2025-08-07 19:30

Traders suggested technical error, interest rate hedge as possible causes Massive 10-year futures sale rumored to be a 'fat finger' mistake Tradeweb executive says that was not the case Incident may have contributed to poorly received 10-year US Treasury auction NEW YORK, Aug 7 (Reuters) - A spike in U.S. Treasury yields across the curve in the late morning on Wednesday caused speculation about what was behind the move, and by Thursday greater consensus emerged among market sources that it was triggered by a large trade. Some traders on Wednesday suggested it could have been a technical error, while others said it may have been due to an interest rate hedge for a corporate bond issue. One U.S. rates trader said the sudden surge in yields may have been due to a "fat finger" mistake, or a typing or input error in the futures market. U.S. Treasury yields on two-year notes to 30-year bonds jumped, caused by what could have been massive selling in the futures market, analysts said. Sign up here. However, Bhas Nalabothula, head of U.S. Institutional Rates at electronic trading platform Tradeweb, said the yield spike was the result of a large transaction. "We saw that there was a large pricing in the marketplace – it was not a fat finger incident – and we did see elevated volumes during that time period in our wholesale business," he said on Thursday. The U.S. 10-year yield jumped to 4.282% , from 4.225%, or a six-basis-point rise in five minutes, a sharp increase for such a time span. A U.S. rate strategist speculated on Wednesday that the spike could be attributed to a "rate lock" going through ahead of a corporate bond issue. Wall Street dealers typically look to lock in borrowing costs for deals that they underwrite. As part of that process, a dealer sells Treasuries or Treasury futures, typically in large size, as a hedge to lock in the borrowing cost on the bond issue before the deal is completed. Tom di Galoma, managing director of rates and trading at Mischler Financial in Park City, Utah, said on Wednesday there was market speculation that someone sold 80,000 contracts in 10-year bond futures, after intending to sell 8,000, after which the trade was speculated to be canceled. "Selling of 80,000 in 10-year futures is massive. It's like 20 times the size of a normal transaction," di Galoma said, noting that the average size of 10-year future sales is about 5,000 contracts with a maximum of around 20,000 contracts. He estimated that the sale of 80,000 contracts was equivalent to between $8 billion and $10 billion, a large sum for one transaction in the $27 trillion U.S. Treasury market. The episode happened as dealers and hedge funds began hedging for Wednesday's $42 billion 10-year Treasury note auction. The auction was poorly received and Wednesday's late morning incident in the futures market could have contributed to the weak outcome. "We did have volatility early in the day when we had that big spike due to a large selling in the futures market," said Jan Nevruzi, U.S. rates strategist at TD Securities in New York. He said that might have caused buyers to pull back at the auction. https://www.reuters.com/markets/us/large-trade-seen-behind-us-treasury-yield-spike-that-fueled-speculation-2025-08-07/

2025-08-07 19:19

Cheniere's adjusted core profit missed analysts' forecasts Cheniere signs 21-year LNG deal with Japan's JERA Tax burden falls below 10% due to Big Beautiful Bill To return to constructing large LNG plants onsite Aug 7 (Reuters) - Cheniere Energy's (LNG.N) , opens new tab second-quarter profit nearly doubled year-on-year, driven by positive changes in the valuation of certain assets, steady demand and robust margins, the U.S. liquefied natural gas (LNG) company reported on Thursday. Despite higher year-over-year profit, its adjusted core profit of $1.42 billion missed analysts' forecasts for profits of $1.56 billion, according to data compiled by financial firm LSEG. Shares were down less than 1% on Thursday afternoon. Sign up here. Cheniere also announced it signed a 21-year LNG supply deal with Japan's biggest power generator JERA for 1 million metric tons per annum (MTPA) of LNG starting in 2029 through to 2050. This is its first long-term deal with a Japanese company, Chief Commercial Officer, Anatol Feygin, said on an earnings call. The U.S. is the world's largest exporter of LNG and commercial activity in the sector has gained momentum after President Donald Trump lifted a moratorium on new LNG export permits in January. In July, the European Union pledged $750 billion worth in strategic LNG purchases from the U.S. over three years as part of a sweeping trade pact, opening up opportunities for major producers like Cheniere. While the EU has committed to buying more U.S. LNG, it is up to commercial parties to reach agreements, said Feygin, adding that in the case of Cheniere, those deals must meet its returns. TAX WINDFALL Cheniere's revenue stood at $4.52 billion in the second quarter, about 43% higher than the same period last year, while the number of LNG cargoes exported totaled 154 during the quarter, down by one cargo due to maintenance activities, the company said. Cheniere's largest plant, Sabine Pass, had two of its LNG plants - also called trains - down for three weeks in the second quarter, impacting production, CEO Jack Fusco said during the call. Cheniere could see a lift to its revenue after its effective tax rate fell below 10% through to 2030 following the passage of Trump's so-called Big Beautiful Bill, Chief Financial Officer Zach Davis said. This year alone the company expects a reduction in its tax burden of $200 million, he added. The company raised the lower-end of its current-year adjusted core profit forecast by $100 million to between $6.6 billion and $7.0 billion. The company reported net income of $1.63 billion, or $7.30 per share, for the quarter, up nearly 85% from a year ago. Cheniere has also added 1 MTPA of LNG capacity by increasing efficiencies at its plants, and plans a 24 MTPA expansion project at Corpus Christi, Fusco said. Cheniere plans to move away from smaller plants built in a factory and assembled on site, like those used in its expansion projects at Corpus Christi, and return to utilizing ConocoPhillips' (COP.N) , opens new tab technology in large, stick-built plants, those constructed onsite from the ground up, Fusco said. It is more cost effective to maintain larger LNG plants, and current demand levels support those projects, he said. The company is aiming to bring its total production capacity to over 100 MTPA, but will only do so if it has the commercial support, said Fusco. https://www.reuters.com/business/energy/chenieres-q2-profits-double-inks-first-long-term-lng-deal-supply-japan-2025-08-07/

2025-08-07 19:19

Dollar gains on report Waller favored to head Fed Sterling up as four BoE policymakers vote to keep rates unchanged Dollar faces weakness on more dovish Fed outlook Aug 7 (Reuters) - The U.S. dollar rose on Thursday after Bloomberg News reported Federal Reserve Governor Christopher Waller is emerging as a top candidate to serve as the central bank's chair among President Donald Trump's team. Waller has met with members of Trump's team, who are impressed with him, though he has not met with the president, Bloomberg reported. Sign up here. Trump has criticised current Fed Chair Jerome Powell, whose term will end in May, as being too slow to cut interest rates and some investors are concerned that his replacement will not act independently of the Trump administration. However, Waller is deeply respected in financial markets and central banking circles and his appointment would be positive for the U.S. dollar, said Karl Schamotta, chief market strategist at Corpay in Toronto. "He is understood to be someone with an easing bias, but he has the credibility that could keep long-term yields anchored and keep flows into the dollar well supported," Schamotta said. Trump said on Tuesday he had narrowed his search for a new Fed chair to four people including economic adviser Kevin Hassett, former Fed governor and Trump supporter Kevin Warsh, and two other people. Trump did not name those people, but one is thought to be Waller. Trump also said on Wednesday he would likely in the next two to three days nominate a candidate, out of a shortlist of three, to fill a coming vacancy on the Fed's Board of Governors after Adriana Kugler last week unexpectedly announced she was leaving. They would serve Kugler’s remaining months, leaving the choice of a permanent replacement for a later date. The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, was last up 0.18% on the day at 98.36. Against the Japanese yen , the dollar strengthened 0.1% to 147.49. Sterling rose after more policymakers than expected at the Bank of England voted to keep rates on hold, even as the British central bank cut rates by 25 basis points as was widely expected. Four of the BoE’s nine policymakers - worried about high inflation - sought to keep borrowing costs on hold, suggesting the BoE's run of rate cuts might be nearing an end. The decision "was a little bit more hawkish than the market expected," said Sarah Ying, head of FX strategy, FICC Strategy at CIBC Capital Markets in Toronto. The British pound was last up 0.41% at $1.341. The euro fell 0.27% to $1.1627. The euro was boosted earlier on Thursday, reaching a more than one-week high of $1.1698, as investors welcomed talks in search of a breakthrough to end the war in Ukraine. Russian President Vladimir Putin and U.S. President Donald Trump will meet in the coming days, after Trump's envoy, Steve Witkoff, held talks with Putin. The single currency is likely to continue to be supported against the U.S. dollar by a relatively more hawkish central bank. “The biggest shift in the foreign exchange markets is really the idea that there's a little bit more tariff certainty - tariff uncertainty has declined,” said Ying. "The central bank story is going to start to matter a lot more ... moving forward there's going to be enough of a rate differential that that's going to matter most to markets.” Markets are pricing in a cumulative 14 basis point decline in ECB rates by the end of 2026, with hikes expected in late 2026 and 2027, compared to expectations of 130 basis points in Fed rate cuts in the same time frame. Traders boosted bets that the Fed would cut rates in September after July’s jobs report on Friday showed fewer jobs gains than expected and sharp downward revisions to previous months. Data on Thursday showed that the number of Americans filing new applications for unemployment benefits ticked higher last week, suggesting the labor market was largely stable even though job creation is weakening and it is taking laid-off workers longer to find new jobs. Americans' longer-term inflation outlook, meanwhile, deteriorated in July even as households boosted their views on the current and future state of their respective financial situations, according to data released by the New York Fed. Risks to the job market have increased, but it remains too soon to commit to interest rate cuts before the next Fed meeting, with key data still to come and inflation still expected to rise in coming months, Atlanta Fed President Raphael Bostic said on Thursday. Against the Swiss franc , the dollar strengthened 0.16% to 0.808, after President Karin Keller-Sutter returned from Washington empty-handed after a trip aimed at averting a 39% tariff on the country’s exports to the U.S. Switzerland will continue talks with the United States, Keller-Sutter said on Thursday. In cryptocurrencies, bitcoin gained 1.06% to $116,348. https://www.reuters.com/world/middle-east/dollar-gains-report-waller-favored-fed-head-2025-08-07/

2025-08-07 18:39

European shares supported by Ukraine ceasefire expectations Sterling rises after "hawkish" BoE rate cut NEW YORK/LONDON, Aug 7 (Reuters) - European stocks closed at a one-week high on strong financial stocks and hopes of a Ukraine ceasefire, while global equities and major Wall Street indexes turned lower on Thursday. Oil price turned lower after the Kremlin said Russian President Vladimir Putin would meet with U.S. President Donald Trump. Sign up here. Prices of gold, seen as a safe haven in volatile times, extended gains to a two-week high. Wall Street was down following a report that Federal Reserve Governor Christopher Waller was Trump's top candidate to become the central bank chair, raising concerns over the Federal Reserve's independence. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab fell 0.19 point, or 0.02%, to 933.04. The Dow Jones Industrial Average (.DJI) , opens new tab fell 0.77% to 43,851.17, the S&P 500 (.SPX) , opens new tab retreated 0.47% to 6,315.33, and the Nasdaq Composite (.IXIC) , opens new tab gave up 0.30% to 21,104.91. "[There] are persistent risks to the downside. Downside surprises in official data are increasing," Capital.com analyst Kyle Rodda wrote in a note. "Valuations are also stretched, with forward price to earnings hovering around the highest in four years. And trade uncertainty persists." Higher U.S. tariffs on imports from dozens of countries kicked in on Thursday, raising the average U.S. import duty to the highest in a century. European shares logged their biggest daily rise in over two weeks on Thursday, boosted by financial stocks as investors weighed mixed corporate earnings and U.S. tariffs. The pan-European STOXX 600 index (.STOXX) , opens new tab closed at a one-week high. Europe's FTSEurofirst 300 index (.FTEU3) , opens new tab rose 0.93%. Plans for a meeting between Trump and Putin over the war in Ukraine also helped sentiment in European equities and underpinned the euro. A ceasefire "would be an extra positive," said Emmanuel Cau, Barclays head of European equity strategy. The Bank of England cut interest rates, but four of its nine policymakers, worried about inflation, voted to keep rates unchanged. The split vote suggested the BoE's run of rate cuts might be nearing an end. Sterling strengthened 0.47% to $1.3416. "The vote split is clearly a lot more hawkish than I was expecting," said Dominic Bunning, head of G10 FX strategy at Nomura. Japanese shares earlier hit a record high. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab closed up 1.03%, as Japan's Nikkei (.N225) , opens new tab gained 0.65%. Taiwan's stock benchmark (.TWII) , opens new tab jumped as much as 2.6% to a more than one-year peak. Shares in chipmaker TSMC (2330.TW) , opens new tab, which this year announced additional investment in its U.S. production facilities and so is expected to be relatively unscathed by the U.S. tariff on imported chips, soared to a record high. The U.S. dollar gained 0.12% against other currencies , with the euro down 0.21% at $1.1634. The yield on benchmark U.S. 10-year notes rose 1.4 basis points to 4.246%. In commodities, spot gold rose 0.68% to $3,391.39 an ounce. Global oil prices wiped out earlier gains, with Brent crude futures down 0.45% at $66.59 per barrel and U.S. crude 0.51% lower at $64.02. https://www.reuters.com/world/china/global-markets-wrapup-7-graphic-2025-08-07/

2025-08-07 18:34

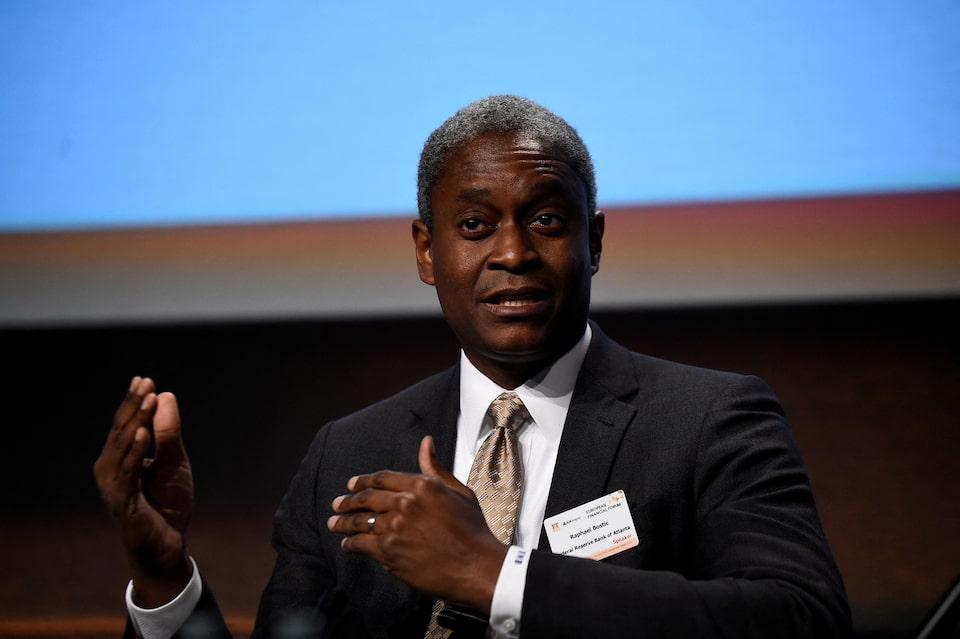

Too soon to commit to rate cut despite weak jobs data Inflation is expected to rise Can't rule out persistent tariff impact on prices WASHINGTON, Aug 7 (Reuters) - Risks to the job market have increased, but it remains too soon to commit to interest rate cuts before the next meeting of the U.S. Federal Reserve with key data still to come and inflation still expected to rise in coming months, Atlanta Fed President Raphael Bostic said on Thursday. Bostic, in comments to a Florida business group, said he still felt a single quarter percentage point rate cut was likely all that will be appropriate this year, but "we're actually going to get a lot of data around inflation, around what's happening in terms of employment, that will allow me to think about...the relative balance of risks between inflation and employment. The employment number did say that the risk on the employment side is much higher than it had been...I will definitely be looking carefully." Sign up here. The Fed next meets on September 16-17 and is widely expected to reduce the benchmark policy rate by a quarter of a point after holding it steady in the current 4.25% to 4.5% range for the last five meetings. President Donald Trump has insisted on deep and immediate rate reductions. Employment growth slowed and the unemployment rate rose in July, and new data from the Bureau of Labor Statistics showed a large downgrade to prior months' job gains, a development that led Trump to fire the head of the agency. Bostic said the size of the revisions had led him to rethink his view of the risks facing the economy, but that his concerns about inflation - and the uncertainty about coming tariff impacts - left his policy view unchanged for now. He said it may take until mid-2026 before businesses have fully responded to changes in tariffs, leaving risks to inflation unresolved. "My outlook for the economy is for it to continue to slow," Bostic said, but the issue of whether tariffs will cause only a one-time round of price hikes, or lead to more persistent price pressures, "is perhaps the most important question we have today." Some on the Fed, and most notably Governor Christopher Waller, a contender to replace current Fed Chair Jerome Powell, have said they don't see tariffs leading to steady price increases and argue that rates could begin to fall. Waller dissented at the last meeting in favor of a rate cut. Bostic said he was still concerned the tariff debate could reset public expectations in a way that boosts prices, and also noted that if tariffs do begin to reshape global supply chains away from low-cost producers like China, as the administration says it hopes, it could lead to structurally higher inflation. "Does the textbook model fit today's environment?" Bostic said, referring to economic models that show tariffs acting like a tax to change prices once, but not persistently. "I think there are reasons that are pretty compelling that suggest we should be somewhat skeptical about that." Still, he said, upcoming data will shape the near-term policy outlook. The Fed will receive new data on consumer prices next week, updates on other inflation measures later in the month, and a jobs report for August before the next policy meeting. https://www.reuters.com/business/bostic-labor-market-risks-rising-lot-data-come-before-september-meeting-2025-08-07/

2025-08-07 17:34

SAO PAULO, Aug 7 (Reuters) - Brazil's auto exports are set to grow much more than previously expected in 2025, automakers' association Anfavea said on Thursday, crediting strong demand from neighboring Argentina for the upward revision to its forecast. The higher exports should help the industry offset the weaker than previously expected local sales, as high interest rates and uncertainties linked to U.S. tariffs weigh on the Brazilian market. Sign up here. Anfavea now sees auto shipments from Latin America's largest economy jumping 38.4% year-on-year to 552,000 units, up from a previous estimate of a 7.5% increase to 428,000 vehicles. The change was "mainly driven by the Argentine market," Anfavea head Igor Calvet told reporters, as data showed that shipments to Brazil's top auto export destination more than doubled so far this year. Between January and July, according to the association, exports to Argentina increased 156.5% year-on-year to 183,905 units, lifting the nation's share of Brazil's auto exports to 58.9%, from 35.1% in 2024. Argentina and Brazil are part of South America's Mercosur trade bloc. Argentine President Javier Milei has implemented austerity measures in the country amid a crisis marked by steep inflation. Other key destinations for Brazilian auto exports include Colombia, Chile, Uruguay and Mexico, although the latter two have seen a decline in shipments in the first seven months of the year. Anfavea also revised its estimate for Brazil's auto sales in 2025. It now forecasts a 5% year-on-year increase to 2.765 million units, down from a previous forecast of 6.3% growth. It blamed the revision on high local interest rates. Brazil's benchmark rate currently stands at 15%, the highest in nearly two decades. Anfavea also cited economic uncertainties related to the trade war triggered by U.S. President Donald Trump. "There is significant uncertainty regarding what will happen to the truck market in light of the U.S. import tariffs," Calvet said. "Around 60% to 70% of Brazil's products are transported by road, and these tariffs have an indirect impact on vehicle registrations in that segment," he noted, as demand for transportation would drop if fewer products are shipped. Anfavea kept its forecast for Brazil's 2025 auto production unchanged at a 7.8% increase to 2.749 million units. https://www.reuters.com/business/autos-transportation/brazil-auto-exports-jump-driven-by-argentina-tariffs-affect-local-sales-2025-08-07/