2025-07-16 21:04

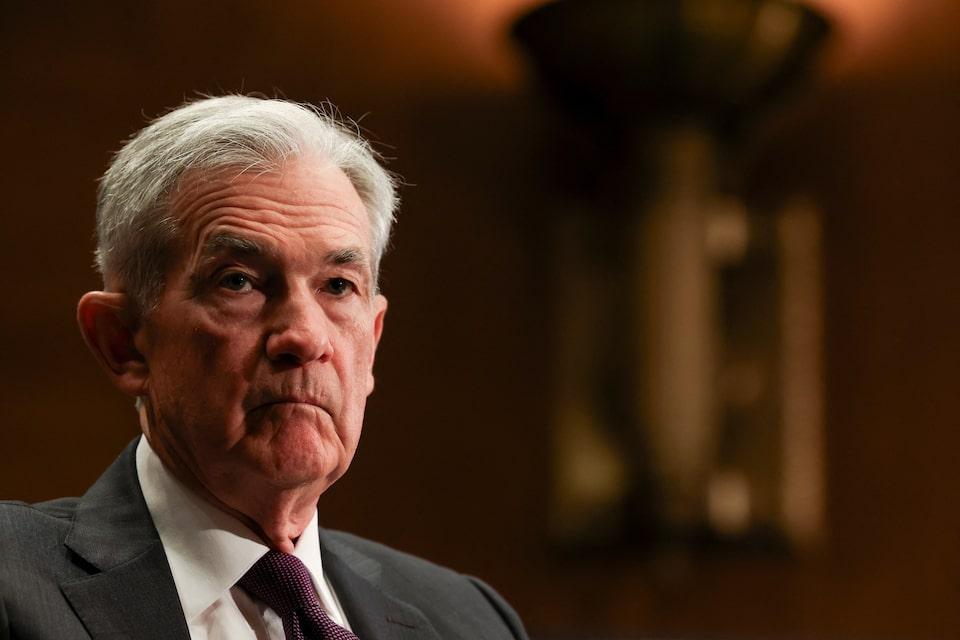

ORLANDO, Florida, July 16 (Reuters) - TRADING DAY Making sense of the forces driving global markets Sign up here. By Jamie McGeever, Markets Columnist A dramatic day on Wednesday ended with Wall Street in the green and the dollar and short-dated Treasury yields lower, although off their earlier extremes, after President Donald Trump denied reports he will soon fire Fed Chair Jerome Powell. More on that below. In my column today I look at Trump's call for 300 basis points of Fed rate cuts and, although it is wishful thinking, why it shines a light on whether Fed policy is too tight, too loose, or maybe just about right. If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves Trump-Powell drama sizzles, dollar fizzles At around midday in the U.S. session on Wednesday, it looked like six months of verbal attacks on Fed Chair Jerome Powell from President Donald Trump for not cutting interest rates were about to reach boiling point - according to Bloomberg News, Powell would soon be fired. The market reaction was what you might expect - the dollar, stocks, and short-dated Treasury yields fell, and the yield curve steepened. The most notable moves were in the dollar and two-year yield. But Trump swiftly denied the report, insisting that although he had discussed ousting Powell with lawmakers, it was "highly unlikely" he would fire him. Markets recovered their poise, especially stocks, although the rebound in short-dated yields and the dollar was less pronounced. Trump firing Powell would be a monumental event as no president has ever formally dismissed a Fed Chair. But it would come as little surprise. Trump's desire for lower interest rates is ferocious, and he regularly berates Powell for not cutting them. Political interference in monetary policymaking? Yes, but Trump crossed that Rubicon some time ago. Rates traders still expect no change from the Fed on rates later this month and a quarter point cut by October. They added around 10 bps of expected easing into next year's forecasts. Even at the depths of the selloff on Wednesday Wall Street's main indices were never down more than 1%, perhaps reflecting investors' skepticism that Trump really will pull the trigger. But it's noteworthy given that the S&P 500 and Nasdaq had clocked new highs the day before - there's scope for a deep correction if investors want one. The latest twist in the Trump-Powell saga dominated the U.S. session and will likely be the main driver of global markets again on Thursday. But investors have other signposts to guide them, including corporate earnings, tariffs and economic data. On Wednesday, three of America's biggest banks reported results - Bank of America, Morgan Stanley and Goldman Sachs. On Thursday the spotlight turns to Netflix, and before that in Asia, Taiwan's TSMC, the world's main producer of advanced AI chips. Trump boxes in Fed with extreme rate cut calls While almost no one thinks Donald Trump's verbal attacks on Federal Reserve Chair Jerome Powell are a positive development, they have electrified the debate about whether the U.S. president is right that interest rates are too high. Presidential tirades aside, there is a strong case to be made that the fed funds rate should be lower than its current 4.25-4.50% target range. The labor market is beginning to show signs of cracking, 'hard' economic data is softening, and a tariff-led slowdown may be in the offing. On the other hand, economic growth is clocking in at an annualized pace of around 2.5% and not expected to dip much below 2% next year, unemployment is still historically low, the stock market is at a record peak, and other financial assets like bitcoin have also never been higher. And, crucially, core inflation is still almost a percentage point above the Fed's 2% target, suggesting that we may be starting to see the inflationary impact of tariffs. By those measures, policy may be too loose, not too tight. Indeed, Jason Thomas, head of global research and investment strategy at Carlyle, reckons financial conditions are "unusually accommodative", and argues that had the Fed not said in December that policy was 'restrictive', there would be no need to explain why it hadn't cut rates six months later. The president clearly does not agree. Trump is clamoring for borrowing costs to be slashed by 300 basis points. That would take the policy rate closer to 1%, a level usually associated with severe financial market stress, strong disinflationary pressures or a deep economic funk. Or all three. R-STAR GAZING One would be hard-pressed to find many experts who would agree with Trump's call, even those who fall on the dovish side. But then where should rates be? Policymakers typically use forward-looking models and frameworks to inform their decisions. The most famous of these, so-called 'R-Star', comes in for a lot of criticism, as it is theoretical, referring to the inflation-adjusted long-term neutral interest rate that neither accelerates nor slows growth when inflation is at target. This may be a fuzzy concept, but officials look at it, so investors cannot dismiss it completely. There are two benchmark 'R-Star' models, both partly created by New York Fed President John Williams. One currently puts this rate at around 0.80% and the other around 1.35%. If inflation were at the Fed's target 2%, then these models would put the nominal fed funds rate at around 2.80% or 3.35%, respectively. Fed policymakers split the difference in their latest median projections, putting the long-term nominal Fed funds rate right at 3.00%. If these estimates are anywhere close to accurate, the nominal policy target range of 4.25-4.50% now appears to be restrictive, so the path ahead is lower. Rates traders and investors seem to agree. While the latest CPI report has caused jitters at the long end of the yield curve, rates markets are still pricing in more than 100 basis points of easing over the next 18 months. But this has helped fuel the asset price rally, which, ironically, strengthens the argument that policy may be closer to neutral than models suggest. WISHFUL THINKING Powell may have backed the Fed into a corner by maintaining that policy is still restrictive, albeit "modestly" so. These claims signal the Fed will lower rates, but it has not done so, as it is waiting to see if Trump's protectionist trade agenda unleashes inflation. Moreover, it also does not want to appear to be responding to political pressure to cut rates. "Some will say this collision was unavoidable. But the Fed would find itself in a far more defensible position had it embraced a posture of neutrality, pledging to cut or hike as warranted by future developments (including policy shifts)," Carlyle's Thomas wrote on Tuesday. In short, the Fed is in a bit of a bind, and Trump's attacks will only make it worse. His call for 300 basis points of rate cuts may end up being similar to his 'reciprocal tariff' gambit: aim extremely high, settle for something less, and claim victory. The problem, of course, is that monetary policy is not supposed to be a negotiation. What could move markets tomorrow? Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/world/china/global-markets-trading-day-graphics-2025-07-16/

2025-07-16 20:58

TSX ends up 0.4% at 27,152.97 Tech sector rises 1.6%, financials add 0.9% Energy loses 1.1% as oil settles lower Cogeco Communications drops 8.5% after revenue miss July 16 (Reuters) - Canada's main stock index rose on Wednesday, with the financial and technology sectors posting gains as investors shrugged off increased uncertainty about the leadership of the Federal Reserve. The S&P/TSX composite index (.GSPTSE) , opens new tab ended up 98.83 points, or 0.4%, at 27,152.97, moving closer to the record closing high it posted on Tuesday. Sign up here. Wall Street benchmarks also ended higher despite a chaotic half hour when news reports suggested U.S. President Donald Trump was set to fire Fed Chair Jerome Powell. "Markets, as they always do, they look forward six to 12 months," said Stan Wong, a portfolio manager at Scotia Wealth Management. "In Canada, the market has rebounded from its worst fears of what the economy would look like which would be a tremendous amount of trade and tariff uncertainty. We've gotten a little bit more color and more clarity around that." Prime Minister Mark Carney said Canada will introduce a tariff rate quota for countries with which it has free trade agreements, excluding the United States, to protect the domestic steel industry. "Compared to the U.S., valuations remain compelling in Canada and if (interest) rates move lower then the dividend yields, which are higher in Canada, will be a big draw for investors," Wong said. The Canadian 10-year yield eased 3.3 basis points to 3.578%, pulling back a one-year high the day before. Technology (.SPTTTK) , opens new tab rose 1.6%, with shares of e-commerce company Shopify Inc (SHOP.TO) , opens new tab ending nearly 4% higher. Heavily weighted financials (.SPTTFS) , opens new tab were up 0.9% but energy (.SPTTEN) , opens new tab was a drag, falling 1.1% as the price of oil settled 0.2% lower at $66.38 a barrel. Giant shovels, driverless trucks and a dog-like robot have all helped Canada's oil sands companies become some of North America's lowest-cost oil producers. The materials group (.GSPTTMT) , opens new tab, which includes metal mining shares, lost 0.6% as copper prices fell. Cogeco Communications (CCA.TO) , opens new tab missed estimates for quarterly revenue. The telecommunications company's shares ended 8.5% lower. https://www.reuters.com/markets/europe/tsx-futures-flat-ahead-us-inflation-data-2025-07-16/

2025-07-16 20:57

WASHINGTON, July 16 (Reuters) - Recent data on consumer inflation showed price pressures may be building in the wake of rising import taxes imposed by the Trump administration, Atlanta Fed President Raphael Bostic said on Wednesday. "We may be at an inflection point," Bostic said in comments to Fox Business' Claman Countdown, a day after data for June showed prices rising faster than the month before with particularly large increases for some categories of heavily imported goods. "The headline number moved away from our target, not towards it...We've seen the highest increase in prices that we've seen all year." Sign up here. The Consumer Price Index rose 2.7% in June compared to 2.4% in May. Bostic noted that nearly half of the products showed an increase of 5% or more, nearly double the share seen in January -- a metric Bostic has focused on as evidence of inflationary pressure spreading in the economy. "We are seeing things underlying in the economy that suggest inflation pressures are up, and that's really a source of concern," said Bostic. While not a voter in rate policy this year, he has said he feels the Fed needs more data before deciding to resume rate cuts, and that only a single quarter-point reduction is likely to be warranted this year given the uncertainty over how tariffs will affect prices. Investors expect two cuts, beginning at the Fed's September meeting. "The price pressures are real," Bostic said, referring to conversations he and his staff have had with regional business officials. The Fed's focus on tariff-driven inflation and the reluctance to cut interest rates has angered President Donald Trump, who wants deep cuts to the Fed's current benchmark rate of 4.25% to 4.5%. News reports on Wednesday that Trump was nearing a decision to try to fire Powell sparked a sell-off in stock and bond markets that reversed after the president clarified that he had no plans to dismiss the Fed chief -- as much as he says he would like to replace him. Bostic said he tried not to focus on the many news reports about the Fed. "We've got a very complex situation in terms of the economy," Bostic said, with his attention on "the things that actually matter." https://www.reuters.com/business/feds-bostic-recent-data-show-price-pressures-may-be-building-2025-07-16/

2025-07-16 20:53

NEW YORK, July 16 (Reuters) - Phillips 66 (PSX.N) , opens new tab has partially shut its 258,500 barrel-per-day Bayway refinery in Linden, New Jersey, after rainstorms in the region caused a power outage at the plant, three sources familiar with the matter said. Phillips 66 confirmed the power outage, but declined to provide more details. Sign up here. A computer that monitors emissions from the refinery's flare stack was damaged during flooding, according to a report filed with the New Jersey Department of Environmental Protection (DEP) on Tuesday. All other monitoring equipment was functioning normally, the report said. There was no major damage to critical infrastructure, and the refinery's flares were working properly after the overnight power outage, the Linden Police Department posted on Facebook on Tuesday. Another report filed with the DEP on Tuesday noted that the sewer system at the refinery was leaking unknown amounts of residual oil into the Morses Mill Creek. Phillips 66 was actively purchasing refined products from the New York Harbor spot market since Tuesday, two market participants said. https://www.reuters.com/business/energy/phillips-66s-bayway-refinery-partially-shut-after-power-outage-sources-say-2025-07-16/

2025-07-16 20:43

Markets recover after brief selloff on Powell firing reports Indexes close up: Dow 0.53%, S&P 500 0.32%, Nasdaq 0.26% Nasdaq posts fifth record high in last six sessions Bank stocks mixed after Q2 earnings US June PPI unchanged on a monthly basis July 16 (Reuters) - Wall Street benchmarks closed modestly higher on Wednesday, with the Nasdaq Composite achieving its latest record finish, despite a chaotic half hour when news reports suggested U.S. President Donald Trump was set to fire Federal Reserve Chair Jerome Powell. Shortly before midday, the benchmark S&P 500 and Nasdaq fell more than 1%, while the dollar plunged and Treasury yields rose, after Bloomberg News reported the possibility of replacing Powell, citing an unidentified White House official. Sign up here. Separately, Reuters News reported, citing a source, that Trump was open to the idea of firing Powell. Trump was quick to deny the reports, even as he unleashed a new barrage of criticism against Powell for not cutting interest rates. "The Fed's independence is hugely important to our overall economy, so you saw the market react when that initial headline came out," said Dylan Bell, chief investment officer at CalBay Investments. Trump's denial revived equity markets, with the Nasdaq Composite (.IXIC) , opens new tab closing at 20,730.49, a gain of 52.69 points, or 0.26%. It was the fifth session in six that the technology-heavy index has posted a record high. The Dow Jones Industrial Average (.DJI) , opens new tab rose 231.49 points, or 0.53%, to 44,254.78, and the S&P 500 (.SPX) , opens new tab gained 19.94 points, or 0.32%, at 6,263.70. Since Trump's April tariff announcement, which initially sent U.S. equities into a spin, U.S. stock markets have been on a tear. The S&P 500 most recently posted a record finish last week. Amid this buoyancy, though, has been investor angst about the prospect of Powell being removed from his job before his term ends next May, as Trump has repeatedly criticized him for not cutting U.S. rates quickly enough. The CBOE Volatility Index (.VIX) , opens new tab, Wall Street's "fear gauge," hit a more than three-week high in the wake of the initial Powell reports, but eased from those levels. CalBay's Bell said while volatility risk from news headlines would persist, the overall positive state of the U.S. economy was a more important factor in driving investor moves. Despite Trump's demands for easier credit, Fed officials have resisted cutting rates until there is clarity on whether his tariffs on U.S. trading partners reignite inflation. This concern was iterated by Atlanta Fed President Raphael Bostic on Wednesday, saying in a Fox Business interview that pressures may be building in the wake of rising import taxes. Inflation has been in focus this week. Producer prices data released on Wednesday showed growth flatlined in June, as tariff-driven goods costs were balanced out by weaker service prices. Just a day earlier, unexpectedly strong consumer inflation had already dented hopes for deeper Fed rate cuts, with Trump's tariffs partly fueling the uptick in prices. On Wednesday, the second day of this earnings season, another round of stronger profits from Wall Street's big banks failed to ignite their own stock prices. Goldman Sachs (GS.N) , opens new tab climbed 0.9% after notching a 22% earnings surge, while Bank of America (BAC.N) , opens new tab and Morgan Stanley (MS.N) , opens new tab declined 0.3% and 1.3%, respectively, despite posting higher profits. Johnson & Johnson (JNJ.N) , opens new tab soared 6.2%, and was the second-best performer on the S&P 500, after halving its expectations for costs this year related to new tariffs and raising its full-year sales and profit forecast. Semiconductor stocks were sluggish after news that Nvidia (NVDA.O) , opens new tab would be allowed to sell its H2O chips in China had fueled gains in the previous session. The semiconductor index (.SOX) , opens new tab slipped 0.4%, from the 12-month high recorded on Tuesday. https://www.reuters.com/business/sp-500-nasdaq-futures-slip-rate-tariff-concerns-2025-07-16/

2025-07-16 20:39

Trump does not shut the door on attempting an ouster Senator Tillis defends Fed's independence as key to US credibility Powell has said he plans to serve out his term WASHINGTON, July 16 (Reuters) - U.S. President Donald Trump said Wednesday he is not planning to fire Federal Reserve Chair Jerome Powell, but he kept the door open to the possibility and renewed his criticism of the central bank chief for not lowering interest rates. A Bloomberg report earlier Wednesday saying that Trump was likely to fire Powell soon sparked a drop in stocks and the dollar, and a rise in Treasury yields. Sign up here. Trump, who has been criticizing Powell on an almost daily basis for being "TOO LATE" to cut interest rates, said the report wasn't true. But Trump confirmed he had floated the idea with Republican lawmakers on Tuesday evening, marking the latest chapter in an escalating campaign by Trump against the independent central bank and its embattled chief. "I don't rule out anything, but I think it's highly unlikely unless he has to leave for fraud," Trump said, a reference to recent White House and Republican lawmaker criticism of cost overruns in the $2.5 billion renovation of the Fed's historic headquarters in Washington. There has been no evidence of fraud, and the Fed has pushed back on criticism of its handling of the project. Powell, who was nominated by Trump during his first term in late 2017 to lead the Fed and then nominated for a second term by Democratic President Joe Biden four years later, has repeatedly said he intends to serve out his term, which runs through May 15, 2026. A recent Supreme Court opinion has solidified a long-standing interpretation of the law that the Fed chair cannot be fired over policy differences but only "for cause." In an interview aired later on Wednesday, Trump was again asked if he was thinking of removing Powell. "I'd love it if he wants to resign, that would be up to him," Trump told the Real America's Voice. "They say it would disrupt the market if I did." Treasury yields pared declines and stocks ended the day higher after Trump's comments, which included the familiar complaint that Powell is a "terrible" chair for keeping the Fed's short-term policy rate in the 4.25%-4.50% range since December while the central bank assesses the impact of sharply higher tariffs on inflation. Trump blames the Fed for higher long-term rates that increase the cost of U.S. government borrowing. His attacks on Powell have continued since his signing on July 4 of the "Big Beautiful Bill," the tax and spending bill that independent analysts say will add trillions of dollars to the U.S. deficit. "A HUGE MISTAKE" Republican Senator Thom Tillis of North Carolina, who opposed the tax bill and has since said he won't run for reelection, on Wednesday delivered a spirited defense of an independent Fed, which economists say is the linchpin of U.S. financial and price stability. "There's been some talk about potentially firing the Fed chair," said Tillis, a member of the Senate Banking Committee, which oversees the Fed and confirms presidential nominations to its Board. Subjecting the Fed to direct presidential control would be a "huge mistake," he said. "The consequences of firing a Fed chair, just because political people don't agree with that economic decision, will be to undermine the credibility of the United States going forward, and I would argue if it happens you are going to see a pretty immediate response, and we've got to avoid that," said Tillis. Other Republicans downplayed the possibility of Trump's firing Powell. Asked if it would be a problem for Trump to fire Powell, Senate Majority Leader John Thune told reporters: “My understanding is he doesn’t have any intention of doing that.” "President Trump's own analysis and that of his Treasury secretary is that he cannot fire Jay Powell," House Financial Services Committee Chair French Hill told CNBC earlier on Wednesday. RENOVATIONS AT THE FED Last week, the White House appeared to try to lay the groundwork for firing Powell for cause when the director of the Office of Management and Budget, Russell Vought, sent Powell a letter saying that Trump was "extremely troubled" by the renovations of two Fed buildings. Powell responded by asking the U.S. central bank's inspector general to review the project. The central bank also posted a "frequently asked questions" fact sheet , opens new tab, which rebutted some of Vought's assertions about VIP dining rooms and elevators that he said added to the costs. "Nobody is fooled by President Trump and Republicans' sudden interest in building renovations — it's clear pretext to fire Fed Chair Powell," Elizabeth Warren, the top Democrat on the Senate Banking Committee and herself a longtime critic of Powell, posted on X. Warren was the committee's only member to vote against Powell's renomination as chair in 2022, saying he had not done enough on regulation. Fed policymakers are worried that, with 40-year-high inflation only recently in the rear-view mirror, any bump up in inflation coupled with a too-early cut to short-term borrowing costs could ignite expectations that inflation is back, a potentially self-fulfilling prophecy that could weaken the economy and undermine progress on price stability. Analysts said they feared the pressure campaign on Powell would continue -- with deleterious effects on the Fed's ability to do its congressionally mandated job of both keeping prices stable and maximizing employment. "Any reduction in the independence of the Fed would likely add upside risks to an inflation outlook that is already subject to upward pressures from tariffs and somewhat elevated inflation expectations," wrote JP Morgan chief U.S. economist Michael Feroli, who said he doubts the "saga" of the president's repeated threats to remove Powell is over. Feroli and others noted that continued pressure on Powell would likely push up longer-term interest rates as investors demand more protection from the risk of higher inflation -- making U.S. government borrowing more, not less, expensive. The "formal process" for identifying a successor to Powell is under way, Treasury Secretary Scott Bessent has said. Bessent is one candidate for the job, along with White House economic adviser Kevin Hassett, former Fed Governor Kevin Warsh and Fed Governor Christopher Waller. https://www.reuters.com/world/us/trump-indicated-republican-lawmakers-he-will-fire-feds-powell-cbs-reports-2025-07-16/