2025-08-18 05:23

A look at the day ahead in European and global markets from Wayne Cole. You know it's crazy times, when speculation Putin sent his body double to Alaska doesn't sound so outlandish. What does seem clear is that President Trump has shifted back to echoing Moscow's line, tweeting Kremlin talking points about Crimea and Zelenskiy. Sign up here. Putin's position seems to be that Ukraine should give up all the land Russia has taken, and much that it has failed to take in more than three years of fighting. This has been repeatedly ruled out by Zelenskiy and European leaders, and it's notable they will be by his side in Washington when he meets Trump later today. Markets have judged there is a diminished threat of further U.S. sanctions or tariffs on Russian oil exports, and oil prices are down modestly with Brent off 0.3%. Share markets are mostly firmer as Japan and Taiwan make more records, and Chinese blue chips scale a 10-month top. European stock futures are up 0.2% or so, as are Wall St futures. Valuations have been underpinned by a solid earnings season as Goldman notes S&P 500 EPS grew 11% on the year and 58% of companies raised their full-year guidance. This week's results will provide some colour on the health of consumer spending with Home Depot (HD.N) , opens new tab, Target (TGT.N) , opens new tab, Lowe's (LOW.N) , opens new tab and Walmart (WMT.N) , opens new tab all reporting. For monetary policy the main event will be the Federal Reserve's Jackson Hole jamboree where Chair Powell speaks on the economic outlook and the Fed's policy framework on Friday, though there doesn't seem to be a Q&A as yet. ECB President Christine Lagarde and Bank of England Governor Andrew Bailey are on panel discussions. Futures are about 85% priced for a Fed rate cut in September so anything less than dovish from Powell would be a setback for debt markets. While Fed expectations are anchoring short-term yields, the long end continues to fret about inflation, budget deficit and the politicisation of monetary policy, so steepening the yield curve. European bond yields have also been on the rise, perhaps in part on a realisation of how much governments are going to have to borrow to cover increased defence spending. Key developments that could influence markets on Monday: - EU trade figures for June, US NAHB housing survey https://www.reuters.com/world/china/global-markets-view-europe-2025-08-18/

2025-08-18 05:20

BEIJING, Aug 18 (Reuters) - China's imports of unwrought aluminium and products in July surged 38.2% from the prior year, customs data showed on Monday. The world's top consumer of the light metal imported 360,000 metric tons of unwrought aluminium and products last month, data from the General Administration of Customs showed. Sign up here. The data includes primary metal and unwrought, alloyed aluminium. In the first seven months of 2025, China imported a total of 2.33 million tons of unwrought aluminium and products, a rise of 1.5% from the corresponding period in 2024. Imports of bauxite, a key raw material for aluminium, rose 34.2% on-year to 20.06 million tons in July. The July import has brought the total in the first seven months of the year to 123.26 million tons, up 33.7% year-on-year. https://www.reuters.com/markets/commodities/china-july-aluminium-imports-surge-38-prior-year-2025-08-18/

2025-08-18 05:04

BEIJING, Aug 18 (Reuters) - China's Dongfeng Motor (0489.HK) , opens new tab has put its 50% stake in Dongfeng Honda Engine Company up for sale, according to a stock exchange filing on the Guangdong United Assets and Equity Exchange on Monday. A reserve price has yet to be set. Sign up here. The company's assets were valued at 5.4 billion yuan ($752.15 million) last year, while its debts totaled 3.3 billion yuan, according to audited results included in the filing. It reported a loss of 227.8 million yuan in 2024. The listing deadline is Sept. 12 ($1 = 7.1794 Chinese yuan renminbi) https://www.reuters.com/sustainability/climate-energy/chinas-dongfeng-motor-puts-its-50-stake-dongfeng-honda-engine-up-sale-2025-08-18/

2025-08-18 04:15

One-off impairment charge on US business of A$439 million Underlying profit down 51%, below estimates Net profit tumbles 90% Sees solid growth for first-half operating earnings Aug 18 (Reuters) - Australian steel producer Bluescope (BSL.AX) , opens new tab said annual profit plummeted 90%, blaming a "maze" of tariffs imposed by U.S. President Donald Trump for lower demand and a hefty writedown on the value of its U.S. metal coatings unit. Shares in the company slid 5%, though Bluescope reiterated its position that it stands to benefit from higher prices due to its interests in the U.S., and forecast growth in first-half profit for the current financial year. Sign up here. Underperformance from BlueScope Coated Products, a U.S. business it bought for $500 million three years ago, led to an impairment charge of A$438.9 million ($285 million). But even without the writedown, underlying profit for the year to end-June halved to A$420.8 million, missing a Visible Alpha consensus estimate of A$466.4 million. Total net profit slumped to A$83.8 million from A$805.7 million. "It is a bit of a maze," CEO Mark Vassella told journalists on a call, referring to U.S. tariffs, which he said sometimes were announced but did not materialise. "There's lots of movement, there's lots of volatility and variability. It's had some impact on demand as people just try and understand what the implications are before they make commitments or bets on inventory." BlueScope has said it considers itself a net beneficiary of the tariffs because it ships a small amount of steel from Australia to the U.S. relative to what it produces in the United States. But on Monday, Vassella said the coatings business also sources some raw product from Australia and New Zealand, incurring tariffs. "What we're now doing is thinking about alternatives for substrate supply," he said, using the term for base material. BlueScope's North America division, its biggest earner, posted underlying earnings of A$514.4 million for the year, down 45%, mostly due to lower selling prices. "With impairment of US coated products business (there is) a recognition that there's no quick fix here," Citi analysts wrote in a client note. Noting that its main U.S. business is starting to see an improvement in profit margins as a result of tariffs driving prices up, the company forecast underlying operating earnings for the first half of 2026 between A$550 million and A$620 million, above last year's A$309 million. The midpoint of the range, however, fell short of a Visible Alpha consensus of A$618 million. BlueScope declared a final dividend of 30 Australian cents per share, in line with last year. ($1 = 1.5352 Australian dollars) https://www.reuters.com/world/asia-pacific/australias-bluescope-logs-profit-plunge-tariff-maze-hits-demand-forces-writedown-2025-08-17/

2025-08-18 03:05

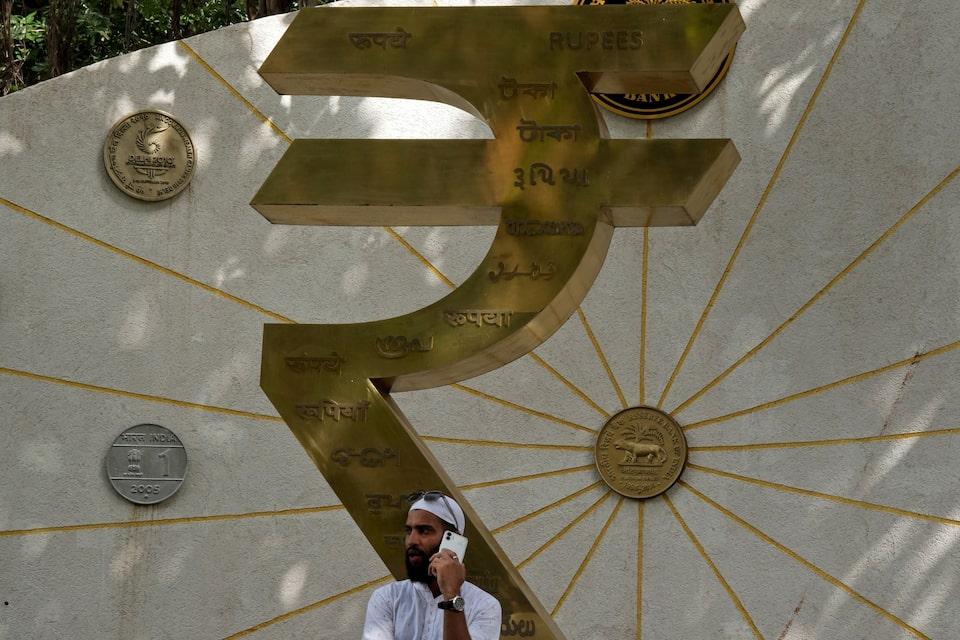

MUMBAI, Aug 18 (Reuters) - The Indian rupee is poised to open higher on Monday, supported by a likely rally in local equities after Prime Minister Narendra Modi’s sweeping tax reforms to boost growth, though persistent U.S.–India trade tensions should cap the advance. The 1-month non-deliverable forward indicated the rupee will open in the 87.50-87.52 range versus the U.S. dollar, compared with 87.55 on Thursday. Indian financial markets were closed on Friday. Sign up here. Gift Nifty futures indicated that the Nifty 50 (.NSEI) , opens new tab will open more than 1% higher after India announced sweeping tax reforms to lift the economy in the face of a trade conflict with Washington. The rupee will "see a bit of lift from equity, however it’s hard to see it doing much with the U.S.–India trade cloud hanging overhead,” said a Mumbai-based FX trader. "The downside (on dollar/rupee) is capped, and any dip will likely be faded." TRUMP-PUTIN MEETING The outcome of the weekend's Trump–Putin meeting did not evoke much of a reaction from Asian equities and currencies. U.S. President Donald Trump has said a full-fledged peace deal for Ukraine remained the ultimate aim rather than a mere ceasefire. After talks with Russian President Vladimir Putin, Trump said he would delay new tariffs on countries like China that continue purchasing Russian oil. Absent from his remarks was any reference to India, which remains on track to face an additional 25% duty starting August 27. Adding to the pressure on the rupee, Washington has scrapped a planned August 25–29 visit by trade negotiators to New Delhi, shelving discussions on a potential trade deal and extinguishing hopes of relief from the fresh tariffs on Indian goods. KEY INDICATORS: ** One-month non-deliverable rupee forward at 87.62; onshore one-month forward premium at 11.5 paise ** Dollar index up at 97.88 ** Brent crude futures down 0.1% at $65.8 per barrel ** Ten-year U.S. note yield at 4.31% ** As per NSDL data, foreign investors sold a net $258.2mln worth of Indian shares on Aug. 13 ** NSDL data shows foreign investors bought a net $200.5mln worth of Indian bonds on Aug. 13 https://www.reuters.com/world/india/rupee-receive-risk-boost-us-india-trade-discord-overhang-persists-2025-08-18/

2025-08-18 00:40

Asian stock markets : Nikkei makes new high, Wall St futures firm Oil slips as Zelenskiy goes to Washington Dollar defensive ahead of Fed conference SYDNEY, Aug 18 (Reuters) - Share markets edged higher in Asia on Monday ahead of what is likely to be an eventful week for U.S. interest rate policy, while oil prices slipped as risks to Russian supplies seemed to fade a little. U.S. President Donald Trump now seemed more aligned with Moscow on seeking a peace deal with Ukraine instead of a ceasefire first, after meeting Russian President Vladimir Putin in Alaska on Friday. Sign up here. Trump will meet Ukrainian President Volodymyr Zelenskiy and European leaders later on Monday to discuss the next steps, though actual proposals are vague as yet. The major economic event of the week will be the Kansas City Federal Reserve's August 21-23 Jackson Hole symposium, where Chair Jerome Powell is due to speak on the economic outlook and the central bank's policy framework. "Chair Powell will likely signal that risks to the employment and inflation mandates are coming into balance, setting up the Fed to resume returning policy rate to neutral," said Andrew Hollenhorst, chief economist at Citi Research. "But Powell will stop short of explicitly signalling a September rate cut, awaiting the August jobs and inflation reports," he added. "This would be fairly neutral for markets already fully pricing a September cut." Markets imply around an 85% chance of a quarter-point rate cut at the Fed's meeting on September 17, and are priced for a further easing by December. The prospect of lower borrowing costs globally have underpinned stock markets and Japan's Nikkei (.N225) , opens new tab firmed 0.5% to a fresh record high. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab was a fraction lower, having hit a four-year top last week. EUROSTOXX 50 futures rose 0.3%, while FTSE futures and DAX futures gained 0.2%. SOLID EARNINGS S&P 500 futures nudged up 0.1%, while Nasdaq futures added 0.2% with both near all-time highs. Valuations have been underpinned by a solid earnings season as S&P 500 EPS grew 11% on the year and 58% of companies raised their full-year guidance. "Earnings results have continued to be exceptional for the mega-cap tech companies," noted analysts at Goldman Sachs. "While Nvidia has yet to report, the Magnificent 7 apparently grew EPS by 26% year/year in 2Q, a 12% beat relative to consensus expectation coming into earnings season." This week's results will provide some colour on the health of consumer spending with Home Depot, Target, Lowe's and Walmart all reporting. In bond markets, the chance of Fed easing is keeping down short term Treasury yields while the longer end is pressured by the risk of stagflation and giant budget deficits, leading to the steepest yield curve since 2021. European bonds also have been pressured by the prospect of increased borrowing to fund defence spending, pushing German long-term yields to 14-year highs. Wagers on more Fed easing has weighed on the dollar, which dropped 0.4% against a basket of currencies last week to last stand at 97.851 . The dollar was a fraction firmer on the yen at 147.33 , while the euro held at $1.1704 after adding 0.5% last week. The dollar has fared better against its New Zealand counterpart as the country's central bank is widely expected to cut rates to 3.0% on Wednesday. In commodity markets, gold was stuck at $3,328 an ounce after losing 1.9% last week. Oil prices struggled as Trump backed away from threats to place more restrictions on Russian oil exports. Brent dropped 0.4% to $65.61 a barrel, while U.S. crude eased 0.2% to $62.67 per barrel. https://www.reuters.com/world/china/global-markets-wrapup-1-2025-08-18/