2025-08-07 07:37

Deal should ease energy crisis in Egypt Israeli pipeline gas should be much cheaper than imported LNG Exports from Leviathan were halted during Israel-Iran war JERUSALEM/LONDON, Aug 7 (Reuters) - Israel's Leviathan natural gas field has signed the largest export agreement in the country's history, worth up to $35 billion to supply gas to Egypt, NewMed , one of the partners in the field, said on Thursday. The deal should ease an energy crisis in Egypt, which has spent billions of dollars on importing liquefied natural gas since its own supplies fell short of demand. Sign up here. Egypt's production began declining in 2022, forcing it to abandon its ambitions to become a regional supply hub. It has increasingly turned to Israel to make up the shortfall. Exports from Leviathan were halted during a 12-day war between Israel and Iran in June for security reasons, but have since resumed. Under the deal announced on Thursday, Leviathan, off Israel's Mediterranean coast, with reserves of some 600 billion cubic metres, will sell about 130 bcm of gas to Egypt through 2040, or until all of the contract quantities are fulfilled. The gas is pumped via pipelines, which makes it cheaper than LNG, the cost of which is inflated by the super-cooling required to make it a liquid that can be transported by ship and regasifying it when it reaches its destination. "It's much, much, much, much better, like dramatically better, than any LNG alternative, and it will save billions of dollars to the Egyptian economy," NewMed CEO Yossi Abu told Reuters in an interview on Thursday. Egypt's Ministry of Petroleum, which is also responsible for energy imports, did not immediately respond to a request for comment. BIGGER AND BIGGER Under Thursday's deal, Leviathan in a first stage will supply Egypt with 20 bcm of gas starting in early 2026 after the connection of additional pipelines. It will export the remaining 110 bcm in a second phase that will begin after completion of the Leviathan expansion project and the construction of a new transmission pipeline from Israel to Egypt via Nitzana in Israel, NewMed said. The initial volumes could lower Egypt's LNG imports by roughly 1-2 bcm in 2026 and reduce the strain on global LNG markets, said Rabobank energy strategist Florence Schmit. "If the full 130 bcm promised under the agreement will ever materialise, Egypt will likely not have to rely on LNG imports anymore – although those volumes are still a long way off," Schmit said. Israeli gas accounts for about 15-20% of Egypt's consumption, data from the Joint Organisations Data Initiative shows. "We'll increase the flow to Egypt practically early next year, from the 4.5 bcm to 6.5 bcm. Then once we finish in 2029 the second phase of Leviathan, we will increase that to 12 bcm a year," Abu said. Egypt has been struggling to get its gas production up. According to latest figures, production reached 3,545 million cubic meters in May, compared to 6,133 mcm in March 2021 - a decline of over 42% in less than five years - according to the Joint Organisations Data Initiative (JODI). The Leviathan reservoir began supplying Egypt shortly after production began in 2020. The field, operated by Chevron (CVX.N) , opens new tab which also holds a 40% stake, also supplies Jordan. Leviathan's expansion, which would cost around $2.4 billion, should allow for production and supplies within Israel and to its neighbours through 2064, NewMed said. https://www.reuters.com/business/energy/israels-leviathan-signs-35-billion-natural-gas-supply-deal-with-egypt-2025-08-07/

2025-08-07 07:32

SHANGHAI, Aug 7 (Reuters) - Chinese companies sold a record amount of currency options in the first half of this year as domestic businesses, particularly exporters, bet on a steady yuan and used derivatives to make some extra money. WHY IT'S IMPORTANT The trend is further evidence Chinese exporters are reluctant to convert their foreign exchange receipts back into low-yielding yuan, despite broad dollar weakness, but are seeking to hedge against potential currency risks. Sign up here. Broad dollar weakness has underpinned the yuan, but domestic economic weakness and lingering trade uncertainty with the United States have limited its upside. BY THE NUMBERS Commercial banks sold a record $132.5 billion worth of dollar/yuan options January to June on behalf of their clients, official data from the State Administration of Foreign Exchange (SAFE) showed. The yuan strengthened 1.9% against the greenback in that period even though the dollar index dropped nearly 11% as the central bank anchored the currency. One-month dollar/yuan implied volatility is around 2.5%, the lowest since July 2024. CONTEXT The central bank's tight grip over the yuan, limiting gyrations in either direction, has prompted exporters to take advantage of the low volatility to trade options to enhance returns from their dollar holdings, traders and analysts said. Some banks recommended "selling call options" to their corporate clients, two banking sources with direct knowledge of the matter said. By selling into one-year dollar/yuan call options with strike prices higher than the current spot level, corporate clients can benefit regardless of how the yuan moves, one source said. If the spot rate moves higher within 12 months, the option will be exercised, giving the exporter a higher rate. If not, they will collect a premium on the option. https://www.reuters.com/world/china/chinese-firms-sell-record-amount-currency-options-first-half-2025-2025-08-07/

2025-08-07 07:22

Trump's higher tariff rates hit goods from major US trading partners Traders see 93% chance of Fed rate cut in September Fed needs to respond to slowing US economy, says Kashkari Aug 7 (Reuters) - Gold rose on Thursday as steep tariffs imposed by U.S. President Donald Trump took effect, boosting safe-haven demand and intensifying trade frictions. Spot gold was up 0.4% at $3,383.49 per ounce as of 0645 GMT. U.S. gold futures gained 0.6% to $3,453.30. Sign up here. "Trump has been dishing up fresh tariff threats which is keeping gold in the frame as a defensive play for investors," Tim Waterer, chief market analyst at KCM Trade said. "Gold is moving towards the doorstep of the psychological $3,400, with risk-assets being kept off-balance somewhat by the constant tariff proclamations by the U.S. president." Trump's higher tariff rates of 10% to 50% on dozens of trading partners kicked in on Thursday, testing his strategy for shrinking U.S. trade deficits without massive disruptions to global supply chains, higher inflation and stiff retaliation from trading partners. Trump also said the United States will impose a tariff of about 100% on imports of semiconductors but offered up a big exemption - it will not apply to companies that are manufacturing in the U.S. or have committed to do so. Gold, traditionally considered a safe-haven asset during political and economic uncertainties, tends to thrive in a low-interest-rate environment. Adding to gold's support, the dollar index (.DXY) , opens new tab hovered near a more than one-week low after surprisingly weak U.S. jobs data last week triggered bets for a U.S. rate cut in September. Traders are now pricing in a 93% chance of a 25-basis-point rate cut next month, according to the CME Group's FedWatch Tool. The Federal Reserve may need to cut rates in the near-term in response to a slowing U.S. economy, Minneapolis Fed President Neel Kashkari said. Elsewhere, spot silver rose 0.6% to $38.07 per ounce, platinum was up 0.5% to $1,340.85 and palladium gained 2.4% to $1,158.80. https://www.reuters.com/world/china/gold-gains-trump-tariffs-take-effect-boosting-safe-haven-demand-2025-08-07/

2025-08-07 07:21

Tariff threats boost short bets on rupee Long positions on China's yuan, Taiwan's dollar trimmed Investors stay long on Singapore's dollar Aug 7 (Reuters) - Long positions on most Asian currencies dwindled over the past fortnight as market participants took a cautious view of the U.S. dollar, while sentiment towards the Indian rupee turned sharply bearish on threats of hefty U.S. tariffs, a Reuters poll showed on Thursday. Poll participants trimmed their long bets on China's yuan to the lowest in a year and on Taiwan's dollar to a 19-month low, the fortnightly survey of 12 respondents showed. Sign up here. Short bets on the Indian rupee surged to their highest since early March as U.S. President Donald Trump threatened to double tariffs on Indian goods over purchases of Russian oil. Deepali Bhargava, Asia-Pacific regional head of research at ING, expects the tariffs to have a "meaningful impact" on India's economic growth and weaken investor sentiment, though the central bank's decision to hold interest rates could help stabilise the rupee. Maybank analysts expect the USD-INR to face upward pressure following Trump's threats of additional tariffs on Indian imports, with the pair expected to breach the 88 per dollar resistance level amid signs of a deadlock in talks with the United States. Asian currencies sharply strengthened in the first half of the year owing to a weak dollar. While growing expectations of U.S. rate cuts could pressure the dollar, investors remain cautious on concerns that tariffs may weigh on regional economic growth. Respondents also turned bearish on South Korea's won for the first time since mid-April, as uncertainty over tax policy reforms and threats of U.S. tariffs on semiconductor and pharmaceuticals cloud the outlook. Bearish positions emerged in Indonesia's rupiah for the first time in nearly three months, while short bets on the Philippine peso rose to a six-month high. In contrast, investors remained bullish on the Singaporean dollar as the city-state's political stability, low taxes, and high-yield equities attract foreign capital seeking quality and refuge in uncertain times. Investors also stayed bullish on Malaysia's ringgit and Thailand's baht . Market participants consider a stronger baht counterproductive to Thailand's export-reliant and tourism-dependent economy, which is already struggling with limited fiscal space, high household debt, and political uncertainty. The currency has risen more than 6% this year, not as much as some of its peers, but it poses a challenge to Thailand's exporters, which now face more competition. Jeff Ng, head of Asia macro strategy at SMBC, predicts limited baht strength going forward and forecasts support to the currency from clarity on the political landscape, tourism, and fiscal spending. The Asian currency positioning poll is focused on what analysts and fund managers believe are the current market positions in nine Asian emerging market currencies: the Chinese yuan, South Korean won, Singapore dollar, Indonesian rupiah, Taiwan dollar, Indian rupee, Philippine peso, Malaysian ringgit and the Thai baht. The poll uses estimates of net long or short positions on a scale of minus 3 to plus 3. A score of plus 3 indicates the market is significantly long U.S. dollars. The figures include positions held through non-deliverable forwards (NDFs). The survey findings are provided below (positions in U.S. dollar versus each currency): https://www.reuters.com/world/china/long-bets-asian-currencies-fade-rupee-short-bets-5-month-high-2025-08-07/

2025-08-07 07:20

MELBOURNE, Aug 7 (Reuters) - Rio Tinto (RIO.AX) , opens new tab joined peer BHP (BHP.AX) , opens new tab on Thursday to play down Australia's prospects of building out a "green iron" sector that would help decarbonise the steel industry because the country lacks the economic incentives to do so. Australia is the world's largest supplier of seaborne iron ore and has been striving to build a role as a reliable source of green metals. In February the government allocated A$1 billion ($652.4 million) to support the manufacture of green iron and its supply chains. Sign up here. Since Australia's iron ore is mostly too low-grade to be directly processed into steel with renewable energy, it needs an additional processing step. When this is undertaken with hydrogen made from renewable energy instead of coal, the product is called hydrogen direct reduced iron (DRI) or "green iron", a low-carbon base for making green steel. "Today I don't believe there is an economic incentive for anybody to move to a hydrogen DRI," Rio Tinto's chief technical officer Mark Davies said. The technology was unproven, and there were complications moving from existing processes using natural gas to hydrogen, he told a business lunch in Melbourne. "And doing it in Australia is expensive. It's an expensive place to build stuff," he said. Major miner BHP (BHP.AX) , opens new tab said last month it was too costly for Australia to build a "green iron" industry, even after the country and China agreed to jointly work to decarbonise the steel supply chain, responsible for nearly a 10th of global emissions. A global carbon price of "a couple of hundred dollars" would be needed to create that incentive, Davies later told a press briefing. ($1 = 1.5328 Australian dollars) https://www.reuters.com/sustainability/climate-energy/rio-tinto-says-no-economic-incentive-green-steel-australia-2025-08-07/

2025-08-07 07:17

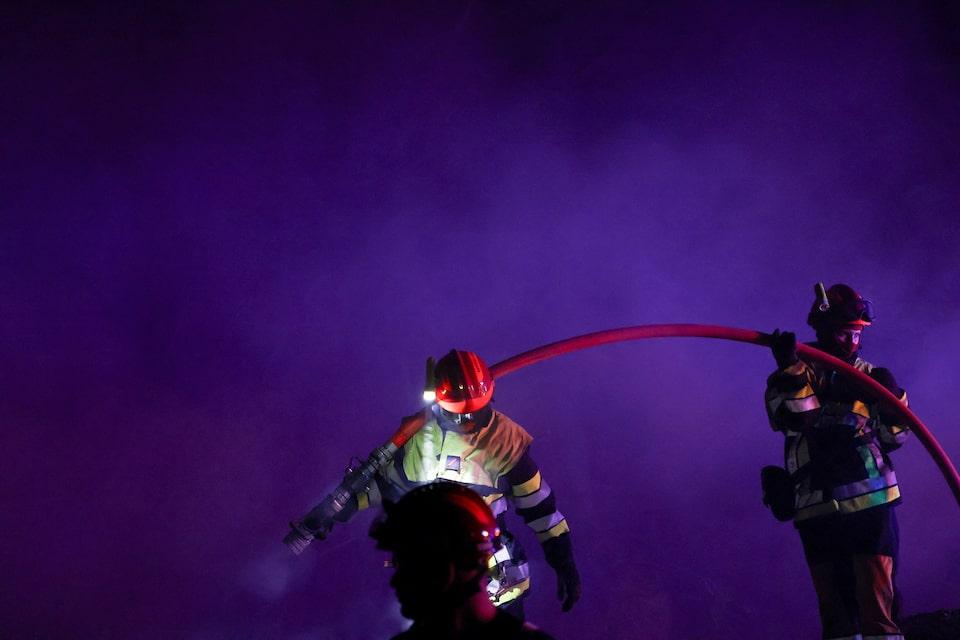

SAINT-LAURENT-DE-LA-CABRERISSE, France, Aug 7 (Reuters) - Firefighters battled for a third day on Thursday to contain France's biggest wildfire in nearly eight decades, which has burnt over 16,000 hectares, killed one person and destroyed dozens of houses. Reuters TV images showed plumes of smoke rising over the forest area in the region of Aude in southern France. Sign up here. Drone footage showed large swatches of charred vegetation. One person has died, three are missing and two people including a firefighter are in critical condition, local authorities said. "As of now, the fire has not been brought under control," Christophe Magny, one of the officials leading the firefighting operation, told BFM TV. He added that he hoped the blaze could be contained later in the day. The blaze, around 100 km from the border with Spain, not far from the Mediterranean Sea, began on Tuesday and has spread rapidly. It has already swept through an area one-and-a-half times bigger than Paris. Officials have said it is France's biggest wildfire since 1949. The fire is now advancing more slowly, Environment Minister Agnes Pannier-Runacher told France Info radio. Scientists say the Mediterranean region's hotter, drier summers put it at high risk of wildfires. France's weather office has warned of a new heatwave starting in other parts of southern France on Friday and due to last several days. https://www.reuters.com/sustainability/climate-energy/france-battles-biggest-wildfire-since-1949-2025-08-07/