2025-12-15 06:33

Rupee down nearly 6% on year, worst performer among Asian FX Lack of trade deal with US key drag Foreign investors sell over $18 billion of Indian stocks YTD MUMBAI, Dec 15 (Reuters) - The Indian rupee fell to a record low on Monday, pressured by a prolonged deadlock in U.S.-India trade negotiations and sustained foreign outflows from domestic equities and bonds. The rupee weakened 0.3% to 90.74 against the U.S. dollar, eclipsing its previous all-time low of 90.55 hit on December 12. Sign up here. The currency, Asia's worst performer this year, avoided steeper losses amid likely central bank intervention, four traders told Reuters. The rupee has declined nearly 6% against the dollar year-to-date, as steep U.S. tariffs of up to 50% on Indian goods hurt exports to its biggest market and diminish local equities' appeal to foreign investors. Overseas investors have net sold Indian stocks worth more than $18 billion so far in 2025, making India one of the worst-hit markets in terms of portfolio outflows. Foreign investors have net sold bonds worth over $500 million in December. India's trade data for November is due later in the day, with economists pencilling in a $32 billion goods deficit, down from a record high of $41 billion in October. Remarks from India's chief economic adviser that the trade deal is likely only by March have bogged sentiment down, and outflows have been near-constant, a trader at a Mumbai-based bank said. India and the European Union, meanwhile, are also unlikely to finalise a trade deal by this year's end, Bloomberg News reported on Friday. This means the rupee has been unable to benefit from a broadly weaker dollar. The dollar index is down 1.1% so far this month. "The next support (for rupee) is at 90.80, after which we could see a crossover of 91 towards 92. RBI has clearly let the market to determine the price and has been intervening only to control any excessive volatility," said Anil Bhansali, head of treasury at Finrex Treasury Advisors. Analysts at ANZ say that while an India-U.S. trade deal could spur a knee-jerk rebound in the rupee, its strength could fade if the RBI chooses to rebuild reserves by purchasing dollars. India's foreign exchange reserves stood at $687.3 billion as of December 5, down from the year-to-date peak of $703 billion hit in early September. India's benchmark equity indexes, the BSE Sensex (.BSESN) , opens new tab and the Nifty 50 (.NSEI) , opens new tab were down 0.2% each, tracking losses in regional shares as sentiment remained tepid heading into a week of key data releases and central bank meetings. https://www.reuters.com/world/india/indian-rupee-weakens-record-low-us-trade-deal-limbo-persistent-outflows-2025-12-15/

2025-12-15 06:32

Trio of central banks to announce rate decisions US non-farm payrolls and inflation data due Yen rises while pound loses ground US dollar index edges lower, bitcoin continues losing streak NEW YORK/LONDON, Dec 15 (Reuters) - The U.S. dollar edged lower against rivals including the yen and Swiss franc on Monday in a week packed with central bank decisions and U.S. data that could shed light on the Federal Reserve's near-term policy outlook. The dollar was last down 0.31% against the yen, trading at 155.345 to the dollar. Sign up here. The Bank of Japan is widely expected to raise interest rates on Friday, giving the yen an advantage over a dollar that could lose support if expected U.S. rate cuts emerge early next year. "Our economists shifted to expecting a December hike from the BoJ in their base case," Goldman Sachs analysts led by Alexandra Kanter wrote in an investor note. "The guidance will be key for near-term direction, and a recent report suggests that there may be less emphasis placed on the bank’s estimate of the neutral rate." The BoJ is likely to maintain a pledge to keep raising interest rates but emphasise that the pace of increases will depend on how the economy reacts to each increase, sources told Reuters. The Bank of England and European Central Bank are among central banks making monetary policy decisions this week. Markets have almost fully priced in a Bank of England cut as inflation finally shows signs of easing while the ECB is expected to leave rates unchanged. Traders have begun speculating that a rate increase could be on the cards for the ECB in 2026. Sterling was down 0.12% at $1.33645, erasing earlier gains, while the euro edged higher by 0.06% at $1.174775 in choppy trading, on track for a fourth straight session of gains. "In terms of the BoE, I think it's going to be very interesting. I think it's going to be a finely balanced decision to cut," said Joseph Capurso, currency strategist at Commonwealth Bank of Australia. "The risk is that the inflation data that comes out this week may take out some of the pricing for follow-up rate cuts." UK wage growth data is due on Tuesday and consumer inflation on Wednesday. US DATA IN SPOTLIGHT A catalogue of U.S. data delayed by the government shutdown is set to be released, giving investors a long-awaited view of the world's largest economy. The November jobs report is due on Tuesday and inflation figures on Thursday. A divided Fed cut rates last week, but Chair Jerome Powell signalled that borrowing costs were unlikely to drop further in the near term. Current above-target inflation does not reflect underlying supply and demand dynamics that are generating price increases much closer to the central bank's 2% target, Federal Reserve Governor Stephen Miran said on Monday, asserting that "prices are now once again stable." "The question really is, is the prevailing theme going to be shifted dramatically from the delayed data we get this week," said Eugene Epstein, head of trading & structured products for Moneycorp Americas. "At the moment, the U.S. and the bulk of its G10 peers are like two ships in the night with respect to 2026 central bank rate policy. In the U.S., it's a story of how long the central bank is going to wait until another cut while almost everywhere else in developed markets, it's a story of how long is the central going to wait until they start hiking," Epstein said. The dollar rose 0.16% to 0.79725 against the Swiss franc . The dollar index , which measures the U.S. currency against a basket of rivals including the yen and the euro, was a shade lower by 0.09% at 98.318. Sweden's Riksbank and Norway's Norges Bank are expected to leave interest rates unchanged after their policy meetings this week. The Swedish crown strengthened by 0.48% to 9.3009 to the dollar. Against the Norwegian crown, the dollar was up 0.34% at 10.1582 . In cryptocurrencies, bitcoin continued its losing streak and was on track for a fourth straight session of losses. It was last down 2.56% to $86,205.11. Ether declined 4.72% to $2,936.89. (This story has been refiled to add the missing word 'long' in the quote in paragraph 18) https://www.reuters.com/world/asia-pacific/currencies-guard-ahead-major-central-bank-decisions-us-data-releases-2025-12-15/

2025-12-15 06:08

MPC expected to vote 5-4 to lower Bank Rate to 3.75% Bailey is likely to change his vote to back a rate cut Policymakers are split on inflation-jobs risk balance UK inflation highest in Group of Seven LONDON, Dec 15 (Reuters) - The Bank of England looks set for a knife-edge vote on interest rates this week with Governor Andrew Bailey expected to change his view and tip the balance for a cut. Barring a major surprise in economic data ahead of Thursday's announcement, the BoE's policymakers will vote 5-4 to lower the central bank's benchmark rate to 3.75% from 4.0% according to most analysts polled by Reuters. Sign up here. That would be the first reduction since August and would take borrowing costs to a three-year low. With Britain's inflation rate still the highest among the Group of Seven economies, BoE policymakers voted 5-4 in November to keep borrowing costs on hold. MPC SPLIT, GOVERNOR VOTE IS KEY Public comments from Monetary Policy Committee members since then have suggested that they remain split on whether job losses or inflation pressures pose the biggest risk to the economy. However, Bailey has spoken only briefly about interest rates since he hinted last month at the possibility of voting for a rate cut if there was evidence of falling inflation. Subsequently, Britain's headline inflation rate eased to 3.6% in the 12 months to October - still a long way above the BoE's 2% target but its first fall since May. Data for November due on Wednesday - a few hours before the MPC's vote - is expected to show inflation edged down further to 3.5%, according to the Reuters poll. Similarly, pay growth has slowed and is expected to ease off again in fresh figures on Tuesday. On the same day, S&P Global's survey of purchasing managers will give an early sense of how businesses are responding to finance minister Rachel Reeves' budget on November 26. Andrew Goodwin, chief UK economist at Oxford Economics, said Thursday's rates decision was probably a much closer call than the 90% probability of a cut which is priced by investors. "But it's notable that Bailey has chosen not to push back against expectations of a December cut," Goodwin said. With Britain's inflation rate still close to double its 2% target, the BoE has been unable to move as quickly as the European Central Bank to bring down borrowing costs. The ECB's benchmark borrowing rate now stands at 2%, half that of the BoE. Now, as major central banks signal that they might be close to halting their rate cuts - the Federal Reserve last week signalled one more next year while the ECB might already be done - the BoE is expected to adopt a cautious stance in 2026. Investors and most analysts polled by Reuters currently expect only one rate cut in 2026. Dani Stoilova, Europe economist with BNP Paribas, said the BoE was likely to remain wary about inflation and it might drop its guidance that rates are likely to fall gradually after a cut on Thursday. "Specifically, removing reference to a 'gradual downward path' would maintain the broader message but give the MPC more flexibility," she wrote in a note to clients. While Reeves' budget is likely to lower inflation by around half a percentage point, that impact will be temporary. Britain's economy slowed before the budget as consumers and businesses worried about tax increases. That feeling of uncertainty might have shifted to the political outlook with Prime Minister Keir Starmer's shaky authority over his Labour Party facing a test in local elections in May. "While the BoE is unlikely to embed this rising uncertainty in its projections just yet, we think it adds to the list of potential downside risks that support the case for a December cut," Stoilova said. https://www.reuters.com/world/uk/bank-england-heads-close-vote-likely-rate-cut-2025-12-15/

2025-12-15 06:07

European Commission expected to make announcement on Tuesday Ban could be pushed back 5 years or softened indefinitely -sources Most significant climb-down on EU green policies of past 5 years EV makers say reneging on ban would yield more ground to China BRUSSELS/LONDON/STOCKHOLM, Dec 15 (Reuters) - The European Commission is expected on Tuesday to reverse the EU's effective ban on sales of new combustion-engine cars from 2035, bowing to intense pressure from Germany, Italy and European automakers struggling against Chinese and U.S. rivals. The move, the details of which are still being hashed out by EU officials ahead of its unveiling, could see the effective ban pushed back by five years or softened indefinitely, official and industry sources said. Sign up here. The likely revision to the 2023 law requiring all new cars and vans sold in the 27-nation bloc from 2035 to be CO2 emission-free would be the European Union's most significant climb-down from its green policies of the past five years. "The European Commission will be putting forward a clear proposal to abolish the ban on combustion engines," Manfred Weber, head of the European Parliament's largest group, the European People's Party, said on Friday. "It was a serious industrial policy mistake." Reneging on the ban has divided the sector. Traditional automakers like Volkswagen (VOWG.DE) , opens new tab and Fiat-owner Stellantis (STLAM.MI) , opens new tab have pushed hard for targets to be eased amid fierce competition from lower-cost Chinese rivals. The EV sector, however, sees it as yielding more ground to China in the electrification shift. "The technology is ready, charging infrastructure is ready, and consumers are ready," said EV maker Polestar's (PSNY.O) , opens new tab CEO Michael Lohscheller. "So what are we waiting for?" COMBUSTION ENGINES AROUND FOR 'REST OF CENTURY' The 2023 law was designed to accelerate a transition from combustion engines to batteries or fuel cells and fine automakers who failed to meet the targets. Meeting the targets means selling more electric vehicles, where European carmakers lag Tesla (TSLA.O) , opens new tab and Chinese producers like BYD (002594.SZ) , opens new tab and Geely (GEELY.UL). Europe's carmakers are making EVs, but say demand has lagged expectations as consumers are reluctant to buy more expensive EVs and charging infrastructure is insufficient. EU tariffs on Chinese-built EVs have only slightly eased the pressure. "It's not a sustainable reality today in Europe," Ford (F.N) , opens new tab CEO Jim Farley told reporters in France last week, announcing a partnership with Renault (RENA.PA) , opens new tab to help cut EV costs. Industry needs were "not well balanced" with EU CO2 targets, he said. The EU granted the sector "breathing space" in March, allowing automakers to comply with 2025 targets over three years. But automakers want to continue selling combustion-engine models alongside plug-in hybrids, range extender EVs with 'CO2-neutral' fuels - including biofuels made from agricultural residues and waste such as used cooking oil. Commission President Ursula von der Leyen said in October she was open to use of e-fuels and "advanced biofuels". "We recommend a multi-technology approach," said Todd Anderson, chief technology officer at combustion-engine fuel systems maker Phinia (PHIN.N) , opens new tab, adding the internal combustion engine will "be around for the rest of the century." DIVIDED OPINION The EV industry meanwhile argues the move will undermine investment and push the EU even further behind China. "It's definitely going to have an effect," said Rick Wilmer, CEO of charging hardware and software provider ChargePoint (CHPT.N) , opens new tab. Automakers want the 2030 target of a 55% reduction in car emissions to be phased over several years and to drop the 50% reduction for vans. Germany wants sustainable practices like using low-carbon steel to count towards CO2 emission reductions. The European Commission will also detail a plan to boost the share of EVs in corporate fleets, notably company cars, which make up about 60% of Europe's new car sales. The auto industry wants incentives, pointing to Belgium as a country where subsidies have worked, rather than mandatory targets. The Commission is likely to propose establishing a new regulatory category for small EVs that would enjoy lower taxes and earn extra credits towards meeting CO2 targets. Environmental campaign groups say the EU should stick to its 2035 target, arguing biofuels are in short supply, are not truly CO2-neutral and supplying them would be prohibitively expensive. "Europe needs to stay the course on electric," said William Todts, executive director of clean transport advocacy group T&E. "It's clear electric is the future." https://www.reuters.com/sustainability/climate-energy/eu-yields-pressure-automakers-it-rethinks-2035-combustion-car-ban-2025-12-15/

2025-12-15 06:00

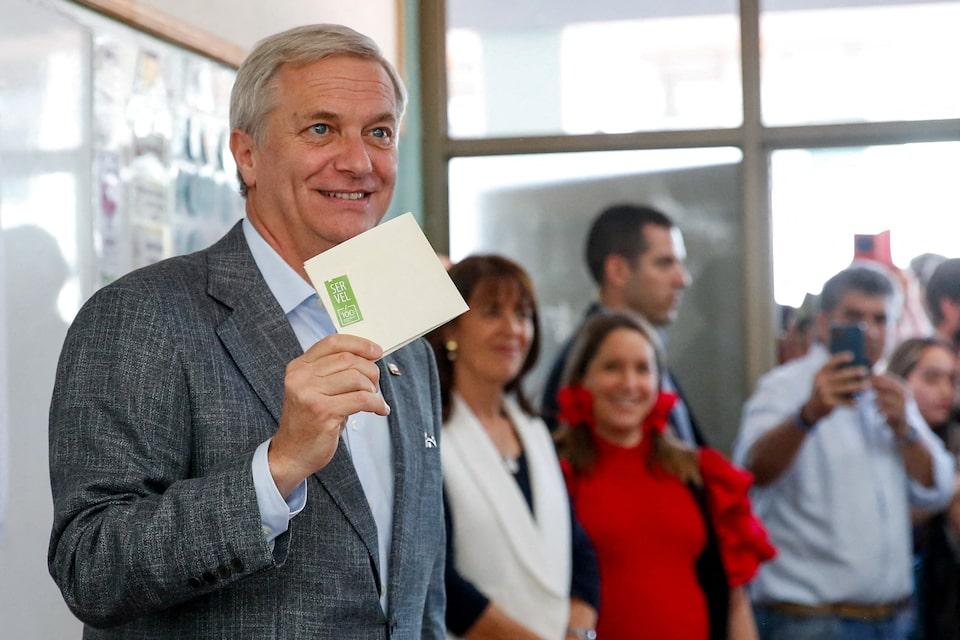

Kast has pledged crackdowns on crime, migration He is a veteran right-wing politician Supported Pinochet in 1988 referendum SANTIAGO, Dec 15 (Reuters) - After falling short in two previous presidential runs, Jose Antonio Kast finally secured the Chilean presidency on Sunday, a sign of how his far-right, anti-immigrant views have gained a wave of new support amid fears about increased crime. Kast, 59, easily beat leftist presidential candidate Jeannette Jara, winning 58% of the vote and steering the South American country toward its sharpest rightward shift since the end of the military dictatorship in 1990. Sign up here. He lost to leftist President Gabriel Boric in the election in 2021, a time when Kast's hardline policies were out of step with an electorate rattled by the COVID-19 pandemic, widespread protests against inequality, and hopes of drafting a new constitution. But now sentiment has shifted and Kast's proposals are resonating with voters who are overwhelmingly concerned about crime and immigration. While Chile remains one of the safest countries in Latin America, an influx of organized crime has led to a rising murder rate and hurt economic growth, with a recent spike in high-profile incidents like kidnappings and assassinations. As well as promising a crime crackdown, Kast has vowed to build border walls and form a specialized police force modeled on U.S. Immigration and Customs Enforcement and tasked with tracking down and deporting migrants in the country illegally. Government data shows the majority are Venezuelans. "This government caused chaos, this government caused disorder, this government caused insecurity," Kast said at the end of the recent campaign. "We're going to do the opposite. We're going to create order, security and trust." DRAWING INSPIRATION FROM EL SALVADOR Kast has taken inspiration from the U.S. for his tough-on-borders approach, and last year visited the mega-prison system built by El Salvador's President Nayib Bukele, a model his platform calls for emulating. The Chilean politician's success makes his country the latest in Latin America to tilt right after Bolivia's election in August and President Javier Milei's success in Argentina's midterm vote in October. Like Milei, Kast - a Catholic with nine children - has expressed strong objections to abortion. He has previously said he would repeal Chile's limited abortion rights and ban sales of the morning-after pill, though he largely focused on other issues during his campaign. Polls show public opinion overwhelmingly supports maintaining existing abortion rights. His economic plan involves more flexible labor laws, corporate tax cuts and less regulation - though he is expected to moderate planned spending cuts widely seen as unrealistic. LINKS TO PINOCHET Kast is the son of a German immigrant, a Nazi party member and army lieutenant who fled to South America after World War Two, where he eventually founded a lucrative sausage business in Paine, south of Santiago. Kast has said his father was a forced Nazi conscript. The president-elect has been married to Maria Pia Adriasola, a lawyer who has frequently campaigned at his side, for more than three decades. His eldest brother, Miguel Kast, was a government minister and central bank president in the early 1980s under the dictatorship of General Augusto Pinochet, during which more than 40,000 people were executed, detained and disappeared, or tortured. One of the "Chicago Boys" who pioneered shock-therapy economics, he pushed deregulation and privatizations. As a law student, Jose Antonio Kast campaigned for the "yes" vote in a referendum on whether Pinochet should remain in power in 1988, a vote that Pinochet lost. After serving as a congressman for the right-wing Independent Democratic Union (UDI) party for more than a decade, Kast stepped down in 2016 to pursue the presidency as an independent but ended up winning less than 10% of the vote. He gained more traction in 2021 running under the banner of his self-founded Republican Party. His style is quite different to that of Milei or Bukele, said Nicholas Watson, Latin America managing director at Teneo. "He is much less flamboyant and more reserved. He is also more of a political insider; he has not burst onto the political scene in the way that Milei did." As such, Chileans view Kast as a familiar face with more than two decades of political experience, said David Altman, a political scientist at Chile's Pontifical Catholic University, adding that Kast benefited from growing rejection of Boric's incumbent government. "It's not that people became more fascist in the space of four years," Altman said. "People abandoned the left and as there essentially was not a political center, they went right. It was the only place where they could land." https://www.reuters.com/world/americas/who-is-jose-antonio-kast-far-right-front-runner-chiles-presidency-2025-11-17/

2025-12-15 05:52

LAGOS, Dec 15 (Reuters) - Nigeria’s richest man Aliko Dangote escalated his fight with regulators on Sunday, accusing them of enabling cheap fuel imports that threaten local refineries. Nigeria is Africa’s biggest oil producer but relies heavily on imports and Dangote’s refinery was meant to change that. Sign up here. Dangote said if imports continue unchecked, they will threaten jobs, investment and energy security. Speaking at his 650,000-barrel-per-day oil refinery in Lagos, Dangote said imports were being used “to checkmate domestic potential”, creating jobs abroad while Nigeria struggles to industrialise. “You don’t use imports to checkmate domestic potential,” he told reporters. Dangote called for an official inquiry into Farouk Ahmed, head of the Nigerian Midstream and Downstream Petroleum Regulatory Authority, citing concerns over his management of the sector and allegations of private expenditures exceeding legitimate earnings. Ahmed did not immediately respond to a request for comment, but he has previously said Dangote refinery wants a monopoly on petroleum products sales, but the refinery's output can not meet local demand. Last month, the regulator urged the president to drop plans to ban imports of refined petroleum products because local output cannot meet the national demand of 55 million litres daily. Dangote disputes this, saying the regulator was distorting the refinery's actual capacity by reporting offtake statistics instead of the true production data. The refinery, designed to end Nigeria’s reliance on imported fuel and save billions in foreign exchange, says it has been unable to secure all the required crude it needs because the regulator has failed to implement a rule that guarantees crude supply to local refiners before exports Dangote said the refinery imports 100 million barrels of crude oil annually — a figure expected to double after expansion of the refinery and limited domestic supply. Despite these hurdles, Dangote vowed to continue with expansion plans for the facility and safeguard his investment, which he said is "too big to fail". He also reiterated plans to list the company on the local stock market and pay dividends in U.S. dollars so “every Nigerian can own a piece of the economy.” Nigeria, Africa’s top oil producer, has long depended on imports due to mothballed state refineries. https://www.reuters.com/world/africa/nigerias-richest-man-dangote-escalates-oil-fight-with-regulator-seeks-corruption-2025-12-15/