2025-08-22 10:25

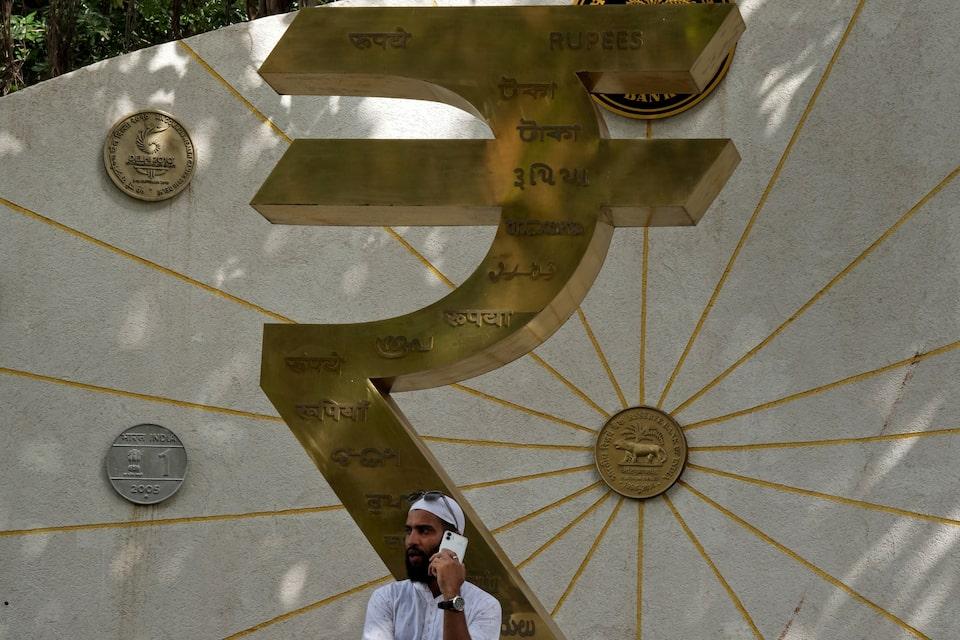

MUMBAI, Aug 22 (Reuters) - The Indian rupee weakened further on Friday against a stronger dollar ahead of a speech by Federal Reserve Chair Jerome Powell, capping a volatile week for the Asian currency that has been pressured by U.S. tariff-related uncertainties. The currency closed 0.3% lower on Friday at 87.5300, against its close of 87.27 in the previous session. It was down 0.02% for the week. Sign up here. The local unit, which opened at 87.4575 on Monday, saw sharp swings through the week due to domestic and geopolitical developments. Talks between the U.S. President Donald Trump and the Russian and Ukrainian presidents, coupled with the Indian government’s proposed tax cuts, pushed the rupee above the 87 handle for the first time this month on Tuesday. However, concerns over tariffs on Indian goods, which are set to take effect on August 27, and importers’ demand for the greenback weighed on the currency on Thursday when it posted its biggest single-day decline in a month. “Looming U.S. tariffs on Indian goods and criticism over Russian oil purchases kept sentiment weak, with continued downside risk (expected in) the rupee through September,” said Jigar Trivedi, senior currency analyst at Reliance Securities. Meanwhile, the dollar index was up 0.14% at 98.742, as of 3:37 p.m. IST, and inched towards the 99-mark ahead of Powell's speech at the Jackson Hole symposium later in the day. His comments will be scrutinised for clues on a September rate cut and the policy trajectory for the rest of the year. Investors are pricing in an over 80% chance of a cut next month, but the question is whether Powell will push back against such aggressive expectations. While his recent comments have leaned hawkish, they came before the weaker July jobs report. Most Asian currencies traded lower on Friday, with the Taiwan dollar and Indonesian rupiah falling sharply against the dollar and leading losses, while the Korean won and Philippine peso climbed in intraday trade. https://www.reuters.com/world/india/rupee-continues-slide-looming-us-tariffs-posts-marginal-weekly-loss-2025-08-22/

2025-08-22 09:58

Aug 22 (Reuters) - Sterling steadied after dipping to a two-week low against the dollar on Friday as traders pared wagers on a rate cut by the U.S. Federal Reserve next month. Sterling was flat against the dollar at $1.3416 after touching its weakest level since August 7. It was slightly higher on the euro at 86.46 pence to the common currency . Sign up here. It was on course for a 0.9% decline for the week, reversing course after gaining over the previous two weeks on the back of a hawkish repricing of the Bank of England's monetary policy path and upbeat economic data. While better than expected business survey data and a comforting public borrowing update released on Thursday helped buoy the pound this week as well, analysts remain cautious heading into the autumn budget announcement. "Until we know what's in the budget, sterling could be subject to some headwinds," said Jane Foley, head of FX strategy at Rabobank. "It's still going to be difficult for the chancellor to avoid significant tax hikes in order for the Labour government to meet its spending commitments through the next fiscal year," Foley said. The tax hikes could dent recently improved consumer confidence, presenting a headwind to growth, she said. The benchmark 10-year gilt yield on Friday rose to its highest level since May 29 and was last up four basis points at 4.7660%. Meanwhile, the dollar was a touch firmer against a basket of peers at 98.71. Investors trimmed rate cut wagers ahead of an eagerly anticipated speech from Fed Chair Jerome Powell scheduled for 1400 GMT. Money markets are currently pricing in a 73% chance of 25 basis point rate cut next month, down from 85% a week earlier, per CME's FedWatch tool. https://www.reuters.com/world/uk/sterling-track-weekly-fall-outlook-clouded-by-fiscal-risks-2025-08-22/

2025-08-22 09:54

Base rate seen unchanged at 6.5% Median forecast sees one 25-bp rate cut this year Analysts split over room for easing this year Reuters Hungary central bank rate forecasts: Reuters Hungary average inflation forecasts: BUDAPEST, Aug 22 (Reuters) - Hungary's central bank is expected to leave its base rate steady at 6.5% for the 11th consecutive month on Tuesday despite a sputtering recovery, as inflation exceeds the bank's 2% to 4% tolerance band even though price growth slowed last month. All 21 analysts surveyed between August 18 and 22 projected that the National Bank of Hungary would leave its base rate unchanged at 6.5% at its meeting. The median projection still sees a 25-basis-point rate cut by the end of this year, although analysts were divided over the room for policy easing. Sign up here. "We still do not expect any rate cuts this year, as the Monetary Council remains focused on tackling persistently high inflation expectations," ING analyst Peter Virovacz said, adding that the only game changer would be if geopolitical tensions eased as the result of a ceasefire between Russia and Ukraine. The bank's governor, Mihaly Varga, reiterated in a statement on Friday that with inflation risks still pointing upwards, the bank would "place special emphasis on cautious and patient monetary policy and an anchoring of inflation expectations". The bank left its base rate on hold at 6.5% in July. The NBH, which predicts average inflation at 4.7% this year, expects to reach its 3% inflation target only in early 2027, projecting mostly upside risks to inflation from tariffs, food and services, and downside risks to Hungary's economic growth, which it forecasts at a mere 0.8% this year. Hungary's headline inflation slowed to 4.3% in July from 4.6% in June but exceeded analysts' median forecast for 4.1%, as energy and food prices stayed high. July core inflation slowed to 4.0% year-on-year from 4.4% in June. "Although lower inflation argues for lower interest rates, heightened external uncertainties provide a reason for monetary policy caution. In our view, policy rates across the CEE-4 are likely to fall considerably further, but the timing and speed of rate cuts remain uncertain," Goldman Sachs analysts said in a note, projecting 50 bps easing for Hungary this year. The bank also forecasts rate cuts in Poland and the Czech Republic before the end of the year. "We expect that stronger exchange rates – combined with milder external inflationary forces – will weigh on inflation during the remainder of 2025 and into 2026," the analysts added. https://www.reuters.com/markets/europe/hungary-leave-base-rate-hold-65-again-despite-sputtering-economy-2025-08-22/

2025-08-22 09:12

Euro, sterling touch two-week low ahead of Powell speech Powell's tone may sway markets as traders trim rate cut bets Odds of 25 basis point cut in September at 69% German GDP contracts 0.3% q/q in Q2, revised from 0.1% MUMBAI, Aug 22 (Reuters) - The U.S. dollar hovered near a two-week high against a basket of other major currencies on Friday as investors scaled back rate cut bets ahead of Federal Reserve Chair Jerome Powell's speech at the Jackson Hole symposium. The euro and sterling touched their weakest levels versus the dollar since early August and were last steady at $1.1160 and $1.3413, respectively. Sign up here. The dollar index edged up 0.1% to 98.72, on course for a 0.9% rise on the week to snap a two-week losing streak. While indications of U.S. labour market weakness had bolstered hopes of an reduction in borrowing costs next month, expectations have been tempered by economic data flashing inflationary risks and cautious comments from Fed policymakers. Traders are currently pricing in , opens new tab just under a 70% chance of a 25 basis point rate cut in September, down from 75% on Thursday, CME's FedWatch tool showed. "The dollar has been reflecting the risk that (Powell) could stick to his guns and become more cautious," said Jane Foley, head of FX strategy at Rabobank. Fed officials on Thursday appeared lukewarm to the idea of a rate cut next month, setting the stage for Powell's speech at 10 a.m. EDT (1400 GMT) at the annual Jackson Hole conference in Wyoming. Chicago Fed president Austan Goolsbee acknowledged the upcoming meeting is "live" and could bring a change in interest rate policy, although he noted mixed economic data and unexpectedly high inflation data gave him pause about the prospect of an imminent easing. The 2-year U.S. Treasury yield, sensitive to interest rate expectations, nudged up to 3.80%, adding to a 5-basis-point rise in the previous session. Bond prices move inversely to yields. Data showed Germany's economy shrank by 0.3% in the second quarter from the first as demand from the U.S. faded following months of accelerated buying in anticipation of U.S. tariffs. "While financial markets seem to have grown numb to tariff announcements, let’s not forget that their adverse effects on economies will gradually unfold over time," Carsten Brzeski, global head of macro at ING Research, said in a note. U.S. tariffs and a stronger euro exchange rate against multiple currencies make it hard to see how the German economy would recover from a "seemingly never-ending stagnation" in the second half of the year, the note said. The single currency is up 12% so far this year versus the dollar, benefiting from a decline in the U.S. currency. Analysts at BofA Global Research said that although they saw modest near-term upside potential for the dollar going into Powell's speech, they continued to hold an overall bearish outlook amid rising stagflation risks for the U.S. economy. The yen weakened 0.16% against the dollar but Japanese 30-year government bond yields hit new highs and 10-year yields touched a 17-year high after core inflation data kept expectations of a Bank of Japan interest rate hike in the coming months alive. The Swedish crown and Norwegian crown were down about 0.2% each in the face of a firmer dollar. https://www.reuters.com/world/africa/dollar-firms-traders-pare-rate-cut-bets-ahead-powell-speech-2025-08-22/

2025-08-22 09:10

WARSAW, Aug 22 (Reuters) - Poland's Finance Ministry said on Friday it was not working on a previously floated idea of taxing interest on banks' required reserves, as banks' shares tumbled following an announcement of plans to hike the corporate income tax they pay. Warsaw's WIG Banks index (.BKNI) , opens new tab fell about 8% in morning trade on Friday after the ministry said Poland planned to raise the corporate income tax levied on banks to 30% in 2026, from the current 19%, to finance increased defence spending. Sign up here. The rate would be lowered to 26% in 2027 and further to 23% in subsequent years, the ministry said. In June, Finance Minister Andrzej Domanski said the ministry was working on a new tax which could target interest on required reserves held in the central bank, potentially bringing in 1.5 billion-2.0 billion zlotys ($408 million-$544 million). However, the ministry said in a post on X on Friday that it was "not currently working on the previously considered solution regarding the taxation of mandatory reserves held at the National Bank of Poland". Erste Securities analyst Lukasz Janczak said that plan would have had a less severe impact on banks' profits than the increase in corporate income tax, which was announced by the Finance Ministry on Thursday. It said the changes to corporate income tax for banks would increase revenues by about 6.5 billion zlotys in 2026. ($1 = 3.6759 zlotys) https://www.reuters.com/business/finance/poland-is-not-working-tax-interest-banks-required-reserves-ministry-says-2025-08-22/

2025-08-22 08:02

Ukraine stepping up attacks on Russian energy infrastructure Unecha pumping station key part of Europe-bound Druzhba pipeline Russian regional governor says Unecha site catches fire as result of Ukrainian missile, drone attacks Hungary says Russian oil flows via Druzhba pipeline halted KYIV/BUDAPEST, Aug 22 (Reuters) - Ukraine's military again struck the Unecha oil pumping station, a critical part of Russia's Europe-bound Druzhba oil pipeline, the commander of Ukraine's unmanned systems forces said late on Thursday, and Hungary said deliveries had been halted. Russia and Ukraine have stepped up attacks on each other's energy infrastructure over the past few weeks with Kyiv damaging several Russian refineries in an effort to reduce revenues financing Russia's war in Ukraine, disrupt its energy exports and create fuel shortages inside Russia. Sign up here. For its part, Russia has fired rockets and drones at Ukraine’s gas infrastructure, reducing Kyiv's ability to import gas and provide heating to its population and fuel for the military. The Druzhba pipeline ships oil from Russia to Hungary and Slovakia, as well as from Kazakhstan to Germany. Ukraine has repeatedly attacked the pipeline's facilities this month, causing a few days of supply disruption. Hungarian Foreign Minister Peter Szijjarto, meanwhile, said crude oil deliveries from Russia to Hungary via the Druzhba link had been halted after an attack on the pipeline located near the Russia-Belarus border. "This is another attack against our energy security," Szijjarto wrote on Facebook. Robert Brovdi, commander of Ukraine's unmanned systems forces, posted a video on Telegram messenger showing a large fire at a facility with numerous fuel tanks. Reuters could not confirm the location of the infrastructure in the video. Russian regional governor Alexander Bogomaz, whose Bryansk region borders both Ukraine and Belarus in the far west of Russia, said on Friday that an energy facility at Unecha had caught fire as a result of Ukrainian missile and drone attacks, adding that the blaze has been extinguished. "As a result of repelling a combined attack carried out by HIMARS MLRS missiles and unmanned aerial vehicles, a fire broke out at a fuel infrastructure facility in the Unecha district," Bogomaz said on Telegram. Unlike most European Union countries, Slovakia and neighbouring Hungary remain dependent on Russian energy and receive most of their crude oil through the Druzhba pipeline that runs through Belarus and Ukraine. Almost daily Ukrainian drone attacks on oil refineries and pipelines have caused fuel shortages in a number of Russian regions. Russia, meanwhile, has intensified its own attacks on Ukrainian energy infrastructure in spite of efforts by U.S. President Donald Trump to negotiate an end to the conflict. https://www.reuters.com/business/energy/ukraine-says-it-struck-russias-unecha-oil-pumping-station-thursday-2025-08-22/