2025-08-28 11:33

Nvidia's shares decline as investors assess earnings, China outlook European tech stocks mixed, Pernod Ricard climbs after results EUR steady with focus on Fed policy, French politics Odds of September Fed rate cut at 87% SINGAPORE, Aug 28 (Reuters) - Global equities were modestly higher on Thursday, sidestepping a wobble in tech sector stocks after the results of bellwether Nvidia (NVDA.O) , opens new tab fell short of some analyst expectations, sending its shares lower in out of hours trading. The MSCI World Equity Index (.MIWD00000PUS) , opens new tab was up 0.1% and pan-European Stoxx 600 (.STOXX) , opens new tab rose 0.4% while equity futures pointed to a steady start for S&P 500 and Nasdaq composite indexes. Sign up here. Nvidia's shares were down 2.2% in U.S. pre-market trading as uncertainty over its China businesses clouded a better-than-expected revenue forecast for the next quarter. Semiconductor stocks in Europe were mixed as investors parsed the firm's outlook, which was slightly above consensus analyst expectations but also disappointed investors accustomed to blowout results. What also caused concern was that data centre revenues of $41.1 billion fell short of analyst expectations of $41.3 billion, said Mark Matthews, head of research for Asia at Bank Julius Baer in Singapore. "Granted it was minor, but a miss is odd for this company," he said. U.S. equity futures, meanwhile, pointed to a muted start for the S&P 500 and Nasdaq composite indexes. Shares of chip supply chain major ASML (ASML.AS) , opens new tab edged lower while in Asia, Taiwan Semiconductor Manufacturing Company 2330 (.TW) , opens new tab tumbled 1.1%. Nvidia's Chinese competitors, on the other hand, surged with SMIC (0981.HK) , opens new tab up 9.5%. Elsewhere, French political developments are likely to stay in focus for regional markets following Prime Minister Francois Bayrou's gamble to win backing for his deeply unpopular debt-reduction plan via a confidence vote next month. France's 10-year government bond yield eased slightly on Thursday but remained close to its highest level since March while the benchmark CAC 40 equity index (.FCHI) , opens new tab advanced 1%. Pernod Ricard (PERP.PA) , opens new tab was among the biggest gainers on the STOXX 600, gaining 7% after the French spirits maker reported a lower than expected drop in its yearly sales and profit "We believe a snap election is partly in the price but could still lead to OAT spreads widening towards 90-95bp. For French equities this could imply further 5% downside," analysts at Citi said in a note. The spread between the 10-year benchmark bund and its French counterpart eased slightly after hitting a seven-month peak of nearly 83 basis points in the previous session. The European single currency , meanwhile, was unchanged on the day at $1.1635, holding on to a three-week winning streak that bumped up its gains this month to 2%. Developments in France are "putting a bit of a dampener on upside potential for euro-dollar but for us the bigger story is obviously what could happen with the Fed," said Lee Hardman, senior currency analyst at MUFG. Expectations of policy easing by the U.S. central bank alongside lingering worries about Fed independence present downside risks to the dollar, he said. On Thursday, the dollar was little changed against a basket of peers at 98.2. Money markets are currently pricing a 88.7% probability of a 25-basis point rate cut at Fed's policy meeting on 17 September, up from 61.9% a month ago, according to the CME Group's FedWatch tool. "Risks are more in balance. We are going to just have to see how the data play out," New York Federal Reserve Bank President John Williams said on Wednesday The interest-rate expectation sensitive 2-year U.S. Treasury yield was at 3.6188%, down 7 basis points on the week and hovering close to its lowest level since late-April. Earlier this week, President Donald Trump said he is firing Federal Reserve Governor Lisa Cook, ramping up his campaign to assert influence on the central bank which left some investors worried about the political influence on monetary policy decisions. In commodities markets, Brent crude fell 0.5% to $67.67 per barrel as investors weighed expectations for lower U.S. demand as the end of summer nears and awaited India's response to punitive U.S. tariffs. Spot gold was flat at $3399.60 per troy ounce, on course for a near 1% weekly gain. https://www.reuters.com/world/china/global-markets-wrapup-3-2025-08-28/

2025-08-28 11:31

MOSCOW, Aug 28 (Reuters) - The Kremlin said on Thursday that it was satisfied with the progress of a German investigation into attacks on the Nord Stream gas pipelines in the Baltic Sea in 2022 after Italy arrested a suspect wanted in Germany. An Italian appeals court earlier this month confirmed the arrest of the 49-year-old Ukrainian man suspected by Germany of coordinating the attacks which largely severed Russian gas supplies to Europe. Sign up here. The suspect, identified only as Serhii K. under German privacy laws, may now be extradited to Germany where prosecutors say he was part of a group of people who planted devices on the pipelines near the Danish island of Bornholm in the Baltic Sea. "Of course, it is satisfying that this investigation is underway and we want to believe that it will be seen through to the end, and that not only the perpetrators but also those who ordered these terrorist acts will be named," Kremlin spokesman Dmitry Peskov told reporters. https://www.reuters.com/business/energy/kremlin-says-it-is-satisfied-after-italy-arrests-ukrainian-man-over-nord-stream-2025-08-28/

2025-08-28 11:21

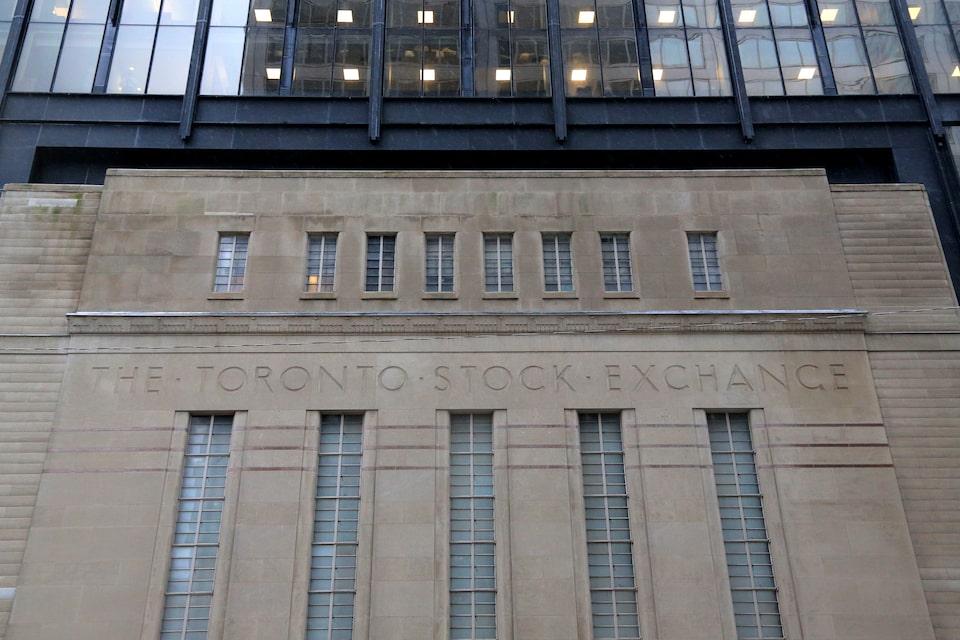

Aug 28 (Reuters) - Futures tied to Canada's main stock index were subdued on Thursday, while TD Bank and CIBC became the latest domestic lenders to report a rise in third-quarter profit. Futures on the S&P/TSX index (.SXFcv1) , opens new tab fell 0.05% by 06:59 a.m. ET (1007 GMT) following the composite index's (.GSPTSE) , opens new tab record close on Wednesday, led by blockbuster earnings from Canada's largest bank, Royal Bank of Canada (RY.TO) , opens new tab. Sign up here. TD Bank's (TD.TO) , opens new tab bottomline was helped by lower cash reserves for bad loans, while Canadian Imperial Bank of Commerce (CM.TO) , opens new tab benefited from robust performance in its capital markets division. Earlier this week, the country's fourth- and fifth-biggest lenders, Bank of Montreal (BMO.TO) , opens new tab and Bank of Nova Scotia (BNS.TO) , opens new tab, also posted upbeat quarterly earnings and set aside smaller-than-expected sums of money to cover potential loan losses as trade-related risks between Canada and the United States eased. In the U.S., AI bellwether Nvidia's (NVDA.O) , opens new tab revenue forecast fell short of heightened investor expectations, sending its shares down 1.9% in premarket trading. In commodities, crude prices fell amid lower U.S. fuel demand expectations as the summer travel season ended. The resumption of Russian supply to Hungary and Slovakia via the Druzhba pipeline also weighed. Gold held firm near a more than two-week peak due to a soft dollar and growing U.S. rate cut bets. Copper prices also gained. U.S. weekly jobless claims and the second estimate of quarterly gross domestic product are due later in the day. FOR CANADIAN MARKETS NEWS, CLICK ON CODES: TSX market report Canadian dollar and bonds report CA/ Reuters global stocks poll for Canada , Canadian markets directory ($1 = 1.3817 Canadian dollars) https://www.reuters.com/markets/europe/tsx-futures-muted-lenders-td-bank-cibc-post-upbeat-results-2025-08-28/

2025-08-28 10:58

JAKARTA, Aug 28 (Reuters) - Indonesia's forestry task force is planning a crackdown starting September 1 on mines operating without proper permits in around 4.27 million hectares (10.55 million acres) of forest areas, an official said on Thursday. The task force already launched what it called a "disciplinary operation" against illegal palm oil production in March, sending military personnel to take over 3.3 million hectares of plantations. Some of the plantations have been handed over to a new state company called Agrinas Palma Nusantara. Sign up here. Febrie Adriansyah, a senior prosecutor at the Attorney's General Office and a task force official, said the owners of businesses operating illegal mines and plantations will be ordered to return some of their profits to the state. "For the information of the public, this law enforcement on forest areas converted into plantations and exploited by miners does not mean ... the launch of a criminal prosecution," Febrie said. "But taking back control over forests by the state means the perpetrators will have to pay or return all of the profits they illegally obtained to the state," he added. As in the palm oil sector, mines seized by the task force will be handed over to the State-Owned Enterprises Ministry for temporary management, Febrie said. However, Febrie said the task force, which include prosecutors, police, the military and civil servants from government agencies, might undertake criminal investigations into some of the specific cases. The task force has not specified the types of minerals produced in the mines it has identified as illegal. President Prabowo Subianto vowed to launch a broader crackdown on the illegal exploitation of natural resources in his first state of the nation address in parliament earlier this month. Indonesia is a major producer of thermal coal, nickel, tin and copper. It is also the world's biggest producer and exporter of palm oil. https://www.reuters.com/business/environment/indonesia-launch-crackdown-illegal-mines-forests-2025-08-28/

2025-08-28 10:57

Aug 28 (Reuters) - Sibanye Stillwater (SSWJ.J) , opens new tab said on Thursday it narrowed its half-year loss to $211 million, mainly due to production credits extended to its U.S. palladium business as well as the restructuring of its South African mines. The diversified miner's loss in the six months to June 30 narrowed from $372 million the year before, when it booked a $407 million impairment on its U.S. operations after cutting its forecast for palladium prices. Sign up here. Under the Inflation Reduction Act enacted in 2022, the U.S. offers credits as an incentive for the domestic production of critical minerals, including palladium. "The positive financial outcomes from solid operational management and decisive restructuring were amplified by the incorporation of Section 45X credits in terms of the Inflation Reduction Act," Sibanye said in a statement. Sibanye said a total $285 million combined estimated credits from the 2023 financial year had been recognised, boosting profitability for the first half of 2025. Cash payments are expected in 2026, it added. https://www.reuters.com/world/africa/sibanye-stillwater-narrows-loss-restructuring-us-production-credits-2025-08-28/

2025-08-28 10:54

US tariffs on India for Russian oil take effect India to raise imports by 10-20% in September, traders say Russian refining drops because of maintenance and attacks Russian exporters sell oil at wider discounts MOSCOW/LONDON, Aug 28 (Reuters) - Russian oil exports to India are set to rise in September, traders said, as producers cut prices to sell more crude because they cannot process as much in refineries that were damaged by Ukrainian drone attacks on energy infrastructure. India has become the biggest buyer of Russian oil supplies that were displaced by Western sanctions after Moscow invaded Ukraine in 2022. This has allowed Indian refiners to benefit from cheaper crude. Sign up here. But the purchases have drawn condemnation from the government of U.S. President Donald Trump, which increased U.S. tariffs on Indian imports to 50% on Wednesday. New Delhi says it is relying on talks to try to resolve Trump's additional tariffs, but Prime Minister Narendra Modi has also embarked on a tour to develop diplomatic ties elsewhere, including meeting Russian President Vladimir Putin. U.S. officials have accused India of profiteering from discounted Russian oil, while Indian officials have accused the West of double standards because the European Union and the U.S. still buy Russian goods worth billions of dollars. The Indian oil ministry did not immediately respond to a request for comment on Thursday. Without India, Russia would struggle to maintain exports at existing levels, and that would cut the oil export revenues that finance the Kremlin's budget and Russia's continued war in Ukraine. Three trading sources involved in oil sales to India said Indian refiners would increase Russian oil purchases in September by 10-20% from August levels, or by 150,000-300,000 barrels per day. The sources, who cited preliminary purchases data, could not be named because they were not authorised to speak publicly on the issue. The two biggest buyers of Russian oil for India, Reliance and Nayara Energy, which is majority Russian-owned, did not immediately respond to a request for comment. Russia has more oil to export next month because planned and unplanned refinery outages have cut its capacity to process crude into fuels. Ukraine has attacked 10 Russian refineries in recent days, taking offline as much as 17% of the country's refining capacity. In the first 20 days of August, India imported 1.5 million barrels per day of Russian crude, unchanged from July but slightly below the average of 1.6 million bpd in January-June, according to data from Vortexa analysts. The volumes are equal to around 1.5% of global supply, making India the largest buyer of seaborne Russian crude, which covers some 40% of India's oil needs. China and Turkey are also big buyers of Russian oil. INDIA SET TO CARRY ON BUYING? India's increased buying of Russian oil over recent years has been to the detriment of more expensive supplies from the Organization of the Petroleum Exporting Countries. OPEC's share edged up in 2024 after an eight-year drop. Russian exporters sold Urals crude loading in September at discounts of $2–$3 per barrel to benchmark dated Brent, the three traders said. The levels are cheaper than discounts of $1.50 per barrel in August, which were the narrowest since 2022, the traders said. "Unless India issues a clear policy directive or trade economics shift significantly, Russian crude will likely remain a core part of its supply mix," said Sumit Ritolia from Kpler. Brokerage CLSA in a note also predicted only "a limited chance of India stopping Russian imports" unless a global ban is imposed. It also said that if Indian imports of Russian crude were halted, the knock-on impact could be to reduce global supplies by around one million bpd and lead to a short-term spike in global prices to nearly $100 a barrel. Traders said the full impact of sanctions and tariffs may only be visible in cargoes arriving to India in October, which will begin to trade in the next few days. In addition to the U.S. tariffs, the European Union has also tightened its price cap designed to limit Russia's oil revenues, which will complicate sales later this year. The EU has set the cap at $47.60 per barrel from September 2 - 15% below the Russian crude market price - restricting access to Western services for cargoes sold above the cap. https://www.reuters.com/business/energy/indias-russian-oil-imports-set-rise-september-defiance-us-2025-08-28/