2025-08-05 07:02

Q2 growth at 5.12% y/y, vs poll's 4.80% Investment growth at highest since Q2 2021 Household consumption supported by holiday spending JAKARTA, Aug 5 (Reuters) - Indonesia's second quarter growth was better than expected, driven by robust investment and household spending, and showed the fastest pace since the second quarter of 2023, but economists said more support may be needed to protect growth in the second half. Gross domestic product accelerated to 5.12% from 4.87% in the previous quarter, data from the statistics bureau showed on Tuesday, and beat growth of 4.80% forecast in a Reuters poll. Sign up here. "GDP growth registered an upside surprise in the second quarter compared to our expectations, with the gap likely explained by a supportive net exports balance on account of frontloading," said DBS Bank economist Radhika Rao. The growth pace defied concerns over weakening economic indicators, including falling car sales, softening consumer confidence and contracting purchasing managers' index, which had pointed to slowing activity. Ahead of Tuesday's data, Bank Indonesia, which has cut policy rates four times since September, forecasts economic growth would be in a range of 4.6% to 5.4% this year. Household spending, which makes up over half of Indonesia's GDP, accelerated slightly to 4.97% year on year in the second quarter, compared to 4.95% in the previous quarter, supported by higher spending for food and travel during a number of religious holidays and a school break. Investment growth surged to a four-year high of 6.99% in the second quarter, from 2.12% previously, helped by infrastructure projects including the expansion of the Jakarta mass rapid transit, Statistics Indonesia Deputy Chief Moh. Edy Mahmud, said. Government spending contracted by an annual 0.33%. Meanwhile, exports were boosted by shipments of vegetable oil, metals, electronics and auto parts. Frontloading of export orders as buyers sought to get ahead of U.S. tariffs has seen the value of exports rise in the first half of the year. Brian Lee, an economist at Maybank, warned the trade surplus could narrow further as export growth cools while slower global trade weighs on demand for Indonesia's key commodities. "We expect a further 50 bps of rate cuts before year-end while the government has laid out plans to introduce a third package of stimulus towards year-end, albeit scaled down in size," Lee said. Rao of DBS also expects slower export momentum. "We continue to expect moderation to set in (in) the second half, partly on account of payback in trade," she said. On a non-seasonally adjusted, quarter-on-quarter basis, gross domestic product expanded 4.04% in April-June, Statistics Indonesia said. Indonesia's government will continue its fiscal support to boost growth in the second half by extending a tax break on purchases of homes of certain values until December, and airfares discounts to increase year-end holiday spending, Senior Economic Minister Airlangga Hartarto said in a press conference. Jakarta also preparing other stimulus for labour intensive industry by giving investment credits to revitalise machinery and cheap loans for certain home developers. Airlangga did not provide the size of the stimulus for the second half, but Jakarta launched 24.4 trillion rupiah ($1.49 billion) worth of incentives in the first half. ($1 = 16,375.0000 rupiah) https://www.reuters.com/world/asia-pacific/indonesia-q2-gdp-beats-expectations-with-fastest-growth-two-years-2025-08-05/

2025-08-05 06:56

Trump threatens India again with harsh tariffs over Russian oil purchases Traders see 90% chance of Fed rate cut in September Dollar at one-week low Aug 5 (Reuters) - Gold prices steadied on Tuesday, hovering near a two-week high hit in the last session, as softer U.S. jobs data bolstered hopes of a rate cut in September and weighed on the dollar, and Treasury yields. Spot gold was trading at $3,369.25 per ounce, as of 0629 GMT. Bullion hit its highest since July 24 on Monday. U.S. gold futures was unchanged at $3,423.20. Sign up here. The dollar index (.DXY) , opens new tab traded near a one-week low, making gold more affordable to holders of other currencies. The yield on the benchmark 10-year Treasury note also hit a one-month low. "Short-term momentum has improved for the bullish side of the story... fundamental narrative supporting gold prices is that the Fed is still in the mode to actually cut rates in September," OANDA senior market analyst, Kelvin Wong, said. U.S. employment growth was softer than expected in July, while non-farm payroll figures for May and June were revised down by a massive 258,000 jobs, suggesting a deterioration in labour market conditions. Traders now see a 90% chance of a September rate cut, per the CME FedWatch tool. Gold, traditionally considered a safe-haven asset during political and economic uncertainties, tends to thrive in a low-interest-rate environment. Meanwhile, U.S. President Donald Trump has again threatened to raise tariffs on U.S. imports of Indian goods over India's Russian oil purchases. New Delhi called his remarks "unjustified" and vowed to protect its economic interests, deepening the trade rift. Still, gold faces some technical resistance. "I still do not see traders pushing up aggressively above the $3,450 level unless we have a very clear catalyst for gold price to actually pick up (to above) this level" Wong said. Elsewhere, spot silver was steady at $37.38 per ounce, platinum lost 0.2% to $1,326.20 and palladium shed 0.3% to $1,203.15. https://www.reuters.com/world/china/gold-hovers-near-two-week-high-weak-us-jobs-data-raises-rate-cut-bets-2025-08-05/

2025-08-05 06:55

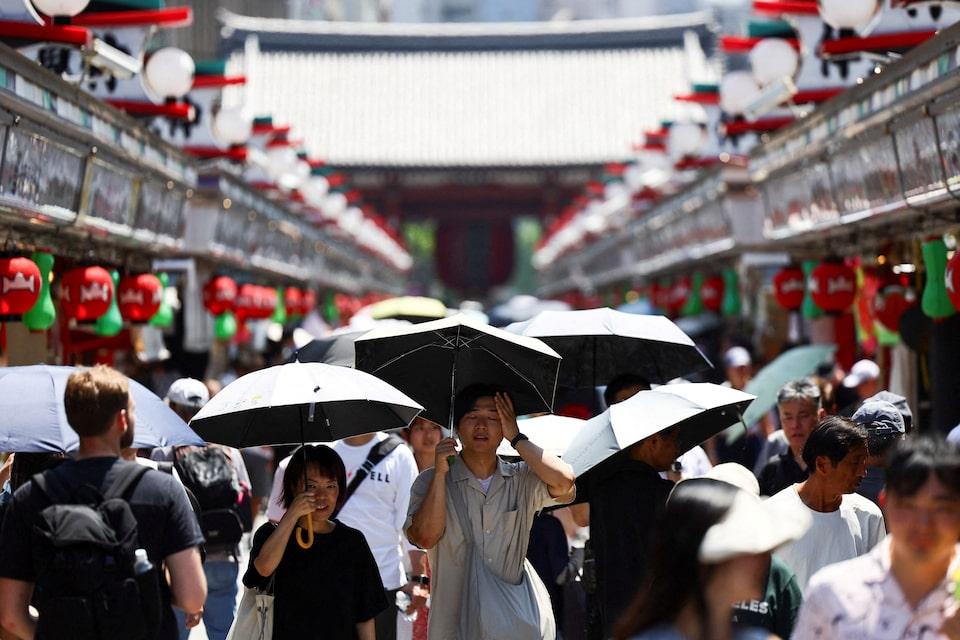

TOKYO, Aug 5 (Reuters) - Japan recorded its highest-ever temperature of 41.8 degrees Celsius (107.2 degrees Fahrenheit) on Tuesday, prompting the government to advise residents to stay indoors and promise steps to ease weather-related damage to rice crops. The eastern city of Isesaki, in Gunma prefecture, set the record to surpass the previous high of 41.2 degrees Celsius marked last week in the western city of Tamba in Hyogo prefecture, the country's meteorological agency said. Sign up here. So far this summer, more than 53,000 people have been taken to hospital for heat stroke, according to the Fire and Disaster Management Agency. Average temperatures across Japan have continued to climb after marking a record high in July for the third year in a row, while the northeastern region along the Sea of Japan saw critically low levels of rainfall, raising concerns over the rice harvest. High temperatures have caused a proliferation of stink bugs in some rice-growing areas, even as the government is set to officially adopt a new policy on Tuesday of increased rice production to prevent future shortages. "We need to act with speed and a sense of crisis to prevent damage" from high temperatures, Farm Minister Shinjiro Koizumi said at a press conference. The government will offer support for pest control and measures to tackle drought, he said. Extreme heat in 2023 had damaged the quality of rice, causing an acute shortage last year that was exacerbated by the government's misreading of supply and demand. That led to historically high prices of the all-important staple food, causing a national crisis. https://www.reuters.com/business/environment/japan-sets-record-temperatures-worries-mount-over-rice-crops-2025-08-05/

2025-08-05 06:49

Brent and US crude stabilise after three consecutive declines OPEC+ output hike, demand worries add to oversupply outlook Trump again threatens India with high tariffs over Russian oil purchases LONDON, Aug 5 (Reuters) - Oil was little changed on Tuesday as traders assessed rising OPEC+ supply and worries of weaker global demand, against U.S. President Donald Trump's threats to India over its Russian oil purchases. The Organization of the Petroleum Exporting Countries and its allies, together known as OPEC+, agreed on Sunday to raise oil production by 547,000 barrels per day for September, a move that will end its most recent output cut earlier than planned. Sign up here. Brent crude futures were down 26 cents, or 0.4%, to $68.50 a barrel at 0800 GMT, while U.S. West Texas Intermediate crude was down 7 cents at $66.22. Both contracts fell by more than 1% on Monday to settle at their lowest in a week. Trump on Monday again threatened higher tariffs on Indian goods over the country's Russian oil purchases. New Delhi called his attack "unjustified" and vowed to protect its economic interests, deepening a trade rift between the two countries. Oil's limited move since then indicates that traders are sceptical a supply disruption will happen, said John Evans of oil broker PVM in a report. He questioned whether Trump would risk higher oil prices, which "would be the inevitable outcome of penalising Russian energy customers". India is the biggest buyer of seaborne crude from Russia, importing about 1.75 million bpd from January to June this year, up 1% from a year ago, according to data provided to Reuters by trade sources. Trump's threats come amid renewed concerns about oil demand and some analysts expect faltering economic growth in the second half of the year. JPMorgan said on Tuesday the risk of a U.S. recession was high. Also, China's July Politburo meeting signalled no more policy easing, with the focus shifting to structural rebalancing of the world's second-largest economy, the analysts said. https://www.reuters.com/business/energy/oil-little-changed-opec-output-hikes-counter-russia-disruption-concerns-2025-08-05/

2025-08-05 06:45

BP shares have underperformed rivals for years BP Q2 profit $2.4 billion vs forecast $1.8 billion Raises dividend, keeps share buyback pace LONDON, Aug 5 (Reuters) - BP (BP.L) , opens new tab will review its portfolio of assets and consider further cost cuts as part of a drive to do better for shareholders, the oil major said on Tuesday, as it reported a second-quarter profit that easily beat expectations. Under pressure to improve profitability, not least from activist investor Elliott, CEO Murray Auchincloss earlier this year announced plans to sell $20 billion of assets through to 2027, reduce spending and share buybacks, and cut costs. Sign up here. On Tuesday, he signalled further action might follow, without giving details. "We will conduct a thorough review of our portfolio of businesses to ensure we are maximizing shareholder value moving forward – allocating capital effectively. We are also initiating a further cost review," Auchincloss said. "BP can and will do better for its investors.” BP has a target to cut costs by $4-$5 billion from 2023 levels by the end of 2027, of which it has achieved $1.7 billion, it said. The company posted a second-quarter underlying replacement cost profit, or adjusted net income, of $2.4 billion, down 14% from last year's $2.8 billion, but easily beating the average $1.8 billion in a company-provided poll of analysts. Its quarterly dividend will rise to 8.32 cents from 8 cents in the first quarter and it will keep the pace of its share buyback programme, making a further $750 million of purchases by the time of its third-quarter results, it said. BP's shares have markedly lagged peers since its 2020 foray into renewables under previous CEO Bernard Looney. Since Auchincloss's strategy revamp in February, BP's shares have lost around 3.5%, compared with rises of around 2.4% for rivals Shell (SHEL.L) , opens new tab and Exxon (XOM.N) , opens new tab, as of Monday. https://www.reuters.com/business/energy/bp-review-assets-costs-profit-beats-expectations-2025-08-05/

2025-08-05 06:44

DUBAI, Aug 5 (Reuters) - Saudi Arabian oil company Aramco (2222.SE) , opens new tab reported a 22% drop in second-quarter profit on Tuesday, mainly on lower revenue, while it racked up more debt. The world's top oil exporter reported a net profit of $22.7 billion in the three months ended June 30, missing a company-provided median estimate from 17 analysts of $23.7 billion. Sign up here. Aramco's average realised crude oil price was $66.7 a barrel in the quarter, down from $85.7 in the second quarter of 2024 and $76.3 in the first quarter of this year. Total borrowing rose to $92.9 billion at June 30 from $74.4 a year prior. Gearing, a measure of indebtedness, rose to 6.5% from minus 0.3% a year earlier and 5.3% the previous quarter. The company, long a cash cow for the Saudi state, confirmed a previously outlined $21.3 billion in total dividends for the second quarter, roughly $200 million of which is performance-linked dividends, a mechanism introduced after a windfall from oil prices in 2022 following Russia's invasion of Ukraine. Aramco in March outlined total dividends of $85.4 billion for 2025 - a 37% drop from its payout of over $124 billion the previous year. The performance-linked component is set to plunge 98% to $900 million as the company's free cash flow dwindles. Free cash flow dropped nearly a fifth year-on-year in the second quarter to $15.2 billion. Reuters reported last month that Aramco is close to a deal to raise around $10 billion in investment from a group led by BlackRock and is considering selling up to five of its gas-powered power plants to raise up to $4 billion, as Riyadh presses the company to increase profit and payout. For the Saudi government, which owns 81.5% of Aramco shares directly and another 16% through its sovereign wealth fund PIF, dividends are a critical source of income, particularly as it spends on efforts to diversify the economy away from oil. Oil generated 62% of the government's revenue last year. The International Monetary fund estimates the kingdom needs oil at more than $90 a barrel to balance its 2025 budget. Global crude benchmark Brent was trading at $68.83 at 0625 GMT. https://www.reuters.com/business/energy/saudi-aramco-second-quarter-net-profit-drops-22-lower-revenue-2025-08-05/