2025-08-13 06:53

Some in board call for tweak to BOJ's focus on 'underlying' inflation Calls for communication change reflects mounting price pressure Government panel member warned BOJ may be 'behind the curve' BOJ may shift communication as rate hike draws near TOKYO, Aug 13 (Reuters) - Pressure is mounting within the Bank of Japan to ditch a vaguely defined gauge of inflation as worries about second-round price effects prompt some board members to call for a more hawkish communication of policy and a clearer path to future rate hikes. BOJ Governor Kazuo Ueda has justified going slow on rate hikes by explaining that "underlying inflation," which focuses on the strength of domestic demand and wages, remains short of the central bank's 2% target. Sign up here. The trouble is that there is no single indicator that gauges "underlying inflation", making it a target for critics who say the BOJ is overly reliant on an obscure reading to guide monetary policy despite both headline inflation and core measures exceeding its target for years. Now, even some members of the BOJ board - worried that second-round price effects were becoming embedded in pricing behaviour and public perceptions of future inflation - are calling for a change to the bank's communication to a more hawkish one that focuses on headline inflation, which hit 3.3% in June. "We're at a phase where we should shift the core of our communication away from underlying inflation to actual price moves and their outlook, as well as the output gap and inflation expectations," one member said, according to a summary of opinions at the bank's July policy meeting. Another member said the BOJ must put more emphasis on upside risks to prices, and consider tweaking its communication to one that is based on the view Japan will hit 2% inflation. Some members of the government's top economic council also warned this month the BOJ might be too complacent of mounting price pressure, a clear nudge to the central bank to steer a more hawkish policy path in the wake of growing public alarm over persistent inflation. "I'm worried that monetary policy is already behind the curve," one panel member was quoted as saying at a meeting last week, adding that prolonged price rises were already affecting people's livelihood and their inflation expectations. OCTOBER POLICY TILT? The BOJ exited a decade-long, radical stimulus programme last year and raised short-term interest rates to 0.5% in January on the view that Japan was on the cusp of sustainably hitting its 2% inflation target. While the central bank has signalled its readiness to raise rates further, the economic impact of higher U.S. tariffs forced it to cut its growth forecasts in May and complicated decisions around the timing of the next rate increase. With Japan having agreed on a trade deal with the U.S. in July, the BOJ has shed some of its gloom over the economic outlook. Of the BOJ's nine board members, Naoki Tamura, Hajime Takata and Junko Koeda have highlighted the risk of persistent rises in food prices leading to broader-based, sustained inflation. To be sure, there is no consensus within the board yet on whether a communication overhaul is needed, with one member quoted as saying in the summary that underlying inflation remained an "important concept in guiding policy." But the fact some members openly called for a tweak to the dovish communication highlights the board's growing attention to broadening inflationary pressure that may pave the way for rate hikes in coming months and into 2026, some analysts say. Annual core consumer inflation hit 3.3% in June, exceeding the BOJ's 2% target for well over three years, due largely to a 8.2% spike in food costs. Such price pressures led the board to revise up its core inflation estimates last month, and cast doubt on the BOJ's view that underlying inflation - measured by a mix of proxies such as public expectations of future price moves - has yet to reach 2%. The BOJ may gradually phase out the concept of underlying inflation from its communication, as it gears up for the next rate hike that could happen as soon as in October, said veteran BOJ watcher Naomi Muguruma. "I think many BOJ officials are beginning to realise that the idea doesn't fit quite well with reality," she said. "We might hear less of this concept when the timing of the next rate hike draws near." https://www.reuters.com/business/boj-faces-pressure-ditch-obscure-inflation-gauge-clear-path-tighter-policy-2025-08-13/

2025-08-13 06:49

TAIPEI, Aug 13 (Reuters) - Typhoon Podul hit Taiwan's sparsely populated southeast coast on Wednesday packing winds of up to 191 kph (118 mph), as a large swathe of southern and eastern parts of the island shut down and hundreds of flights were cancelled. Taiwan is regularly hit by typhoons, generally along its mountainous east coast facing the Pacific. Sign up here. Podul slammed into the southeastern city of Taitung around 1 p.m. (0500GMT), Taiwan's Central Weather Administration said. "Destructive winds from typhoon expected. Take shelter ASAP," read a text message alert issued to cellphone users in parts of Taitung early on Wednesday. The alert warned people of gusts above 150 kph (93 mph) in the coming hours. Nine cities and counties announced the suspension of work and school for Wednesday, including the southern metropolises of Kaohsiung and Tainan. In the capital Taipei, home to Taiwan's financial markets, there were blustery winds but no impact. Authorities are also working to evacuate those whose homes were damaged by a July typhoon that brought record winds and damaged the electricity grid in a rare direct hit to Taiwan's west coast. The government said more than 5,500 people had been evacuated ahead of the typhoon's arrival. All domestic flights were cancelled on Wednesday - 252 in total - while 129 international ones were axed too, the transport ministry said. Taiwan's two main international carriers China Airlines (2610.TW) , opens new tab and EVA Air (2618.TW) , opens new tab said their cancellations were focused on routes out of Kaohsiung, with some flights from the island's main international airport at Taoyuan stopped as well. After making landfall, the storm is expected to hit Taiwan's much more densely populated western coast before heading for China's southern province of Fujian later this week. As much as 600 mm (24 inches) of rain was forecast in southern mountainous areas over the next few days, the Central Weather Administration said. More than a year's rainfall fell in a single week this month in some southern areas, unleashing widespread landslides and flooding, with four deaths. https://www.reuters.com/business/environment/typhoon-podul-slams-into-southern-taiwan-hundreds-flights-cancelled-2025-08-13/

2025-08-13 06:41

Interest in yuan-denominated settlements from China likely to continue DBS's CIPS settlement flows up 30% y/y in 2024 Bank seeks to grow FI clearing capabilities, enhance ROE SINGAPORE, Aug 13 (Reuters) - DBS Group (DBSM.SI) , opens new tab, Southeast Asia's largest lender by assets, is seeing growing interest from Chinese exporters to settle trades in renminbi (RMB), or yuan, particularly with counterparts in Latin America and the Middle East, a senior executive said. "Right now, you see the Chinese exporters, some are beginning to ask and say, I'm going to sell in RMB, please settle in RMB," said Han Kwee Juan, speaking to Reuters in his first media interview since becoming DBS's group head of institutional banking in January. Sign up here. "Is that a trend that will continue? I think that it's something that they will continue to ask for as they trade more with the rest of the world, outside of the U.S.," he said. The shift comes as decades of unwavering faith in the U.S. dollar's dominance in global trade and capital flows faces scrutiny. Major emerging market economies are stepping up efforts to trade in local currencies, underscoring efforts to reduce reliance on the dollar in the global financial system. However, Han said that most settlements outside of China remain "largely in dollars". The bank's subsidiary, DBS China, has been a member of China's Cross-Border Interbank Payment System (CIPS) since 2015. China launched CIPS in 2015 to promote the yuan's usage in international trade. It allows global banks to clear cross-border yuan transactions directly onshore, instead of through clearing banks in offshore yuan hubs. DBS's settlement flows through the CIPS clearing system grew 30% year-on-year in 2024, Han said, though he maintained that the shift toward more yuan-denominated settlements remains gradual. In a wide-ranging interview, Han spoke of how businesses are dealing with the uncertainty over Trump's tariffs and outlined DBS's growth strategy in the current economic environment. "One of the things that we have been growing this year is we have been growing our capability for FI clearing," he said. "We have been quite purposeful in terms of investment that we have made in the clearing capabilities." The bank is also looking to capitalise on its institutional banking business to drive its return on equity, which currently stands at 17%, Han said. Last week, DBS posted a quarterly profit that beat estimates, sending its shares to a record high. "By being able to work with the customers holistically, not just with lending, but also with advisory and as well as cash management, enables us to not only just look at lending or (net interest income) as a source of revenue, but really growing our fee-based revenues," Han said. https://www.reuters.com/business/finance/dbs-sees-rising-demand-yuan-settlements-chinese-exporters-2025-08-13/

2025-08-13 06:40

Vestas second quarter profit lags forecast, orders down Keeps 2025 outlook despite US trade policy uncertainty COPENHAGEN, Aug 13 (Reuters) - Wind turbine maker Vestas (VWS.CO) , opens new tab on Wednesday reported a smaller-than-expected rise in operating profit for the second quarter but maintained its financial outlook for the year as it expected to absorb the impact of U.S. policy uncertainty. Vestas reported an April-June operating profit before one-off items of 57 million euros ($66.56 million), below the 89 million euros expected by 22 analysts in a poll compiled by the company, but up from a year-ago loss of 185 million euros. Sign up here. "In the quarter, we had good order momentum in EMEA, but political uncertainty impacted key markets," CEO Henrik Andersen said in a statement, adding that the company was working to address challenges. The largest wind turbine maker outside of China kept its 2025 forecast unchanged for an operating profit margin before special items of 4%-7% and revenue of 18 billion to 20 billion euros, slightly up from 17.3 billion euros in 2024. There remained considerable uncertainty over tariffs, especially in the United States, Vestas said. Wind turbines include components and materials sourced globally, making the sector vulnerable to trade tariffs. U.S. President Donald Trump has issued executive orders and bills that curtail the use of incentives for wind and solar energy, which dominate the queue of new power generation waiting to connect to the electric grid. Vestas said its second quarter wind turbine orders dropped by 44% in megawatts (MW), as orders fell in some core markets such as the U.S.. While rising tariffs will likely raise costs, Vestas expected this would also lead to higher electricity prices. ($1 = 0.8564 euros) https://www.reuters.com/sustainability/climate-energy/wind-turbine-maker-vestas-second-quarter-profit-lags-forecast-keeps-outlook-2025-08-13/

2025-08-13 06:23

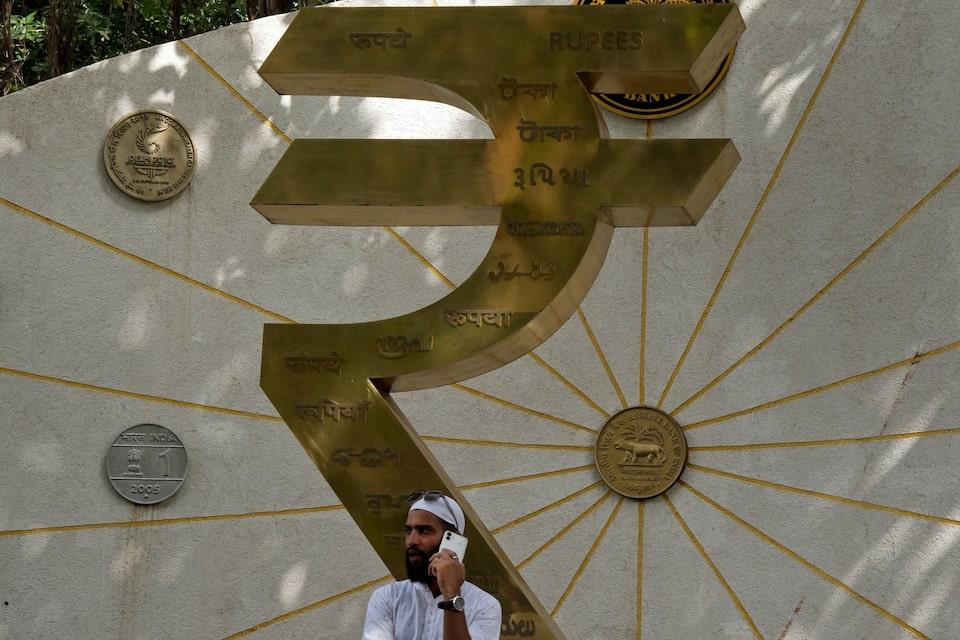

MUMBAI, Aug 13 (Reuters) - The Indian rupee and forward premiums traded higher on Wednesday, lifted by tame headline U.S. inflation data that reinforced bets of a Federal Reserve rate cut next month. The local currency quoted at 87.6750 at 11.00 am IST, compared to 87.7125 on Tuesday. The U.S. consumer price index for July showed limited impact from recent tariffs. Sign up here. That provided a boost to emerging market currencies, with Fed rate cut odds for September climbing to 94%, and markets now pricing in 60 basis points of cuts this year. Based on the details in the CPI report, Goldman Sachs estimates that the U.S. core PCE price index - the Fed's preferred measure of inflation - rose 0.26% in July versus their expectation of 0.31% prior to the report, corresponding to a year-over-year rate of 2.88%. The inflation data has lent the rupee a bit of a reprieve ahead of the crucial Trump-Putin meeting on Friday, a currency trader at a bank said. The relief is unlikely to extend much beyond the current level — at most to 87.50 — with companies hedging more and interbank positioning expected to remain light until the outcome of the meeting is known. The stakes of the meeting, which aims to explore a resolution to the war in Ukraine, are high for the rupee. Market participants expect any resolution to the conflict to have a bearing on additional tariffs that President Trump has imposed on Indian goods in response to New Delhi’s continued purchases of Russian oil. Dollar/rupee forward premiums moved higher, with the one-year dollar/rupee implied yield rising 2 bps to 2.09%, supported by the drop in U.S. yields amid Fed rate cut bets. https://www.reuters.com/world/india/rupee-rides-us-inflation-relief-forward-premiums-perk-up-fed-cut-bets-2025-08-13/

2025-08-13 06:20

LITTLETON, Colorado, Aug 13 (Reuters) - The pace of new capacity of U.S. solar, wind and battery systems has slowed nationally and in key states this year, hurting clean energy sector sentiment. But climate trackers can take heart from the continued growth outside Texas and California. Combined installations of solar, wind and battery storage systems are on track to climb by around 7% in 2025 from the year before, according to data compiled by energy data platform Cleanview as of mid-2025. Sign up here. That would mark the smallest year-over-year percentage expansion in the footprint of those energy technologies in over a decade, and comes amid aggressive cuts to support for clean power since U.S. President Donald Trump returned to office. Climate advocates are particularly alarmed by the slowing in capacity growth in Texas and California, which account for over a third of national combined clean energy capacity but have grown by less than the national average this year. But while there's plenty for clean energy trackers to be concerned about, there are signs that expansions continue outside of the main clean energy states to suggest the U.S. energy transition may be widening even as it slows in 2025. SOLAR SLOWDOWN Solar power capacity has been the fastest-growing form of clean power generation over the past five years, with national capacity expanding by 181% since 2020 to roughly 136,250 megawatts (MW) as of mid 2025, Cleanview data shows. Total U.S. solar capacity has grown by an annual average of 27% since 2020, but so far in 2025 has only grown by 10% from 2024's total due to the sharp slowdown in developer activity. The growth pace of the combined solar installations in California and Texas - the top two solar producing states - was 8% so far in 2025, and so was less than the national average due mainly to the lowest capacity growth in California on record. Capacity growth in Florida, Nevada, Georgia and Virginia - all top 10 solar states - was also well below the national average. However, Arizona, Ohio and Indiana, which are also in the top 10 list, posted growth rates of well over twice the national average to sustain the overall national growth trend. WIND WOES Wind power capacity growth has been slowing steadily in recent years due to cost increases for parts and labour, as well as difficulties in securing new suitable sites for wind farms. Even so, the 1.8% expansion in total U.S. wind capacity so far this year is the smallest annual increase in the U.S. wind power footprint since at least 2010. Among the 10 largest wind power producing states, only Texas (+2.1%) and Illinois (+4.5%) recorded growth in excess of the national average this year, while seven of the top ten states have so far recorded no increase in capacity versus 2024 at all. That said, states outside the 10 largest wind power producers have expanded capacity by 3% so far this year from 2024's total, which is helping the national total tick higher even as the core wind states tread water. BATTERY BUFFERS Battery energy storage systems (BESS) have been the fastest-growing segment of the clean energy space in recent years, and continue to expand at a faster pace than wind and solar farms in 2025. Total installed utility-scale BESS capacity was 33,212 MW as of mid-2025, Cleanview data shows, which is up 22% from 2024's total. Again, California and Texas have posted growth rates below the national average so far in 2025, of 11% and 14% respectively. However, Arizona, Nevada, Massachusetts and Idaho - all top 10 states for battery capacity - have registered capacity increases of far more than the national average. And with federal support for battery systems still available under the Trump administration even as incentives for solar and wind power are slashed, batteries look set to remain the leading growth driver of U.S. clean energy capacity going forward. COMBINED TAKEAWAYS Combined capacity of solar, wind and battery systems hit 325,700 MW as of mid-2025, which marks a 7% or 20,700 MW rise from a year ago. Among the 10 largest states by combined solar, wind and battery capacity, Texas brought on the largest volume, with a 5,250 MW rise, followed by Arizona, California and Indiana. Florida and Illinois also increased their overall clean energy footprints, mainly through battery systems, and look set to remain attractive markets for battery developers going forward given the need for local utilities to ease grid strain. Batteries will also remain in high demand in areas with large volumes of surplus solar generation that utilities want to harness for use during peak consumption periods. That suggests even if the roll-out of new solar and wind capacity remains stunted as the federal support gets phased out, the overall footprint of clean technology looks set to keep rising as more batteries take root. The opinions expressed here are those of the author, a columnist for Reuters. Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn , opens new tab and X , opens new tab. https://www.reuters.com/markets/commodities/us-clean-energy-capacity-growth-gets-slower-wider-2025-2025-08-13/