2025-08-05 20:41

Aug 5 (Reuters) - The Trump administration is considering whether to terminate a $7 billion grant program designed to help power low and moderate-income households with solar energy, two sources briefed on the matter said. The Environmental Protection Agency could as soon as this week terminate the grants, which were awarded in 2024 during the administration of former President Joe Biden, to 60 nonprofit groups, tribes and states, said the sources. One of sources said they were briefed by a person inside the EPA and both of them spoke on condition of anonymity. Sign up here. EPA's deliberations were first reported by the New York Times. EPA said it had not made a final decision on the program. "With the passage of the One Big Beautiful Bill, EPA is working to ensure Congressional intent is fully implemented in accordance with the law," an EPA spokesperson said. The EPA's "Solar for All" program was funded by Biden's 2022 climate change law, the Inflation Reduction Act. Most of the grantees are state energy agencies that are developing programs to deploy rooftop and community solar arrays. President Donald Trump's administration has sought to roll back federal support for solar and wind energy, calling them expensive and unreliable. Three Solar for All grantees contacted by Reuters said they had not received official word from EPA about the status of their grants. "This program remains fully aligned with congressional intent and delivers critical benefits to the rural and frontline communities we serve," Hilary Shohoney, chief of staff at the non-profit Bonneville Environmental Foundation, which received $130 million in Solar for All grants for solar projects in Montana, Idaho and Wyoming. "Solar for All also aligns with the President’s commitment to 'unleash American energy' by boosting local generation, strengthening energy independence, and creating family-wage jobs in rural communities." https://www.reuters.com/business/energy/us-epa-could-cancel-7-billion-grants-solar-energy-sources-say-2025-08-05/

2025-08-05 19:23

Pemex aims for financial self-sufficiency by 2027 Government-backed vehicle to raise $13 billion for Pemex projects in 2025 Mixed contracts to boost production by 450,000 bpd Pemex plans to reduce crude oil exports by 2035 Pemex's debt at $99 billion, aims to reduce to $77.3 billion by 2030 MEXICO CITY, Aug 5 (Reuters) - Mexico's government on Tuesday said it aimed to cease funding Pemex by 2027 when the highly-indebted state energy company should become financially self-sufficient, helped by a series of measures to bring down debt and stabilize production. Mexican President Claudia Sheinbaum, flanked by her energy and finance ministers and the chief executive of Pemex, told a press conference that by 2027, Pemex "will no longer need the finance ministry's support." Sign up here. Pemex reported last week a financial debt of around $99 billion and a debt to providers of around $23 billion, which is down from earlier years but still has investors worried. In recent years, Pemex has received what the government has often called unprecedented support, mostly in the form of capital injections, refinancing of debt, tax reductions and credit lines. Later in the day, the government presented a ten-year plan in which it laid out steps on how to achieve its goals to make Pemex financially self-sufficient. In it, the government said that 21 so-called mixed contracts could help lift declining production by as much as 450,000 barrels per day (bpd). At the same time, it would refine more at home and therefore reduce crude oil exports to 393,100 bpd in 2035, from 487,900 bpd in 2026. The target for local crude oil processing, including at the new Olmeca refinery in the port of Dos Bocas, is 1.3 million barrels per day. This would help wean the country off gasoline and diesel imports. Officials reiterated the government's ambition to pay down debt - both maturing bond debt and what the company owes to providers. To achieve all this, a new government-backed investment vehicle will seek to raise up to 250 billion Mexican pesos ($13 billion) for Pemex projects in 2025 alone. It follows a $12 billion debt offering to ease Pemex's short-term financial pressures and support debt refinancing, announced last week. This year, $5.1 billion of bond debt is due for repayment, followed by $18.7 billion for next year, and $7.7 billion for the year after. Finance Minister Edgar Amador said that through a capitalization and financing strategy currently underway, Pemex's financial debt should close this year at $88.8 billion and at $77.3 billion by 2030. Pemex Chief Executive Victor Rodriguez also outlined several additional initiatives, including for the development of the Zama and Trion fields and returning to other fields with potential to lift production. In addition, Pemex intends to build three new pipelines. ($1 = 18.8228 Mexican pesos) https://www.reuters.com/world/americas/mexico-reveals-sweeping-plan-bring-down-pemex-debt-boost-investment-lift-2025-08-05/

2025-08-05 18:28

CFTC takes step toward exchange trading of spot digital assets Move is part of broader Trump administration pro-crypto policies Expectations for mainstream adoption of crypto assets grow Aug 5 (Reuters) - The U.S. Commodity Futures Trading Commission (CFTC) said on Monday it would launch an initiative to allow for trading of spot crypto asset contracts listed on a futures exchange registered with the agency. While not final, the move is another by the Trump administration to integrate digital assets more deeply into traditional finance, and could pave the way for wider adoption of crypto assets. Sign up here. The CFTC, which regulates U.S. derivatives markets, will enable immediate trading of digital assets at the federal level in coordination with the Securities and Exchange Commission's Project Crypto initiative, CFTC Acting Chair Caroline Pham said. The CFTC invited , opens new tab stakeholders to comment on how to list the spot crypto asset contracts in a designated market. This brings crypto one step closer to the structure and standards of traditional markets, said Saad Ahmed, head of Asia Pacific at Gemini, noting that it could drive broader use by institutions and sophisticated market participants globally. The digital assets industry has made advances this year under U.S. President Donald Trump, with bills like the GENIUS Act and CLARITY Act designed to provide new, tailored rules it has long pushed for. The CFTC's latest move is another sign to crypto participants that regulators are intent on making infrastructure changes. Shortly after taking office in January, Trump ordered the creation of a crypto working group tasked with proposing new regulations, making good on his campaign promise to overhaul U.S. crypto policy. Last week, the Trump administration's working group released a landmark report in which the White House called on the U.S. securities regulator to create new rules specific to digital assets. The report also encouraged the CFTC to use its existing authority to "immediately enable the trading of digital assets at the federal level." Trump courted cash from the crypto sector on the campaign trail, calling himself the "crypto president." Industry executives spent hundreds of millions of dollars supporting Trump and other Republican congressional candidates in last year's elections. SEC Chair Paul Atkins last week outlined several pro-crypto initiatives, including directing staff to develop guidelines to determine when a crypto token qualifies as a security, and proposals for various disclosures and exemptions. The two regulators' approach marks a significant victory for the crypto industry, which has long advocated for tailored regulations. It also may be seen as a win by exchanges. So far, crypto trading platforms have been major players in spot trading, taking advantage of the regulatory gray area. "The hope continues to be that a broader range of assets beyond bitcoin and ethereum entrench themselves on U.S. venues over the next 24 months, and moves like this ultimately help along that process," said Joseph Edwards, head of research at Enigma Securities. One key to the success of Trump's crypto initiatives will be the ability of the CFTC and SEC to resolve long-standing questions such as whether digital assets are commodities or securities, industry sources said. Neither the CFTC nor the SEC immediately responded to requests seeking further comment. Trump's embrace of digital assets is in stark contrast to former U.S. President Joe Biden's regulators, who cracked down on the industry to prevent fraud and money laundering. The Biden administration sued exchanges Coinbase (COIN.O) , opens new tab, Binance and dozens more, alleging they were flouting U.S. laws. Trump's SEC has dropped those cases. https://www.reuters.com/legal/government/cftc-seeks-allow-spot-crypto-trading-registered-exchanges-2025-08-04/

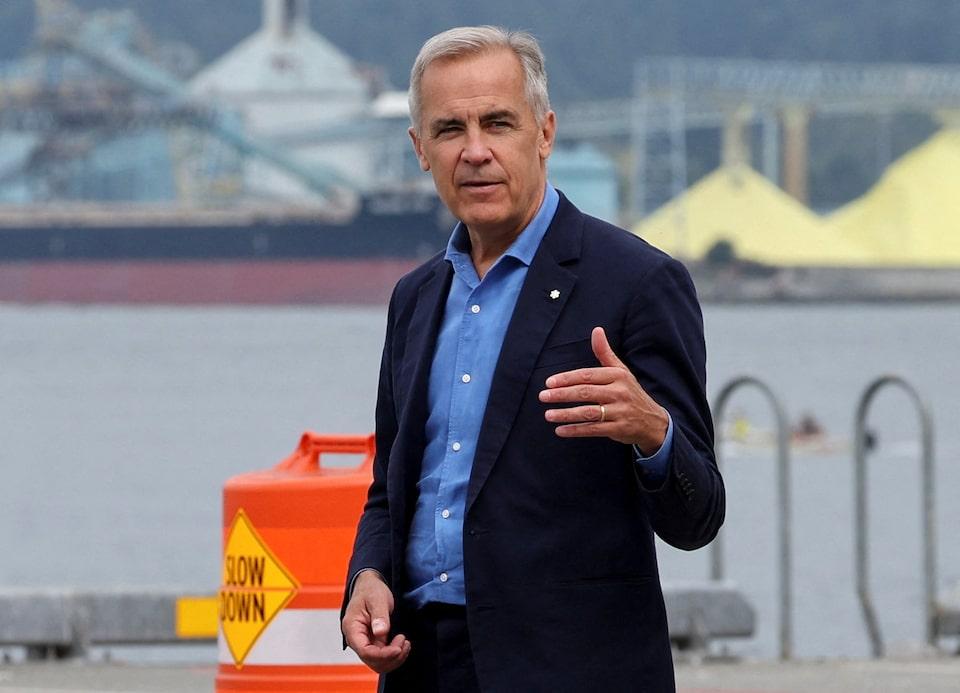

2025-08-05 18:09

OTTAWA, Aug 5 (Reuters) - Canada will provide up to C$1.2 billion to help softwood lumber producers deal with U.S. countervailing and anti-dumping duties, Prime Minister Mark Carney said on Tuesday. Carney, speaking to reporters in the Pacific province of British Columbia, said Ottawa would make up to C$700 million available in loan guarantees and also provide C$500 million to help speed product development and market diversification. Sign up here. (Reuters Ottawa editorial; [email protected] , opens new tab)) Keywords: USA TARIFFS/TRUMP CANADA https://www.reuters.com/business/canada-help-lumber-industry-cope-with-us-tariffs-says-carney-2025-08-05/

2025-08-05 16:27

LONDON, Aug 5 (Reuters) - Institutional Shareholder Services has recommended that shareholders in Third Point Investors Limited (TPOGu.L) , opens new tab vote against a deal to acquire Malibu Life Reinsurance SPC, a report from the proxy adviser said on Tuesday. The proposed deal would "fundamentally change" the fund's investment case without offering minority shareholders an exit option at a fair price for their entire holdings, the report said. Sign up here. Third Point had no immediate comment on the recommendation. Third Point Investors Limited, which listed on the London Stock Exchange in 2007, said last month that it will acquire Malibu Life Reinsurance SPC, a life annuity reinsurer which billionaire Daniel Loeb launched last year. Shareholders have to vote on the deal on August 14. Loeb has proposed transforming his Third Point Investors Limited to address a valuation discount it has to his New York-based hedge fund Third Point. Third Point Investors (TPIL) would also move from being based in Guernsey to the Cayman Islands, change its name to Malibu Life Holdings Ltd, according to the ISS report. These changes would constitute a "reverse takeover" under UK Listing Rules, ISS said. Like other UK-listed investment companies, TPIL is known as a feeder fund and was originally designed to give retail shareholders a taste of hedge funds that had long been off limits to all but the wealthiest financiers. A dissenting shareholder group said the acquisition should be put to an independent vote. "Without Third Point and Dan Loeb's affiliated shares and votes, it is the Group's considered view that the transaction would not pass," the dissenting shareholder group said in a statement. It includes UK investment firm Asset Value Investors Limited, Metage Capital and Evelyn Partners Investment Management, as well as Australian investment firm Staude Capital and California-based Almitas Capital. The dissenting shareholder group said on Friday that it had contacted a further 10% of shareholders that it said oppose the deal. Reuters was not able to verify the identity of these shareholders or their intention to vote. TPIL said last month that it had irrevocable undertakings from shareholders holding 45% of the company’s voting rights to back the deal, including Third Point Management, with 25%. https://www.reuters.com/sustainability/boards-policy-regulation/proxy-adviser-tells-third-point-investors-ltd-shareholders-vote-against-malibu-2025-08-05/

2025-08-05 15:29

Aug 5 (Reuters) - Wells Fargo Investment Institute on Tuesday downgraded U.S. small-cap equities to "unfavorable" from "neutral", pointing to its heavy tariff exposure, elevated interest rates and weak earnings record. The broader U.S. equity market has rebounded on easing trading tensions and strong corporate earnings since hitting its lows in April following Trump's "Liberation Day" tariffs. Sign up here. However, the small-cap Russell 2000 index (.RUT) , opens new tab has not had the same pace of recovery, having fallen 0.9% this year, including session movements, whereas the large-cap S&P 500 index (.SPX) , opens new tab has gained 7%. "Interest rates above their levels during past economic cycles should leave this group vulnerable", said strategists at Wells Fargo, adding that small caps are more exposed to tariff frictions as they have less flexible supply chains and thinner margins than their larger competitors. Among the 545 companies in the index that have reported quarterly earnings so far, about 25% have missed analysts' expectations, compared to about 15% in the large-cap segment, as per LSEG I/B/E/S estimates. "A poor earnings track record and an elevated portion of index components with no profits have continued to plague...the Russell 2000 index," Wells Fargo added. The investment institute, a subsidiary of Wells Fargo bank (WFC.N) , opens new tab, also downgraded its stance on the U.S. energy and communication services sector and the broader commodities asset class to "neutral" from "favorable". While Wells Fargo foresees a turbulent second half of 2025 amid tariff-related headwinds, it remains optimistic about the economy's trajectory, expecting momentum to strengthen in 2026, with trade uncertainties unlikely to pose a major threat. https://www.reuters.com/business/wells-fargo-downgrades-us-small-cap-equities-unfavourable-2025-08-05/