2025-08-07 23:08

HOUSTON, Aug 7 (Reuters) - At least three vessels that oil major Chevron (CVX.N) , opens new tab had used to transport Venezuelan crude to the U.S. were navigating toward the South American country's waters on Thursday, with exports expected to resume later this month following a new U.S. license, according to shipping data and sources. The U.S. Treasury Department late last month authorized Chevron to operate in the sanctioned OPEC nation again, export its oil and do swaps with state company PDVSA through a restricted license banning any payments to Venezuela's government. Sign up here. Chevron Chief Executive Mike Wirth last week said a small volume of exports from the country would resume later in August. The oil producer is now in negotiations with PDVSA to receive the first cargoes and reactivate a supply agreement with U.S.-based Valero Energy (VLO.N) , opens new tab. Chevron-chartered tankers MediterraneanVoyager and Canopus Voyager were approaching the Caribbean island of Aruba, north of Venezuela's western coast on Thursday, vessel monitoring data by LSEG showed. A third ship, Sea Jaguar, was navigating from Europe with Aruba also its initial destination. Chevron and PDVSA did not immediately reply to requests for comment. Venezuela's oil exports fell to 727,000 barrels per day last month as PDVSA's joint venture partners, including Chevron and a handful of European companies, awaited U.S. authorizations to resume operations. https://www.reuters.com/business/energy/chevron-chartered-tankers-begin-returning-venezuela-after-us-license-shipping-2025-08-07/

2025-08-07 23:00

Aug 7 (Reuters) - Argentina's state-controlled energy company YPF (YPFDm.BA) , opens new tab on Thursday reported a nearly 90% plunge in second-quarter net profit to $58 million, dragged down by lower fuel prices. Revenues dropped 6% from a year earlier to $4.64 billion, as softer prices for refined products and lower seasonal demand for naphtha weighed on sales. Sign up here. YPF's performance is a critical indicator for Argentina's economy, which is relying on the Vaca Muerta formation in its push to become a net energy exporter. Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) – a key measure of profitability – came in at $1.12 billion for the April-June period, down 7% from a year earlier. Analysts polled by LSEG had on average expected an adjusted EBITDA of $1.17 billion from revenues of $4.49 billion. Benchmark Brent crude , opens new tab prices averaged $67 per barrel in the second quarter, down from $75 in the previous three months and $85 a year earlier. The weaker Brent prices, alongside reduced conventional output after YPF sold off mature fields, dragged down upstream sales by some 10%. Downstream sales, which declined 6%, were also hit by lower fuel prices, though strong diesel and agricultural demand helped to partially offset the drop. The results come as Argentina faces a major legal battle after a U.S. judge ordered the government to hand over its 51% stake in YPF to partially satisfy a $16.1 billion judgment tied to a 2012 expropriation of a stake from Spain's Repsol (REP.MC) , opens new tab. https://www.reuters.com/business/energy/argentinas-ypf-q2-profit-slumps-nearly-90-lower-fuel-prices-2025-08-07/

2025-08-07 22:59

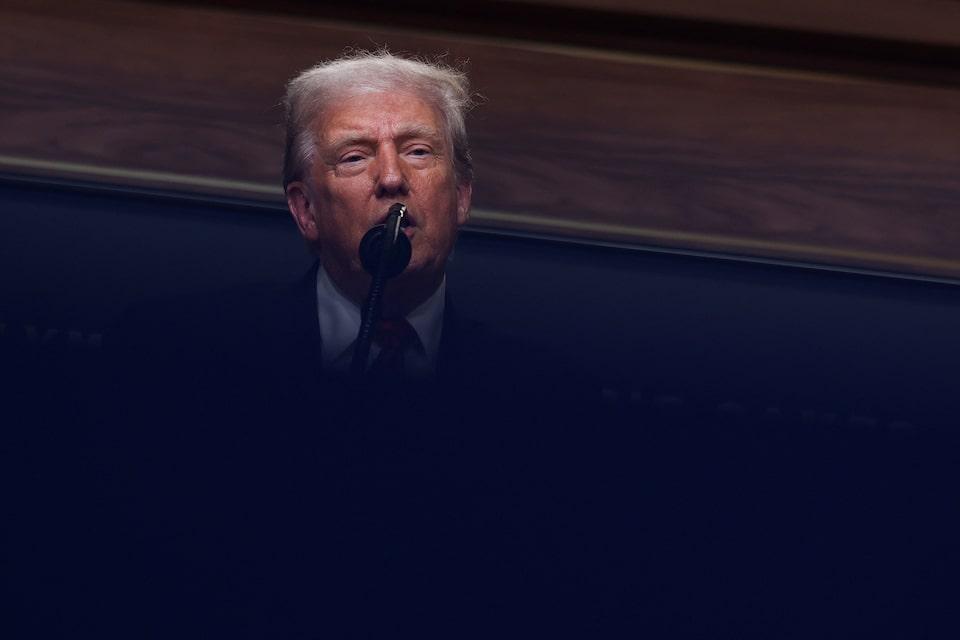

Proponents say investors will have access to new assets with higher returns Critics warn of increased risk and litigation concerns BlackRock plans new fund with private equity and credit assets WASHINGTON, Aug 7 (Reuters) - U.S. President Donald Trump signed an executive order on Thursday that aimed to allow more private equity, real estate, cryptocurrency, and other alternative assets in 401(k) retirement accounts – opening the way for alternative asset managers to tap a greater share of trillions of dollars in Americans' retirement savings. The White House said regulatory overreach and litigation risks have prevented retirees from benefiting from potentially higher returns, while critics warned the investments were inherently riskier, lacked the same disclosures and carried higher fees than traditional retirement investments. Sign up here. "My Administration will relieve the regulatory burdens and litigation risk that impede American workers’ retirement accounts from achieving the competitive returns and asset diversification necessary to secure a dignified, comfortable retirement," the order said. It directed the Labor Secretary and Securities and Exchange Commission to make it easier for investors to access alternative assets in their defined contribution retirement plans. It did not expressly ask the agencies to add more legal protections for investments, but directed them to clarify or potentially revise rules that could help shield the industry from litigation risk. Asset managers welcomed the news, saying it was a major step toward modernizing retirement savings. "Expanding access to investments long out of reach will help ensure millions of Americans build stronger, more diversified portfolios designed to increase savings and address the practical considerations of DC plan fiduciaries," Jaime Magyera, head of retirement for leading asset manager BlackRock (BK.N) , opens new tab said in a statement, referring to defined-contribution plans like 401(k)s. The move could be a boon for big alternative asset managers such as Blackstone (BX.N) , opens new tab, KKR (KKR.N) , opens new tab, and Apollo Global Management (APO.N) , opens new tab by opening the $12-trillion market for all defined-contribution plans, of which 401(k)s are the most popular, to their investments. Some of those firms have already struck partnerships with asset managers who run those plans. A Blackstone spokesman said the firm welcomed the decision. BlackRock, which lobbied the Trump administration to expand asset options, plans to launch its own retirement fund that includes private equity and private credit assets next year. Proponents have argued that younger savers can benefit from potentially higher returns on riskier investments in funds that get more conservative as they approach retirement. "On the asset manager side, it's a $12-trillion retirement market that they have previously not had access to. For them, there's certainly a lot of opportunity," said Morningstar analyst Jason Kephart. "From the individual investor standpoint, though, that's where it's less clear after all the additional fees, the additional complexity, and less transparency," Kephart added. The new investment options carry lower disclosure requirements and are generally less easy to sell quickly for cash than the publicly traded stocks and bonds that most retirement funds rely on. Investing in them also tends to carry higher fees. In defined contribution plans, employees make contributions to their own retirement account, frequently with a matching contribution from their employer. The invested funds belong to the employee, but unlike a defined benefit pension plan, there is no guaranteed regular payout upon retirement. RISKS AND REWARDS Many private equity firms are hungry for the new source of cash that retail investors could offer after three years in which high interest rates shook their time-honored model of buying companies and selling them at a profit. Whatever results may come from Trump's order, it likely will not happen overnight, private equity executives say. Plaintiffs' lawyers are already preparing for lawsuits that could be filed by investors who do not understand the complexity of the new forms of investments. BlackRock CEO Larry Fink acknowledged in a recent call with analysts that the change posed challenges for asset managers. "The reality is, though, there is a lot of litigation risk. There's a lot of issues related to the defined contribution business," Fink said. "And this is why the analytics and data are going to be so imperative way beyond just the inclusion." CFO Martin Small said the industry may seek litigation reform before it can expand into the market. The Department of Labor issued guidance during Trump's previous presidency on how such plans could invest in private equity funds within certain limits, but few took advantage, fearing litigation. Easing access to cryptocurrencies to be included in 401(k)s would be Trump's latest embrace of digital assets, and could be a potential boon for the sector, including asset managers that operate crypto exchange-traded funds, such as BlackRock and Fidelity. "Bitcoin has moved beyond its early days as a merely speculative asset and is slowly entering into many investors’ long-term investment strategy," said Gerry O'Shea, head of global market insights at Hashdex Asset Management. "This EO will help accelerate this trend." Democratic Senator Elizabeth Warren wrote in June to the CEO of annuity provider Empower Retirement, which oversees $1.8 trillion in assets for more than 19 million investors, asking how retirement savings placed in private investments could be safeguarded "given the sector's weak investor protections, its lack of transparency, expensive management fees, and unsubstantiated claims of high returns." https://www.reuters.com/business/finance/trump-signs-order-broadening-access-alternative-assets-401ks-2025-08-07/

2025-08-07 22:49

Aug 7 (Reuters) - U.S. utility Alliant Energy (LNT.O) , opens new tab reported a rise in second quarter profit on Thursday, lifted by strong electricity demand amid warmer weather. Hotter temperatures between April and June drove up use of cooling appliances such as air conditioners and refrigerators, boosting power demand for utilities like Alliant. Sign up here. The Madison, Wisconsin-based company said heating degree days — a measure of energy needs for space heating — increased across its service areas in Iowa and Wisconsin. Revenue from its electric utility business rose to $851 million in the second quarter, up from $789 million a year earlier. Revenue from the gas segment climbed 10%. Alliant supplies electricity to about 1 million customers and natural gas to 427,000 customers in the two states. Lower operating expenses also helped the company, with costs falling more than 3% to $738 million. The company said its net income attributable to shareholders rose to $174 million, or 68 cents per share, in the quarter ended June 30, from $87 million or 34 cents per share a year earlier. https://www.reuters.com/business/energy/alliant-energy-second-quarter-profit-surges-summer-heat-drives-power-use-2025-08-07/

2025-08-07 22:28

Aug 7 (Reuters) - Russian gas giant Gazprom (GAZP.MM) , opens new tab on Thursday denounced a move by Moldova's gas authority to withdraw the licence from its local subsidiary for distributing gas, saying the move damaged its affiliate and jeopardised Moldova's energy security. Moldova's gas regulator, the National Agency for Energy Regulation, this week said the licence to distribute gas had been withdrawn from Moldovagaz, 50% of whose shares belong to Gazprom, and turned over to the state-run Energocom company. Sign up here. Distribution of gas to 800,000 consumers, it said, would be taken over by Energocom from September 1. The dispute centres on what Gazprom describes as Moldova's failure to pay at least $709 million in arrears for gas supplies, mainly from state-run industries. Moldova, citing audits, says it owes no such debts, which were the focal point of a halt of gas supplies in January. The cutoff, which coincided with an end to gas transit through Ukraine, halted gas supplies for weeks to homes and industry in Transdniestria, a pro-Russian separatist region on Moldova's border with Ukraine. Gazprom, in its latest statement, said Moldova had failed to resolve the debt issue, adding the gas concern had issued proposals to find a solution to the arrears. "The Moldovan government has introduced a series of measures leading to, in the final analysis, the forced reorganisation of Moldovagaz ... a sharp rise in gas prices and, as a consequence, a decline in the country's energy security," Gazprom said. Gazprom said it would continue "to defend its lawful rights and interests with all available means." Moldova has long been in dispute with Gazprom over prices and what the Russian gas giant describes as arrears. It has actively sought to reduce reliance on Russian supplies and clinched agreements to purchase gas from suppliers in Europe. It said its decision was taken as Gazprom was demanding payment of arrears it did not recognise and was failing to implement changes demanded by the European Union on separating responsibility for transporting and supplying gas. Moldova's pro-European government is seeking EU membership by 2030. Moldovagaz Chairman Vadim Ceban said this week the issues were "political" in nature and therefore out of the company's control. https://www.reuters.com/business/energy/russias-gazprom-denounces-moldova-move-alter-gas-supply-system-2025-08-07/

2025-08-07 22:23

Miran has argued for stronger presidential control over Fed Board Trump has pressured Fed to cut rates Economic data may be shifting Fed policymakers towards rate cuts WASHINGTON, Aug 7 (Reuters) - U.S. President Donald Trump on Thursday said he will nominate Council of Economic Advisers Chairman Stephen Miran to serve out the final few months of a newly vacant seat at the Federal Reserve while the White House seeks a permanent addition to the central bank's governing board and continues its search for a new Fed chair. Miran, who has called for a complete overhaul of the Fed's governance, will take over from Fed Governor Adriana Kugler following her surprise resignation last week, as she returns to her tenured professorship at Georgetown University. Sign up here. The term expires January 31, 2026 and is subject to approval by the Senate. Trump said the White House continues to search for someone to serve in the 14-year Fed Board seat that opens February 1. Trump is also weighing options for a successor to Fed Chair Jerome Powell, whose term ends May 15, 2026. Trump has unsuccessfully pressured Fed policymakers -- who include Powell, his six fellow Board members and the 12 Fed bank presidents - to lower interest rates. Appointing Miran to the central bank, even in a placeholder role, gives the president a potentially more direct route to pursue his desire for easier monetary policy and sway over the world's most influential central bank. "Near term, an interim Fed governor Miran gives Trump the best of both worlds: immediate policy influence without surrendering Fed Chair optionality and leverage," LHMeyer analyst Derek Tang wrote. "Disruption from within is a bonus." Miran, in a paper he co-authored last year for the Manhattan Institute, laid out a case for increasing presidential control of the Fed Board, including by shortening their terms. He also wants to end the "revolving door" between the executive branch and the Fed, and nationalize the Fed's 12 regional banks. It is unclear how much time he would have at the Fed to try to deploy such far-reaching reforms, most of which would require Congressional action, or even to vote on interest rates. TOUGH QUESTIONS All Fed nominees require Senate confirmation, a process that includes a hearing before the Senate Banking Committee, a vote from that panel advancing the nomination and a series of floor votes before the full Senate, where Democrats have been slowing the pace of approval for Trump appointments. "I look forward to quickly considering his nomination in the Senate Banking Committee and hearing more about his plans to increase transparency and accountability at the Federal Reserve to ensure the agency prioritizes its mandate and avoids politics," Senate Banking Committee Chairman Tim Scott said. The panel's top-ranking Democrat Elizabeth Warren said she would have "tough questions for him during his confirmation hearing about whether he'd serve the American people as an independent voice at the Fed or merely serve Donald Trump." The Senate is not due to reconvene until September 2, at which point Congress will also be turning to the pressing challenge of funding the government past the end of the month or triggering a partial federal agency shutdown. There are just four policy-setting meetings, including one on September 16-17, before the end of what would be Miran's term. Fed policymakers kept the policy rate in its current 4.25%-4.50% range at their July meeting, with Powell citing somewhat elevated inflation and the concern that Trump's tariffs could keep it that way as reasons to keep policy restrictive. After a government jobs report released Friday showed far fewer job gains in recent months than earlier estimated, sentiment within the central bank may already be moving toward a rate cut as early as the Fed's next meeting. Several central bankers this month have raised concerns about labor market weakness, and at least a couple have expressed renewed confidence that tariffs may not push up on inflation as much as earlier thought. Those views echo the arguments made by two Fed governors -- both Trump appointees -- who last month dissented on the decision to leave policy on hold. Miran earlier on Thursday praised one of those dissenters, Fed Governor Christopher Waller, for avoiding "tariff derangement syndrome," a phrase meant to denigrate concerns about the economic effects of the Trump administration's sharply higher import levies. Waller is said to be the preferred candidate among Trump's team to succeed Powell as Fed chair. (This story has been refiled to add the dropped word 'who' in paragraph 2) https://www.reuters.com/world/us/trump-nominates-miran-temporarily-serve-fed-board-2025-08-07/