2025-08-07 06:41

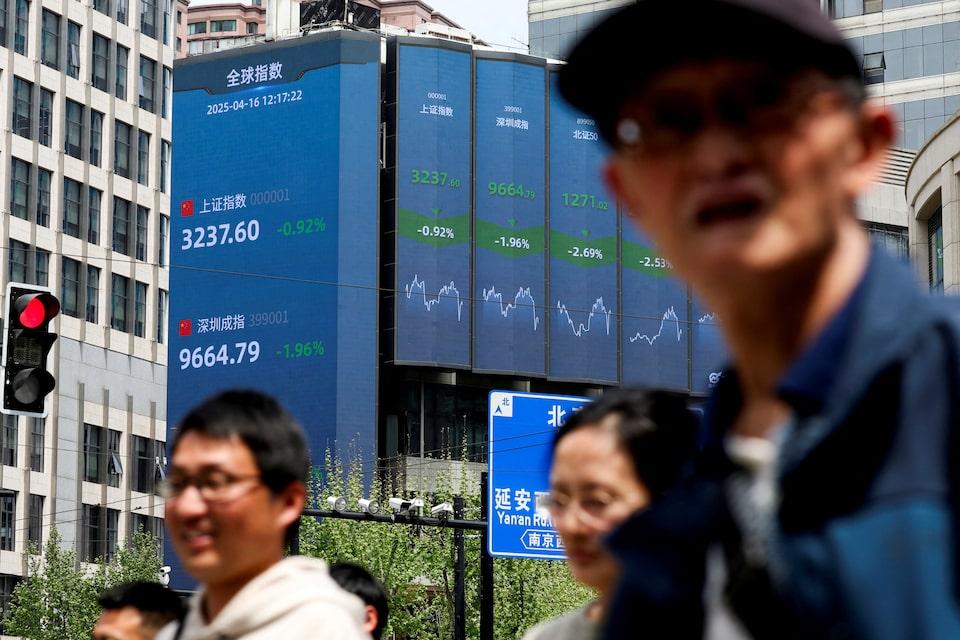

Investors doubt anti-price war campaign will be effective Industrial stocks such as steelmakers, cement producers retreat after July rally Commodity prices snap back on weak real demand SHANGHAI/SINGAPORE, Aug 7 (Reuters) - Fund manager Yang Tingwu was quick to harvest his gains after a furious July rally in Chinese steel and cement stocks, spurred by Beijing's campaign against price wars and excess industrial production. Yang, like many other investors, does not believe China's ambitious plan to pull producers out of a deflationary spiral will succeed. Sign up here. Reducing excessive capacity is hard to implement because closing factories "hits local tax revenues, employment, and GDP," said Yang, a vice general manager at Tongheng Investment. On the demand side, the property market crisis and the trade war mean "the price rebound is short-lived." Profit-takers like Yang threaten to kill a budding upturn in Chinese industrial stocks and commodities that was triggered by President Xi Jinping's call last month for regulating disorderly competition, or "involution". An index tracking Chinese steelmakers (.CSI930606) , opens new tab surged 16% in July but has softened since. Shares of cement producers (.CSI930706) , opens new tab shot up 23% last month but have pulled back. Share price rallies in coal, solar energy, and electric car sectors have also stalled. The snapback points to a lack of confidence among investors that Beijing's vow to tackle industrial overcapacity will carry much punch. The effect, if any, would also be muted by the economy's most serious consumer slowdown in years and the biggest global trade ructions in decades. Analysts draw parallels with China's supply-side reforms in 2016, which underpinned a two-year uptrend in the stock market (.SSEC) , opens new tab. But circumstances were hugely different then, with local households less indebted and more confident, a thriving property sector and no global trade tensions. Yuan Yuwei, hedge fund manager at Water Wisdom Asset Management, said the recent rally was driven merely by "animal spirits", or raw investor emotions. "This time is different," Yuan said. Alexis De Mones, a London-based portfolio manager at the Ashmore Group, said much depended on how the policy is implemented and whether it impacted overall output or helped reduce disinflationary pressures. "Is that a positive? Well, it could be positive for the stock market if it's positive for profits growth. The impact of the anti-involution policy is still very ambiguous, I think," he said. FRAGILE CONFIDENCE That lack of conviction in policy has meant prices of local commodities such as coal , glass , rebar and steel wired rod have all surrendered much of July's sharp gains. "Polysilicon prices jumped and then fell back. Coal prices jumped and then fell back. Why? Because there's a severe shortage of demand," said William Xin, chairman of Spring Mountain Pu Jiang Investment Management. "So it's just a quick trading opportunity." To be sure, some analysts are more upbeat, and look beyond just days, or weeks. They expect more concrete measures to curb price-cutting after China suffered from 33 consecutive months of factory-gate deflation. "Reflation appears to have gained importance on the policy agenda, with the aim of breaking the cycle of falling prices and weaker demand," Standard Chartered said in a note. Recent calls to rectify disorderly competition "are likely to be followed by more supply-side actions." The view was echoed by JPMorgan, whose analysts expect concerted efforts across China to restore pricing and investment returns to normality. A team of equity strategists led by Wendy Liu said in a report that loss-making sectors such as lithium and solar will "see more fixes" and "may see a broad-based rally." In other sectors such as coal and battery, leading players may gain market share due to industry consolidation, they said. "We see anti-involution as an 18-month trade." https://www.reuters.com/business/autos-transportation/sceptical-investors-call-time-chinas-anti-price-war-rally-2025-08-07/

2025-08-07 06:25

Oil prices rise on steady U.S. demand US crude inventories fall by 3 million barrels, exceed estimates Investors cautious amid more U.S. tariffs on India Aug 7 (Reuters) - Oil prices rose on Thursday, recovering from a five-day losing streak, on signs of steady demand in the United States, the world's largest oil consumer, although concerns over the economic impact of U.S. tariffs capped gains. Brent crude futures was up 41 cents, or 0.6%, at $67.3 a barrel, as of 0607 GMT. Sign up here. U.S. West Texas Intermediate crude climbed 0.6% to $64.76, gaining 41 cents. Both benchmarks slid about 1% on Wednesday to their lowest levels in eight weeks following U.S. President Donald Trump's remarks on progress in talks with Moscow. Trump could meet Russian President Vladimir Putin as soon as next week, a White House official said, though the U.S. continued preparations to impose secondary sanctions, including potentially on China, to pressure Moscow to end the war in Ukraine. Russia is the world's second-biggest producer of crude after the United States. Still, oil markets found support from a bigger-than-expected draw in U.S. crude inventories last week. The Energy Information Administration said on Wednesday that U.S. crude oil stockpiles fell by 3 million barrels to 423.7 million barrels in the week ended August 1, exceeding analysts' expectations in a Reuters poll for a 591,000-barrel draw. Inventories fell as U.S. crude exports climbed and refinery runs climbed, with utilization on the Gulf Coast, the country's biggest refining region, and the West Coast climbing to their highest since 2023. Analysts at JP Morgan said in a note that global oil demand through August 5 has averaged 104.7 million barrels per day, tracking annual growth of 300,000 bpd, but 90,000 bpd below their forecast for the month. "Despite a slightly soft start to the month, relative to our expectations, high frequency indicators of oil demand suggest global oil consumption is likely to improve sequentially over the coming weeks," the analysts said, with jet fuel and petrochemical feedstocks anticipated to drive the consumption growth. Meanwhile, China's crude oil imports in July dipped 5.4% from June but were still up 11.5% year-on-year, with analysts expecting refining activity to remain firm in the near term. Still, global macroeconomic uncertainty after the U.S. ordered a fresh set of tariffs on Indian goods capped price gains. Trump on Wednesday imposed an additional 25% tariff on Indian goods, citing their continued imports of Russian oil. The new import tax will go into effect 21 days after August 7. "While these new duties (on India by the U.S.) are set to take effect in three weeks, markets are already pricing in the downstream ripple effects on trade flows, emerging market demand, and broader energy diplomacy," said Phillip Nova's senior market analyst Priyanka Sachdeva. Trump also said he could announce further tariffs on China similar to the 25% duties announced earlier on India over its purchases of Russian oil. "Tariffs are likely to harm the global economy, which will ultimately affect fuel demand," said Phillip Nova's Sachdeva, adding that markets are overlooking the fact that its impact will still be much greater on the U.S. economy and inflation. https://www.reuters.com/business/energy/oil-rises-us-demand-strength-though-macroeconomic-uncertainty-looms-2025-08-07/

2025-08-07 06:25

LONDON, Aug 7 (Reuters) - British house prices rose by the most in six months in July when they increased by a slightly faster than expected 0.4% from June, according to figures from mortgage lender Halifax that add to signs of a stabilisation in the housing market. Economists polled by Reuters had expected prices to rise by 0.3% in month-on-month terms after a 0.1% gain in June. Sign up here. Halifax said on Thursday house prices were 2.4% higher compared with July last year, slowing from June's 2.7% increase. Britain's housing market has settled after a rush to beat the expiry in April of a tax break for some home buyers which depressed sales immediately after the deadline. "Challenges remain for those looking to move up or onto the property ladder. But with mortgage rates continuing to ease and wages still rising, the picture on affordability is gradually improving," Amanda Bryden, Halifax's head of mortgages, said. "We expect house prices to follow a steady path of modest gains through the rest of the year," she said. The Bank of England is widely expected to cut its main interest rate to 4% from 4.25% later on Thursday but the outlook for further reductions in borrowing costs is unclear due to persistent inflation pressures, even as the jobs market cools. Rival lender Nationwide said last week its measure of house prices rose by 0.6% in July compared with June. https://www.reuters.com/business/finance/uk-house-prices-rise-by-most-six-months-july-halifax-says-2025-08-07/

2025-08-07 06:23

Aug 7 (Reuters) - The Australian government said on Thursday it will invest A$50 million ($32.5 million) in Liontown Resources to help ramp up operations and transition to underground mining at its flagship Kathleen Valley project, in a bid to boost domestic minerals supply. The investment, which will be undertaken through the A$15 billion National Reconstruction Fund Corporation, underscores Prime Minister Anthony Albanese's efforts to back critical mineral projects and boost domestic manufacturing. Sign up here. "Lithium is a critical mineral that is central to both decarbonisation efforts and the government's Future Made in Australia strategy," NRFC CEO David Gall said , opens new tab. "Australia is well-positioned to be a competitive, long-term supplier of lithium to the rest of the world and local lithium production is important to the nation's economic security and resilience." In January, NRFC invested A$200 million , opens new tab in Arafura Rare Earths (ARU.AX) , opens new tab to develop a new mine and processing facility at its Nolans project in central Australia. Kathleen Valley has a multi-decade mine life and will produce 500,000 tonnes of spodumene concentrate per annum with potential for expansion, according to NRFC. Liontown (LTR.AX) , opens new tab is a key lithium supplier to Tesla (TSLA.O) , opens new tab, Ford (F.N) , opens new tab and LG Energy Solution (373220.KS) , opens new tab. The government's investment is part of Liontown's A$266 million institutional capital raise, priced at A$0.73 per share. Its shares were last trading at A$0.845 before being halted on Thursday pending the announcement. The miner will use also the capital to shore up its balance sheet. Australian billionaire Gina Rinehart's Hancock Prospecting is Liontown's top shareholder, with an 18% stake, as per LSEG data. Media reports , opens new tab indicate Hancock will not take part in the placement, which would dilute its stake. Hancock declined to comment, while Liontown did not respond to a Reuters email seeking comment. ($1 = 1.5378 Australian dollars) https://www.reuters.com/markets/commodities/australia-invest-33-million-boost-liontowns-kathleen-lithium-operations-2025-08-07/

2025-08-07 06:14

July exports +7.2% y/y vs +5.4% in Reuters poll Imports +4.1% y/y vs forecast -1.0% in poll China faces August 12 deadline to reach trade deal with U.S. BEIJING, Aug 7 (Reuters) - China's exports beat forecasts in July, as manufacturers made the most of a fragile tariff truce between Beijing and Washington to ship goods, especially to Southeast Asia, ahead of tougher U.S. duties targeting transshipment. Global traders and investors are waiting to see whether the world's two largest economies can agree on a durable trade deal by August 12 or if global supply chains will again be upended by the return of import levies exceeding 100%. Sign up here. U.S. President Donald Trump is pursuing further tariffs, including a 40% duty on goods rerouted to the U.S. via transit hubs that took effect on Thursday, as well as a 100% levy on chips and pharmaceutical products, and an additional 25% tax on goods from countries that buy Russian oil. China's exports rose 7.2% year-on-year in July, customs data showed on Thursday, beating a forecast 5.4% increase in a Reuters poll and accelerating from June's 5.8% growth. Imports grew 4.1%, defying economists' expectations for a 1.0% fall and climbing from a 1.1% rise in June. China's trade war truce with the U.S. - the world's top consumer market - ends next week, although Trump hinted further tariffs may come Beijing's way due to its continuing purchases of Russian hydrocarbons. "The trade data suggests that the Southeast Asian markets play an ever more important role in U.S.-China trade," said Xu Tianchen, senior economist at the Economist Intelligence Unit. "I have no doubt Trump's transshipment tariffs are aimed at China, since it was already an issue during Trump 1.0. China is the only country for which transshipment makes sense, because it still enjoys a production cost advantage and is still subject to materially higher U.S. tariffs than other countries," he added. China's exports to the U.S. fell 21.67% last month from a year earlier, the data showed, while shipments to ASEAN rose 16.59% over the same period. The levies are bad news for many U.S. trading partners, including the emerging markets in China's periphery that have been buying raw materials and components from the regional giant and furnishing them into finished products as they seek to move up the value chain. China's July trade surplus narrowed to $98.24 billion from $114.77 billion in June. Separate U.S. data on Tuesday showed the trade deficit with China shrank to its lowest in more than 21 years in June. Despite the tariffs, markets showed optimism for a breakthrough between the two superpowers, with China (.CSI300) , opens new tab and Hong Kong (.HSI) , opens new tab stocks rising in morning trade. Trump indicated earlier this week that he might meet Chinese President Xi Jinping later this year if a trade deal was reached. TRADE UNCERTAINTY China's commodities imports painted a mixed picture, with soybean purchases hitting record highs in July, driven by bulk buying from Brazil while avoiding U.S. cargoes. Analysts, however, cautioned that inventory building may have skewed the imports figure, masking weaker underlying domestic demand. "While import growth surprised on the upside in July, this may reflect inventory building for certain commodities," said Zichun Huang, China economist at Capital Economics, pointing to similarly strong purchases of crude oil and copper. "There was less improvement in imports of other products and shipments of iron ore continued to cool, likely reflecting the ongoing loss of momentum in the construction sector," she added. A protracted slowdown in China's property sector continues to weigh on construction and broader domestic demand, as real estate remains a key store of household wealth. Chinese government advisers are stepping up calls to make the household sector's contribution to broader economic growth a top priority at Beijing's upcoming five-year policy plan, as trade tensions and deflation threaten the outlook. Reaching an agreement with the United States — and with the European Union, which has accused China of producing and selling goods too cheaply — would give Chinese officials more room to advance their reform agenda. However, analysts expect little relief from Western trade pressures. Export growth is projected to slow sharply in the second half of the year, hurt by persistently high tariffs, President Trump's renewed crackdown on the rerouting of Chinese shipments and deteriorating relations with the EU. https://www.reuters.com/world/china/chinas-exports-top-forecasts-shippers-rush-meet-tariff-deadline-2025-08-07/

2025-08-07 06:12

LITTLETON, Colorado, Aug 7 (Reuters) - The fresh 25% tariffs slapped on Indian goods by U.S. President Donald Trump this week are being viewed by many as a negotiating tactic designed to force India to buy more U.S. energy products and other goods going forward. But even though India's fast-growing economy is the fifth largest globally, India's energy importers may have far less room to maneuver than they might appear. Sign up here. Tight corporate operating margins, cost-sensitive consumer markets, binding long-term import contracts and slowing economic growth all limit India's ability to spend big on U.S. oil, LNG, coal and refined products over the near term. At the same time, India's location at the base of Asia means it is far closer to other major energy product exporters than it is to the United States, which would trigger sharply higher shipping costs if it were to switch to U.S.-origin products. No doubt some Indian corporations will be cajoled into pledging major U.S. purchases and investments during upcoming trade negotiations, which may boost sentiment in Washington, D.C. But U.S. exporters of oil, gas, coal and fuels that are hoping for massive, viable and binding purchase commitments by Indian buyers are likely to be left disappointed. TOUGH SPOT It's not just its import needs that India has to worry about. The United States is by far India's largest export market, and has accounted for nearly 20% of all Indian exports in recent years, according to International Monetary Fund (IMF) data. In 2024, the value of India's exports to the United States was just over $80 billion, while its imports from the U.S. totalled just under $45 billion. As the U.S. is more than twice as large as India's next largest export market - the United Arab Emirates - it will be nearly impossible for the country to replace lost U.S. consumers with other buyers. That means that trade negotiators will remain committed to healing trade ties with Washington as quickly as possible, and will be looking at every possible means of reducing the trade imbalance. CUT-PRICE CRUDE The rapid rise in India's purchases of Russian crude oil since mid-2022 has been a sore point for the U.S. and Europe, and has been a focal point during the recent trade talks. Average monthly crude oil flows from Russia to India jumped from around 3.2 million barrels a month between 2018 and 2021 to 50 million barrels a month since mid-2022, data from Kpler shows. That more than 15-fold surge in Russian oil purchases by India provided Moscow with critical import earnings while it grappled with the fallout from its war in Ukraine, and seriously undermined international efforts to cut funding to Moscow. However, while India's refusal to join Western-led sanctions drew ire from the international community, its willingness to step up imports of Russian oil ensured that its refiners and fuel consumers were shielded from any rise in global oil prices. Indeed, the opposite has occurred as Indian importers were able to extract steep discounts from Russian oil sellers who were desperate to secure sales wherever they could. Those cheap imported Russian barrels in turn allowed major Indian refiners such as Reliance (RELI.NS) , opens new tab to expand supplies and fuel the country's economic growth since 2020. Indian authorities have stated that providing energy security for its 1.4 billion population has been the main driver of its oil import programme, and that the new tariffs are unfair given that the country is only acting in its own self-interest. What's more, any aggressive pivot away from cheap Russian oil to pricier U.S. crude would drastically change the economic outlook for Indian oil refiners and consumers, and likely result in a surge in fuel prices that would cause economic harm. Since 2022, the official prices of the main grade of Russian oil imported by India have averaged around $70 a barrel, which is around $10 cheaper than the price of the main U.S. crude for export over that same period, data from LSEG shows. As Indian importers likely secured their Russian oil supplies at even lower prices, the real discount compared to U.S. prices is likely larger. That in turn means that there is almost no prospect of Indian refiners being able to profitably switch to U.S. crude any time soon, even if pressured to do so. LNG & COAL LONGSHOTS U.S. trade negotiators have touted U.S. liquefied natural gas (LNG) as a means of reducing trade gaps, as a single LNG cargo can cost several million dollars. However, Indian energy product importers have arguably even less scope to switch out current suppliers for the U.S. here. The primary limiting factor is that Indian gas importers are already locked into long-term purchase deals with suppliers such as Qatar and the United Arab Emirates, and face stiff penalties for breaking contracts. And even if Indian buyers were prepared to tear up those deals in favor of buying from the U.S. instead, they would face a surge in shipping costs that could make overall cargo costs uneconomical. The journey time for an LNG tanker from the U.S. to India is around 30 days, which is six times longer than the trip from Qatar. U.S. coal exporters will likely face similar difficulties in dislodging Indonesia from India's coal import pipeline. The Indonesia to India shipping time is around 11 days, compared to around 27 days for the trip from the U.S. East coast. Such a yawning gap in journey times and shipping costs means that India's trade negotiators may not be able to rely on its energy consumers to close the trade gap, and will need to look elsewhere to secure a trade deal with the U.S. The opinions expressed here are those of the author, a columnist for Reuters. Enjoying this column? Check out Reuters Open Interest (ROI), your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI can help you keep up. Follow ROI on LinkedIn , opens new tab and X , opens new tab. https://www.reuters.com/business/energy/us-energy-exporters-face-likely-letdown-any-us-india-trade-deal-2025-08-07/