2025-08-28 07:11

US PCE data due on Friday Need to see data before considering rate cut - Fed official Aug 28 (Reuters) - Gold held firm near a more than two-week peak on Thursday, supported by a weaker dollar and U.S. interest rate cut prospects as market participants awaited U.S. inflation data due this week. Spot gold was steady at $3,394.60 per ounce, as of 0648 GMT. Earlier in the session, bullion touched its highest point since August 11. Sign up here. U.S. gold futures for December delivery edged 0.1% higher to $3,451.60. The dollar index (.DXY) , opens new tab fell 0.1% against its rivals, making gold less expensive for other currency holders. "We've got a lot of positive interest for gold because of that sort of issues with institutional trusts and risks about Fed's independence," said Kyle Rodda, Capital.com's financial market analyst. Investors are now awaiting the release of the Personal Consumption Expenditures (PCE) Price Index, the preferred inflation measure of the U.S. Fed, scheduled for Friday. "But we're really looking for something more sort of to push the price above critical level of $3,400 ... the U.S. PCE data will be super significant. We are still bullish on gold. I think all the fundamentals (are) moving in the right direction," he added. Economists polled by Reuters expect the PCE price index (USPCEY=ECI) , opens new tab to rise 2.6% in July, matching the climb from June. Markets are anticipating an over 88% chance of a 25-basis-point rate cut at the Fed's policy meeting next month, according to CME FedWatch Tool. Non-yielding gold typically performs well in a low-interest-rate environment. New York Fed Bank President John Williams said on Wednesday it is likely interest rates can fall at some point but policymakers will need to see what upcoming data indicate about the economy to decide if it's appropriate to make a cut next month. Elsewhere, spot silver was up 0.6% at $38.86 per ounce, platinum gained 0.3% to $1,351.63 and palladium climbed 0.6% to $1,097.95. https://www.reuters.com/markets/europe/gold-holds-firm-soft-us-dollar-rate-cut-bets-lend-support-2025-08-28/

2025-08-28 07:10

BANGKOK, Aug 28 (Reuters) - At least five people have been killed and seven remain missing after heavy rains and landslides brought on by tropical storm Kajiki swept across northern Thailand, the Thai disaster agency said Thursday. Kajiki made landfall as a typhoon in Vietnam earlier this week, killing seven people, inundating more than 10,000 homes and offices as well as 86 hectares of rice and cash crops, the Vietnam government said on Wednesday. Sign up here. In Thailand, flooding and landslides hit 12 provinces in the north and northeast, including Chiang Mai, Chiang Rai and Mae Hong Son, affecting more than 6,300 people and 1,800 households, the disaster agency said. Four people in Chiang Mai died in a landslide, and another person drowned in Mae Hong Son, the Interior Ministry said. Fifteen others were injured in Chiang Mai, with another five buried in landslides and two swept away by floodwaters. On Thursday, flooding continued in eight provinces, where nearly 6,000 people in 1,600 households are still affected, according to the ministry. The destruction marked the second time this year when northern Thailand was battered by typhoon remnants, after Wutip in June swept in from southern China. https://www.reuters.com/business/environment/tropical-storm-kajiki-kills-five-leaves-seven-missing-northern-thailand-2025-08-28/

2025-08-28 07:01

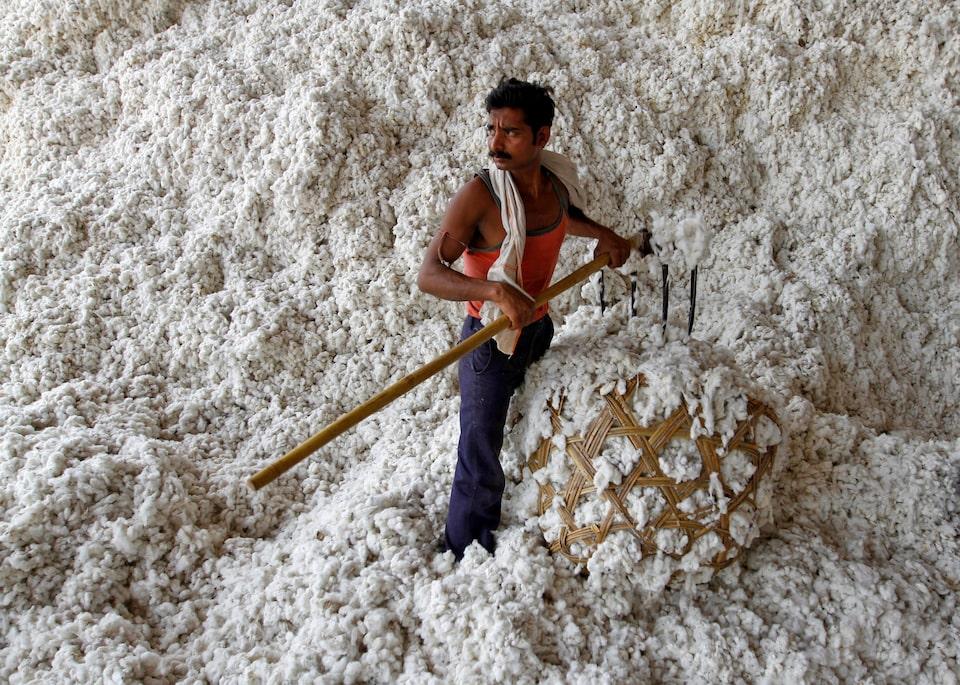

MUMBAI/NEW DELHI, Aug 28 (Reuters) - India has extended an import duty exemption on cotton by three months, until the end of December, a government order showed on Thursday, as New Delhi seeks to support the local garment industry that has been hit by hefty U.S. tariffs. The imports are likely to support global cotton prices , which erased losses and rose 0.2% after the order. However, they are likely to reduce demand for local cotton, pressuring domestic prices, market watchers said. Sign up here. The world's second-biggest cotton producer had earlier announced an exemption on cotton imports from an 11% duty until September-end and has now extended that to December 31. The cotton is likely to be sourced from Australia, Brazil, the United States and Africa, which have a surplus available for export, industry officials said. U.S. President Donald Trump's doubling of tariffs on imports from India to as much as 50% on good such as garments and jewellery took effect on Wednesday. The United States is India's largest market for garments and jewellery, worth nearly $22 billion in 2024. India has a 5.8% share in the U.S. garment market, behind China, Vietnam and Bangladesh. The duty exemption until year-end will let Indian textile companies import cheaper cotton, easing pressure amid a slowdown in U.S. demand, Atul Ganatra, president of the Cotton Association of India, told Reuters. "With the duty-free extension, imports could hit a record 4.2 million bales this year. Strong imports are likely to continue into the first quarter of next year as well," Ganatra said. India's cotton marketing year runs from October to September. The earlier import window, ending in September, was too narrow, said a New Delhi-based trader with a global trading house. Textile mills could not import cotton during that period, as the voyage from exporting countries typically takes more than a month. However, they can now place orders for large quantities for the subsequent period, the trader said. The landed cost of imported cotton is nearly 5% to 7% lower than that of local supplies, and the quality is also superior, said a Mumbai-based trader. "Most of the imports will arrive around the December quarter, just when the local crop hits the market. This is likely to push local prices down," the trader said. (1 Indian bale = 170 kg) https://www.reuters.com/world/india/india-extends-cotton-import-duty-exemption-amid-us-tariff-pressure-2025-08-28/

2025-08-28 06:58

SEOUL, Aug 28 (Reuters) - South Korean Foreign Minister Cho Hyun said on Thursday that the U.S. and South Korea agreed to discuss nuclear fuel reprocessing following a summit between U.S. President Donald Trump and South Korean President Lee Jae Myung this week. "We operate 26 nuclear power plants, buying and bringing in fuel for them every time... We have been feeling the necessity of being able to reprocess it and to make our own fuel through concentrates," Cho said in a live televised interview. Sign up here. "In order to do this, cooperation with the U.S. is most important. We need to change the nuclear agreement, or use another method under the agreement (between the countries). So it is very meaningful that we decided to begin discussions in that direction." South Korea is not allowed to reprocess spent nuclear fuel - which can be used to make nuclear weapons - without U.S. consent under an agreement , opens new tab between the countries. Foreign Minister Cho has said previously that South Korea's intention is for industrial and environmental purposes, not for nuclear armament. Cho reiterated on Thursday that "any talk about wanting our own nuclear arms or having potential nuclear capabilities through revision (of the agreement) would be something that the U.S. could never accept in terms of overall nuclear non-proliferation." https://www.reuters.com/business/energy/south-korea-minister-says-agreed-with-us-discuss-nuclear-fuel-reprocessing-2025-08-28/

2025-08-28 06:55

BEIJING, Aug 28 (Reuters) - China has placed curbs on coal production following an unexpected supply increase in the first half of the year that weighed on prices, according to an official of a major mining firm and analysts. China's output in July dipped to the lowest level in over a year. It had risen more than 5% year-on-year in the first half, sending prices in some parts of the country down nearly 30% year-on-year by the end of June. Sign up here. Analysts said the country ramped up inspections in July to ensure plants kept to approved production capacity. "The increase (in supply) has exceeded expectations and that has led to prices falling," an official from China Coal Energy , China's third-largest coal miner, told analysts on Monday. "So we have seen regulations regarding production and limitations on production imposed." Shanghai-based commodities consultancy, Mysteel, said on Wednesday that among 153 coking coal mines surveyed in Shanxi, 54 mines with total production capacity of 61.1 million metric tons per year have suspended, or are cutting back, production. Shanxi is China's top-coal producing province. Mysteel cited China's "anti-involution" campaign and inspections across multiple provinces. "Involution" describes supposedly unsustainable competition among Chinese firms. "Anti-involution" has become a slogan for reducing industrial overcapacity. When prices fall below cost level, mines cut back on investments and upgrades, leading to safety concerns, Galaxy Futures analysts said on Thursday. State planner, the National Development and Reform Commission, and the energy regulator did not immediately respond to questions. More recently, regulators are restricting production out of concerns that an accident would look bad ahead of a September 3 military parade marking the end of World War Two, analysts say. On Wednesday, the 5 million ton per year Wanbolin mine in Shanxi's Taiyuan was closed for safety reasons, Mysteel said. https://www.reuters.com/sustainability/boards-policy-regulation/china-is-capping-coal-production-support-prices-top-miner-analysts-say-2025-08-28/

2025-08-28 06:48

Brent, WTI fall after 1% gain in previous session US demand to ease at the end of summer driving Indian buying pattern of Russian oil in focus Aug 28 (Reuters) - Oil prices fell on Thursday after rising in the previous session as investors weighed expectations for lower U.S. fuel demand with the end of the summer demand season nearing and awaited India's response to punitive U.S. tariffs. Brent crude futures dropped 50 cents, or 0.73%, to $67.55 at 0643 GMT, and West Texas Intermediate (WTI) crude futures declined 51 cents, or 0.80%, to $63.64. Sign up here. Both contracts climbed in the prior session after the U.S. Energy Information Administration reported that U.S. crude inventories fell by 2.4 million barrels in the week ended August 22, compared with analysts' expectations in a Reuters poll for a 1.9-million-barrel draw. "Oil prices are pulling back this morning as traders reassess yesterday’s rally driven by the EIA report," said Priyanka Sachdeva, a senior market analyst at Phillip Nova. "While U.S. crude inventories did post another drawdown, the pace of declines slowed compared with last week’s sharper drop, tempering bullish momentum," she added. The drop signaled strong demand ahead of the upcoming U.S. Labor Day long weekend. However, this typically marks the unofficial end of the summer driving season and the onset of lower U.S. demand, IG market analyst Tony Sycamore said. Traders are watching out for how New Delhi responds to pressure from Washington to stop buying Russian oil, after U.S. President Donald Trump doubled tariffs on imports from India to as much as 50% on Wednesday. "India is expected to continue purchasing crude oil from Russia at least in the short term, which should limit the impact of the new tariffs on global supply," said Sycamore. Also weighing on the market is the increasing supply coming to the market as major producers have removed some voluntary cuts, which offset some of the supporting factors, including that Russia and Ukraine have stepped up attacks on each other's energy infrastructure. Russia launched a massive drone attack on energy and gas transport infrastructure across six Ukrainian regions overnight, leaving more than 100,000 people without power, Ukrainian officials said on Wednesday. The prospect of a near-term interest rate cut in the U.S. has also supported the oil market, as that would potentially boost economic activity and oil demand. New York Federal Reserve Bank President John Williams said on Wednesday rates will likely fall at some point, but policymakers will need to see upcoming economic data before deciding whether it is appropriate to make a cut at the Fed's September 16-17 meeting. https://www.reuters.com/business/energy/oil-falls-market-weighs-end-us-summer-demand-2025-08-28/