2025-08-05 06:43

MADRID, Aug 5 (Reuters) - Spanish power utility Naturgy (NTGY.MC) , opens new tab said on Tuesday it sold about 5.5% of its shares through an accelerated bookbuilding and a bilateral sale as part of its plan to increase its free float and return to the main stock market indexes. The company said it raised 500 million euros ($577.30 million) selling 2% of its shares at 25.90 euros through an accelerated bookbuilding, opened on Monday. Sign up here. Morgan Stanley advised the bookbuilding. In a separate operation, Naturgy agreed to sell 3.5% of its shares to an unidentified "international financial entity", the company said without disclosing the price per share. The operations would increase Naturgy's free float - or shares available to the public for trading - to 15%, which the company has previously said should be enough to achieve its goal of returning to the main indexes. Naturgy in February said it would buy back almost 2.5 billion euros of its own shares at 26.5 euros per share, or about 9.08% of its equity, and then resell these shares in the market. Its four main shareholders backed the plan and agreed to reduce their stakes. With these two sales, the company reduced the shares it holds to 4.5% down from 9.99%. ($1 = 0.8661 euros) https://www.reuters.com/business/energy/naturgy-sells-55-shares-bid-raise-free-float-2025-08-05/

2025-08-05 06:35

Ocean freight rates to trek lower through rest of 2025 Tariffs and conflict reshape global shipping routes Rerouting absorbs capacity, providing floor to rates SINGAPORE, Aug 5 (Reuters) - Asia-U.S. sea freight rates are set to drop further in 2025 as shipping capacity outpaces demand and trade routes shift due to tariffs and geopolitical tensions, though vessel rerouting is expected to limit some losses, industry experts said. Average spot rates for containers from Asia to the U.S. west and east coasts have slumped by 58% and 46%, respectively, since June 1 and are expected to fall further, according to shipping analytics firm Xeneta. Sign up here. Adding to uncertainty are unresolved trade talks between the U.S. and China. Officials from the world's top two economies last week agreed to seek an extension of their 90-day tariff truce. The China-U.S. trade lane remains one of the most profitable for container ship operators. Sea freight saw a brief uptick in late May and early June as shippers took advantage of a 90-day pause in U.S. President Donald Trump's tariffs, but rates quickly fell as capacity outweighed demand, Xeneta data showed. "There is significant overcapacity globally and this will continue to shape the market," said Erik Devetak, Xeneta's chief technology and data officer. "China-to-U.S. trade is dampened and the EU economy is not exactly hot, so blanked sailings and cancellations will become a recurring theme as carriers desperately try to keep freight rates up," Devetek said. Blanked sailing refers to cancelled port calls or voyages. Logistics major DHL noted that spot rates, which rose in the early summer surge of traffic from Asia to North America, have since reversed. "Carriers rushed to add capacity on the transpacific to chase early gains, but oversupply is becoming apparent as the momentum fades," said Niki Frank, CEO of DHL Global Forwarding Asia Pacific. Jarl Milford, maritime analyst at Veson Nautical, expects rates to decline steadily in the second half when more vessels are expected to enter the market. "Ongoing uncertainty, including tariff policy and slowing global demand, adds continued pressure," Milford said. Ocean Network Express, a joint venture between Japan's Kawasaki Kisen Kaisha (9107.T) , opens new tab, Mitsui O.S.K. Lines (9104.T) , opens new tab and Nippon Yusen (9101.T) , opens new tab, said last week that "recent trade uncertainties further complicate visibility for the latter half of the fiscal year". REROUTING PROVIDES FLOOR A key factor helping absorb some of the excess capacity, however, is the rerouting of vessels from traditional sailings. Carriers are diverting from the Red Sea following attacks by Yemeni Houthis, and some are bypassing U.S. ports to avoid tariffs. These longer voyages are soaking up more ships and helping provide a floor for rates, analysts said. "These diversions continue to soak up in excess of 10% of containership supply, leading capacity utilization to a healthy level in the 86-87% range," analysts at Jefferies Research wrote, referring to the Red Sea. And while China's exports to the U.S. have fallen, shipments elsewhere have climbed. Jefferies analysts said spot bookings to the U.S. in recent weeks suggest July volumes are likely to be down, pushing transpacific freight rates to their lowest this year, but rates to markets such as Europe and Latin America remain elevated. https://www.reuters.com/world/china/asia-us-sea-freight-rates-set-extend-declines-amid-tariff-chaos-2025-08-05/

2025-08-05 06:22

Nyrstar to study production of antimony, bismuth at Port Pirie Will consider producing germanium, indium at Hobart zinc plant Funding will allow for studies into modernising plants MELBOURNE, Aug 5 (Reuters) - Australia said on Tuesday that it will provide A$135 million ($87.4 million) in financial support for two smelters owned by Trafigura unit Nyrstar, as part of its strategy to become a key supplier of critical minerals to Western allies. The funding, announced by federal and state governments and supported by investment by Nyrstar, comes amid growing worries about supply chain vulnerabilities tied to China that have ramped up pressure on Western nations to secure access to critical minerals vital for the energy transition and defence. Sign up here. Australia aims to position itself as a main player in this shift, but its metals processing sector is under strain from high energy and labour costs, while oversupply from top producer China continues to depress prices. Earlier this year, Nyrstar put its troubled Port Pirie lead smelter in South Australia and Hobart zinc processing operations in Tasmania under strategic review, citing high energy prices and lower processing fees. The support package will now allow Nyrstar to maintain operations while it explores modernisation of both facilities and accelerates studies to produce critical minerals - germanium and indium in Hobart and antimony and bismuth in Port Pirie. The initial focus will be on fast-tracking an antimony pilot plant in Port Pirie, Nyrstar said. It first told Reuters in May that it was considering production of the metal used in ammunition and lead-acid batteries at the site. But modernising Australia's ageing smelters will require significantly more capital, potentially testing the government's, and taxpayers', resolve. China, which dominates global processing of many critical minerals, has over the past year imposed restrictions on antimony and rare earths exports, disrupting supply chains for industries including automotive and defence and underscoring the geopolitical risks of over-reliance on Chinese refining. Bolstering an alternative supply chain has become a top priority for Western governments and for the Trump Administration. South Australia Premier Peter Malinauskas warned that without Western intervention, China could hold all the world's smelting capacity. "That's an unacceptable risk, particularly in the current geostrategic environment," he told broadcaster ABC. Australia's minister for industry and innovation, Tim Ayres, told the ABC that he expected Port Pirie would be capable of producing 15,000 metric tons of antimony metal. Antimony is an alloy hardener for other metals in ammunition and batteries and is critical for the manufacturing of semi-conductors found in electronics and defence applications. It is also used in flame retardant materials. Meanwhile, the bailout of Nyrstar may trigger a flurry of aid-seeking calls to government officials from other struggling processing companies. Last week IGO (IGO.AX) , opens new tab said it was assessing the future of its loss-making lithium hydroxide plant on the outskirts of Perth, run by joint venture partner Tianqi Lithium (002466.SZ) , opens new tab. Glencore (GLEN.L) , opens new tab has asked for government assistance to support its Mount Isa copper smelter in Queensland state, while Rio Tinto (RIO.AX) , opens new tab has repeatedly flagged a tough outlook for its Tomago aluminium smelter in New South Wales, the state's biggest energy user, given costly power. BHP (BHP.AX) , opens new tab already pulled the trigger on its Western Australian nickel operations, putting them on ice a year ago. ($1 = 1.5451 Australian dollars) https://www.reuters.com/markets/asia/australia-pledges-87-million-rescue-trafiguras-nyrstar-smelters-critical-2025-08-05/

2025-08-05 06:17

Government will prioritise strategic projects like rare earths Price floor part of Australia's critical minerals reserve strategy Lynas shares hit highest in 13 years MELBOURNE, Aug 5 (Reuters) - Australia is considering setting a price floor to support critical minerals projects, including rare earths, Resources Minister Madeleine King said, in comments that led to a rally in share prices for Australian-listed rare earths miners. Australia has been positioning itself as an alternative source of critical minerals to dominant producer China for use in sectors such as the automotive industry and defence. Sign up here. It offered on Tuesday an $87 million lifeline to Trafigura unit Nyrstar's metals processing operations. Nyrstar is assessing the potential to produce antimony, bismuth, germanium, indium at its smelters in Port Pirie and Hobart. The support comes as prices for some metals like rare earths have been too low to fund processing capacity in Western nations, meaning that China has remained the world's dominant supplier. There was a strategic shift last month when the U.S. government offered a pricing floor in a landmark deal with its largest rare earths producer intended to support a viable U.S. rare earths industry. "Pricing certainty means companies and investors are less exposed to volatile markets and prices, which are opaque and prone to manipulation," King said in a statement first reported by the Australian newspaper on Monday evening. Australia aims to provide price certainty for emerging critical minerals projects through its role as a buyer, after it pledged A$1.2 billion ($775.08 million) to build a strategic critical mineral reserve earlier this year. "Mechanisms for an appropriate price floor are under active consideration," King said. "The focus will be on creating national offtake agreements," she said, referring to purchase deals. "These will be voluntary." The agreements will focus on critical minerals with demonstrated end-uses in defence and strategic technologies and minerals where Australia is especially well-placed to provide supply amidst supply chain issues, particularly heavy rare earths. Rare earths are a group of 17 elements. They include a subset of heavy rare earths, such as terbium and dysprosium, which are categorised by their higher atomic weight, are less plentiful and command higher prices than others. Shares in Australian producer Lynas Rare Earths (LYC.AX) , opens new tab, which started producing heavy rare earths earlier this year, rallied more than 6% to the highest in 13 years. Shares of Iluka Resources (ILU.AX) , opens new tab and Arafura Rare Earths (ARU.AX) , opens new tab were both up close to 10% on Tuesday. "I think the market is now viewing rare earths miners and processors as strategic assets given the (Australian) government involvement," said Luke Winchester, portfolio manager at Merewether Capital. U.S. rare earths producer MP Materials (MP.N) , opens new tab last month unveiled a multibillion-dollar deal with the U.S. government to boost output of rare earth magnets and help loosen China's grip on the materials used to build weapons, electric vehicles and many electronics. That pricing deal, which offered a minimum price floor that a buyer would pay, was set to have global implications, analysts said at the time. The move was positive for producers, but could increase costs for consumers such as automakers and in turn for their customers, analysts said. ($1 = 1.5482 Australian dollars) https://www.reuters.com/markets/commodities/australia-weighs-price-floor-critical-minerals-boosting-rare-earths-miners-2025-08-05/

2025-08-05 05:54

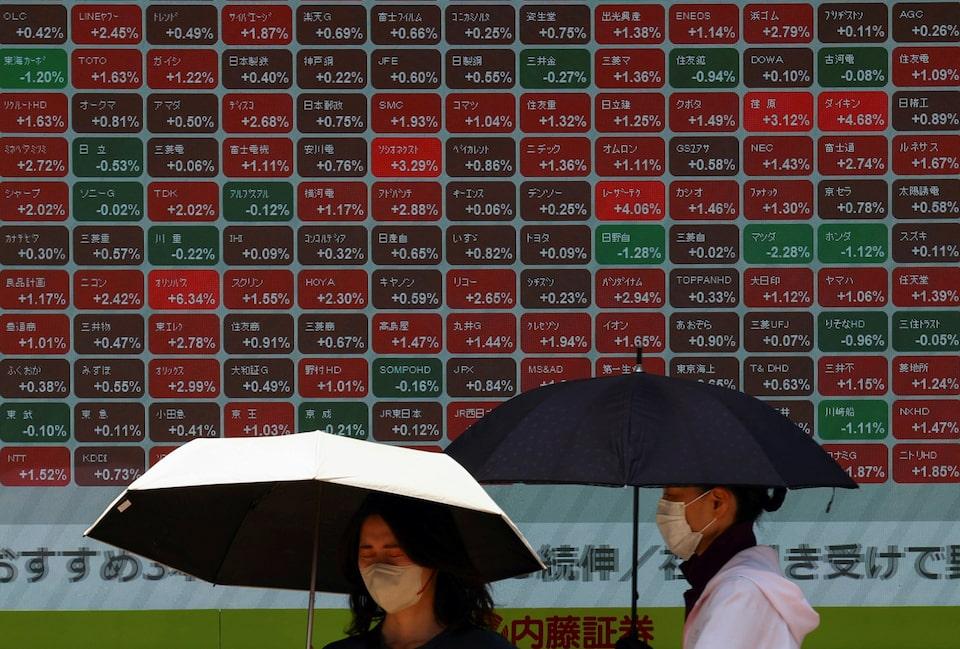

US earnings boost market sentiment, tech stocks surge Fed rate cut odds rise to 94% after weak US jobs data Euro Stoxx 50 futures rise 0.2%, DAX futures up 0.3% TOKYO, Aug 5 (Reuters) - Shares in Asia rose for a second-straight session on Tuesday and the U.S. dollar steadied as investors increased bets the Federal Reserve will act to prop up the world's largest economy. U.S. shares rallied on Monday on generally positive earnings reports and increasing bets for a September rate cut from the Fed after disappointing jobs data on Friday. Sign up here. Oil prices edged lower after output increases by OPEC+, while gold hovered near a one-week high and Vietnamese shares climbed to a new record high. "There are signs of weakness in parts of the U.S. economy, that plays to the view that maybe not in September, but certainly this year that the Fed's still on course to ease potentially twice," said Rodrigo Catril, senior currency strategist at National Australia Bank. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab rose 0.6%, while Japan's Nikkei gauge climbed 0.7% after falling by the most in two months on Monday. Pan-region Euro Stoxx 50 futures were up 0.2%, while German DAX futures were up 0.3% and FTSE futures rose 0.3%. U.S. S&P 500 e-mini stock futures rose 0.2%. The dollar was flat at 147.09 yen, and the euro was down 0.1% on the day at $1.1557. The dollar index , which tracks the greenback against a basket of major peers, rallied 0.2% after a two-day decline. Friday's soft U.S. nonfarm payrolls data added to the case for a cut by the Fed, and took on another layer of drama with Trump's decision to fire the head of labor statistics responsible for the figures. Odds for a September rate cut now stand at about 94%, according to CME Fedwatch, from a 63% chance seen on July 28. Market participants see at least two quarter-point cuts by the end of this year. News that Trump would get to fill a governorship position at the Fed early also added to worries about politicisation of interest rate policy. Trump again threatened to raise tariffs on goods from India from the 25% level announced last month, over its Russian oil purchases, while New Delhi called his attack "unjustified" and vowed to protect its economic interests. Oil prices fell on mounting oversupply concerns, with the potential for more Russian supply disruptions providing support after Trump said he could impose 100% secondary tariffs on Russian crude buyers such as India. Brent crude futures fell 0.1%, to $66.21 a barrel. Second-quarter U.S. earnings season is winding down, but investors are still looking forward to reports this week from companies including Walt Disney (DIS.N) , opens new tab and Caterpillar (CAT.N) , opens new tab. Tech heavyweights Nvidia (NVDA.O) , opens new tab, Alphabet (GOOGL.O) , opens new tab and Meta (META.O) , opens new tab surged overnight, and Palantir Technologies (PLTR.O) , opens new tab raised its revenue forecast for the second time this year on expectations of sustained demand for its artificial intelligence services. "Company earnings announcements continue to spur market moves," Moomoo Australia market strategist Michael McCarthy said in a note. Data today from Asia's two biggest economies showed resilience in their service sectors. In Japan, the S&P Global final services purchasing managers' index (PMI) to 53.6 in July from 51.7 in June for the strongest expansion since February. China's services activity last month at its fastest pace in more than a year. China's blue-chip CSI300 Index (.CSI300) , opens new tab climbed 0.4%, while the Shanghai Composite Index (.SSEC) , opens new tab gained 0.6%. Vietnam's (.VNI) , opens new tab gauge of shares surged 2.4% and touched a fresh record high. Bitcoin fell 0.4% to 114,448.59 while spot gold was slightly lower at $3,368.44 per ounce. https://www.reuters.com/world/china/global-markets-global-markets-2025-08-05/

2025-08-05 05:42

Traders boost bets on Fed easing moves extending through 2026 Goldman Sachs expects Fed to deliver 3 consecutive rate cuts Fed could harden its view to protect independence, analysts say Investors still concerned about the tariff impact Aug 5 (Reuters) - The dollar edged up against the euro and the yen, but remained within striking distance of Friday’s lows, after weak U.S. jobs data boosted bets on Federal Reserve rate cuts and triggered a sharp selloff in the greenback. Goldman Sachs expects the Federal Reserve to deliver three consecutive 25 basis-point rate cuts starting in September, with a 50 basis-point move possible if the next jobs report shows a further rise in unemployment. Sign up here. It also sees the European Central Bank as having concluded its easing cycle. Economists raised their growth forecasts for the euro area and Japan following relatively benign trade agreements, while arguing that Friday’s U.S. jobs report confirmed the economy is hovering near stall speed. Meanwhile the firing of the head of the Bureau of Labor Statistics (BLS) on Friday, and the resignation of Fed Governor Adriana Kugler, could harden the views of the FOMC to ensure its independence is protected, analysts said, recalling that the new appointee will be just one vote on the Fed’s Federal Open Market Committee (FOMC). The euro was last down 0.12% at $1.15592, after hitting on Friday $1.15855. The dollar index , which measures the U.S. currency against six counterparts, was at 98.816, after touching a one-week low earlier in the session at 98.609. "Traders likely inferred that the (U.S. jobs) report gave President Donald Trump even more justification to 'fire' Jay Powell," said Thierry Wizman, global forex and rates strategist at Macquarie Group. "Alternatively, it gave Trump even more support for giving the Chairmanship to someone that would be more 'structurally' dovish," he added, arguing that Friday's employment report shifted the outlook for where the Fed Funds rate target will be one year from now. RATE CUTS Money markets are now pricing in a 92% chance of the Fed cutting rates in its next meeting in September, compared with 63% a week earlier. They also indicate 130 bps of rate cuts by October 2026, 30 bps more than the levels seen on Friday before U.S. jobs data. The Japanese yen was down 0.14% at 147.3 per dollar after minutes of its June policy meeting showed a few Bank of Japan board members said the central bank would consider resuming interest rate increases if trade frictions de-escalate. The focus remains on tariff uncertainties, after the latest duties imposed on imports from scores of countries last week by Trump stoked worries about the health of the global economy. The Swiss franc extended losses for a second day, weakening 0.1% to 0.8089 per dollar after dropping 0.5% in the previous session. However it was still above the levels seen before Friday's economic figures, at around 0.8128. Switzerland is looking to make a "more attractive offer" in trade talks with Washington, to avert a 39% U.S. import tariff on Swiss goods that threatens its export-driven economy. In other currencies, the Australian dollar eased 0.05% to $0.6464, while the New Zealand dollar slipped 0.1% to $0.5898. https://www.reuters.com/world/middle-east/dollar-steady-rate-cut-odds-rise-risk-appetite-returns-2025-08-05/