2025-07-22 21:32

Baker Hughes wraps up oilfield sector earnings with profit beat, cautious upstream spending outlook Company aims to exceed $1.5 billion data center orders target earlier than expected Gas technology services orders surge 28%, boosting IET revenue July 22 (Reuters) - Oilfield services provider Baker Hughes (BKR.O) , opens new tab surpassed Wall Street expectations for second-quarter profit on Tuesday, helped by robust demand for its natural gas services even as it warned of a drop in spending by oil producers. Baker Hughes joined its U.S. rivals Halliburton (HAL.N) , opens new tab and SLB (SLB.N) , opens new tab in warning of a slowdown in upstream activity and spending, as producers grapple with weakness and volatility in commodity prices. Sign up here. In North America, upstream spending is expected to be down in the low-double digits, Baker Hughes said on Tuesday, while international spending could be down in the high-single digits. However, the Big 3 oilfield services firms are concentrating on pockets of resilience such as LNG infrastructure, power grid upgrades and data center-driven power demand to weather a slower, more uneven recovery. The energy industry is benefiting from an increase in demand for natgas, driven primarily by LNG exports and rising electricity consumption as a result of hotter temperatures, data centers and AI operations. Baker Hughes has been trying to leverage its industrial and energy technology (IET) portfolio to drive growth and expand its presence in the natural gas and LNG sectors. With demand from data centers rapidly accelerating, Baker Hughes said it is well-positioned to "meet or exceed" its three-year target to book $1.5 billion of orders in data center equipment earlier than anticipated. Shares of the company rose over 2% after the bell. Orders in Baker Hughes' gas technology services business jumped 28% during the quarter, lifting revenue in the IET segment to $3.29 billion. However, total revenue fell 3% to $6.91 billion from last year as a slowdown in drilling activity across key markets weighed on demand for its oilfield equipment and technology. The Houston-based company posted an adjusted per-share profit of 63 cents for the three months ended June 30, compared with analysts' estimates of 56 cents apiece, according to data compiled by LSEG. https://www.reuters.com/business/energy/baker-hughes-beats-second-quarter-profit-estimates-strong-demand-natgas-2025-07-22/

2025-07-22 21:29

BRASILIA, July 22 (Reuters) - Brazil's government on Tuesday eased the total spending curbs previously deemed necessary to comply with fiscal rules, after raising its net revenue forecast by 27.1 billion reais ($4.87 billion) this year, according to its latest revenue and expenditure report. The Finance and Planning ministries fully eliminated the spending freeze announced in May to meet this year's fiscal target, which had totaled 20.7 billion reais. Sign up here. The boost was driven mainly by an upward revision of 17.9 billion reais in projected revenue from natural resource exploration. The report also slightly raised to 10.7 billion reais, from 10.6 billion previously, the spending block needed to comply with the cap on expenditure growth under the new fiscal framework approved during the administration of leftist President Luiz Inacio Lula da Silva in 2023. As a result, the total amount of spending curbs - which had stood at 31.3 billion reais when including the now-reversed freeze - fell to 10.7 billion reais. The higher estimate for public revenue follows congressional approval of a measure that clears the way for an extra oil auction involving uncontracted areas in the offshore pre-salt region, a move first reported by Reuters in April. This year's fiscal target is a primary deficit of zero, with a tolerance band of 0.25% of GDP in either direction. That means the government can post a primary deficit of up to 31 billion reais and still remain in compliance with the goal. The government now forecasts a primary deficit of 26.3 billion reais, excluding nearly 50 billion reais in court-ordered payments, which the Supreme Court has ruled should not be included in the fiscal target calculation. ($1 = 5.5681 reais) https://www.reuters.com/world/americas/brazil-eases-2025-spending-curbs-needed-comply-with-fiscal-rules-2025-07-22/

2025-07-22 21:16

July 22 (Reuters) - Prices out of an annual energy auction held by PJM Interconnection, the largest grid operator in the U.S., cleared at $329.17 a megawatt-day, 22% higher than last year's record-high levels, according to results released by the organization on Tuesday. A recent surge in U.S. power consumption driven by Big Tech's data center demand has butted up against roughly a decade of shrinking power supplies in PJM, leading to a supply shortfall that has driven prices in the capacity auction to new heights. Sign up here. PJM's so-called capacity auction determines what power plant owners in the grid network that covers one in five Americans will be paid to guarantee that they pump out electricity during times of extreme demand, which typically happen on the hottest or coldest days of the year. Shares of major power-producing companies in PJM rose on the auction result news. Talen Energy shares up over 9%, Constellation Energy up over 5% and NRG Energy up over 6% in trading after the bell. The payments are a sign of the energy supply and demand balance on the grid, which spans 13 states and the District of Columbia, with higher prices typically acting as an incentive for developers to build more power plants. PJM's territory covers the biggest concentration of the world's energy-intensive data centers in Northern Virginia's "Data Center Alley" and other fledgling hubs that require massive amounts of electricity faster than power plants are connecting to the grid. Year-ago auction prices shot up by more than ninefold, rising to $269.92 per megawatt-day from the previous year as data center demand crept up. Those high payment prices, which are ultimately paid for by the public, drew a backlash from state consumer advocates, politicians and environmental groups, leading to several changes at PJM. The capacity cleared through the auction was 45% natural gas-fired power, 21% nuclear, 22% coal, 4% hydro, 3% wind and 1% solar. https://www.reuters.com/business/energy/prices-jump-22-biggest-us-power-grid-energy-auction-2025-07-22/

2025-07-22 21:05

ORLANDO, Florida, July 22 (Reuters) - TRADING DAY Making sense of the forces driving global markets Sign up here. By Jamie McGeever, Markets Columnist The rally in U.S. tech stocks lost steam on Tuesday while bond yields and the dollar fell, as investors trimmed positions ahead of the first 'Big Tech' earnings reports and digested U.S. President Donald Trump's latest tirade against Fed Chair Jerome Powell. More on that below. In my column today I look at the differences - and potentially worrying similarities - between today's AI frenzy and the dotcom boom and bust of 25 years ago. Is today's bubble bigger than it was back then? If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves Tech cools, Trump's Fed ire burns If investors cooled their stock-buying fervor on Tuesday, Trump showed no sign of relaxing the pressure he's heaping on Powell, branding the Fed chair a "numbskull" for not cutting interest rates. Financial markets may be getting inured to the attacks by now, but one wonders if Powell will be prepared to face another 10 months of them until his term as Fed Chair expires. With Powell in blackout period ahead of next week's Fed decision, investors are unlikely to hear from him until next Wednesday when he holds his scheduled post-meeting press conference. Powell has insisted he won't resign and that Trump does not have the legal authority to fire him, while the president doesn't appear to be in any mood to tone down his rhetoric against Powell or the Fed as an institution. The standoff is getting more tense. So much so, former PIMCO CEO and co-CIO Mohamed El-Erian posted on X that Powell should resign "to safeguard the Fed's operational autonomy," a far from ideal scenario but preferable to the growing and broadening threats to Fed independence which will "undoubtedly increase should he remain in office." Meanwhile, on trade, Treasury Secretary Scott Bessent said he will meet his Chinese counterpart next week in Stockholm to discuss extending an August 12 deadline for a deal to avert sharply higher tariffs. Trump said he may take up President Xi Jinping on his offer to visit "in the not-too-distant future". Washington announced a trade deal with the Philippines which will see imports from the South East Asian country slapped with 19% tariffs, while the U.S. will pay zero tariffs. Similar tariffs on imports from Indonesia were also announced. U.S.-Philippines and U.S.-Indonesia goods trade volumes last year were around $23.5 billion and $38.3 billion, respectively. The latest U.S. corporate earnings were a mixed bag, with Coca-Cola reporting strong profits and demand, while General Motors' net income slumped by a third as tariff costs took a $1.1 billion bite from its bottom line. Still, nearly 80% of the S&P 500 firms that have reported so far have beaten analyst expectations, according to LSEG data. Analysts' year-on-year aggregate earnings growth forecasts for the index now stand at 7.0%, up from 5.8% as of July 1. Attention on Wednesday rests squarely on Alphabet and Tesla, the first of the megacap tech firms to report. Is today's AI boom bigger than the dotcom bubble? Wall Street's concentration in the red-hot tech sector is, by some measures, greater than it has ever been, eclipsing levels hit during the 1990s dotcom bubble. But does this mean history is bound to repeat itself? The growing concentration in U.S. equities instantly brings to mind the internet and communications frenzy of the late 1990s. The tech-heavy Nasdaq peaked in March 2000 before cratering 65% over the following 12 months. And it didn't revisit its previous high for 14 years. It seems unlikely that we'll see a repeat of this today, right? Maybe. The market's reaction function appears to be different from what it was during the dotcom boom and bust. Just look at the current rebound from its post-'Liberation Day' tariff slump in early April – one of the fastest on record – or its rally during the pandemic. But despite all of these differences, there are also some worrying parallels. Investors would do well to keep both in mind. TOP 10 CLUB The most obvious similarity between these two periods is the concentration of tech and related industries in U.S. equity markets. The broad tech sector now accounts for 34% of the S&P 500's market cap, according to some data, exceeding the previous record of 33% set in March 2000. Of the top 10 companies by market capitalization today, eight are tech or communications behemoths. They include the so-called 'Magnificent 7' – Apple (AAPL.O) , opens new tab, Amazon (AMZN.O) , opens new tab, Alphabet (GOOGL.O) , opens new tab, Meta (META.O) , opens new tab, Microsoft (MSFT.O) , opens new tab, Nvidia (NVDA.O) , opens new tab and Tesla (TSLA.O) , opens new tab – as well as Berkshire Hathaway (BRKa.N) , opens new tab and JPMorgan (JPM.N) , opens new tab. By contrast, only five of the 10 biggest companies in 1999 were tech firms. The other five were General Electric (GE.N) , opens new tab, Citi, Exxon (XOM.N) , opens new tab, Walmart (WMT.N) , opens new tab, and Home Depot (HD.N) , opens new tab. On top of that, the top 10 companies' footprint in the S&P 500 (.SPX) , opens new tab today is much larger than it was back then. The combined market cap of the top 10 today is almost $22 trillion, or 40% of the index's total, significantly higher than the comparable 25% in 1999. This all reflects the fact that technology plays a much bigger role in the U.S. economy today than it did around the turn of the millennium. AI BUBBLE? By some measures, the current tech boom, driven in part by enthusiasm for artificial intelligence, is more extreme than the IT bubble of the late 1990s. As Torsten Slok, chief economist at Apollo Global Management, points out, the 12-month forward earnings valuation of today's top 10 stocks in the S&P 500 is higher than it was 25 years ago. However, it's worth remembering that the dotcom bubble was characterized by a frenzy of public offerings and a raft of companies with shares valued at triple-digit multiples of future earnings. That's not the case today. While the S&P tech sector is trading at 29.5 times forward earnings today, which is high by historical standards, this is nowhere near the peak of almost 50 times recorded in 2000. Similarly, the S&P 500 and Nasdaq are currently trading around 22 and 28.5 times forward earnings, compared with the dotcom peaks of 24.5 and over 70 times, respectively. $3 TRILLION INVESTMENT HURDLE With all that being said, a meaningful, prolonged market correction cannot be ruled out, especially if AI-driven growth isn't delivered as quickly as investors expect. AI, the new driver of technological development, will require vast capital outlays, especially on data centers, which may mean that earnings and share price growth in tech could slow in the short run. According to Morgan Stanley, the transformative potential of generative AI will require roughly $2.9 trillion of global data center spending through 2028, comprising $1.6 trillion on hardware like chips and servers and $1.3 trillion on infrastructure. That means investment needs of over $900 billion in 2028, they reckon. For context, combined capital expenditure by all S&P 500 companies last year was around $950 billion. Wall Street analysts are well aware of these figures, which suggests that at least some percentage of these huge sums should be factored into current share prices and expected earnings, but what if the benefits of AI take longer to deliver? Or what if an upstart (remember China's DeepSeek) dramatically shifts growth expectations for a major component of the index, like $4-trillion chipmaker Nvidia? Of course, technology is so fundamental to today's society and economy that it's difficult to imagine its market footprint shrinking too much, for too long, as this raises the inevitable question of where investor capital would go. It's therefore reasonable to question whether a tech crash today would take well over a decade to recover from. But, on the other hand, it's that type of thinking that has gotten investors into trouble before. What could move markets tomorrow? Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/world/china/global-markets-trading-day-2025-07-22/

2025-07-22 21:04

Beats quarterly profit estimates Raises full-year production forecast Sees in-basin natural gas power and data center demand July 22 (Reuters) - EQT Corp (EQT.N) , opens new tab beat Wall Street estimates for second-quarter adjusted profit on Tuesday as the U.S. energy company benefited from stronger natural gas prices and sales volumes, sending its shares up 1.2% in extended trading. The company also raised its full-year production forecast to reflect the $1.8 billion acquisition of Olympus Energy. Sign up here. "We are seeing tremendous momentum for in-basin natural gas power and data center demand and EQT is uniquely positioned to capitalize on this set-up," said CEO Toby Rice. The energy sector has been riding a rise in demand for natural gas, fueled by LNG exports and increasing power consumption due to hotter temperatures and data center operations. Higher natural gas prices through 2025 compared with last year have also supported production levels, according to the U.S. Energy Information Administration (EIA). During the quarter, EQT's average realized price for natural gas jumped 20.6% year-over-year to $2.81 per thousand cubic feet equivalent (Mcfe). In April, EQT announced plans to reduce capital spending but produce more energy in 2025, attributing the decision to strong well performance, efficiency gains and synergies from the company's purchase of Equitrans Midstream , opens new tab in 2024. The Pittsburgh, Pennsylvania-based company now expects annual production of between 2,300 and 2,400 billion cubic feet equivalent (Bcfe), from 2,200 to 2,300 Bcfe previously. Total sales volume in the second quarter was 568,227 million cubic feet equivalent (MMcfe), compared with 507,512 MMcfe a year earlier. It expects total sales volume in the July-September quarter to be between 590 and 640 Bcfe. EQT is predominantly engaged in the exploration and production of natural gas, primarily in the Appalachian Basin, spanning Ohio, Pennsylvania and West Virginia. The company reported adjusted profit of 45 cents per share for the quarter ended June 30, above analysts' average estimate of 41 cents per share, according to data compiled by LSEG. https://www.reuters.com/business/energy/eqt-beats-profit-estimates-higher-natgas-prices-sales-volumes-2025-07-22/

2025-07-22 20:57

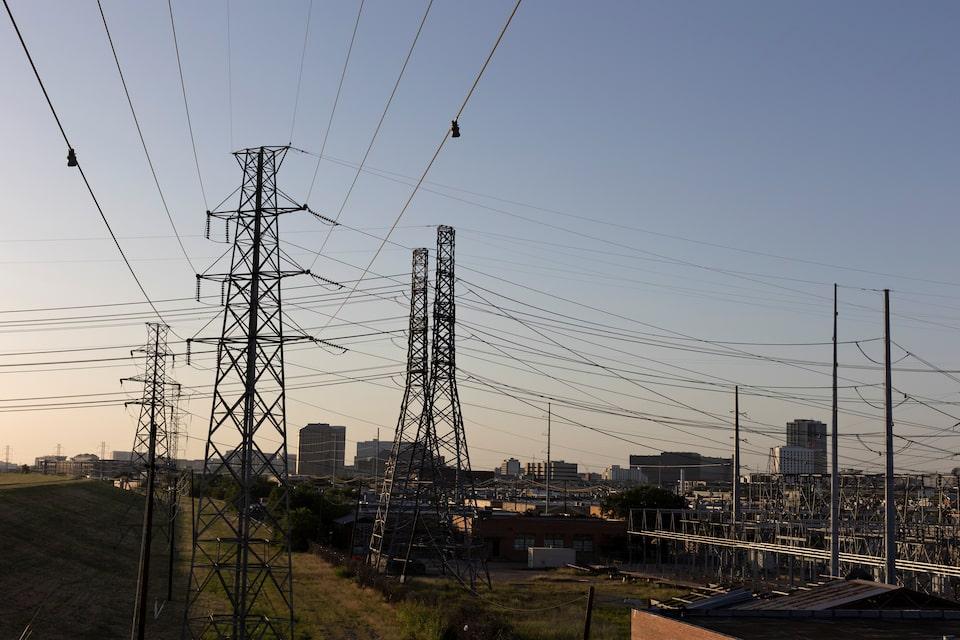

July 22 (Reuters) - Texas-based utility firm CPS Energy on Tuesday said it entered into an agreement with energy company Modern Hydrogen on a new project to explore the potential for increasing electricity grid resiliency and enabling cleaner power generation from natural gas. "CPS Energy will pilot Modern Hydrogen’s technology to convert natural gas into clean hydrogen as an ongoing gas-decarbonization service," CPS Energy said in a statement. Sign up here. Instead of burning natural gas and managing the resulting carbon dioxide emissions, Modern Hydrogen, which is based in Seattle, employs a process that breaks down the hydrocarbons in natural gas to produce hydrogen and solid carbon, CPS Energy said. "The solid carbon is captured and reused in products like asphalt for infrastructure projects," it added. CPS Energy has over 950,000 electric and 389,000 natural gas customers in San Antonio and portions of seven adjoining counties. https://www.reuters.com/sustainability/climate-energy/us-companies-cps-energy-modern-hydrogen-agree-work-clean-power-generation-2025-07-22/