2025-08-22 07:44

BEIJING/HOUSTON Aug 22 (Reuters) - The sharp jump in China's imports of rare earth ore from the United States in July was probably the final customs accounting of shipments from U.S. supplier MP Materials (MP.N) , opens new tab. Data on Wednesday from the General Administration of Customs showed imports of rare earths ore from the U.S. surged to 4,719 metric tons in July after falling to zero in June, sparking market speculation over the source of the shipments. Sign up here. MP Materials, which owns the only U.S. rare earth mine has long sent ore to China for its minority shareholder Shenghe Resources (600392.SS) , opens new tab to process. But MP said in April that it had stopped shipping the critical minerals to China as the U.S. and China clashed over import tariffs before ceasing them altogether in July after announcing the U.S. Department of Defence had invested in the company to effectively become the biggest shareholder. MP told Reuters on Thursday that its final exports were sent in the second quarter and "shipments over water, warehousing and other factors can contribute to reporting delays." The jump coincided with a recovery in China's exports of rare earth magnets, key to electric vehicles, wind turbines and defence sectors. China's rare earth magnet exports to the U.S. jumped by 75.5% from the month before to 619 tons, 4.8% higher than the same month in 2024, the customs data showed. https://www.reuters.com/world/china/chinas-imports-us-rare-earth-ore-surge-july-2025-08-22/

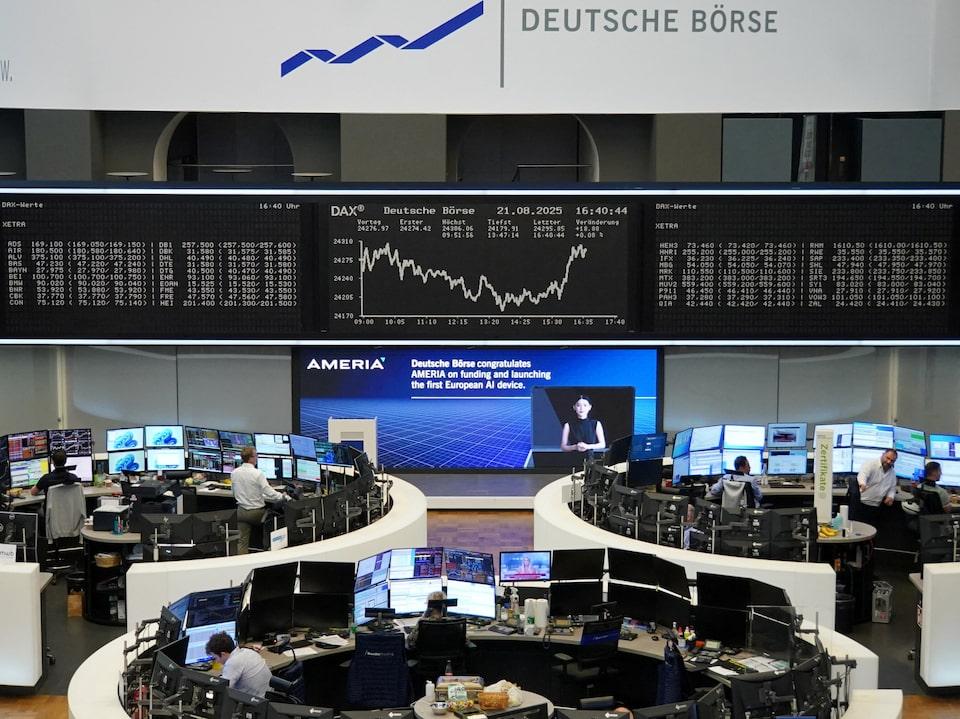

2025-08-22 07:19

Aug 22 (Reuters) - European shares edged lower on Friday as cautious traders awaited Federal Reserve Chair Jerome Powell's speech for clues on the policy outlook. The pan-European STOXX 600 index (.STOXX) , opens new tab was down 0.1% as of 0702 GMT, but still set for a third consecutive weekly gain. Sign up here. Most regional bourses were mixed, with Germany's blue-chip DAX (.GDAXI) , opens new tab falling 0.2%. The German economy contracted by 0.3% in the second quarter of 2025 more than initially expected, the statistics office said, with industrial production performing worse than assumed. Investors geared up for Powell's speech at the annual Jackson Hole conference after Fed officials appeared lukewarm to the idea of a rate reduction next month. The European Union pushed for reduced U.S. tariffs on certain sectors after locking in a trade deal. The EU said it would work to ensure lower tariffs on car exports applied retroactively from August 1 while continuing to press for a preferential levy on wine and spirits. Dulux paints maker AkzoNobel (AKZO.AS) , opens new tab rose 4.3% after activist investor Cevian Capital took a 3% stake, according to a a filing by Dutch market regulator AFM. https://www.reuters.com/sustainability/sustainable-finance-reporting/european-shares-edge-lower-ahead-powells-speech-2025-08-22/

2025-08-22 07:16

China's CCRC to invest over $1 billion in 2 oilfields, exec says Aims to produce 60,000 bpd of oil by end-2026, exec says SINGAPORE/HOUSTON, Aug 22 (Reuters) - China Concord Resources Corp has begun developing two Venezuelan oilfields, planning to invest more than $1 billion in a project to produce 60,000 barrels per day of crude oil by end-2026, an executive directly involved in the project said. The project marks a rare investment by a private Chinese firm in the OPEC country, which has struggled to attract foreign capital due to international sanctions on the administration of President Nicolas Maduro. The investment figure and the production plan are being reported for the first time. Sign up here. Beijing has been a key ally of Maduro and his predecessor late President Hugo Chavez and is currently buying more than 90% of Venezuela's total oil exports. Chinese state oil giant CNPC was among the largest investors in Venezuela's oil sector before U.S. energy sanctions were first imposed on Venezuela in 2019. China was also a big lender to Venezuela. Early last year, CCRC began negotiating its participation in the two oilfields - Lago Cinco and Lagunillas Lago - and signed in May 2024 a 20-year production sharing contract with Venezuela, said the executive, speaking on condition of anonymity due to the sensitivity of the subject. The contract model, introduced by the Venezuelan government in 2020 under the Anti-Blockade Law to cope with U.S. sanctions, allows investors to act as operators in return for an agreed share of production. PDVSA and Venezuela's oil ministry did not respond to requests for comment. The oilfields in Venezuela's second largest oil producing region, Lake Maracaibo, are part of a group of blocks PDVSA has been seeking partners for in recent years. Most of the intended partners are little known companies with no track record on oil production, according to a PDVSA document. With no previous oil drilling experience, CCRC has since last September sent in around 60 Chinese staff skilled in oilfield development and a Chinese drill rig, aiming to quickly reopen about 100 wells and recover crude output, said the executive. Production at the two fields, largely mothballed in recent years due to lack of investment and technical expertise, is now running at 12,000 bpd, said the executive. CCRC aims to develop a total of 500 wells and raise output to up to 60,000 bpd by the end of 2026, he said, adding that it's a mix of light and heavy oil, with light crude to be delivered to PDVSA and heavier crude destined for China. "Because of the U.S. sanctions on Venezuela's oil sector, no big name companies would dare operate there, handing opportunities to small companies like Concord," the executive said. State oil company PDVSA, which controls joint ventures and contracts, has stabilized oil output at around 1 million bpd, in part because of U.S. licenses that allow a limited number of foreign partners to operate there and export oil. Since the U.S. imposed energy sanctions on Venezuela in 2019, most Chinese state oil firms have stopped lifting oil. Chinese independent refiners, however, continue to buy the oil via traders. https://www.reuters.com/business/energy/private-chinese-firm-producing-oil-venezuela-under-rare-20-year-pact-source-says-2025-08-22/

2025-08-22 06:59

Aug 22 (Reuters) - Nvidia earnings are in the spotlight as pressure on tech stocks rises, while Ukraine and political developments in Japan could also grab attention. Here's what coming up in the week ahead in financial markets from Lewis Krauskopf and Suzanne McGee in New York, Kevin Buckland in Tokyo, Dhara Ranasinghe in London and Libby George in Minneapolis. Sign up here. 1/ NVIDIA NEXT Nvidia's August 27 earnings report takes on greater significance after tech shares stumbled this week on some caution over the AI boom. Its dominant position in AI chips has led to another soaring performance in 2025. Last month, it became the first company to top $4 trillion in market value. Any commentary from the AI bellwether related to demand and spending could have broad ramifications for companies exposed to the technology. Focus could also fall on Nvidia's deal with the Trump administration, which gives the U.S. government 15% of revenue from sales of some advanced chips in China. U.S. Commerce Secretary Howard Lutnick is looking into the government taking equity stakes in Intel and other chipmakers in exchange for grants under a federal act that aims to spur factory-building in the U.S., sources say. 2/ PRICING IN PEACE Global defence stocks took a beating on signs that peace could return to Ukraine, although geopolitical analysts caution that it is far too soon to start pricing in a "peace dividend". The sector has been on a tear for most of 2025, as conflicts in the Middle East and Ukraine, and U.S. pressure, prompt governments to bump up defence spending. That has helped propel stocks like U.S.-based RTX Corp (RTX.N) , opens new tab, the parent company of defence contractor Raytheon, roughly 35% higher so far this year. The S&P 500 is up 9% (.SPX) , opens new tab. Germany's Rheinmetall has surged 160% (RHMG.DE) , opens new tab and Italian aerospace giant Leonardo S.p.A. (LDOF.MI) , opens new tab is still up 73% even after this week's selloff. A de-escalation in the war in Ukraine could prompt further selling but not much given the global great power play taking place, strategists say. Given that most countries are viewed as "behind the curve" on defence spending, the sector will remain in favour. 3/ EXIT STRATEGY Political paralysis in Japan is putting pressure on the bond market, with 10-year bond yields hitting the highest since 2008, and 30-year yields at all-time peaks. Calls continue for Prime Minister Shigeru Ishiba to step down following a bruising loss in recent upper house elections, but his refusal has kept worries alive about a loosening of fiscal restraint to cater to up-and-coming opposition parties. Things could come to a head next week, with Ishiba's ruling Liberal Democratic Party due to release a fact-finding report on the reasons for the poor poll showing by month-end. Some observers reckon this could provide the timing for a graceful exit, as it also allows Ishiba to clear key diplomatic meetings with South Korea's leader , opens new tab this weekend and India's Narendra Modi a week later. 4/ WATCHING MR. BOND As the tech selloff grabbed headlines, renewed pressure in bond markets went a little under the radar. German and French 30-year bond yields this week rose to their highest since 2011, Japanese yields are at their highest in years, UK long-dated bonds sold off again and U.S. 30-year yields are hovering near 5%. Sure, the reasons behind the selling are well established: debt levels are rising, so governments need to sell more bonds. Some such as Japan need to hike rates, others including the U.S. and UK face still sticky inflation. Some reckon that fast-money types could be starting to position for a crisis. That the selling pressure on bonds continues is, in itself, a worry for governments now forking out meaningful amounts of their income on debt service payments. The selloff could be a harbinger of what comes in September when supply picks up. 5/ HIDE AND SEEK West Africa's Senegal awaits the results of an International Monetary Fund mission, concluding on Tuesday, to unpick its mammoth hidden debts and move forward. The scale of the hidden debts, which the IMF pegs at $11.3 billion, has ballooned since September 2024, when its then-new leaders first flagged the issue. Note, Mozambique's “tuna bond” hidden debt scandal tallied up to just a few billion. Investors are watching. A communique could shed light on what the IMF does next, after pushing for better debt reporting across emerging markets for years. Senegal's scandal is a black eye for the Fund, since it had a monitoring programme at the time. The IMF must now balance the need to show consequences for misreporting while avoiding punishing Senegal for openness. Investors hope the Fund will move forward with a long-awaited misreporting waiver after the mission, paving the way for a new programme. Without a waiver, Senegal could have to repay. https://www.reuters.com/business/take-five/global-markets-themes-repeat-update-1-graphic-2025-08-22/

2025-08-22 06:57

Retail buying remains subdued, traders say India dealers offer discount up to $2/oz to premium $3 this week China premiums at $3-$8/oz this week Aug 22 (Reuters) - Physical gold demand in key Asian hubs remained subdued this week as price volatility kept buyers at bay, while jewellers in India resumed purchases ahead of a key festival season. Gold prices in India were trading around 99,300 rupees ($1,135.77) per 10 grams on Friday after hitting a record high of 102,250 rupees earlier this month. Sign up here. "With prices easing, jewellers are feeling more confident about festival demand and have slowly started buying again," said a Mumbai-based bullion dealer with a private bank. Indians will celebrate the Dussehra and Diwali festivals in October, when buying gold is considered auspicious. This week, Indian dealers were quoting between a discount of $2 per ounce and a premium of $3 per ounce over official domestic prices, inclusive of 6% import and 3% sales levies, compared to last week's discount of up to $6. Retail buying is still subdued, currently at around 60% of normal levels, said Amit Modak, chief executive of PN Gadgil and Sons, a Pune-based jeweller. In top consumer China, bullion changed hands between premiums of $3 and $8 an ounce over the global benchmark spot price , which traded in a range of $3,311 to $3,358 this week, down 0.2% so far for the week. "With gold in the doldrums, there is scope for exaggerated moves on news from Jackson Hole, which reflects the thin trading conditions currently gripping the market," said Ross Norman, an independent analyst. In Hong Kong, gold was sold at par to a premium of $1.70, while in Singapore , gold traded between at-par prices and a $2.50 premium. "We've seen a bit of retail buying, but nothing really substantial... In the jewellery space, demand has been quiet because prices are high," said Brian Lan, managing director at Singapore-based GoldSilver Central. While there has been more interest in investment bars, it is nothing really well out of the ordinary, Lan added. In Japan, bullion changed hands at par to a premium of $0.50 over spot prices. ($1 = 87.4300 Indian rupees) https://www.reuters.com/world/china/asia-gold-volatile-prices-stifle-gold-demand-top-asian-hubs-2025-08-22/

2025-08-22 06:57

Aug 22 (Reuters) - Oil prices rose slightly on Friday as hopes for an imminent peace deal between Russia and Ukraine dimmed, increasing the risk premium demanded by oil sellers and putting prices on track to snap a two-week losing streak. Brent crude futures were up 12 cents at $67.79 a barrel as of 0633 GMT, while West Texas Intermediate (WTI) crude futures rose 13 cents to $63.65. Sign up here. Both contracts climbed more than 1% in the prior session. Brent has risen 2.7% this week, while WTI has gained 1.1%. Traders are pricing in more risk as hopes fade that U.S. President Donald Trump can quickly broker a deal to end the Russia-Ukraine war, which propelled a sell-off in oil over the last two weeks. "It's proving difficult to set up a Putin-Zelenskiy summit, while discussions around potential security guarantees face obstacles," analysts at ING said in a client note on Friday. "The less likely a ceasefire looks, the more likely the risk of tougher (U.S.) sanctions" on Russia, they said. The three-and-a-half-year war continued unabated on Thursday as Russia launched an air attack near Ukraine's border with the European Union and Ukraine said it hit a Russian oil refinery. Meanwhile, U.S. and European planners said they have developed military options by allied national security advisers. That followed the first in-person talks at the weekend between the U.S. and Russian leaders since Russia invaded Ukraine. Russian President Vladimir Putin demanded Ukraine give up all of the eastern Donbas region, renounce NATO ambitions and keep Western troops out of the country, sources told Reuters. Trump pledged to protect Ukraine under any war-ending deal. Ukraine President Volodymyr Zelenskiy dismissed the idea of withdrawing from internationally recognised Ukrainian land. Oil prices were also supported by a larger-than-expected drawdown from U.S. crude stockpiles in the last week, indicating strong demand. Stockpiles fell 6 million barrels in the week ended August 15, the U.S. Energy Information Administration said on Wednesday. Analysts had expected 1.8 million barrels. Investors were also looking to the Jackson Hole economic conference in Wyoming for signals of a Federal Reserve interest rate cut next month. The annual gathering of central bankers began on Thursday, with Fed Chair Jerome Powell speaking on Friday. Lower interest rates can stimulate economic growth and increase oil demand, potentially boosting prices. https://www.reuters.com/business/energy/oil-prices-set-snap-two-week-losing-streak-peace-ukraine-remains-elusive-2025-08-22/