2025-07-22 00:03

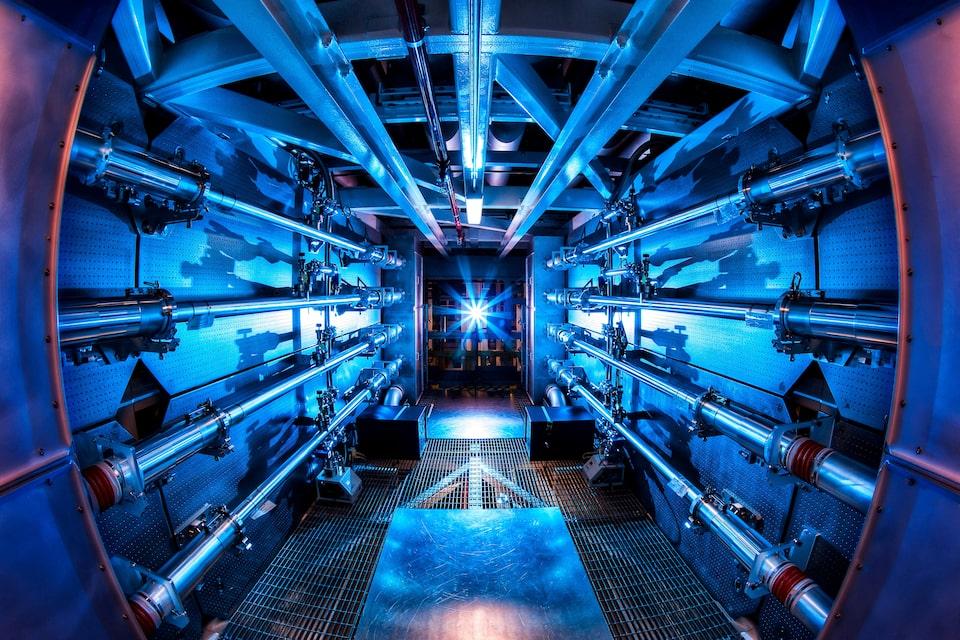

WASHINGTON, July 21 (Reuters) - Global fusion energy investment grew by $2.64 billion in the year since last July, an industry group said in an annual industry survey on Monday, but companies said they need much more money to take the industry commercial. The investment rise took place in places including the United States, the EU, Japan, China and Britain and was the highest since 2022. Sign up here. Total funding since 2021 for the 53 fusion companies in the survey by the Washington-based Fusion Industry Association, is now nearly $9.77 billion, a five-fold increase. This year's investment was a 178% jump from the more than $900 million raised last year. "The acceleration of capital, even when the global economy has tightened, is a signal of maturing investor confidence, technological progress, and a rapidly coalescing supply chain," said Andrew Holland, FIA's CEO. Fusion, which fuels the sun and stars, is in the experimental stage on Earth, but could one day generate enormous amounts of energy that emits virtually no greenhouse gas and without generating large amounts of long-lasting radioactive waste. Physicists work to replicate fusion reactions by forcing together light atoms with technology including lasers or giant magnets. Tall hurdles to commercialization include lowering the amount of energy needed to spur reactions, getting reactions to occur continuously, and systems to transmit the energy. The survey does not count public funding for public fusion projects, which China is believed to the world leader in. Venture arms of traditionally fossil fuel companies Chevron (CVX.N) , opens new tab and Shell (SHEL.L) , opens new tab and Siemens Energy (ENR1n.DE) , opens new tab and Nucor (NUE.N) , opens new tab, the largest U.S. steel producer, were some of the investors. The investment hike has benefited from a boom in power demand from artificial intelligence and data centers. Google (GOOGL.O) , opens new tab said last month it had struck a deal to buy power from a Commonwealth Fusion systems plant in Virginia which hopes to generate power by the early 2030s. Despite the funding jump, 83% of respondents said they still consider getting investments challenging. Fusion companies said they would need an additional $3 million to $12.5 billion to bring their first pilot plants online, with a median response of $700 million. The total of $77 billion that respondents said they would need is about eight times more than has been committed by investors. Expected industry consolidation could reduce the total investment needed, the survey said. https://www.reuters.com/sustainability/climate-energy/global-investment-fusion-energy-rises-most-since-2022-2025-07-21/

2025-07-21 23:59

WASHINGTON, July 21 (Reuters) - U.S. Treasury Secretary Scott Bessent said the Federal Reserve's vital independence on monetary policy is threatened by its "mandate creep" into non-policy areas and he called on the U.S. central bank to conduct an exhaustive review of those operations. The Fed's autonomy "is threatened by persistent mandate creep into areas beyond its core mission, provoking justifiable criticism that unnecessarily casts a cloud over the Fed's valuable independence on monetary policy," Bessent said in a post on X. Sign up here. He called Fed monetary policy "a jewel box" that should be walled off to preserve its independence, which he called a cornerstone of continued U.S. economic growth and stability. Bessent said a review should be conducted into the Fed's decision to launch a massive renovation project of its headquarters at a time when it is posting operating losses. He did not say who should conduct that review, adding that he has "no knowledge or opinion on the legal basis" for the project. President Donald Trump has railed repeatedly against Fed Chair Jerome Powell and urged him to resign because of the central bank's reluctance to cut interest rates. In recent days Trump has also taken aim at the $2.5 billion renovation at the Fed's almost 100-year-old Washington headquarters, which has exceeded its budget, suggesting there could be fraud involved and that might be a reason to oust Powell. A recent Supreme Court opinion has solidified a long-standing interpretation of the law that the Fed chair cannot be fired over policy differences but only "for cause." The Fed's Board of Governors approved the renovation project , opens new tab in 2017, during Trump's first term, and received design approval from the National Capital Planning Commission in 2020 and 2021. Speaking with CNBC earlier on Monday, Bessent declined to comment on a report that he had advised Trump not to fire Powell, saying it would be the president's decision. "If this were the (Federal Aviation Administration) and we were having this many mistakes, we would go back and look at why. Why has this happened?" said Bessent, whom Trump has mentioned as a possible candidate to replace Powell. "All these PhDs over there, I don't know what they do." Powell last week responded to a Trump administration official's demands for information about cost overruns on the renovation project, saying it was large in scope and involved a number of safety upgrades and hazardous materials removals. Bessent declined to be drawn on predictions that U.S. financial markets could crash if Powell was ousted. Powell's term as chair ends in May 2026, although he is due to stay on as a Fed governor through January 2028. Bessent noted another governor seat will come open in January. https://www.reuters.com/business/us-treasurys-bessent-calls-review-fed-non-monetary-policy-operations-2025-07-21/

2025-07-21 23:56

Lutnick confident US will secure EU trade deal Verizon boosts annual profit forecast, shares rise S&P 500 +0.14%, Nasdaq +0.38%, Dow -0.04% July 21 (Reuters) - The S&P 500 and the Nasdaq notched record high closes on Monday, lifted by Alphabet and other megacaps ahead of several earnings reports this week, while investors bet on potential trade deals to blunt economic damage from the Trump administration's global tariffs. Google-parent Alphabet (GOOGL.O) , opens new tab rallied 2.7% ahead of its quarterly report on Wednesday. It and Tesla (TSLA.O) , opens new tab, also reporting on Wednesday, kick off earnings from the so-called "Magnificent Seven", and their results may set the tone for other heavyweight companies reporting in the next several days. Sign up here. Tesla dipped 0.35%, while Apple (AAPL.O) , opens new tab gained 0.62% and Amazon (AMZN.O) , opens new tab rose 1.43%, both lifting the S&P 500 and Nasdaq. Verizon (VZ.N) , opens new tab rallied over 4% after the telecommunications company boosted its annual profit forecast. Analysts on average expected S&P 500 companies to report a 6.7% increase in earnings for the second quarter, with Big Tech driving much of that gain, according to LSEG I/B/E/S. "So far, companies that have reported have, in general, met or beat guidance from the prior quarter, and we haven't seen any degradation either in corporate profits or consumer spending," said Tom Hainlin, national investment strategist at U.S. Bank Wealth Management in Minneapolis. With U.S. President Donald Trump's August 1 tariff deadline approaching, the S&P 500 (.SPX) , opens new tab is up about 8% year to date, with investors betting the economic damage from tariffs will be less than feared. U.S. Commerce Secretary Howard Lutnick said on Sunday he was confident the United States could secure a trade deal with the European Union, even as EU members explored possible countermeasures against the United States. Trump has threatened 30% tariffs on imports from Mexico and the EU, and sent letters to other trading partners, including Canada, Japan and Brazil, setting tariffs ranging from 20% to 50%. The S&P 500 climbed 0.14% to end the session at 6,305.60 points. The Nasdaq gained 0.38% to 20,974.18 points, while the Dow Jones Industrial Average declined 0.04% to 44,323.07 points. Seven of the 11 S&P 500 sector indexes rose, led by communication services (.SPLRCL) , opens new tab, up 1.9%, followed by a 0.6% gain in consumer discretionary (.SPLRCD) , opens new tab. Volume on U.S. exchanges was relatively heavy, with 19.7 billion shares traded, compared to an average of 17.7 billion shares over the previous 20 sessions. The S&P 500 has gained about 7% in 2025, while the Nasdaq has climbed almost 9%. Investors focused on how tariff uncertainty is impacting the U.S. economy will scrutinize jobless claims data and the July business activity report, expected on Thursday. They will also watch a speech by Federal Reserve Chair Jerome Powell on Tuesday for clues about when the Fed might cut interest rates, especially after mixed inflation signals last week. Traders have largely ruled out a July rate cut, and they now see a greater than 50% chance the Fed will cut by its September meeting, according to CME Group's FedWatch tool. Declining stocks outnumbered rising ones within the S&P 500 (.AD.SPX) , opens new tab by a 1.7-to-one ratio. The S&P 500 posted 17 new highs and 9 new lows; the Nasdaq recorded 97 new highs and 56 new lows. https://www.reuters.com/business/sp-500-nasdaq-notch-record-high-closes-lifted-by-alphabet-2025-07-21/

2025-07-21 23:23

MELBOURNE, July 21 (Reuters) - BHP Group (BHP.AX) , opens new tab has opted to sell its interest in the $942 million Kabanga nickel project in Tanzania to its partner Lifezone Metals (LZM.N) , opens new tab for as much as $83 million, Lifezone said. The NYSE-listed company will acquire BHP's 17% equity interest in Kabanga Nickel Limited (KNL), the majority owner of the Kabanga Nickel Project in northwestern Tanzania, Lifezone said in a filing late on Friday. Sign up here. The company issued a report on Friday that put pre-production capital costs for the project at $942 million and life of mine costs at $2.49 billion. It is expected to produce around 50,000 metric tons of nickel annually once fully ramped up, a process that will take six years including construction. A final investment decision on the project is due next year. BHP had agreed in 2022 to make an investment of as much as $100 million in the nickel mine and processing facilities if certain conditions were met. BHP still considers Kabanga to be one of the world's best undeveloped nickel sulphide projects, said a source with knowledge of the matter, but the uncertain nickel market outlook and the miner's capital allocation framework have made investments in greenfield nickel projects challenging. A BHP spokesperson declined to comment. BHP has shifted its view on nickel on the back of a boom in output from Indonesia in recent years. It put its Australian Nickel West operations on care and maintenance last year due to a poor outlook for nickel prices, and a decision on the future of those operations is due by early 2027. As a result of the transaction, Lifezone now owns 100% of KNL, which in turn holds an 84% interest in Tembo Nickel Corporation Limited (TNCL), the Tanzanian operating company for the Kabanga Nickel Project. The remaining 16% of TNCL is held by Tanzania's government. All existing agreements with BHP have been terminated and Lifezone has also assumed full control of 100% of the offtake from the Kabanga Nickel Project, it said. (This story has been corrected to fix the project capital costs to $942 million pre-production from $2.5 billion life of mine development costs in the headline and paragraphs 1 and 3) https://www.reuters.com/world/africa/bhp-exits-942-million-tanzania-nickel-project-partner-lifezone-says-2025-07-21/

2025-07-21 23:11

Turkey says current Iraq pipeline deal to end in July 2026 Kirkuk-Ceyhan pipeline has been out of operation since 2023 due to dispute Iraq oil ministry official says Turkey submitted draft energy agreement proposal ANKARA, July 21 (Reuters) - Turkey has submitted a draft proposal to Iraq to renew and expand an energy agreement between the two countries to include cooperation in oil, gas, petrochemicals and electricity, an Iraqi oil ministry official told the state news agency late on Monday. The statement came after Ankara announced the end of a decades-old agreement covering the Kirkuk-Ceyhan oil pipeline. Sign up here. "The Ministry of Oil is in the process of reviewing the draft agreement sent by the Turkish side and negotiating with them regarding it to reach a formula that serves the interests of Iraq and Turkey", the Iraqi oil ministry official added. The 1.6 million barrel-per-day Kirkuk-Ceyhan pipeline has been offline since 2023 after an arbitration court ruled Ankara should pay $1.5 billion in damages for unauthorised Iraqi exports between 2014 and 2018. Turkey is appealing the ruling. Turkey still wants to revive the oil pipeline with Iraq, a senior Turkish official told Reuters earlier on Monday. In a decision published in its Official Gazette on Monday, Turkey said the existing deal dating back to the 1970s - the Turkey-Iraq Crude Oil Pipeline Agreement - and all subsequent protocols or memorandums would be halted from July 27, 2026. Iraq and Turkey have been working to resume oil flows from the pipeline. Ankara said in late 2023 that the pipeline was ready to receive Iraq's oil but talks between Baghdad, Iraq's Kurdistan Regional Government and independent oil producers were not able to reach an agreement on terms. The Turkish official said the pipeline had the potential to become a "highly active and strategic pipeline for the region". The person added that Turkey had invested heavily in its maintenance, and noted its importance for regional projects like the Development Road - a planned trade route involving Turkey and Iraq. "A new and vibrant phase for the Iraq-Turkey pipeline will benefit both countries and the region as a whole," the Turkish official said, without giving details of what Ankara wanted the new agreement to include. Turkey sees the Development Road initiative - a high-speed road and rail link, running from Iraq's port city of Basrah on the Gulf to the Turkish border and later to Europe - as an opportunity to extend the pipeline further south. Baghdad allocated initial funding for the project in 2023. https://www.reuters.com/business/energy/turkey-submits-draft-proposal-iraq-renew-expand-energy-agreement-2025-07-21/

2025-07-21 21:52

SAO PAULO, July 21 (Reuters) - Brazilian planemaker Embraer (EMBR3.SA) , opens new tab said on Monday its firm order backlog ended the second quarter at $29.7 billion, a record high for any quarter and up 40% from a year earlier, according to a securities filing. Embraer, the world's third-largest planemaker, said its commercial jet segment reached a backlog of $13.1 billion, rising 16%, while the executive jet business ended the quarter with a $7.4 billion backlog, jumping 62%. Sign up here. The company said earlier this month that it delivered 61 aircraft in the second quarter. Embraer also registered a total $4.9 billion backlog from its services and support unit, as well as $4.3 billion from its defense segment. Embraer, whose chief executive last week said that U.S. tariffs announced against Brazil could have a pandemic-like impact on the firm, is set to unveil its full second-quarter earnings on August 5. https://www.reuters.com/business/aerospace-defense/brazil-planemaker-embraer-ends-q2-with-record-30-billion-backlog-2025-07-21/