 7-4 vote rules against Trump's tariffs Court delays ruling taking effect to allow for Supreme Court appeal Trump administration may have Plan B NEW YORK, Aug 29 (Reuters) - A divided U.S. appeals court ruled on Friday that most of Donald Trump's tariffs are illegal, undercutting the Republican president's use of the levies as a key international economic policy tool. The court allowed the tariffs to remain in place through October 14 to give the Trump administration a chance to file an appeal with the U.S. Supreme Court. Sign up here. The decision comes as a legal fight over the independence of the Federal Reserve also seems bound for the Supreme Court, setting up an unprecedented legal showdown this year over Trump's entire economic policy. Trump has made tariffs a pillar of U.S. foreign policy in his second term, using them to exert political pressure and renegotiate trade deals with countries that export goods to the United States. The tariffs have given the Trump administration leverage to extract economic concessions from trading partners but have also increased volatility in financial markets. Trump lamented the decision by what he called a "highly partisan" court, posting on Truth Social: "If these Tariffs ever went away, it would be a total disaster for the Country." He nonetheless predicted a reversal, saying he expected tariffs to benefit the country "with the help of the Supreme Court." The 7-4 decision from the U.S. Court of Appeals for the Federal Circuit in Washington, D.C., addressed the legality of what Trump calls "reciprocal" tariffs imposed as part of his trade war in April, as well as a separate set of tariffs imposed in February against China, Canada and Mexico. Democratic presidents appointed six judges in the majority and two judges who dissented, while Republican presidents appointed one judge in the majority and two dissenters. The court's decision does not impact tariffs issued under other legal authority, such as Trump's tariffs on steel and aluminum imports. 'UNUSUAL AND EXTRAORDINARY' Trump justified both sets of tariffs - as well as more recent levies - under the International Emergency Economic Powers Act. IEEPA gives the president the power to address "unusual and extraordinary" threats during national emergencies. "The statute bestows significant authority on the President to undertake a number of actions in response to a declared national emergency, but none of these actions explicitly include the power to impose tariffs, duties, or the like, or the power to tax," the court said. "It seems unlikely that Congress intended, in enacting IEEPA, to depart from its past practice and grant the President unlimited authority to impose tariffs." The 1977 law had historically been used for imposing sanctions on enemies or freezing their assets. Trump, the first president to use IEEPA to impose tariffs, says the measures were justified given trade imbalances, declining U.S. manufacturing power and the cross-border flow of drugs. Trump's Department of Justice has argued that the law allows tariffs under emergency provisions that authorize a president to "regulate" imports or block them completely. Trump declared a national emergency in April over the fact that the U.S. imports more than it exports, as the nation has done for decades. Trump said the persistent trade deficit was undermining U.S. manufacturing capability and military readiness. Trump said the February tariffs against China, Canada and Mexico were appropriate because those countries were not doing enough to stop illegal fentanyl from crossing U.S. borders, an assertion the countries have denied. MORE UNCERTAINTY William Reinsch, a former senior Commerce Department official now with the Center on Strategic and International Studies, said the Trump administration had been bracing for this ruling. "It's common knowledge the administration has been anticipating this outcome and is preparing a Plan B, presumably to keep the tariffs in place via other statutes." There was little reaction to the ruling in after-hours stock trading. "The last thing the market or corporate America needs is more uncertainty on trade," said Art Hogan, chief market strategist at B. Riley Wealth. Trump is also locked in a legal battle to remove Federal Reserve Governor Lisa Cook, potentially ending the central bank's independence. "I think it puts Trump's entire economic agenda on a potential collision course with the Supreme Court. It's unlike anything we've seen ever," said Josh Lipsky, chair of international economics at the Atlantic Council. The 6-3 conservative majority Supreme Court has issued a series of rulings favoring Trump's second term agenda but has also in recent years been hostile to expansive interpretations of old statutes to provide presidents newly-found powers. The appeals court ruling stems from two cases, one brought by five small U.S. businesses and the other by 12 Democratic-led U.S. states, which argued that IEEPA does not authorize tariffs. The Constitution grants Congress, not the president, the authority to issue taxes and tariffs, and any delegation of that authority must be both explicit and limited, according to the lawsuits. The New York-based U.S. Court of International Trade ruled against Trump's tariff policies on May 28, saying the president had exceeded his authority when he imposed both sets of challenged tariffs. The three-judge panel included a judge who was appointed by Trump in his first term. Another court in Washington ruled that IEEPA does not authorize Trump's tariffs, and the government has appealed that decision as well. At least eight lawsuits have challenged Trump's tariff policies, including one filed by the state of California. https://www.reuters.com/legal/government/most-trump-tariffs-are-not-legal-us-appeals-court-rules-2025-08-30/

2025-08-29 21:49

US dollar index last down against euro after PCE data Oil prices lower with weaker demand expected Fed funds futures price in 89% odds of a US cut next month NEW YORK, Aug 29 (Reuters) - Major stock indexes fell on Friday, with technology shares including Dell Technologies (DELL.N) , opens new tab leading declines, while the dollar weakened against the euro after U.S. inflation data kept alive expectations of a September interest rate cut. Dell dropped 8.9% after it reported results late Thursday that included high manufacturing costs for artificial intelligence-optimized servers. Other AI-related shares fell in the broader tech selloff including Nvidia (NVDA.O) , opens new tab, down 3.3%, and Broadcom (AVGO.O) , opens new tab, down 3.6%. The Nasdaq fell more than 1% and the S&P 500 technology index (.SPLRCT) , opens new tab fell 1.6%. Sign up here. The U.S. Commerce Department said on Friday its Personal Consumption Expenditures Price Index (PCE) 0.2% in July, versus an unrevised 0.3% increase in June and matching the estimate of economists polled by Reuters. In the 12 months through July, PCE inflation increased 2.6% after climbing 2.6% in June. Stripping out the volatile food and energy components, the so-called core PCE Price Index increased 0.3% last month. That followed a 0.3% rise in core inflation in June. "You have to love it when a plan comes together. Today's numbers on both the personal consumption, expenditure, and income, and spending, were right down the middle of the fairway," Art Hogan, chief markets strategist for B. Riley Wealth in Boston, said via email. "This leaves the door wide open for the Fed to cut rates in September and likely again in October and in December." Traders are now pricing in 89% odds of a cut by the Federal Reserve next month, up from 84% before the data. Traders had increased bets on more cuts after Fed Chair Jerome Powell last Friday adopted an unexpectedly dovish tone. The euro was last up 0.11% at $1.1696. The dollar index , which measures the greenback against a basket of currencies, fell 0.09% to 97.79. The Dow Jones Industrial Average (.DJI) , opens new tab fell 92.02 points, or 0.20%, to 45,544.88, the S&P 500 (.SPX) , opens new tab fell 41.60 points, or 0.64%, to 6,460.26 and the Nasdaq Composite (.IXIC) , opens new tab fell 249.61 points, or 1.15%, to 21,455.55. "Today is just weakness in the top of the market, in tech," said Zachary Hill, head of portfolio management at Horizon Investments in Charlotte, North Carolina. For the month, the S&P 500 rose 1.9%, the Dow rose 3.2% and the Nasdaq added 1.6%. Major U.S. financial markets will be closed for the Labor Day holiday on Monday. European shares closed lower, hitting their lowest in over two weeks, weighed down by British banks. Data released on Friday also showed French consumer prices rose slightly less than anticipated in August while Spain's European Union-harmonized 12-month inflation rate was steady at 2.7%. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab fell 4.77 points, or 0.50%, to 951.57. The pan-European STOXX 600 (.STOXX) , opens new tab index fell 0.64%. In Treasuries, l edged higher as traders closed positions ahead of the long weekend and repositioned for month-end. The yield on benchmark U.S. 10-year notes rose 1.6 basis points to 4.223%. The two-year note Fed Governor Christopher Waller on Thursday said he wanted to start cutting interest rates next month and "fully expects" more rate cuts to follow, to bring the Fed's policy rate closer to a neutral setting. Investors are keen to see U.S. jobs data for August, which is due next Friday. They also are watching for more news on U.S. President Donald Trump's attempt to fire Fed Governor Lisa Cook. A federal judge said on Friday she would set an expedited briefing schedule in Cook's bid to temporarily block Trump from firing her while she pursues a lawsuit that says he has no valid reason to remove her. Oil prices were lower. U.S. crude fell 59 cents to settle at $64.01 a barrel and Brent declined 50 cents to settle at $68.12. Spot gold rose 0.88% to $3,446.75 an ounce. https://www.reuters.com/world/china/global-markets-global-markets-2025-08-29/

2025-08-29 21:12

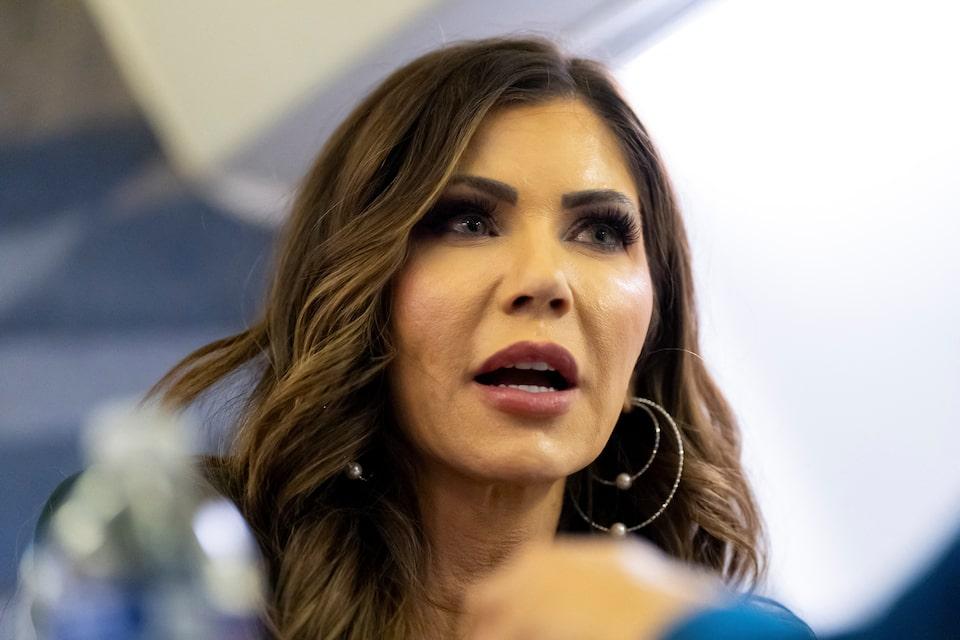

WASHINGTON, Aug 29 (Reuters) - U.S. Department of Homeland Security Secretary Kristi Noem said on Friday she fired two dozen members of the Federal Emergency Management Agency's (FEMA) IT department, citing "massive cyber failures." "While conducting a routine cybersecurity review, the DHS Office of the Chief Information Officer (OCIO) discovered significant security vulnerabilities that gave a threat actor access to FEMA’s network," the DHS said in a statement. Sign up here. "The investigation uncovered several severe lapses in security that allowed the threat actor to breach FEMA’s network and threaten the entire Department and the nation as a whole." No Americans were directly impacted and no sensitive data was extracted from any DHS networks, the statement added. https://www.reuters.com/world/us/dhs-chief-noem-fires-two-dozen-fema-employees-citing-cybersecurity-failures-2025-08-29/

2025-08-29 21:04

Aug 29 (Reuters) - The U.S. International Trade Commission voted on Friday to proceed with an investigation into whether solar panels from India, Laos and Indonesia are stifling domestic manufacturing, a key procedural step that could result in tariffs on those imports. WHY IT'S IMPORTANT The unanimous decision by the three-member panel is a victory for domestic solar manufacturers who say Chinese companies with operations in those countries receive unfair government subsidies and are selling their products below the cost of production in the United States. U.S. producers are seeking to protect billions of dollars of investment in American factories. Sign up here. KEY QUOTE "Today's ITC decision confirms what our petitions allege: U.S. solar manufacturers are being undercut and harmed by unfairly traded imports. Chinese-owned and other companies in Laos, Indonesia, and India are gaming the system with unfair practices that are gutting U.S. jobs and investment,” said Tim Brightbill, lead counsel to the Alliance for American Solar Manufacturing and Trade and partner at Wiley Rein LLP. CONTEXT The case was brought in July by the alliance, a coalition of U.S. solar manufacturers including First Solar (FSLR.O) , opens new tab and Hanwha's (000880.KS) , opens new tab Qcells. Imports from India, Indonesia, and Laos surged to $1.6 billion last year, up from $289 million in 2022, according to the group. Many of these imports are believed to have shifted from countries already subject to U.S. tariffs on Southeast Asian solar exports. WHAT’S NEXT The U.S. Department of Commerce will continue investigations into the imports, with preliminary determinations on countervailing, or anti-subsidy, duties expected around Oct. 10 and on antidumping duties around Dec. 24. https://www.reuters.com/sustainability/climate-energy/us-will-proceed-with-probe-solar-imports-india-laos-indonesia-2025-08-29/