2025-08-18 11:03

SAO PAULO, Aug 18 (Reuters) - Brazilian power company Eletrobras has partnered with C3 AI (AI.N) , opens new tab to apply artificial intelligence to help operate the electric power transmission network in Latin America's largest economy, the two companies told Reuters on Monday. Eletrobras, Brazil's largest operator in the segment, will implement the C3 AI Grid Intelligence tool, which focuses on monitoring and resolving failures in real time, in all of its transmission assets. Sign up here. The value of the deal was not disclosed. The companies said in a joint statement that the use of artificial intelligence would increase the network's resilience and reliability at a large scale, by helping, for example, to correct failures more quickly. Eletrobras' investment in AI comes at a time when investments in electrical networks are gaining relevance worldwide, both as preparation for a more complex and dynamic operation of diversified electrical matrices, and as a security reinforcement in the face of extreme weather events. One of the main challenges faced by transmission companies in Brazil is fires near lines and substations. "We are modernizing critical network monitoring processes, which allows us to respond to incidents more effectively and agilely, ensuring system stability and availability," said Pablo Flores, Executive Manager of Protection, Automation and Control of Operating Systems at Eletrobras. https://www.reuters.com/business/energy/eletrobras-partners-with-c3-ai-modernize-brazils-power-grid-2025-08-18/

2025-08-18 11:03

MOSCOW, Aug 18 (Reuters) - In Russia, barter is back for the first time since the chaos of the 1990s as settlement problems resulting from the conflict in Ukraine have forced at least one Chinese company to seek steel and aluminium alloys in exchange for engines. In the economic and political chaos which followed the 1991 collapse of the Soviet Union, spiralling inflation and chronic shortages of funds forced enterprises across the land to agree to payment in kind. Sign up here. Barter, though, sowed even more chaos through the economy as vast chains of contingent deals were set up for everything from electricity and oil to flour, sugar and boots, making pricing even harder to determine, and earning some people fortunes. More than three years into the Ukraine war, barter is back again in Russia. At the Kazan Expo business forum on Monday, Chinese companies cited settlement issues and Russian demands that they bring production to Russia as major issues hindering the development of bilateral trade. "We offer innovative cooperation models aimed at reducing settlement risks," Xu Xinjing from Hainan Longpan Oilfield Technology Co., Ltd told the forum through a translator, adding that "we offer a model of barter trade." In exchange for the power equipment, his company wants to receive Russian shipbuilding materials. "In the current conditions of limited payments, this provides new opportunities for enterprises in Russia and Asian countries, the Asian region. For example, we supply marine engines in exchange for special steel materials or aluminium alloys for shipbuilding from Russia," he said. Russia last year discussed barter deals with China, sources told Reuters at the time. Barter is most popular for trades in metals and agricultural products, which are relatively easy to price, according to industrial sources. China is by far Russia's most important trading partner as European powers cut off many of their trade links to Moscow due to the conflict in Ukraine, which the Kremlin calls a "special military operation". Delays in payments for trade with Russia's major partners such as China or Turkey where banks are under pressure from Western regulators to scrutinise transactions with Russia have become a major headache for Russian companies and banks. https://www.reuters.com/world/china/barter-is-back-russia-one-chinese-company-seeks-navigate-settlement-issues-2025-08-18/

2025-08-18 10:52

PALACIOS DE JAMUZ, Spain, Aug 18 (Reuters) - Raging wildfires in Spain spread to the southern slopes of the Picos de Europa mountain range on Monday and authorities closed part of the popular Camino de Santiago pilgrimage route. About 20 wildfires, fuelled by a severe 16-day heatwave, have devastated more than 115,000 hectares (285,000 acres) in the regions of Galicia and Castile and Leon over the past week. Sign up here. "This is a fire situation we haven't experienced in 20 years," Defence Minister Margarita Robles told radio station Cadena SER. "The fires have special characteristics as a result of climate change and this huge heatwave." She said thick smoke was affecting the work of water-carrying helicopters and aircraft. The Spanish army has deployed 1,900 troops to help firefighters. Highways and rail services have been cut in the area, as well as the "Camino de Santiago" hiking route, an ancient pilgrimage path trodden by thousands in the summer. It links France and the city of Santiago de Compostela on the Western tip of Spain, where the remains of the apostle St James are said to be buried. Authorities in the Castile and Leon region have closed the path in the area between the towns of Astorga and Ponferrada, which are about 50 km (30 miles) apart, and told hikers "not to put (their) lives in danger". A firefighter died when his truck crashed on a forest path near the village of Espinoso de Compludo. Four firefighters have died so far. The Interior ministry says 27 people have been arrested and 92 are under investigation for suspected arson since June. Southern Europe is experiencing one of its worst wildfire seasons in two decades, with Spain among the hardest-hit countries. In Portugal, wildfires have burnt 155,000 hectares so far this year, according to the ICNF forestry protection institute - three times the average for this period between 2006 to 2024. About half of that area burned in the past three days. Robles said things are not likely to improve until the heatwave that has seen temperatures hit 45 Celsius degrees (113 Fahrenheit) starts easing on Monday evening or Tuesday. The heatwave is the third hottest since 1975, when the national weather agency started tracking them. Most of the country is subject to wildfire warnings. https://www.reuters.com/sustainability/climate-energy/pilgrimage-route-cut-spanish-wildfires-spread-picos-de-europa-mountains-2025-08-18/

2025-08-18 10:43

LONDON, Aug 18 (Reuters) - Britain is suspending the previously planned introduction of extra border checks on live animal imports from the European Union to ease trade ahead of the implementation of a deal agreed in May to reduce friction, the UK government said on Monday. Extra border checks on some animal and plant goods imported from Ireland will also be suspended. Sign up here. May's sanitary and phytosanitary (SPS) deal, part of a wider reset in UK-EU relations, will reduce paperwork and remove routine border checks on plant and animal products moving between the UK and EU, while maintaining high food standards. However, the deal is yet to be implemented as details are still being negotiated. In the meantime, British traders must continue to comply with the terms of the UK’s Border Target Operating Model (BTOM) that protect the country's biosecurity, including existing checks. The suspension of the introduction of additional border checks follows the announcement in June that checks on EU fruit and vegetable imports had been scrapped. A spokesperson for the Department for Environment, Food and Rural Affairs could not give a timeline for implementation of the SPS deal. When Britain left the EU's single market in 2021, the EU immediately enforced its rules, leading to port delays and prompting some British exporters to stop selling to the bloc. Britain was much slower implementing its post-Brexit border arrangements, and after repeated delays and confusion it started to set new rules in phases from January last year. https://www.reuters.com/world/uk/britain-cancels-extra-border-checks-animals-ahead-uk-eu-deal-2025-08-18/

2025-08-18 10:40

LONDON, August 18 (Reuters) - A look at the day ahead in U.S. and global markets by Dhara Ranasinghe, European Financial Markets Editor After Donald Trump and Russian President Vladimir Putin's gathering in Alaska, it's now Ukraine President Volodymyr Zelenskiy and European leaders’ turn to meet the U.S. President. They’re all gathering on Monday to map out a peace deal to end the war in Ukraine. Sign up here. Unsurprisingly, the response from financial markets to Friday's Alaska summit has been muted, to say the least. Oil prices , the euro and Ukraine's bonds are little changed. * The fear (from Europe) is that Trump could try to pressure Kyiv into accepting a settlement favourable to Moscow. Zelenskiy has already all but rejected the outline of Putin's proposals, including for Ukraine to give up the rest of its eastern Donetsk region, of which it currently controls a quarter. Analysts reckon a ceasefire remains some way off, meaning geopolitical tensions remain a potential headwind to otherwise pretty buoyant world stock markets. * Markets will likely be on alert for any sign of deterioration in Trump’s further talks with Putin. Especially those that might prompt the U.S. president to impose secondary tariffs targeting Russian energy trading, say with India. In an opinion piece published in Monday's Financial Times, White House trade adviser Peter Navarro said India's Russian crude buying was funding Moscow's war in Ukraine and had to stop. * Trump's meeting with Zelenskiy in Washington is one key gathering markets have their eye on this week. The other, the Federal Reserve's annual central bank conference in Jackson Hole, Wyoming, takes place later this week. Fed chief Jerome Powell's speech there on Friday is expected to be his valedictory speech , opens new tab before his term ends next May. In Mike Dolan’s column today, he looks at what could disturb the eerily calm credit markets. Today's Market Minute * Ukraine's Volodymyr Zelenskiy and European leaders will meet Donald Trump in Washington on Monday to map out a peace deal amid fears the U.S. president could try to pressure Kyiv into accepting a settlement favourable to Moscow. * India aims to slash taxes on small cars and insurance premiums as part of a sweeping reform of its goods and services tax (GST), a government source said on Monday, as Prime Minister Narendra Modi's plan sparked a rally in stock markets. * Hong Kong's debt-laden developers and their creditors are set to face intensifying financial pressure as bond maturities are slated to jump by nearly 70% next year amid falling sales and valuations for the city's economically crucial property sector. * China's refiners lifted their processing rates in July, they are still likely adding to their stockpiles, which will allow them to trim imports should prices rise to levels they believe are not justified by market fundamentals. * News that Chinese battery giant CATL has suspended operations at its giant Jianxiawo mine has lit a fire under the lithium market, writes ROI columnist Andy Home. Chart of the day Although stock markets across the globe are at or near world highs, analysts say a ceasefire scenario is not yet priced in. So if there was any sign of a movement in that direction, risk assets - especially European shares - would be in a good position to rally further. Today's events to watch * Zelenskiy meets Trump in Washington * U.S. bills auction https://www.reuters.com/world/china/global-markets-view-usa-2025-08-18/

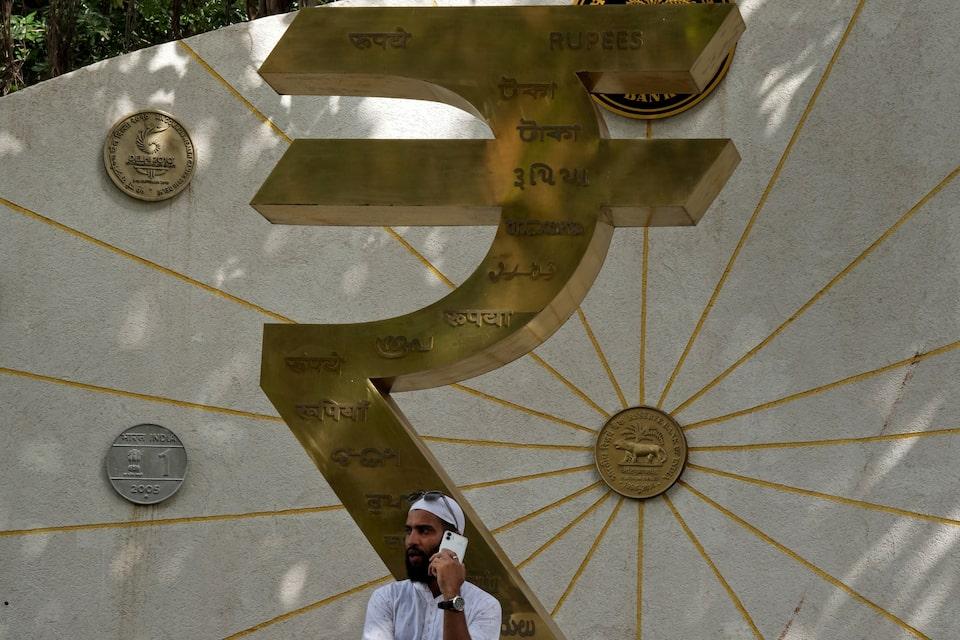

2025-08-18 10:20

MUMBAI, Aug 18 (Reuters) - The Indian rupee rose on Monday, boosted by the rally in local equities on Prime Minister Narendra Modi's planned tax cuts, while forward premiums and volatility expectations barely budged following the Trump-Putin meeting. The rupee settled at 87.35 per U.S. dollar, up 0.23% from 87.55 in the previous session, rising in tandem with local shares. The Nifty 50 (.NSEI) , opens new tab rose 1% - the biggest single-day percentage gain since June 26, 2025 - to 24,876.95 points and the BSE Sensex (.BSESN) , opens new tab gained 0.84% to 81,273.75. Sign up here. New Delhi will propose a two-rate structure of 5% and 18%, doing away with the 12% and 28% tax that was imposed on some items, a government official said on Friday, after Modi announced the reforms. The tax cuts are expected to boost consumption in India's economy, with steep U.S. tariffs threatening economic growth, dragging the rupee and dampening the foreign investor appetite for local equities. The tax cuts, coupled with faint hopes of progress on a Russia–Ukraine deal, could encourage foreign investors back into Indian equities, lending support to the rupee, traders said. Following his meeting with Russian leader Vladimir Putin, U.S. President Donald Trump is pressing for a Russia-Ukraine deal. Ukraine's Volodymyr Zelenskiy flies to Washington on Monday for meeting Trump. Any tangible progress would likely be taken as a boost for the rupee, traders say, as it could improve the odds that Trump might reverse the additional 25% tariffs on Indian goods for purchase of Russian oil, currently scheduled to take effect on Aug. 27. The rupee's near-term outlook remains tethered to how U.S.–India trade relations shape up, Kunal Kurani, vice president at FX risk advisory firm Mecklai Financial, said. For now, he is advising his importer clients to hedge on dips on the dollar/rupee pair. Meanwhile, the dollar/rupee forward premiums and volatility expectations barely moved in response to the Trump–Putin meeting over the weekend, in line with the mostly muted reaction seen across Asian markets. https://www.reuters.com/world/india/rupee-ends-higher-alongside-local-equities-premiums-volatility-flat-2025-08-18/