2025-07-22 23:56

TOKYO, July 22 (Reuters) - Japan has launched an anti-dumping investigation into nickel-based stainless cold-rolled steel sheets and strips imported from China and Taiwan, its trade and finance ministries said on Tuesday. The move follows a petition filed on May 12 by Nippon Steel (5401.T) , opens new tab and other domestic manufacturers, who claim they have been forced to lower prices due to weakening domestic demand as buyers have shifted to cheaper imports. Sign up here. The Ministry of Economy, Trade and Industry and the Ministry of Finance plan to complete the investigation within a year and will then decide whether to impose anti-dumping duties. According to the application submitted by the steelmakers, imported products were being sold in Japan at prices 20% to 50% lower than those in China and 3% to 20% lower than those in Taiwan. The Japanese steelmakers claim they have been unable to set prices that reflect rising costs, leading to a decline in operating profits and other damages. Excess production and exports by Chinese steelmakers have become an international concern. Japan is among a number of countries that have criticised Chinese companies for receiving government subsidies to produce excess steel and then exporting it at cheap prices, worsening global market conditions. While other countries have imposed anti-dumping measures or similar actions against China, Japan has yet to do so. Tadashi Imai, chairman of the Japan Iron and Steel Federation and also president of Nippon Steel, has repeatedly warned the global rise in protectionism could leave Japan vulnerable to inexpensive steel imports, hurting domestic production. Taiwan's economy ministry, in a statement sent to Reuters, said when it came to such cases it would help impacted companies respond "in order to protect their export interests." China's commerce ministry did not immediately respond to a request for comment. https://www.reuters.com/world/china/japan-launches-anti-dumping-probe-into-stainless-steel-sheets-china-taiwan-2025-07-22/

2025-07-22 23:47

July 23 (Reuters) - Australia's Woodside Energy (WDS.AX) , opens new tab reported a stronger-than-expected 8% rise in second-quarter revenue on Wednesday due to robust output from Senegal's Sangomar project, though it marginally lowered its annual production forecast following an asset divestment. Woodside in late March agreed to sell offshore oil and gas assets in Trinidad and Tobago to London-based Perenco, which included production facilities and interests in the shallow water Angostura and Ruby fields within the Greater Angostura project. Sign up here. The country's top gas producer posted revenue of $3.28 billion for the three months ended June 30, surging 8% from $3.04 billion a year earlier and comfortably exceeding the Visible Alpha consensus estimate of $3.09 billion. The revenue beat underscores the strong performance of the Sangomar project, which has emerged as a key growth driver for the company. Overall production jumped 13% to 50.1 million barrels of oil equivalent (mmboe) during the quarter, up from 44.4 mmboe in the same period last year. As a result of the asset sale, Woodside marginally adjusted its 2025 production forecast to between 188 and 195 mmboe, compared with its previous guidance range of 186 to 196 mmboe. https://www.reuters.com/business/energy/woodsides-second-quarter-revenue-beats-estimates-sangomar-output-trims-2025-2025-07-22/

2025-07-22 23:46

July 23 (Reuters) - Australia's top fuel retailer Ampol Ltd (ALD.AX) , opens new tab on Wednesday forecast weaker half-year earnings as sea-freight conditions impacted its supply chain, and reported a 1.1% drop in second-quarter refining margins at its Lytton refinery. The company expects first-half earnings before interest and tax on a replacement cost basis (RCOP EBIT) to be A$400 million ($262.04 million), compared with A$502.1 million a year earlier. Sign up here. The second-quarter refining margin at its Lytton refinery in Queensland, one of the company's key assets, decreased to $8.71 per barrel in the second quarter, down from $8.81 last year. Over the year, operational disruptions such as planned maintenance and loss of production days due to Cyclone Alfred, coupled with weak refining margins in Singapore, have weighed on refining margins and the output levels of the Queensland refinery. However, the refinery margin increased from the prior quarter's $6.07 per barrel, due to improved product crack - the difference between the price of crude oil and the prices of the refined petroleum products - in the later part of the year. The Sydney-based firm reported second-quarter total sales volume of 6,304 million liters (ML), down 4.7% from a year earlier. Its Lytton refinery output for the second quarter was 1,406 ML, compared to 1,420 ML logged a year earlier. The company is slated to report its half-year financial results on August 18. ($1 = 1.5265 Australian dollars) https://www.reuters.com/business/energy/ampol-forecasts-lower-half-year-earnings-supply-chain-impacts-2025-07-22/

2025-07-22 23:38

MEXICO CITY, July 22 (Reuters) - Mexican lender Banorte's (GFNORTEO.MX) , opens new tab net profit ticked up 4% in the second quarter, lifted by a double-digit jump in its loan book, it reported on Tuesday. Net profit for the period was 14.62 billion pesos ($779.09 million), but below the 15.01-billion-peso estimate from analysts polled by LSEG. Sign up here. Net interest income, the difference between what banks earn on loans and dole out in deposits, grew 12% from the year-ago quarter, which Banorte attributed to a more diversified portfolio and lower funding costs. That rise helped offset an 887-million-peso hit from foreign exchange impacts, Banorte, one of Mexico's largest banks, said. The growth comes during an interest-rate-cutting cycle from Mexico's central bank, which in June trimmed the benchmark rate to its lowest level in nearly three years. Lower rates typically pressure rate margins. Banorte's total portfolio, minus government loans, posted 13% growth year-on-year. The consumer segment posted the strongest performance, with auto loans climbing 30% and credit card loans rising 18%. Corporate and commercial loans also grew in the double digits, though government lending fell as loans were paid back early. Return on equity, a key measure of profitability, ticked up to 23.6% from 23.3% a year earlier, while the bank's non-performing loan ratio held steady at 1.1%. Banorte maintained its full-year guidance, projecting net income between 59.6 billion and 62.1 billion pesos and loan growth of 8% to 11%. "Given Banorte's track record, we translate (that) into confidence on the provided ranges, particularly in loan growth," analysts at Citi wrote in a note, saying it was a key concern among investors. MONEY LAUNDERING JITTERS Banorte's CEO, Marcos Ramirez, told journalists that the lender was wrapping up its relationships with firms which in June had been targeted by the U.S. Treasury for alleged money laundering concerns. The sanctions applied to three financial institutions -- CIBanco, Intercam Banco and Vector Casa de Bolsa -- and while the groups are relatively small, they have sent shockwaves through Mexico's banking system. Ramirez said Banorte had doubled down on its own anti-money laundering standards, which it had boosted earlier in the year after calls to do so from the U.S. Ramirez said as head of Mexico's banking association, the group was unaware of any investigations into other groups, which the market has widely speculated. ($1 = 18.7654 pesos at end-June) https://www.reuters.com/business/finance/mexicos-banorte-posts-4-profit-bump-loan-book-grows-2025-07-22/

2025-07-22 23:14

FRANKFURT, July 23 (Reuters) - Central banks risk being blindsided by climate-driven shocks to global labour markets unless they overhaul their approach to monetary policy, a report published on Wednesday by the London School of Economics warned. The study found that, even under relatively optimistic scenarios in which global warming is limited to 1.5-2 degrees, climate change would lower labour productivity, particularly in agriculture, construction and other sectors exposed to heat. Sign up here. With up to 1.2 billion workers in 182 countries vulnerable to climate disruption, the report by the Centre for Economic Transition Expertise (CETEx) urged monetary authorities to pay greater attention to environmental risks - from natural disasters to the consequences of the green transition. "Our research shows that central banks should seek to integrate environmental employment risks into their policies and operations," said Joe Feyertag, senior policy fellow at CETEx and author of the report. The European Central Bank and the Bank of England have highlighted the dangers stemming from climate change and its potential impact on inflation, growth and banks' health. But the U.S. Federal Reserve, in many ways the world's most influential central bank, withdrew from a climate-focused network of authorities earlier this year, raising questions about the depth of its engagement on these issues. The report found rich countries were most at risk from the shift away from pollution-intensive industries. By contrast, poorer regions in Africa, Asia and Latin America faced a bigger threat from physical risk such as floods and droughts. These divergent pressures, combined with demographic shifts and tighter immigration policies, could further strain labour markets in developed countries while loosening them in emerging ones, the study said. Feyertag also warned that labour market disruptions could amplify social inequalities, especially in countries with rigid labour markets Inflation tends to be higher in a tighter labour market, all other factors being equal. Low productivity can also contribute to high inflation. Feyertag reviewed 114 central bank mandates and found just 15 of them, including the Bank of England, explicitly reference employment as a main or secondary objective. The Fed and Reserve Bank of Australia include jobs as a core policy goal. This could give some of these banks cover to take bolder action in order to cushion the labour-market impact of climate change. "If their mandate allows, (central banks) could even take more active steps to stimulate demand for workers from low-carbon or climate-resilient employment opportunities and thereby smoothen this path," Feyertag said. https://www.reuters.com/sustainability/cop/central-banks-told-prepare-climate-shock-labour-market-2025-07-22/

2025-07-22 23:13

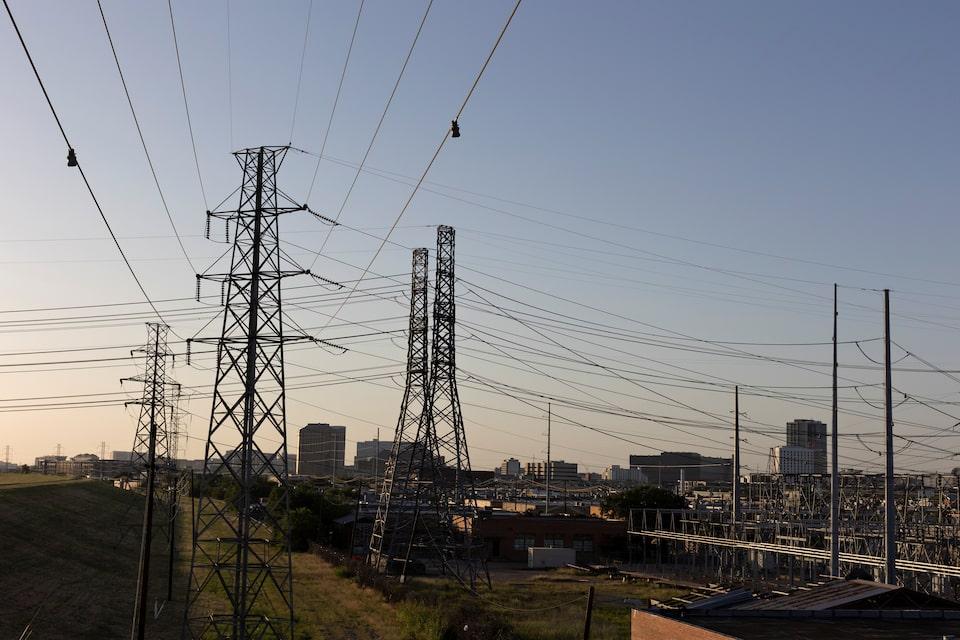

PJM auction prices rise due to data center demand, supply shortfall Shares of power companies rise on auction results Environmental groups criticize PJM for slow renewable energy integration July 22 (Reuters) - Prices out of the biggest U.S. power auction, held by grid operator PJM Interconnection, cleared at $329.17 a megawatt-day, roughly 22% higher than last year's record-high levels as electricity demand continues to outstrip supply, according to results released by the organization on Tuesday. A recent surge in U.S. power consumption driven by Big Tech's data center demand has butted up against roughly a decade of shrinking power supplies in PJM, North America's largest power grid operator, leading to a supply shortfall that has driven up prices in the capacity auction. Sign up here. PJM's capacity auction determines what power plant owners in the grid network, which covers one in five Americans, will be paid to guarantee that they pump out electricity during times of extreme demand to help avoid blackouts. Shares of major power-producing companies that receive capacity payments rose on the auction results. Talen Energy shares were up over 9%, Constellation Energy shares rose over 5%, and NRG Energy (NRG.N) , opens new tab climbed over 6% in trading after the bell. The payments are a sign of the energy supply and demand balance in PJM, with higher prices typically acting as an incentive for developers to build more power plants. PJM's territory covers 13 states and the District of Columbia, as well as the biggest concentration of data centers in the world, including Virginia's "Data Center Alley." The latest auction, which covers the year beginning next summer, is showing signs of a continued supply crunch. PJM attracted 2,669 megawatts of additional power supplies, which will be added through upgrading existing power plants and adding new ones, marking the first time in the last four auctions that new generation was added. The additions, however, represent only about half the amount of new power demand PJM expects to see over the period the auction covers. While prices overall increased from last year, two zones within PJM - covered by Baltimore Gas and Electric Company and Dominion Energy (D.N) , opens new tab - saw price decreases. "Rapid electricity demand growth continues to outpace the rate of new generation," Evercore ISI analyst Nicholas Amicucci said in a note of the higher prices. BACKLASH Year-ago auction prices shot up by more than 800%, rising to $269.92 per megawatt-day from the previous year as data center demand crept up. Prices from that auction began to take effect last month, while the most recent results will impact bills beginning next summer. Those high payment prices, which are ultimately paid for by the public, drew a backlash from state consumer advocates, politicians and environmental groups, leading to several changes at PJM. PJM says it expects power bills for homes and businesses will rise only 1.5% to 5% year-over-year as a result of the latest auction results. Prices in BGE and Dominion may decline, it said. The types of power-generating capacity cleared through the auction included 45% natural gas, 21% nuclear, 22% coal, 4% hydro, 3% wind and 1% solar. Environmental groups, which successfully sued over the last PJM capacity results, said PJM has failed to quickly connect new carbon-free renewable power like wind and solar. “PJM has failed our communities through its refusal to adopt substantive reforms, completely at odds with its mission of providing reliable energy at the lowest cost to its customers,” said Jessi Eidbo, Sierra Club senior adviser. PJM said it has approved the connection of 46,000 MW of power plants, many of them solar, but those projects have not yet been built for reasons outside the grid operator's control. https://www.reuters.com/business/energy/biggest-us-power-grid-auction-prices-rise-by-22-new-heights-2025-07-22/