2025-12-02 10:54

Amsterdam-based firm expects to launch in second half of 2026 BNP Paribas joins consortium with nine other banks Former NatWest chair Howard Davies to be chair PARIS/MADRID, Dec 2 (Reuters) - A group of 10 European banks, including ING (INGA.AS) , opens new tab, UniCredit (CRDI.MI) , opens new tab and BNP Paribas (BNPP.PA) , opens new tab, have formed a company to launch a euro-pegged stablecoin in the second half of 2026, in a move they hope will counter U.S. dominance in digital payments. The CEO of the Amsterdam-based company, named Qivalis, will be Jan-Oliver Sell, who was previously the CEO of crypto exchange Coinbase's German business, and has also worked for Binance. Former NatWest chair Howard Davies will be chair, the group said at a press conference in Amsterdam on Tuesday. Sign up here. The new company, which will have headquarters in Amsterdam, plans to hire 45 to 50 people in the next 18 to 24 months, Sell said, adding that they have a third of this number already. Banks are grappling with the fast-growing stablecoin industry and the wider growth of cryptocurrencies, which are seen by some lenders as potential direct competitors. That growth has put traditional lenders under pressure to find uses for blockchain technology within their own businesses. A host of top U.S. financial firms have been preparing to launch their own dollar-backed stablecoins after U.S. President Donald Trump signed a law establishing rules for stablecoins. DOLLAR-PEGGED STABLECOINS HAVE SURGED Stablecoins – a type of cryptocurrency designed to maintain a constant value and backed by traditional currencies - have grown sharply in recent years, driven by El Salvador-based company Tether, which has around $185 billion worth of its dollar-based token in circulation. There are few signs of demand for euro-pegged stablecoins. Societe Generale's crypto arm, SG-FORGE - which is not part of Qivalis - launched a euro-pegged stablecoin in 2023, but it has just 64 million euros ($74.27 million) worth of tokens in circulation. Qivalis said in a statement that the token will provide "near-instant, low-cost payments and settlements", although Davies said that the initial use-case will be in crypto trading. Sell said the name was chosen to convey trust, quality, and values, which were essential in finance and that it was easy to pronounce across languages. The company expects to launch its stablecoin at the beginning of the second half of 2026, with the licencing process taking six to nine months, Sell said. It is applying for an Electronic Money Institution (EMI) licence from the Dutch central bank. REGULATORY WORRIES Regulators worry that stablecoins could suck money flows out of the regulated banking system. ECB President Christine Lagarde has told European policymakers that privately issued stablecoins posed risks for monetary policy and financial stability. The ECB is also working on a digital euro of its own as a strategic alternative to private, U.S.-dominated means of payment such as credit cards and stablecoins. Floris Lugt, ING’s digital assets lead, who will become Qivalis’s CFO, said the group was in touch with the ECB, which was “very supportive” of the plan. “Our impression from them is that they are very supportive and that’s because one important policy objective is to achieve strategic autonomy in European payments and they are quite concerned about stablecoins, in particular U.S. dollar fintech-issued stablecoins and they prefer to have – is our impression – the European champions that they can support.” The banks involved in the project, first announced in September, were originally ING, UniCredit, Banca Sella (BSEL.HT) , opens new tab, KBC (KBC.BR) , opens new tab, DekaBank, Danske Bank (DANSKE.CO) , opens new tab, SEB (SEBa.ST) , opens new tab, Caixabank (CABK.MC) , opens new tab and Raiffeisen Bank International (RBIV.VI) , opens new tab. BNP Paribas has since joined the group, Lugt said on Tuesday. A separate group of ten banks, including Bank of America (BAC.N) , opens new tab, Deutsche Bank (DBKGn.DE) , opens new tab, Goldman Sachs (GS.N) , opens new tab and UBS (UBSG.S) , opens new tab, have also said that they are jointly exploring issuing a stablecoin. BNP Paribas is part of both groups. ($1 = 0.8617 euros) https://www.reuters.com/business/finance/group-european-banks-announce-euro-stablecoin-plans-2025-12-02/

2025-12-02 10:53

FRANKFURT, Dec 2 (Reuters) - Germany has been putting import terminals for liquefied natural gas into operation as part of its efforts to replace piped Russian gas following Moscow's invasion of Ukraine in 2022. The Brunsbuettel terminal received its floating storage regasification unit, the Hoegh Gannet, back on November 24 after upgrades, and Wilhelmshaven 2 has restarted its FSRU Excelsior ready for the coming winter months, state-appointed terminal company Deutsche Energy Terminal said. Sign up here. DET, which is in charge of three terminal locations, has said it will rerun auctions for LNG landing capacity at Wilhelmshaven 1 and 2 in December, having so far failed to place a variety of slots. It has fed 59 terawatt hours into German grids so far this year. Here are the details of developments at the sites: MUKRAN The terminal on Ruegen island in the Baltic Sea operated by private firm Deutsche ReGas supplies onshore grids with LNG from pipeline firm Gascade's OAL link, in cooperation with Norway's Hoegh Evi's FSRU Neptune. It wants to restart a second FSRU eventually and restore full capacity of 13.5 billion cubic metres by 2027. ReGas has launched a bidding round to expand Mukran's capacity by offering an additional 5 billion cubic metres per year from 2027 to 2043. In September, it signed long-term agreements with chemicals producer BASF (BASFn.DE) , opens new tab and Norwegian incumbent Equinor (EQNR.OL) , opens new tab for non-specified regas capacity. The company said it regasified 8.35 TWh of LNG in October and November, holding first place ahead of each of the other three working LNG terminals. LUBMIN ReGas and Hoegh plan to develop the Baltic Sea port, a forerunner of Mukran, into a green ammonia and hydrogen production and import terminal, which Gascade will link up with customers. WILHELMSHAVEN Utility Uniper launched Germany's first FSRU operation, Wilhelmshaven 1, on the North Sea in 2022. Uniper plans to add a land-based ammonia import reception terminal and cracker in the second half of this decade to make green hydrogen, and build a 200 MW electrolyser to be fed with local wind power. DET officially started commercial operations at Wilhelmshaven 2 on August 29 via the Excelerate Energy-operated FSRU Excelsior. Maintenance also took place in October. In auctions on November 25-26, DET failed to place some available regasification slots in 2025, 2026 and 2027 with gas market players, and will repeat them on December 9 and 10. STADE DET has agreed with the Hanseatic Energy Hub to take on the job of erecting an FSRU superstructure at the Elbe River onshore terminal. DET said it would start on the inspection, planning and execution of the job, but added that the terminal would not be ready to go into operation before the second quarter of 2026. The FSRU Energos Force would return to the site, where Uniper and sector peer EnBW (EBKG.DE) , opens new tab will be the main customers. Prior to the latest developments, DET and HEH had temporarily cancelled contracts with each other over unresolved disputes related to construction schedules and payments. HEH plans to start a shore-based terminal for LNG, bio-LNG and synthetic natural gas at Stade in 2027. BRUNSBUETTEL The Hoegh Gannet was removed temporarily in September for upgrades. These were completed and the ship returned on November 24 to the North Sea port. It went into operation in 2023 in Brunsbuettel, initially chartered by the trading arm of utility RWE (RWEG.DE) , opens new tab, before being handed over to DET. It is the forerunner of a land-based LNG facility, cleared to receive 40 million euros ($46.4 million) of state support. This could start operations at the end of 2026, when a newly inaugurated, adjacent ammonia terminal could also start up. ($1 = 0.8618 euros) https://www.reuters.com/business/energy/how-germany-is-building-up-lng-import-terminals-2025-12-02/

2025-12-02 10:51

OBR's Miles says Reeves November 4 speech "not misleading" Reeves in spotlight over presentation of pre-budget OBR views Miles questions government briefings around tax policy OBR sought to correct misconceptions in letter last week - Miles LONDON, Dec 2 (Reuters) - British finance minister Rachel Reeves was not misleading in comments she made about the tough budget situation she faced which have been attacked by opposition lawmakers, an official from Britain's fiscal watchdog said on Tuesday. In a speech on November 4, Reeves appeared to lay the groundwork to raise income tax rates which would have broken the Labour Party's promise to voters before the 2024 election. Sign up here. She cited a "weaker than previously thought" productivity forecast by the Office for Budget Responsibility - whose projections underpin government budgets - but did not mention higher OBR tax revenue forecasts which offset it. Political opponents have accused Reeves of misleading the public in the run-up to the budget and seeking to find a reason to raise taxes to justify an increase in welfare spending, a charge she denies. 'NOT MISLEADING' TO CALL FISCAL SITUATION VERY CHALLENGING Reeves last week announced 26 billion pounds ($34.3 billion)in tax increases to remain on track to meet her fiscal targets and fund an increase in welfare for families with children. David Miles, a member of the OBR's Budget Responsibility Committee, said the forecasts shared with Reeves before her speech on November 4 showed she had a "wafer thin" buffer for meeting her fiscal targets and the costs of a u-turn on welfare savings had not been included at that stage. "I don't think it was misleading for the chancellor to say that the fiscal position was very challenging at the beginning of that week," Miles told lawmakers on parliament's Treasury Committee. However, Miles questioned briefings given to media later in November in which unnamed government sources said the government could avoid raising income tax rates in the budget thanks to improvements to the OBR's economic forecasts. British government borrowing costs fell sharply in the bond market after those briefings. "It certainly didn't reflect anything that was news from the OBR being fed into the government," Miles said, saying the changes in the watchdog's forecast rounds were small. ROW OVER FORECASTS The OBR last week took the unusual step of publishing a letter setting out how those forecasts had evolved. Miles said the agency felt it had to explain the process and show it was not behind the sharp changes in expectations about the budget. "The letter really was to try and remove misconceptions about the OBR being either the patsy that was doing what the government wanted, or that through its own fickle behaviour changing from one day to the next... that was making it virtually impossible for the government," he said. The Treasury responded frostily to the letter last week, saying it welcomed the OBR's confirmation that such explanations would not become usual practice. The chair of the Treasury Committee, Meg Hillier, said lawmakers would discuss the early release of the OBR's economic and fiscal outlook report - which included all the key details of Reeves' budget - at a future date. The OBR's chair, Richard Hughes, resigned on Monday after an investigation by the agency into the lapse found fault with the leadership of the watchdog. ($1 = 0.7583 pounds) https://www.reuters.com/world/uk/uk-fiscal-watchdog-official-says-reeves-pre-budget-speech-was-not-misleading-2025-12-02/

2025-12-02 10:38

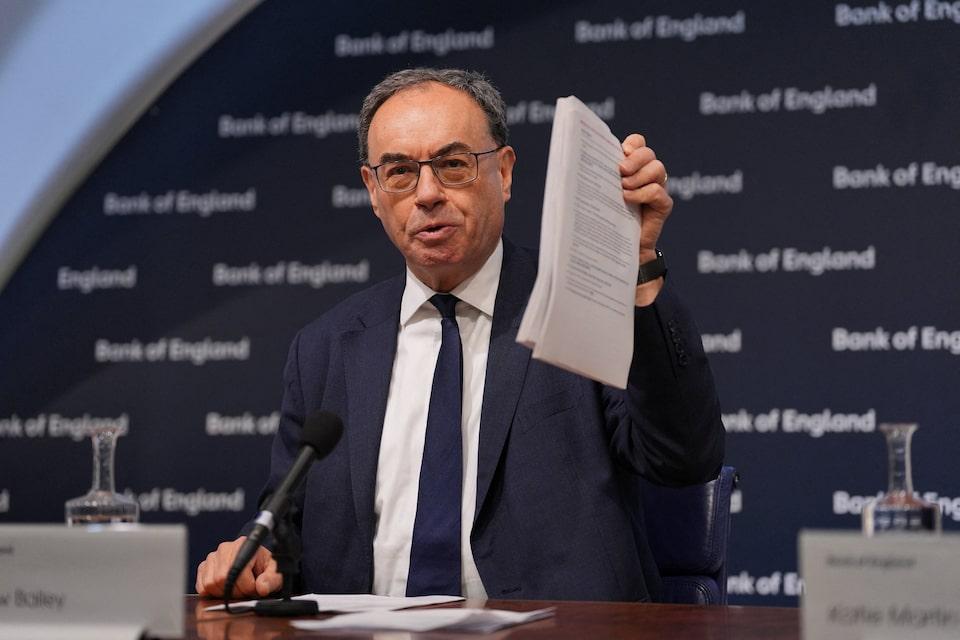

LONDON, Dec 2 (Reuters) - Banks should increase their lending to boost the economy following a reduction in the amount of capital they need to set aside, the Bank of England Governor Andrew Bailey said on Tuesday. Bailey told a press conference that while it was not for the BoE to dictate how banks run their businesses, they stand to gain from boosting credit to companies and households, as stronger growth would improve their own performance and returns. Sign up here. “There is a two-way relationship here,” he said when asked how the BoE could ensure banks lent the money rather than returned excess capital to shareholders. “If the banks support the economy by lending, that will strengthen the economy and the banks will benefit from that … I would expect that they will have that very much in mind when they think about the consequences of this.” https://www.reuters.com/sustainability/boards-policy-regulation/bank-englands-bailey-urges-banks-boost-lending-after-capital-change-2025-12-02/

2025-12-02 10:21

Report suggests euro adoption benefits outweigh risks for Sweden Sweden's political parties divided on euro adoption Public opinion remains against euro adoption, poll shows STOCKHOLM, Dec 2 (Reuters) - Sweden should join the 20 countries using the euro as their currency as the potential economic benefits now outweigh the risks amidst increased global uncertainty, a report by the independent Swedish Free Enterprise Foundation said. Sweden joined the European Union in 1995 but a referendum in 2003 rejected adopting the euro by a majority of 56% to 42%. Over 80% of Swedes voted. Sign up here. "As I see it, the arguments for joining the euro have strengthened over time," Lars Calmfors, professor meritus of International Economics at Stockholm University, and one of the authors of the report, said in a statement. "Sweden should, therefore, adopt the euro." Euro membership would lead to increased cross-border trade and foreign investment, while Sweden would also gain more influence in Brussels over the development and integration of Europe's capital markets, Calmfors said. Bulgaria is set to join the euro area from January, becoming the 21st nation to share the common currency. On the downside, the risk that high levels of government debt across the euro zone would lead to costs for Sweden has increased. Russia's invasion of Ukraine has already led Sweden to join NATO and has also increased the value of deeper integration across the European Union, Calmfors said. But Swedes remain to be convinced and the issue is unlikely to be a major one in the general election due in September 2026. The Moderates, the biggest party in the coalition, support a new inquiry on the issue but have said membership is a long way off. The Christian Democrats are also on the fence. Of the three coalition parties, only the Liberals are firmly positive and they could drop out of parliament next year. The populist Sweden Democrats, the biggest party on the right, are against. "We need to keep control over our own monetary policy and be able to make decisions that are suitable to our own economic situation, not based on the euro zone's needs," Sweden Democrats' economic spokesman Oscar Sjostedt said in a written comment. Prior to the election in 2022, the Sweden Democrats had advocated Sweden leaving the EU. The opposition Social Democrats, Sweden's biggest party, said the issue had already been decided by referendum. "We don't see any reason currently to review that decision," economic spokesman Mikael Damberg said. In May, 32% of Swedes supported adopting the euro with 49.5% against, according to a poll by the statistics agency. https://www.reuters.com/business/benefits-joining-euro-zone-outweigh-downside-sweden-new-report-says-2025-12-02/

2025-12-02 10:10

UK growth revised up to 1.2% in 2026, rising to 1.3% in 2027 Inflation forecast to slow from 3.5% in 2025 to 2.5% in 2026 OECD cautions lopsided fiscal policies could slow growth LONDON, Dec 2 (Reuters) - Britain's economy will grow faster than previously expected next year, the OECD said on Tuesday, citing the impact of finance minister Rachel Reeves' budget on consumption and drag from global uncertainty that could keep pressure on inflation. The Paris-based organisation raised its 2026 forecast for British growth to 1.2% from 1% in its previous forecast in September. It sees gross domestic product expanding 1.3% in 2027. Sign up here. "Continuing to ensure that consolidation is carefully timed, given substantial downside risks to growth and upside risks to inflation, and well-calibrated, with a combination of revenue-raising measures and spending cuts, is essential," the OECD said in its latest global outlook. Reeves announced increases to government spending in her November 26 budget, paid for by higher state borrowing and hiking taxes on workers, people saving for pensions and investors. Welcoming the OECD forecasts of higher growth and slower inflation, Reeves reiterated that her budget would cut borrowing and debt, help with the costs of living for households, and reduce costs for businesses. The OECD expects Britain's government deficit to remain large, but to narrow from 5.9% of GDP in 2025 to 5.1% in 2027, with total revenue reaching 40% of economic output. INFLATION TO SLOW BUT HEADWINDS REMAIN It said consumer price inflation was likely to average 3.5% this year - higher than in any other G7 country - before easing to 2.5% in 2026 and to 2.1% in 2027. The inflation forecast for next year was in line with estimates from Britain's budget watchdog, published last week. "Elevated inflation expectations and potential second-round effects from increases in payroll taxes and the minimum wage, as well as from high food inflation, constitute an upside risk to prices," the OECD said, adding this could prompt the Bank of England to keep interest rates higher for longer, and pose a downside risk to economic growth. An OECD official said Reeves' budget increased short-term spending while delaying the planned tax rises, echoing concerns from analysts last week who questioned whether the government would still go through with such fiscal tightening closer to the national election, due by mid-2029. "The new budget has a consolidation path that is somewhat more back-loaded than we had expected. There are increases in spending that are relatively front-loaded," the OECD's director of country studies, Luiz de Mello, told a press conference after the report was published. The report said past tax and spending adjustments would weigh on household disposable incomes and would slow consumption. It said continued fiscal consolidation, sluggish productivity and weak working-age population growth, partly due to slowing inward migration, would all prove a drag on growth. With public finances stretched, the OECD said Britain had limited capacity to deal with potential economic shocks in the future. https://www.reuters.com/world/uk/uk-set-faster-growth-2026-slower-inflation-oecd-forecasts-2025-12-02/