2025-07-25 12:15

EU says trade deal with US within reach Trump presses Federal Reserve Chair Powell to cut rates July 25 (Reuters) - Gold prices fell on Friday, pressured by a recovery in the U.S. dollar and optimism over progress in trade talks between the United States and the European Union. Spot gold was down 0.7% at $3,343.0 per ounce by 1150 GMT. U.S. gold futures fell 0.9% to $3,344.50. Sign up here. The U.S. dollar index (.DXY) , opens new tab rebounded from its lowest in more than two weeks, making bullion more expensive for overseas buyers, while benchmark 10-year U.S. Treasury yields rose. A resurgence in risk appetite driven by optimism over potential tariff negotiations, and lower-than-expected U.S. jobless claims reinforcing the view that the Federal Reserve is unlikely to cut rates, are pressuring gold, said Ricardo Evangelista, senior analyst at brokerage firm ActivTrades. The European Commission said on Thursday that a negotiated trade solution with the U.S. is within reach - while EU members voted to approve counter-tariffs on 93 billion euros ($109 billion) of U.S. goods in case the talks collapse. Data showed the number of Americans filing new applications for jobless benefits fell to a three-month low last week, indicating stable labour market conditions. President Donald Trump pressed Fed Chair Jerome Powell to lower interest rates in a tense visit to the U.S. central bank on Thursday. Markets are pricing in a potential rate cut in September. Gold typically performs well in times of uncertainty and in low-interest-rate environments. "Central bank buying can continue to hold the floor for gold, but a reignition of ETF inflows is needed for prices to break out higher once again towards our bullish year-end target of $3,675/oz, which likely also requires Fed cuts exceeding market expectations," analysts at JP Morgan said in a note. Spot silver fell 0.9% to $38.74 per ounce, but was still on track for a weekly gain of about 1.6%. Platinum was 1.7% lower at $1,384.95, with palladium also down 1.8% at $1,201.75, its lowest in over a week. https://www.reuters.com/world/china/gold-falls-firmer-us-dollar-rising-trade-optimism-2025-07-25/

2025-07-25 12:13

Central bank lowers 2025 inflation forecast Says inflation is declining faster than forecast Bank maintains 2025 growth forecast at between 1% and 2% Nabiullina says attempts to pressure over rates harm economy Russian rouble weakens ahead of rate cut MOSCOW, July 25 (Reuters) - The Russian central bank cut its key interest rate by 200 basis points to 18% on Friday, hoping to revive lending and boost flagging economic growth after stubbornly high inflation showed signs of easing. The move is the biggest decrease since May 2022, when the central bank cut by 300 bps as the economy was recovering from the shock from Western sanctions imposed following the launch of Russia's military action in Ukraine. Sign up here. The latest reduction was in line with a Reuters poll of 27 economists, and comes after Russian business leaders and some government officials complained that high interest rates were strangling the economy. The central bank had raised rates substantially since July 2023 in order to deal with the effects of an overheating economy caused by a surge in military spending. Russia's economy minister said last month the country was on the brink of recession as a result. Alongside its sharp rate cut, the central bank lowered its 2025 inflation forecast to between 6% and 7% from between 7% and 8% and said inflationary pressures were declining faster than previously forecast. The bank said it would keep monetary conditions as tight as necessary to return inflation to the target of 4% in 2026. "We are on the path to returning inflation to target, but this path has not yet been completed," central bank governor Elvira Nabiullina said at a news conference following the rate decision. "Returning to the target... implies a stable consolidation of inflation at a low level not only in actual data, but also in the perception of people and businesses," she said. Analysts now expect the central bank to continue cutting rates later this year. "Everything points to a fairly significant optimism on the part of the central bank and allows us to expect a continuation of active monetary policy easing with the key rate not exceeding 16% by the end of the year," Raiffrisen Bank analysts said. WESTERN SANCTIONS Russia's consumer price index fell by 0.05% in the latest week, marking weekly deflation for the first time since September 2024, while annualized inflation slowed to 9.17% from its peak of 10.3% in March. The central bank maintained its 2025 gross domestic product growth forecast at between 1% and 2% and said it saw some softening in Russia's tight labour market. The economy grew by 4.3% last year. The central bank cut its forecast for the average oil price in 2025 to $55 per barrel from $60 per barrel, implying a fall in state budget revenues, but Nabiullina said she did not expect any surprises from the budget. The Russian economy will face another test in early September when a 50-day deadline set by U.S. President Donald Trump for Russia to show progress toward peace in Ukraine expires, with potential new U.S. sanctions against buyers of Russian oil to follow. Nabiullina said the bank will work to ensure the financial sector’s resilience to Western sanctions does not weaken. "We see that indeed the financial sector is one of the main targets for sanctions, and these sanctions are being tightened," Nabiullina said. The bank was under intense pressure from the business community to start easing after it hiked the key rate to the highest level since the early 2000s last year. Business leaders complained that at such a rate, investment no longer made sense. Nabiullina said that such pressure does the economy a disservice by creating the false impression that the central bank has been forced to cave in when cutting rates, which in turn fuels inflationary expectations "Such attempts to exert pressure would, in effect, result in higher interest rates," she warned. President Vladimir Putin has backed the policy of the central bank, but warned it not to cool the economy too much. High interest rates have hit Russia's construction and coal sectors and led to a rise in bad debt for Russian banks. Speaking just before the rate decision on Friday, Deputy Prime Minister Marat Khusnullin, who oversees the construction sector, said that a 400 bps cut was more desirable, indicating that many officials in Russia want the central bank to cut more. The rouble, which rallied by 45% against the U.S. dollar earlier this year in part due to the high key rate, began to weaken ahead of the expected rate cut and touched the 80 mark against the dollar on Friday, a near-six week low. The stronger rouble has aided the central bank in fighting inflation by making imported goods cheaper with some bankers alleging that supporting the rouble was a deliberate policy by the central bank. https://www.reuters.com/markets/europe/russian-central-bank-slashes-key-rate-by-200-bps-biggest-cut-since-may-2022-2025-07-25/

2025-07-25 11:52

Sentiment boosted by US-Japan trade deal Markets pause ahead of next week's Fed, BOJ policy meetings Focus on US-EU trade negotiations Markets shrug off Trump's Fed visit Pound weakens on euro and dollar after soft economic data SINGAPORE/LONDON, July 25 (Reuters) - The dollar index steadied but was set for its biggest weekly drop in a month on Friday as investors contended with tariff negotiations and central bank meetings next week, while sterling dipped after softer-than-expected British retail sales data. Both the U.S. Federal Reserve and the Bank of Japan are expected to hold rates steady at next week's policy meetings, but traders are focusing on the subsequent comments to gauge the timing of the next move. Sign up here. Politics is a factor for both central banks, most dramatically in the U.S., where President Donald Trump once again pressed the case for lower interest rates on Thursday as he locked horns with Fed Chair Jerome Powell. The dollar managed to recover a touch against the euro late on Thursday, however, after Trump said he did not intend to fire Powell, as he has frequently suggested he could. "The market relief was based on the fact that Trump refrained from calling for Powell to go, although that was based on Trump's view that Powell would 'do the right thing'," said Derek Halpenny, head of EMEA research at MUFG. He added, however, that "the theme of Fed independence being undermined by the White House will unlikely go away and remains a downside risk for the dollar". Falls against the euro and yen leave the dollar index , which measures the dollar against six other currencies, at 97.45, on track for a drop of 0.75% this week, its weakest performance in a month, though it bounced back 0.3% on Friday. Meanwhile, in Japan, though the trade deal signed with the U.S. this week could make it easier for the BOJ to continue rate hikes, the bruising loss for Prime Minister Shigeru Ishiba's coalition in upper house elections on Sunday complicates life for the BOJ. Prospects of big spending could keep Japanese inflation elevated, suggesting swifter tightening, while potentially prolonged political paralysis and a global trade war provide compelling reasons to go slow on rate hikes. On the day, the yen was softer, thanks in part to below-expectations Tokyo inflation data, with the dollar last up 0.55% at 147.8 yen, though on course for a weekly 0.7% fall. The euro was down 0.2% at $1.1721 but set for a weekly gain of 0.8%. CROSS-CHANNEL DIVERGENCE The common currency took some support Thursday from the European Central Bank meeting. Policymakers left the policy rate at 2%, as expected, but the bank's relatively upbeat assessment of the economic outlook and signs that an EU-U.S. trade deal is near caused investors to reassess previous assumptions of one more rate cut this year. "While a renewed deterioration on the trade front, or a more marked near-term fall in inflation, could still prompt the ECB to cut again, there appears to be a strong bias to keep policy on hold," said Paul Hollingsworth, head of developed markets economics, BNP Paribas Markets 360. "We think the (easing) cycle is over." In contrast, soft British data is supporting expectations of more Bank of England rate cuts, and causing euro zone bond yields to rise faster than British ones, supporting the euro against the pound. The euro rose as much as 0.23% on sterling to 87.27 pence on Friday, its highest since April, building on a 0.44% gain the previous day. Data on Friday showed British retail sales data for June slightly below analysts' expectations, albeit rebounding from a sharp drop in May, after figures on Thursday showed business activity grew only weakly in July and employers cut jobs at the fastest pace in five months. The pound was down 0.5% on the dollar at $1.3445. https://www.reuters.com/world/middle-east/dollar-steadies-set-weekly-drop-focus-shifts-fed-boj-meetings-2025-07-25/

2025-07-25 11:34

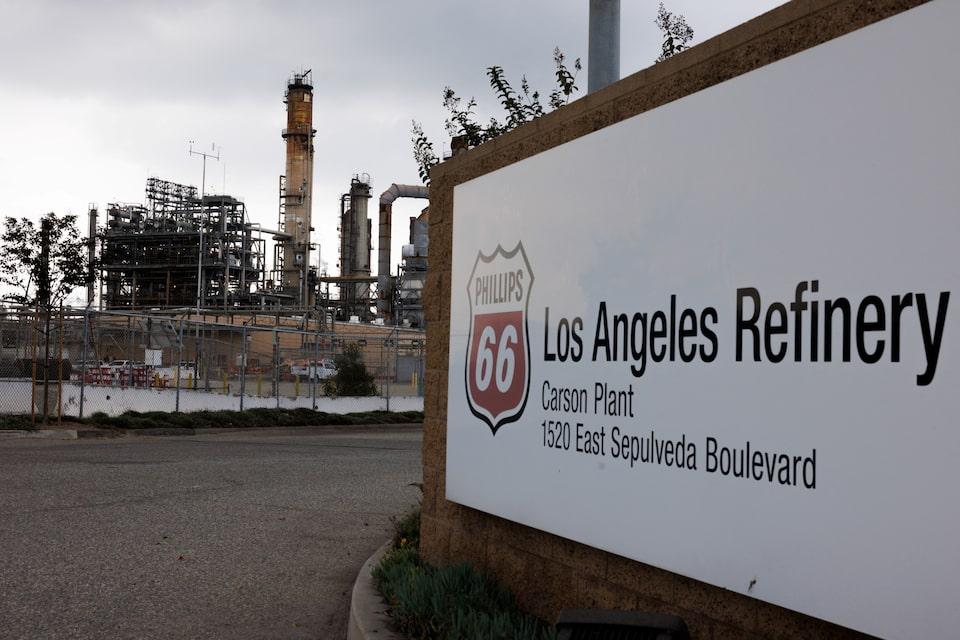

July 25 (Reuters) - Refiner Phillips 66 (PSX.N) , opens new tab beat Wall Street estimates for second-quarter profit on Friday, helped by higher refining margins and lower turnaround expenses. Shares of Phillips 66 were up around 0.8% at 2 p.m. EDT. Sign up here. Top U.S. refiners were expected to post higher second-quarter profit, rebounding from losses in the prior quarter as stronger-than-expected diesel margins lifted earnings. The improved margins helped peers such as Valero Energy (VLO.N) , opens new tab exceed Wall Street estimates. "Earnings beat on stronger refining results from lower opex and retail results from higher U.S. margins," TD Cowen analyst Jason Gabelman said in a note. The refiner's realized margin per barrel rose 12.4% to $11.25 in the quarter from a year ago, while turnaround expenses fell 47% at $53 million. Its crude capacity utilization was 98%, while adjusted earnings from its refining segment rose about 30% at $392 million. Some analysts flagged concerns about heavy debt. The refiner's net debt to capital ratio for the second quarter was 41%, compared to rival Valero's 12%. "Concerns about leverage, as it expands midstream capabilities, remain," said Stewart Glickman, energy equity analyst at CFRA Research. The results come after a board fight in May, where Phillips 66 and activist investor Elliott Investment Management each won two board seats at an annual shareholders meeting. As part of its argument for actions to boost share price, Elliott had advocated exploring the sale or spin-off of its midstream business and other asset divestments, to focus on the company's refining operations. "We will engage with industry experts to make sure that we're thinking about it the right way and certainly we'll lay it out all out for our board to drive to the right conclusions," CEO of Phillips 66, Mark Lashier told analysts during the company's earnings call on Friday. Earlier this year, the refiner reported a bigger-than-expected loss for the first quarter, hurt by lower refining margins amid heavy turnaround activities in the U.S. refining sector. In the second quarter, the refiner's quarterly adjusted earnings for its midstream segment were down about 3% at $731 million from a year ago. The company reported an adjusted profit of $2.38 per share for the second quarter, compared with analysts' average estimate of $1.71, according to data compiled by LSEG. https://www.reuters.com/sustainability/sustainable-finance-reporting/phillips-66-profit-beats-estimates-higher-refining-margins-2025-07-25/

2025-07-25 11:34

DUBAI, July 25 (Reuters) - Iran's Deputy Foreign Minister Kazem Gharibabadi said on Friday that Tehran held a "serious, frank, and detailed" discussion with European powers about sanctions relief and the nuclear issue, in which both sides presented specific ideas. He added that Iran reiterated its principled positions, including on the snapback sanctions mechanism, and that it was agreed that consultations on the matter would continue. Sign up here. https://www.reuters.com/business/energy/irans-gharibabadi-held-serious-talks-with-europeans-consultations-continue-2025-06-25/

2025-07-25 11:28

Latest EU sanctions on Russia targeted Indian refiner Nayara New Nayara CEO has been with company since 2017 Some ships have diverted from Nayara's port since sanctions India is biggest buyer of seaborne Russian crude NEW DELHI, July 25 (Reuters) - Russia-backed Indian refiner Nayara Energy has named a new chief executive after its previous CEO resigned following European Union sanctions that targeted the company, four sources with knowledge of the matter said on Friday. The reshuffle at the top is the latest disruption for the company since the EU announced a new round of sanctions last Friday directed at Russia over its war in Ukraine. Sign up here. This week, a tanker carrying Russian Urals crude was diverted away from Nayara's Vadinar port to unload its cargo at another port in western India, Reuters reported. That came after two other tankers skipped loading refined products from Vadinar, Reuters reported. Mumbai-based Nayara has appointed company veteran Sergey Denisov as chief executive to replace Alessandro des Dorides, the sources said. Denisov's appointment was decided at a board meeting on Wednesday, they said. Nayara Energy did not immediately respond to a request for comment. Des Dorides, who joined Nayara Energy in April 2024, did not immediately respond to a message sent on LinkedIn. In its announcement of his appointment last year, Nayara described Des Dorides as a 24-year veteran of the energy industry. He left Italian major Eni in 2019 after about six months as head of oil trading and operations. Denisov has been with Nayara since 2017. His LinkedIn profile describes him as Nayara's chief development officer. In recent days, Nayara's website has no longer carried pages listing its leadership. The company is one of India's two major private-sector refiners, along with the larger Reliance Industries (RELI.NS) , opens new tab. The pair have been India's biggest buyers of discounted Russian crude. Nayara, which operates India's third-biggest refinery, typically exports at least four million barrels of refined products per month, including diesel, jet fuel, gasoline and naphtha. It has been accelerating sales domestically, and operates more than 6,000 fuel stations. Nayara Energy has criticised the EU's "unjust and unilateral" decision to impose sanctions. Russia's Rosneft holds a 49.13% stake in Nayara and a similar stake is owned by a consortium, Kesani Enterprises Co Ltd, led by Italy's Mareterra Group and Russian investment group United Capital Partners, according to a 2024 note by India's CARE Ratings agency. India, which has become the top importer of seaborne Russian oil in the aftermath of Moscow's Ukraine invasion, has also criticised the EU's sanctions. Rosneft, which said the sanctions on Nayara were unjustified and illegal, did not immediately respond to a request for comment. https://www.reuters.com/sustainability/boards-policy-regulation/ceo-russia-backed-indian-refiner-nayara-resigns-after-eu-sanctions-sources-say-2025-07-25/