2025-07-23 21:22

July 23 (Reuters) - Texas state lawmakers met during a special session on Wednesday, to address for the first time the deadly flash floods that hit the Texas Hill Country this month, killing at least 137 people. Senator Charles Perry, chairperson for the joint Senate-House committee investigating the preparation for and response to the flooding, said the committee did not want to assign blame, but sought "constructive policy solutions which will remit future loss of life." Sign up here. Texas Governor Greg Abbott included the investigation on the agenda of a special legislative session that opened on Monday. Abbott said on social media that the death toll from the July 4 flash flooding ticked up to 137, and a man and a girl remained missing. Nim Kidd, chief of the Texas Division of Emergency Management, was the first person lawmakers called to testify. He described the vast state's emergency response system as fragmented. Under the system, each of 254 counties maintains control over ordering evacuations. Such an order was not given in the hardest hit areas earlier this month. Kidd told lawmakers that to improve preparation for natural disasters, he needed better in-house radar systems, better communications systems to warn local leaders and residents, and more resources for evacuations or to assist residents who shelter in place. The high casualty toll ranked as one of the deadliest U.S. flood events in decades, raising questions about the lack of flash-flood warning sirens in hardest hit Kerr County. Many have expressed concern about vacancies at National Weather Service offices due to staffing cuts under President Donald Trump. The legislative committee investigating the floods will next meet on July 31 in Kerr County. The committee will write a report to be forwarded to the full Texas Senate and House to inform possible legislation during the month-long special session. https://www.reuters.com/sustainability/climate-energy/texas-lawmakers-investigate-flash-floods-death-toll-hits-137-2025-07-23/

2025-07-23 21:16

White House taps mining executive for top NSC role, sources say Copley expected to focus on supply chains, critical minerals Trump administration sees rare earths access as key to national security WASHINGTON, July 23 (Reuters) - The White House has tapped a former mining executive to head an office at the National Security Council focused on strengthening supply chains, three sources said, as a pared-down NSC zeroes in on a few of President Donald Trump's most oft-stated priorities. David Copley, who was chosen earlier in the year to serve as the top mining official at the U.S. National Energy Dominance Council, or NEDC, an interagency body chaired by the interior secretary, is now a senior director at the NSC, said the sources, who requested anonymity to discuss non-public personnel moves. Sign up here. The shift in roles reflects the White House ramping up its efforts to gain ground against China in a critical minerals arms race that touches a broad swath of global industries. China recently demonstrated its leverage by withholding exports of rare earth magnets, upending global markets and forcing U.S. officials back to the negotiating table, before reversing course. At the NSC, Copley will focus on strengthening U.S. supply chains and boosting U.S. access to the critical minerals that are often vital components of advanced military technology, two of the sources said. A White House official said Copley, who did not respond to a request for comment, will be overseeing the NSC's "international economics" component. Copley's precise title was not immediately clear, nor was it clear if he has formally left the NEDC. The decision to tap a mining expert for a top NSC position offers a window into how national security priorities have shifted under U.S. President Donald Trump. The NSC has been sharply downsized in recent months. Offices overseeing Africa and international organizations have been among those shuttered or downgraded, in line with the administration's skepticism of multilateral institutions. A special forces veteran was recently tapped to head the Latin America office, a move that comes as Trump has openly considered unilateral action against Mexican drug cartels. But Trump's focus on obtaining critical minerals like cobalt and nickel has never waned, and China's near-total control of the critical minerals industry has long rankled the president. In May, Reuters reported that Copley was among a clutch of officials who had been working on plans to pull Greenland deeper into America's sphere of influence, in part to ensure access to the island's vast deposits of rare earths. One of the sources said Copley's remit is, broadly speaking, "geostrategic affairs." Geostrategy is a field of international relations that focuses in part on the interplay of resource wealth and security, a matter of particular relevance for an administration that has made securing access to foreign resources a central element of its foreign policy. In April, the U.S. and Ukraine signed a sprawling deal to give the United States preferential access to Ukrainian minerals. An economist by training, Copley is an intelligence officer with the U.S. Navy Reserve, and he worked on Iraq-related issues for the State Department during Trump's first term. He previously held roles at minerals producer U.S. Silica. Copley consulted for Boston Consulting Group earlier in his career and served as an intelligence officer with the Defense Intelligence Agency, a component of the U.S. Department of Defense. Copley until recently had worked in a strategic development role for Denver-based Newmont (NEM.N) , opens new tab, the world's largest gold miner by production with a market value of $54 billion. https://www.reuters.com/world/us/white-house-taps-mining-expert-head-national-security-office-sources-say-2025-07-23/

2025-07-23 21:06

Fed says politics plays no part in its decisions Bessent's charge of a political Fed echoes Trump's Trump wants Fed to cut rates WASHINGTON, July 23 (Reuters) - U.S. Treasury Secretary Scott Bessent on Wednesday suggested without evidence that the Federal Reserve's widely followed economic forecasts are motivated by politics, as the Trump administration steps up pressure on the U.S. central bank to cut interest rates. "The Fed publishes something called a summary of economic projections, and it's pretty politically biased," Bessent said, summarizing the projections as forecasts for one to two quarter-point interest-rate cuts this year. President Donald Trump has demanded the Fed deliver an immediate 300 basis-point rate cut. Sign up here. The Fed publishes interest-rate forecasts from each of its 19 policymakers each quarter and does not identify which policymaker made which forecast. In June, eight projected two quarter-point interest-rate cuts this year, seven projected none, two saw one interest rate cut and two saw three. Two of the Fed Board's Trump appointees - Governor Christopher Waller and Fed Vice Chair for Supervision Michelle Bowman -- have each articulated economic reasons for supporting a rate cut this month. Fed Chair Jerome Powell, also a Trump appointee, has not signaled such support. Fed policymakers universally reject the idea that politics have any role in their monetary policy decisions, and say that to suggest they do undermines the central bank's credibility and its ability to do its job fighting inflation and promoting maximum employment. https://www.reuters.com/business/bessent-says-fed-forecasts-politically-biased-2025-07-23/

2025-07-23 21:03

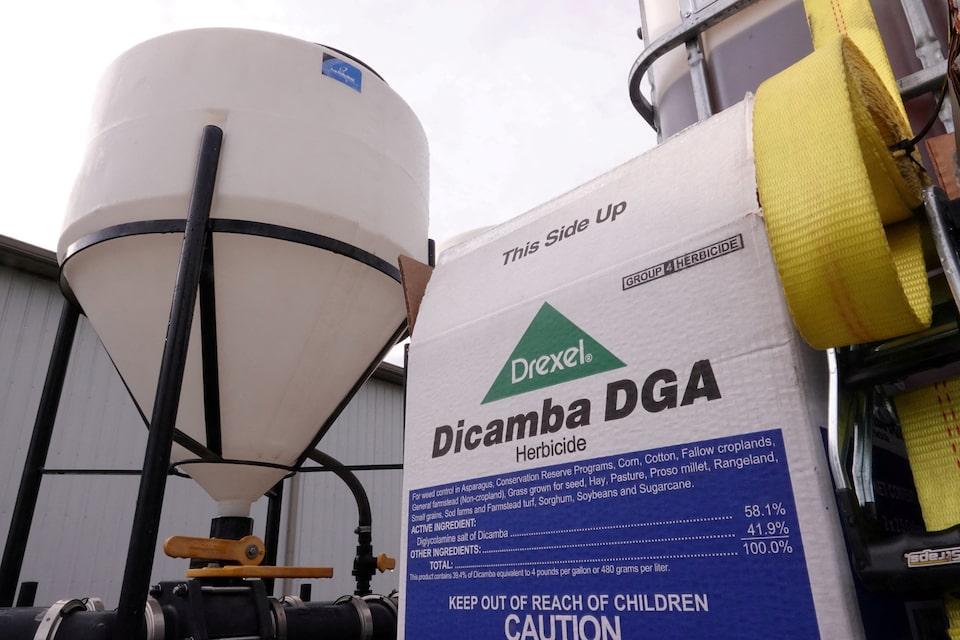

Dicamba use was halted in 2024 by federal court EPA says chemical poses no significant human health or environmental risk Dicamba can drift and cause damage to nearby plants WASHINGTON, July 23 (Reuters) - The U.S. Environmental Protection Agency on Wednesday proposed approvals for three products containing the weedkiller dicamba, whose use was halted by a federal court in 2024, arguing it does not pose a significant human health or environmental risk. Cotton and soybean farmers had sprayed dicamba on crops that were genetically engineered to resist the herbicide, which controls tough weeds. Environmental groups have criticized the chemical because it can drift from where it is sprayed and damage neighboring plants. Sign up here. A 2024 U.S. District Court ruling found the EPA previously violated public input procedures in its approval of three dicamba products, and vacated the product registrations. As a result, farmers were unable to spray dicamba on crops this year. The EPA has received applications from Bayer AG (BAYGn.DE) , opens new tab, BASF and Syngenta for new approvals, the agency said in regulatory documents. Bayer, which sold the dicamba herbicide XtendiMax, said it was pleased the EPA opened a public comment period on its proposal to approve dicamba usage. "We are confident that low-volatility dicamba herbicides, when used according to the label, can be used safely and successfully on-target," Bayer said. BASF said it would work with regulators to ensure farmers can use dicamba. Syngenta did not immediately respond to a request for comment. An EPA review found no risk to human health from the products, but some risk to certain plants, it said in a release. To mitigate that risk, the agency is proposing restrictions on how much of the chemical can be applied and when, the release said. The top pesticides official at the EPA's Office of Chemical Safety and Pollution Prevention, Kyle Kunkler, previously worked as a lobbyist for the American Soybean Association, which has supported allowing farmers to spray dicamba on soybeans. The association said it was reviewing the EPA's proposal and that dicamba is a critical tool for farmers. https://www.reuters.com/sustainability/climate-energy/us-epa-moves-approve-dicamba-weedkiller-use-cotton-soybeans-2025-07-23/

2025-07-23 21:02

ORLANDO, Florida, July 23 (Reuters) - TRADING DAY Making sense of the forces driving global markets Sign up here. By Jamie McGeever, Markets Columnist A sense of euphoria washed over global stock markets on Wednesday as a U.S.-Japan trade deal and indications of a U.S.-Europe agreement lifted major indexes around the world, pushing the S&P 500 and MSCI All Country to new highs. More on that below. In my column today I look at why the U.S. bond market has been so calm lately despite swirling fears over tariffs, deficits and inflation. Foreign demand, especially from the private sector, appears to have returned with a bang. If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves Tracking trade - from gloom to boom The tariff pessimism that choked markets immediately following President Donald Trump's 'Liberation Day' in early April seems like an age ago. The U.S.-Japan deal and signs of progress on a U.S.-Europe accord injected buoyant stocks with a further dose of adrenaline on Wednesday. At first blush, the Japan deal looks to be much better than investors had expected, with the U.S. tariff on Japanese imports set at 15% instead of the previously threatened 25%. This includes autos too, the largest single component of the U.S. trade deficit with Japan. Investors appear to be cheering the 15% rate. If this is the level agreed upon in the U.S.-EU deal, as European diplomats suggest, it will be half the 30% levy Trump is currently threatening to impose. Relative to the worst-case expectations, that's also a huge relief for markets. At least that's how investors are trading it right now. It remains to be seen what the longer-term tariff impact on growth, inflation, consumer spending, and corporate profits will be. While the tariff relief dominated markets on Wednesday, equity investors also had the latest wave of U.S. earnings to digest - shares in Google's parent company Alphabet fell 2% in after-hours trading, and Tesla shares rose around 1%. In bonds, a $13 billion auction of 20-year Treasuries was met with strong demand, selling at nearly two basis points below the market at the bidding deadline. This helped limit the broad rise in yields underway on the back of the trade optimism. It was a different story in Japan, where the first sale of 40-year debt since Sunday's upper house election defeat for Prime Minister Shigeru Ishiba logged the weakest demand in almost 14 years. The 40-year yield climbed towards its recent 17-year high, and the 10-year yield hit its highest since 2008. Ishiba denied reports that he is about to resign. But uncertainty around his future, fiscal policy and the Bank of Japan's rate path is extremely high. Thursday's focus will turn to the European Central Bank, which is expected to pause after eight consecutive rate cuts and keep its deposit rate on hold at 2.00%. Foreign demand for U.S. Treasuries holds off bond vigilantes So much for the bond vigilantes. The U.S. bond market has been remarkably calm lately, despite fears that inflation, tariffs, eroding Fed independence, and Washington's ballooning debt load will push up Treasury yields. What explains the resilience? The above concerns remain valid, of course, as any one of them could eventually cast a long shadow over the world's largest and most important market. But that doesn't seem to be on the immediate horizon. The so-called bond vigilantes - those investors determined to bring profligate governments into line by forcing up their borrowing costs - might have been driving bond prices lower earlier this year, but they are taking a back seat now. The 10-year Treasury yield on Tuesday closed at 4.34%. That's below the year-to-date average of 4.40%, and less than 10 basis points above the one- and two-year averages. Perhaps even more surprising, implied Treasury market volatility is hovering at its lowest levels in three-and-a-half years, further evidence that investors have little fear of an imminent spike in borrowing costs. OVERSEAS DEMAND The obvious explanation is that demand for Treasuries has picked up, investors lured back into the market by attractive yields on 10-year bonds approaching 5% and even juicer returns on 30-year paper. Concern about an economic slowdown, and thus lower interest rates, is likely adding fuel to this trend. A lot of this demand has likely come from overseas, based on the latest release of Treasury International Capital flows data. Admittedly, these figures are released with a lag, but they are among the most reliable and closely tracked of all international flows information. The TIC data show that the foreign official and private sectors bought a net $146.3 billion of U.S. Treasury notes and bonds in May on a non valuation-adjusted basis. That's the second-highest monthly total ever. And if you include corporate debt, agency bonds and equities, total foreign purchases of U.S. securities in May were the highest on record. Private sector investors accounted for roughly 80% of that total. Their holdings of U.S. Treasuries began to outstrip official holdings a few years ago, and that trend seems to be accelerating. They now hold over $5 trillion, compared to the official sector's $4 trillion. Bank of America's U.S. rates strategy team notes that outsized foreign private demand has also been evident in more recent flows data, particularly from Japanese investors who have bought more than $60 billion in overseas bonds since the start of May. Demand from private sector buyers like pension funds is generally thought to be more price-sensitive than reserve managers and sovereign wealth funds, who are more inclined to buy and hold for the very long term. REGULATION, STABLECOINS Will the back end of the yield curve remain resilient? This will obviously depend in part on what happens in the U.S. economy. But there are a few exogenous factors that could boost demand moving forward, including potential regulatory changes to the U.S. banking system and the accelerated adoption of cryptocurrency stablecoins. First, the Fed has proposed revisions to the supplementary leverage ratio, which would free up capital for banks to hold more Treasuries. That could generate an estimated $1.1 trillion in extra buying capacity. Next, the increased use of stablecoins, digital tokens that are pegged 1:1 to highly liquid assets like T-bills, short-dated bonds or the U.S. dollar, could drive demand for shorter-dated Treasuries. The House of Representatives last week passed a bill to create a regulatory framework for stablecoins, and U.S. President Donald Trump is expected to sign it into law soon. HIBERNATING BEARS Despite all this, there are still plenty of bond bears out there with good reasons to be bearish, not least the $1 trillion flood of new debt issuance expected before this year is out. But what the market action in the first half of this year has shown – filled as it has been with heightened uncertainty around tariffs, geopolitics, deficits and the Fed – is that bond market selloffs aren't likely to last long. That's partly because of the lack of a true alternative. The near-$30 trillion Treasury market is bigger than the Chinese, Japanese, French, UK and Italian government bond markets combined. And it is more than ten times bigger than the German Bund market, the euro zone's premium safe-haven asset. Underlying demand is stronger than the vigilantes have bargained for. What could move markets tomorrow? Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/world/china/global-markets-trading-day-2025-07-23/

2025-07-23 20:57

WASHINGTON, July 23 (Reuters) - The Federal Aviation Administration agreed on Wednesday to extend cuts to minimum flight requirements at congested New York City airports through October 2026, citing significant air traffic controller staffing shortages. Under minimum flight requirements, airlines can lose their takeoff and landing slots at congested airports if they do not use them at least 80% of the time. The FAA's waiver allows airlines to fly 10% fewer flights. The FAA has previously issued a series of waivers to address the staffing issues at JFK and LaGuardia for several years. Sign up here. The FAA said it does not anticipate issuing further broad slot waivers as it works on a "long-term solution to solve the chronic low levels of fully certified air traffic controllers" overseeing New York traffic. Airlines for America, a trade group representing American Airlines (AAL.O) , opens new tab, United Airlines (UAL.O) , opens new tab Delta Air Lines (DAL.N) , opens new tab Southwest Airlines (LUV.N) , opens new tab in April asked for an extension through October 2027 and also to cover flights at Newark. In May, the FAA ordered flight cuts at Newark, one of the main airports serving New York City following a series of major disruptions. The airlines said this year about 75% of all delays in the National Airspace System occur because of delays in the NYC Airspace. "Delays and cancellations in the NYC Airspace ripple across the entire NAS so it is critical to ensure this part of the system is healthy," the group said. The FAA is also extending flexibility for impacted flights operating between Ronald Reagan Washington National Airport and New York airports. The FAA is about 3,500 air traffic controllers short of targeted staffing levels and a series of near-miss incidents has raised concerns in recent years, but Congress approved $12.5 billion in recent weeks to boost hiring and overhaul the system. A persistent shortage of controllers has delayed flights and, at many facilities, controllers are working mandatory overtime and six-day weeks. A report last month found the FAA's air traffic workforce in 2024 logged 2.2 million hours of overtime, costing $200 million. https://www.reuters.com/world/us/us-extends-cuts-minimum-new-york-flight-requirements-through-late-2026-2025-07-23/