2025-07-07 22:48

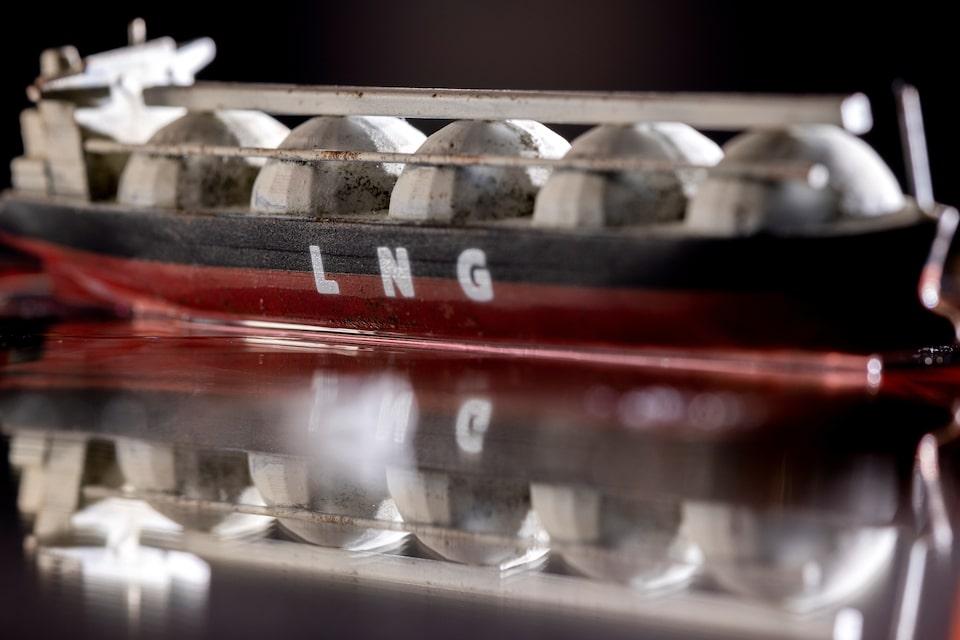

HOUSTON, July 7 (Reuters) - Venture Global (VG.N) , opens new tab exported more liquefied natural gas (LNG) cargoes from its Plaquemines export facility in Louisiana and earned more than double in fees compared with its other U.S. plant, a company filing showed on Monday. The LNG company exported 51 cargoes from Plaquemines at an average liquefaction fee of $7.09 per million British thermal units (mmBtu) for the second quarter of 2025, the SEC filing showed. Sign up here. During the same period, it exported 38 LNG cargoes from its Calcasieu Pass facility at an average liquefaction fee of $2.66 per mmBtu. The lower second-quarter liquefaction fees at Calcasieu Pass come as Venture Global started to sell LNG under long-term contracts there, rather than on the spot market. The Plaquemines facility which is being commissioned while parts remain under construction, has been able to sell on the spot market for higher prices during this period. In just three years Venture Global has become the second-largest U.S. LNG producer, playing a key role in keeping the country as the world's top LNG exporter. The company earned significant profit by quickly building its plants combined with a long commissioning period, allowing it to sell LNG on the spot market at higher prices than it can get from long-term customers. In April the company began commercial operations at its first plant, Calcasieu Pass, three years after it started selling the superchilled gas on the spot market. This led to contract arbitration cases brought by some of the world's top oil and gas producers, including BP (BP.L) , opens new tab, Shell (SHEL.L) , opens new tab, Edison (EDNn.MI) , opens new tab, Orlen (PKN.WA) , opens new tab and Repsol (REP.MC) , opens new tab, which accused Venture Global of profiting from the sale of LNG on the spot market while not providing them with their contracted cargoes from Calcasieu Pass. Venture Global denied the claim, saying it delayed moving to commercial operations because of a faulty electric system that did not allow the plant to operate optimally. https://www.reuters.com/business/energy/venture-global-cashes-exports-plaquemines-lng-plant-sec-filing-shows-2025-07-07/

2025-07-07 22:38

July 7 (Reuters) - U.S. President Donald Trump on Monday directed federal agencies to strengthen provisions in the One Big Beautiful Bill Act that repeal or modify tax credits for solar and wind energy projects. In an executive order, Trump said the renewable energy resources were unreliable, expensive, displaced more dependable energy sources, were dependent on foreign-controlled supply chains and were harmful to the natural environment and electric grid. Sign up here. The order directs the Treasury department to enforce the phaseout of tax credits for wind and solar projects that were rolled back in the budget bill passed by Congress and signed into law by Trump last week. It also directs the Interior department to review and revise any policies that favor renewables over other energy sources. Both agencies are required to submit a report to the White House within 45 days detailing actions taken. The One Big Beautiful Bill Act effectively ends renewable energy tax credits after 2026 if projects have not started construction. Wind and solar projects whose construction starts after that must be placed in service by the end of 2027. Under previous law, project developers would have been able to claim a 30% tax credit through 2032. https://www.reuters.com/legal/government/trump-executive-order-seeks-end-wind-solar-energy-subsidies-2025-07-07/

2025-07-07 22:29

July 8 (Reuters) - Europe's car industry could return to producing 16.8 million cars a year, equalling its post-2008 crisis peak, if the European Union maintains its 2035 clean cars target and implements policies to support the transition, a study published by campaign group Transport & Environment showed on Tuesday. Conversely, deploying no industrial strategy and going back on the 2035 target that all new cars and vans sold in the EU no longer emit carbon dioxide could result in a loss of 1 million auto industry jobs and two-thirds of planned battery investments, T&E said in a statement. Sign up here. WHY IT'S IMPORTANT Already challenged by high costs in their home markets and a gap to Chinese and U.S. rivals in the electric vehicle industry, European carmakers now face the effects of U.S. President Donald Trump's 25% tariffs on auto imports, which have pushed many manufacturers to pull their forecasts for 2025. Following heavy lobbying, the European Parliament gave its backing to a softening some of the EU CO2 emissions targets for cars and vans in May, but it has so far stuck the regulations that will bar the sale of fossil-fuel cars by 2035. KEY QUOTES "It's a make or break moment for Europe's automotive industry as the global competition to lead the production of electric cars, batteries and chargers is immense," Julia Poliscanova, Senior Director for Vehicles & Emobility Supply Chains at T&E, said in the statement. BY THE NUMBERS If the 2035 goal is maintained and policies to boost domestic EV production are implemented, the automotive value chain's contribution to the European economy would grow 11% by 2035, the advocacy group said. Job displacement in vehicle manufacturing could be offset by the creation of more than 100,000 jobs in battery making by 2030 and 120,000 in charging by 2035, it added. Weakening the goal alongside lack of comprehensive industrial policies meanwhile could slash the value chain's contribution by 90 billion euros ($105.5 billion) by 2035, the report said. ($1 = 0.8529 euros) https://www.reuters.com/sustainability/climate-energy/abandoning-eus-2035-zero-emission-car-target-would-risk-1-million-jobs-study-2025-07-07/

2025-07-07 22:23

July 7 (Reuters) - Canadian gold and copper miner Aura Minerals (ORA.TO) , opens new tab is preparing to list its shares on the Nasdaq, the company said on Monday, in a move that could fetch the company a valuation of $2.14 billion. The company is seeking to raise around $210 million, if it were to price its public offering of common shares near their July 4 closing price on the Toronto Stock Exchange. Sign up here. Many foreign companies list in U.S. to secure higher valuations and tap deeper capital markets. Uncertainty around U.S. President Donald Trump's tariff policies rattled investors and froze new listings, but sentiment is shifting as new listings gain momentum. Proceeds from Aura's U.S. offering will be used for strengthening business, including incremental liquidity and financial flexibility to support its strategic growth initiatives. Aura Minerals plans to sell 8.1 million shares, and expects to list on the Nasdaq under the symbol "AUGO". Founded in 1946, the gold and copper mining company is focused on project development and operations in the Americas. BofA Securities and Goldman Sachs are serving as global coordinators for the offering, while BTG Pactual and Itau BBA are acting as joint bookrunners. https://www.reuters.com/world/americas/canadas-aura-minerals-prepares-nasdaq-listing-targets-21-billion-valuation-2025-07-07/

2025-07-07 21:58

July 7 - TRADING DAY Making sense of the forces driving global markets Sign up here. By Alden Bentley, Editor in Charge, Americas Finance and Markets Jamie is enjoying some well-deserved time off, but the Reuters markets team will still keep you up to date on what moved markets today and we'll take a close look at how markets are digesting the latest U.S. tariff headlines and how they reacted to Tesla CEO Elon Musk's move to reclaim political influence. I'd love to hear from you so please feel free to reach out at [email protected] , opens new tab Today's Key Market Moves Today's key reads US signals trade announcements imminent as deadline looms Tesla slides as Musk's 'America Party' heightens investor worries Tesla short sellers set to pocket about $1.4 billion in profits after stock slump Trump says will impose 25% tariffs on Japan, South Korea Tariff headlines and moving deadlines Wall Street paused its bull run to start Monday on the back foot bracing for a barrage of tariff headlines before Wednesday, which U.S. President Donald Trump set as the expiration of a postponement he declared in the wake of the April 2 "Liberation Day" meltdown. While last week's record highs for the S&P 500 (.SPX) , opens new tab and Nasdaq (.IXIC) , opens new tab suggest that markets are learning to take the White House's fluid trade tactics in stride, they did pull back even more at midday after Trump said that from August 1 he will impose 25% tariffs on Japan and South Korea, two of the U.S.'s most stalwart trade allies who have yet to reach trade deals with Trump. Trump has promised to notify countries that haven't reached deals by the July 9 deadline of what their new tariffs will be as of August 1, which now becomes the next big calendar notation for investors. Treasury Secretary Scott Bessent said more trade announcements were likely by Wednesday. Monday's pullback aside, the stock market has more than recovered from the April panic, riding out numerous other potential major risks, from Trump's threats to fire Fed Chair Jerome Powell, to the U.S. bombing of Iran nuclear sites to last week's passage of the "Big Beautiful Bill" that economists predict will add trillions to the U.S. debt, any tariff revenue notwithstanding. Only the dollar remains deep underwater. Although it bounced nicely on Monday, it is off 7% against the euro since April 2, and the broader dollar index is down about 6%, while the S&P 500 is up 9.5%. The 10-year Treasury note's benchmark yield is only about 20 basis points higher than its April 2 close, having weathered global concern that the U.S. was no longer a safe place to be invested. Speaking of the "big beautiful" tax bill, Tesla CEO and former-Trump-ally- turned enemy Elon Musk declared it would bankrupt America and announced the formation of a third U.S. political party, the America Party. Investors immediately tanked Tesla shares, which also weighed on Wall Street, recalling how his stint running Trump's Department of Government Efficiency was a costly distraction from the business of making electric vehicles and rockets. What could move markets tomorrow? Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. Trading Day is also sent by email every weekday morning. Think your friend or colleague should know about us? Forward this newsletter to them. They can also sign up here. https://www.reuters.com/world/china/global-markets-trading-day-2025-07-07/

2025-07-07 21:35

July 7 (Reuters) - U.S. power outages could double in five years if suppliers fail to add capacity during peak demand, the Department of Energy said on Monday. "Blackouts could increase by 100% in 2030 if the U.S. continues to shutter reliable power sources," DOE noted in a report on grid reliability and security. Sign up here. It cited green policies of the Biden administration as a major reason for the retirement of power plants and the delay in approving their replacements. The gap between electricity demand and supply is widening, particularly as artificial intelligence drives the need for more power-hungry data centers, it added. The department said it expects 209 gigawatts of new electricity generation to be added by 2030 to replace 104 GW of plant retirements, but only 22 GW of the new energy will come from power sources that provide stable and continuous power supply, raising outage risk in several regions. https://www.reuters.com/business/energy/lack-new-us-power-capacity-could-double-blackouts-by-2030-says-energy-department-2025-07-07/