2025-08-22 06:35

DUBAI, Aug 22 (Reuters) - Iran's Foreign Minister Abbas Araqchi will have a joint telephone call with his French, British and German counterparts on Friday to discuss nuclear talks and sanctions, state news agency IRNA reported. The three European powers have threatened to activate United Nations sanctions on Iran under a "snapback" mechanism if Iran does not return to the negotiating table over its nuclear programme. Sign up here. The countries, along with the United States, contend that Iran is using the nuclear programme to potentially develop weapons. The International Atomic Energy Agency has stated that Iran is nowhere near developing a nuclear bomb and U.S. national intelligence director Tulsi Gabbard testified in March that intelligence officials had not found evidence of Iran moving toward a nuclear weapon. Iran's state broadcaster said Araqchi and the British and European foreign ministers will discuss triggering the snapback mechanism. Tehran suspended nuclear negotiations with the U.S., which were aimed at curbing the Islamic Republic's nuclear programme, after the U.S. and Israel struck its nuclear sites in June. Since then, IAEA inspectors have been unable to access Iran's nuclear installations, despite IAEA chief Rafael Grossi stating that inspections remain essential. Iran's state-broadcaster said an Iranian delegation is due to travel to Vienna on Friday to meet with IAEA officials. It gave no further details. https://www.reuters.com/world/middle-east/iran-european-powers-discuss-nuclear-talks-sanctions-irna-reports-2025-08-22/

2025-08-22 06:32

LONDON, Aug 22 (Reuters) - Governments and employers should take urgent action to help protect the health of workers who are increasingly exposed to extreme heat, the United Nations said on Friday. Climate change is making heatwaves more common and intense, and workers worldwide are already experiencing the health impacts, the agencies said in what they described as a “much needed” major update of a report and guidance last published in 1969. Sign up here. Worker productivity drops by 2-3% for every degree above 20°C, the report said, with half of the world’s population already suffering the adverse consequences of high temperatures. The health risks include heatstroke, dehydration, kidney dysfunction and neurological disorders, said the World Health Organization and the World Meteorological Association. Manual workers in sectors like agriculture, construction and fisheries, as well as vulnerable populations like children and older adults in developing countries, were particularly at risk, they added. "Protection of workers from extreme heat is not just a health imperative but an economic necessity," said WMO Deputy Secretary-General Ko Barrett. In response, the agencies called for heat action plans tailored to regions and industries, developed alongside workers, employers, unions and public health experts. Unions in some countries have pushed for maximum legal working temperatures, for example, which the agencies said was an option but would likely differ globally depending on the context. They also called for better education for health workers and first responders, as heat stress is often misdiagnosed. The International Labour Organization recently found that more than 2.4 billion workers are exposed to excessive heat globally, resulting in more than 22.85 million occupational injuries each year. "No-one should have to risk kidney failure or collapse just to earn a living," said Rüdiger Krech, director ad interim for environment, climate change and health at the WHO, at a press conference ahead of the report’s release. https://www.reuters.com/sustainability/climate-energy/urgent-action-needed-protect-workers-heat-stress-warming-world-un-says-2025-08-22/

2025-08-22 06:28

MUMBAI, Aug 22 (Reuters) - The Indian rupee weakened further on Friday, extending its late-session slide from the previous day, as the dollar rose ahead of a speech by Federal Reserve Chair Jerome Powell and on renewed concerns of steep U.S. tariffs on local goods. The rupee fell to an intraday low of 87.4850 and was last at 87.4550, compared with its close of 87.27 in the previous session. On Thursday, the currency had briefly climbed past 87 before reversing course in the afternoon to mark its sharpest one-day decline in a month. Sign up here. "Thursday’s move, and then today, shows tariff fears are back on the table after a brief lull," a Mumbai-based currency trader said, referring to the possibility of Washington imposing additional tariffs of up to 50% on Indian goods from August 27. "The added uncertainty around Powell's speech just makes it harder for the rupee," he added. The dollar index advanced towards 99 ahead of Powell's comments at the Federal Reserve's annual Jackson Hole symposium, while most Asian currencies were weaker on the day. Investors are pricing in an over 80% chance of a rate cut at the Fed’s September meeting, but the question is whether Powell will push back against such aggressive expectations. "We do not expect Powell to decisively signal a September cut, but the speech should make it clear to markets that he is likely to support one," Goldman Sachs said in a note. The brokerage reckons that most Fed policymakers who have mixed feelings about cutting rates next month will be willing to support a reduction if Powell presses for one. https://www.reuters.com/world/india/rupee-backslides-towards-8750-with-powell-tariff-clouds-overhead-2025-08-22/

2025-08-22 06:23

Chinese stocks lead gains in Asia, dollar appreciates Powell to speak at 1400 GMT, markets eye policy clues Japan core inflation slightly ahead of estimates SINGAPORE, Aug 22 (Reuters) - Stocks in Asia mostly clung to safe ranges on Friday as traders awaited a key speech from Federal Reserve Chair Jerome Powell at the annual Jackson Hole symposium this weekend that could shed light on the direction of monetary policy. Financial markets are looking for Powell to provide clues on the likelihood of a September rate cut in the wake of recent signs of job market weakness. Sign up here. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab gave up early gains and was last down 0.1%, paring its advance to 1.3% so far this month. "Top of mind among investors is what central bankers will say about U.S. tariffs and their impact on economic growth and inflation, and which of these two factors will have a bigger influence on interest rate policy, as central banks grapple with the risk of stagflation," said Vasu Menon, managing director for investment strategy at OCBC in Singapore. Defying the sleepy mood, China's blue-chip CSI 300 Index (.CSI300) , opens new tab jumped 1.8%, on track for a third consecutive day of gains. Tech shares led the advance, after DeepSeek released an upgrade to its flagship V3 AI model and Reuters reported Nvidia (NVDA.O) , opens new tab had asked Foxconn (2317.TW) , opens new tab to suspend work on the H20 AI chip, lending support to shares of Chinese rivals. China's tech-focused STAR 50 index (.STAR50) , opens new tab rose almost 8%. The Nikkei 225 (.N225) , opens new tab veered between gains and losses, and was last down 0.1%. Japanese data showed core consumer prices slowed for a second straight month in July but stayed above the central bank's 2% target, keeping alive expectations for a rate hike in the coming months. That did little to help the yen, though, which was poised for a 1% decline for the week. BOJ Governor Kazuo Ueda will also speak at Jackson Hole this weekend. The dollar index (.DXY) , opens new tab, which tracks the greenback against a basket of currencies of major trading partners, advanced 0.2% to 98.796, as traders parsed speeches from Fed officials who appeared lukewarm to the idea of an interest rate cut next month. S&P 500 futures bobbed between gains and losses and were last trading down 0.1%. The cash gauge on Wall Street is on a five-day losing streak, which has left it on track for its biggest one-week decline this month. Traders had ramped up bets for a September cut following a surprisingly weak payrolls report at the start of this month, and after consumer price data showed limited upward pressure from tariffs. However, market pricing pulled back slightly following the release of minutes from the Fed's July meeting. Traders are now pricing in a 73.3% probability of a cut in September, down from 82.4% on Thursday, according to the CME Group's FedWatch tool. The most likely scenario is that Powell won't provide "any definitive clues" on what the Fed will do next ahead of critical non-farm payrolls and CPI data, said Carol Kong, an economist and currency strategist at Commonwealth Bank of Australia in Sydney. "Given where the current market is, the risk is a stronger U.S. dollar, especially if he challenges the current market pricing of a 25-basis-point cut." Traders are assessing signs that U.S. economic activity picked up pace in August, with PMI data from S&P Global showing the strongest growth in manufacturing orders in 18 months. But the labour market also highlighted pockets of weakness, as the number of Americans filing new applications for jobless benefits rose by the most in about three months last week and the number of people collecting unemployment relief in the prior week climbed to the highest level in nearly four years. The euro slipped, weakening 0.2% to a two-week low of $1.1585 as the EU and the U.S. set out details of a framework trade deal struck in July. Oil prices stabilised, with Brent crude last trading up 0.1% at $67.73 per barrel, following strong gains on Thursday as Russia and Ukraine blamed each other for a stalled peace process, and U.S. data showed signs of strong demand in the top oil consuming nation. Gold was slightly lower, with spot bullion off 0.3% at $3,329.40 per ounce. https://www.reuters.com/world/china/global-markets-corrected-wrapup-2-2025-08-22/

2025-08-22 06:19

Fed Chair Powell to deliver Jackson Hole address at 1400 GMT US weekly jobless claims jump to near 3-month high last week Markets put chance of Fed rate cut next month at 75% Aug 22 (Reuters) - Gold prices edged lower on Friday on a stronger dollar while investors awaited U.S. Federal Reserve Chair Jerome Powell's speech at the annual Jackson Hole symposium that could offer fresh clues on the monetary policy path. Spot gold fell 0.3% to $3,329.19 per ounce by 0607 GMT. U.S. gold futures for December delivery lost 0.3% to $3,372.10. Sign up here. The U.S. dollar index (.DXY) , opens new tab hovered near a two-week high, making gold less attractive to overseas buyers. Fed officials appeared lukewarm on Thursday to the idea of a rate cut next month as investors geared up for Powell's speech, due at 1400 GMT on Friday. "With a Russia-Ukraine peace deal still a possibility, and the USD attracting some buyers, gold is facing headwinds," KCM Trade chief market analyst Tim Waterer said. "But if Powell's message is interpreted as being a dovish shift, the USD could be undone, and gold may be on the move higher again." Futures markets indicate a 75% chance of a quarter-point rate reduction next month, according to CME's FedWatch tool. Recent labour data showed U.S. jobless claims rose last week by the most in nearly three months, while unemployment claims the previous week hit a near four-year high. The challenge for Fed policymakers is that even though there are signs of labour market weakening, inflation remains above the central bank's 2% target and could go higher due to the Trump administration's aggressive tariff hikes. Russian President Vladimir Putin is demanding that Ukraine give up all of the eastern Donbas region, renounce ambitions to join NATO, remain neutral and keep Western troops out of the country, three sources familiar with top-level Kremlin thinking told Reuters. Elsewhere, spot silver was down 0.4% to $38.01 per ounce, platinum fell 0.6% to $1,345.06, and palladium rose 0.2% to $1,113.19. https://www.reuters.com/world/china/gold-edges-down-stronger-dollar-powells-remarks-focus-2025-08-22/

2025-08-22 06:17

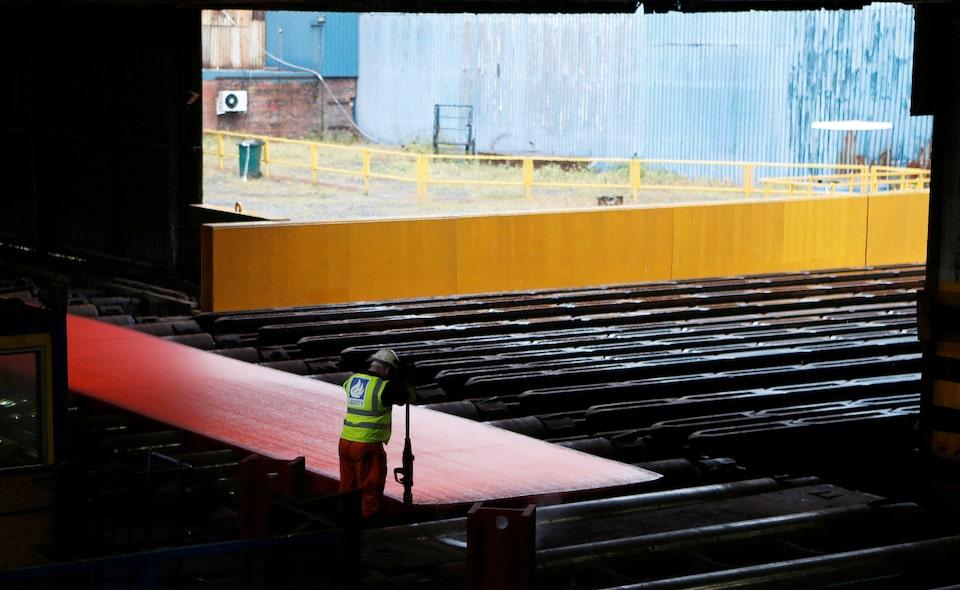

LONDON, Aug 21 (Reuters) - The British government said it will take control of a part of Liberty Steel, owned by commodities tycoon Sanjeev Gupta, after the business was placed into liquidation following a petition from its creditors on Thursday. A judge at London's High Court approved the petition for Yorkshire-based Speciality Steel UK, one of Britain's largest steelworks, to be placed into compulsory liquidation, describing the business as "hopelessly insolvent", the BBC reported. Sign up here. The government would cover the ongoing costs of the business while it tries to find a buyer, the report added. The business, which employs 1,450 people and produces steel used in aerospace, defence and power generation, will be placed under a government-appointed liquidator and managers from consultancy Teneo, the government's Insolvency Service said. The government's takeover of the business marks its second intervention in the industry following its move to take control of British Steel's loss-making Scunthorpe plant in April. Liberty Steel is part of Gupta's family conglomerate, GFG Alliance, which has been refinancing its businesses in steel, aluminium and energy after its backer, supply chain finance firm Greensill, filed for insolvency in 2021. It also has operations in other parts of Europe, Australia and the United States. The company said the court's decision was "irrational" and that the plan it had presented would have secured new investment into the steel industry. "Liquidation will now impose prolonged uncertainty and significant costs on UK taxpayers," Liberty Steel Chief Transformation Officer Jeffrey Kabel said in an emailed statement. The government said it was committed to supporting the steel industry. "We know this will be a deeply worrying time for staff and their families, but we remain committed to a bright and sustainable future for steelmaking and steel making jobs in the UK," a government spokesperson said. https://www.reuters.com/world/uk/uk-government-take-over-liberty-steel-division-after-collapse-2025-08-21/