2025-07-22 19:31

HOUSTON, July 22 (Reuters) - U.S. oilfield service provider Halliburton (HAL.N) , opens new tab on Tuesday said Mexico's oil production decline rates are creating pressure for a reactivation of business amid long delays from state-run Pemex to pay its suppliers. Output of crude and condensate by Pemex, the largest producer in the country, fell 8.4% in May to 1.64 million barrels per day, according to official figures. Sign up here. Oilfield service companies have significantly decreased activities because of the lack of payments from Pemex, the world's most indebted energy company. Halliburton said issues related to payments from Pemex have not been resolved yet. Last week, larger rival service firm SLB (SLB.N) , opens new tab said the government and Pemex must address critical issues before there can be a rebound. "We believe we're there. We're just waiting now to see what are the next steps that could help unlock the value of obviously the assets in Mexico and the dynamic of Pemex to rebound from this," SLB's chief executive Olivier Le Peuch said during the company's earnings call. SLB is ready to work closely with Pemex to solve the issues, he added. Last month, the Mexican association that groups foreign oil services companies warned that many of these firms may have to stop operations as early as July. Pemex has an outstanding debt with an extensive list of suppliers and contractors of about $20 billion, in addition to its financial debt of $101 billion, despite the government's billions of dollars in recent years to cover amortizations. In a letter in June, the Mexican Association of Oil Service Companies urged Pemex to process and release billing for services provided last year; guarantee regular billing and timely payment for services this year; and design a payment plan to settle all historical debts owed to companies in the sector. Mexico's oilfield services sector has shrunk significantly due to Pemex's lack of payments, the association said, adding it would not be able to guarantee operational continuity due to cash flow problems. Halliburton, which posted second-quarter earnings on Tuesday, said it expects its full-year international revenue to decline by mid-single digits, year on year, primarily driven by activity reductions in Saudi Arabia and Mexico. https://www.reuters.com/business/energy/halliburton-says-mexico-oil-output-decline-rates-will-pressure-reactivation-2025-07-22/

2025-07-22 19:24

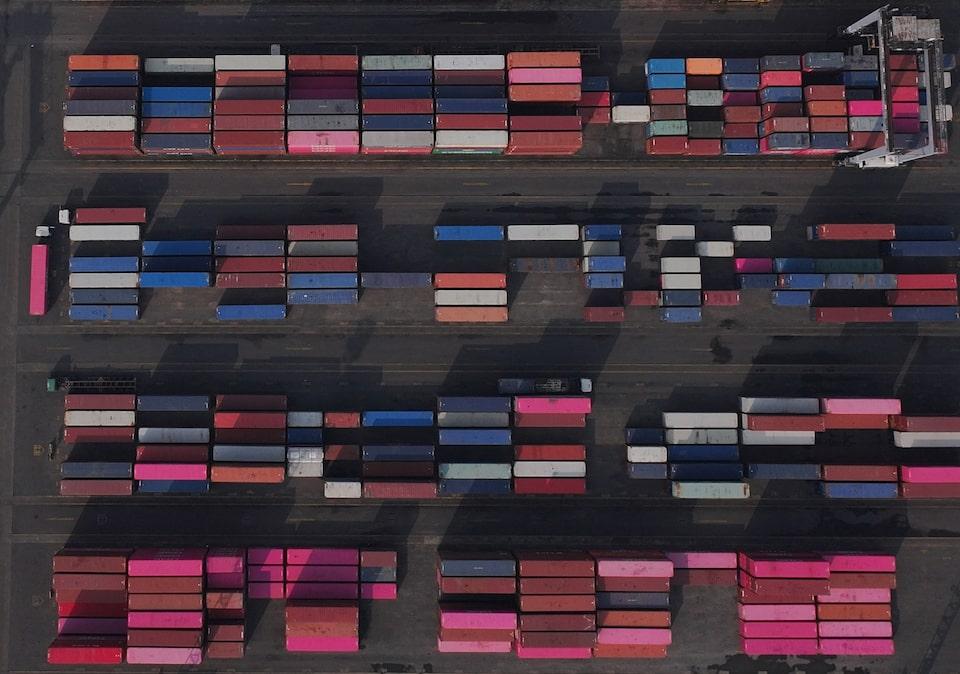

July 22 (Reuters) - Indonesia will drop tariffs to zero on more than 99% of its trade with the United States and will also eliminate all non-tariff barriers for American goods in a deal that cuts threatened U.S. tariffs on Indonesian products to 19% from an initial 32%, a senior Trump administration official said on Tuesday. Indonesia will immediately drop its plans to levy tariffs on internet data flows and will support renewal of a longstanding World Trade Organization moratorium on e-commerce duties, the official told reports on a conference call held a week after the deal was first announced on July 15. Sign up here. Indonesia also will remove recently enacted pre-shipment inspection and verifications of U.S. exports, which have posed problems for U.S. agricultural exports and contributed to a growing U.S. farm trade deficit, the official said. In a win for U.S. automakers, the official said that Indonesia has agreed to accept U.S. Federal Motor Vehicle Safety Standards for vehicles exported from the United States to the growing country of 280 million people. Indonesia also has agreed to remove export restrictions on critical minerals and remove local content requirements products using these commodities shipped to the U.S. Keywords: USA TRUMP/TARIFFS INDONESIA https://www.reuters.com/business/autos-transportation/indonesia-cut-tariffs-non-tariff-barriers-us-trade-deal-trump-official-says-2025-07-22/

2025-07-22 18:42

EU explores broader counter-measures as US tariff deal prospects dim Fed's Bowman: Political-free monetary policy is 'very important' Bullion hits highest since June 16 July 22 (Reuters) - Gold climbed to a five-week high on Tuesday, drawing strength from trade uncertainty and weaker U.S. bond yields as investors continue to eye U.S. President Donald Trump's August 1 tariff deadline. Spot gold rose 1% to $3,428.84 per ounce by 2:10 p.m. ET (1810 GMT), hitting its highest since June 16. Sign up here. U.S. gold futures were up 1.1% at $3,443.70. The yield on benchmark U.S. 10-year notes fell to a near two-week low, making non-yielding bullion more attractive. "Trade uncertainty is prompting some safe haven demand. The U.S. has got several trade deals in the works and there's rumors that the EU and the U.S. might not be able to come to an agreement or certainly are not anywhere close yet," said Jim Wyckoff, a senior analyst at Kitco Metals. Treasury Secretary Scott Bessent on Tuesday said he would meet his Chinese counterpart next week, suggesting a possible extension of an August 12 tariff deadline. He added that the U.S. is poised to announce "a rash of trade deals" with other countries. Meanwhile, European Union diplomats hinted that the EU is looking at broader counter-measures against the U.S. as prospects for a trade agreement dwindle. "Gold is likely to stay bullish. A strong resistance is seen near $3,420. On the flip side, $3,350 is a support," said Jigar Trivedi, a senior commodity analyst at Reliance Securities. Investors are also positioning ahead of next week's Federal Reserve meeting. While the Fed is expected to hold rates steady, markets are eyeing a potential rate cut in October. Gold, traditionally considered a hedge during times of uncertainty, also tends to do well in a low-interest rate environment. Bessent on Tuesday also said there was no need for Fed Chair Jerome Powell to step down immediately, a day after calling for a review of the central bank as an institution. Meanwhile, Fed Vice Chair Michelle Bowman underscored the importance of the central bank's independence amid rising pressure from Trump to lower borrowing costs. Spot silver rose 0.6% to $39.16 per ounce, platinum lost 0.5% to $1,431.64 and palladium gained 1.4% to $1,282.82. https://www.reuters.com/world/china/gold-hits-five-week-peak-trade-jitters-lower-bond-yields-2025-07-22/

2025-07-22 18:10

Trump says Powell should deliver lower rates Economists say political influence over monetary policy never ends well Goldman Sachs notes rising risk to Fed independence, inflation expectations increase WASHINGTON, July 22 (Reuters) - U.S. Federal Reserve Chair Jerome Powell is a "numbskull" who has kept interest rates too high, but he will be out in eight months, President Donald Trump said at a news conference on Tuesday. "I think he's done a bad job, but he's going to be out pretty soon anyway. In eight months, he'll be out," he said from a meeting at the White House with Philippine President Ferdinand Marcos Jr. Sign up here. Powell's term as Fed chair runs through May 15, and he has repeatedly said he will not leave the post early. Eight months would mean Powell would remain in place until mid-March; it was not immediately clear why Trump picked that time frame. Trump has been hammering at Powell for months for not cutting rates and has frequently raised the possibility of ousting him, while also saying that firing him would be "unlikely." Lately, the White House has intensified Trump's pressure campaign, launching a review of the Fed's renovation of two buildings in Washington which they say are inappropriately lavish and may not have followed planning protocols, charges that the Fed vigorously rejects. Treasury Secretary Scott Bessent on Tuesday repeated his call for a "big internal investigation" of the Fed's non-monetary policy operations. Economists warn that efforts to push the Fed to loosen monetary policy could actually have the opposite effect. They point to hyperinflation in countries from Argentina to Zimbabwe as examples of what can happen when politicians exert influence on central bank rate-setting. Some see evidence in financial markets that the Trump administration's constant attacks on Powell are eroding confidence in the Fed's ability to achieve its dual goals of price stability and maximum employment. "Market participants seem to agree that the risk to Fed independence is rising," Goldman Sachs economist Jan Hatzius wrote late on Monday, pointing to a rise in longer-term inflation expectations as captured in 5-year 5-year forward inflation swaps, which measure expected inflation over five years beginning five years out. "A further increase could make Fed officials more reluctant to cut," Hatzius said. If inflation expectations rise, the thinking goes, actual inflation is likely to follow. Powell and other Fed officials believe that longer-term inflation expectations remain stable, but they say they are watching nearer-term measures closely, particularly with tariffs likely to increase upward price pressures as companies pass on more of the costs to consumers. "Efforts by the administration to push the (Fed) into an accommodative monetary policy stance that would not be justified by macroeconomic conditions would likely backfire with higher long-term rates, higher inflation expectations, and ultimately the need for a tighter monetary policy stance," Barclays economists wrote on Tuesday. On Tuesday Trump repeated his view that the policy rate should be 3 percentage points lower than it is now. The central bank's policy-setting Federal Open Market Committee is nearly universally expected to leave the policy rate in its current range of 4.25%-4.50% when it meets next week, as policymakers wait to see how inflation and employment react to tariffs. "Our economy is so strong now, blowing through everything. We're setting records," Trump said on Tuesday. "But you know what? People aren't able to buy a house because this guy is a numbskull. He keeps the rates too high, and is probably doing it for political reasons." Mortgage rates had increased last year even as the Fed cut its policy rates by a total of 1 percentage point, tracking U.S. Treasury yields, which surged amid economic resilience and worries about Trump's proposed policies. Bessent, at the same meeting, raised a different complaint against the Fed. "The Fed has had big mission creep, and that's where a lot of the spending is going," Bessent said. "That's where, why they're building these new, or refurbishing these buildings, and I think they have got to stay in their lane." https://www.reuters.com/world/us/trump-says-feds-powell-will-be-out-8-months-calls-him-numbskull-2025-07-22/

2025-07-22 16:05

DUBAI, July 22 (Reuters) - Egypt's current account deficit narrowed to $2.1 billion in January to March 2025 from $7.5 billion in the same period a year earlier, the central bank said on Tuesday. The central bank attributed the slimmer deficit to the increase in remittances from Egyptians working abroad, as well as a rise in the services surplus due to higher tourism revenue. Sign up here. Oil exports declined to $1.2 billion, from $1.4 in the year earlier, while imports of oil products rose to $4.8 from $3.4 billion. Egypt has sought to import more fuel oil and liquefied natural gas this year to meet its power demands after disruptions to gas supply led to blackouts over the last two years. Concerns over supplies increased after the pipeline supply of natural gas from Israel to Egypt decreased during Israel’s air war with Iran last month. Revenues from the Suez Canal, declined to $0.8 billion in the third quarter of the country’s financial year, from $1 billion the same time a year ago, as Yemeni Houthis' attacks on ships in the Red Sea continued to cause disruption. The Iran-aligned group says it attacks ships linked to Israel in support of Palestinians in Gaza. Meanwhile, Egypt’s tourism revenues reached $3.8 billion, compared to $3.1 billion in the same period in 2023/24. Remittances from Egyptians working abroad increased to $9.3 billion, from $5.1 billion. The increase in remittances has helped to reduce the wider trade deficit. Foreign direct investment hit $3.8 billion, compared to $18.2 billion in the same quarter a year before. Egypt has suffered an economic crisis exacerbated by a foreign currency shortage, which forced it to undergo economic reforms under an $8 billion IMF programme that included allowing its pound to depreciate sharply last year. https://www.reuters.com/world/africa/egypt-quarterly-current-account-deficit-eases-21-billion-higher-remittances-2025-07-22/

2025-07-22 14:17

Central bank leaves monetary policy rate at 27.5% Rates held to address existing, emerging inflationary pressures Central bank governor says aiming for single digit inflation ABUJA, July 22 (Reuters) - Nigeria's central bank kept its monetary policy rate at 27.50% (NGCBIR=ECI) , opens new tab for the third consecutive time this year, pledging on Tuesday to maintain its current stance until inflation risks recede. Consumer inflation (NGCPIY=ECI) , opens new tab in the oil-producing West African nation fell for the third straight month in June to 22.22% year-on-year from 22.97% in May. Sign up here. Central Bank Governor Olayemi Cardoso acknowledged that inflation was easing. He said the rate-setting Monetary Policy Committee's decision was based on the need to sustain disinflation. "Maintaining the current monetary stance will continue to address the existing and emerging inflationary pressure," Cardoso said, adding the goal was to get inflation to single digits. Most economists polled by Reuters had predicted the central bank would keep the rate unchanged after hiking it six times in 2024 to fight soaring inflation, which repeatedly hit 28-year peaks last year. Price pressures have been spurred by President Bola Tinubu's reforms since coming to office in 2023, including ending costly subsidies and the devaluation of the naira currency . But inflation dropped sharply in January when the statistics agency updated the base year for its calculations and re-weighted the inflation basket, falling to 24.48% in annual terms from 34.80% in December. However, its decline has since slowed. Cardoso said the fall in inflation in June was largely driven by the moderation in energy prices and stability in the foreign exchange market. "Despite these positive developments, members (of the MPC) observed the uptick in month-on-month headline inflation, suggesting the persistence of underlying price pressures, the continued global uncertainties," he said, adding that tariff wars and geopolitical tensions could sustain price pressures. The World Bank has warned that persistently high inflation remains a challenge for Nigeria, urging it to stick to tight monetary and disciplined fiscal policies. https://www.reuters.com/world/africa/nigerias-central-bank-pledges-keep-policy-tight-it-holds-key-rate-again-2025-07-22/