2025-07-02 19:47

WARSAW, July 2 (Reuters) - Polish oil and gas company Orlen (PKN.WA) , opens new tab could face a bill of almost $300 million after an arbitration tribunal ruled that Russia's Gazprom (GAZP.MM) , opens new tab had the right to retroactively charge higher prices for gas supplies to Poland, it said on Wednesday. Orlen, which took over Polish gas monopoly PGNiG in 2022, is in several disputes with Gazprom in an arbitration tribunal in Stockholm over prices Poland paid for Russian gas from 2017 to 2022. Sign up here. Gazprom is fighting numerous legal cases, with combined claims of at least 17 billion euros ($20.05 billion) from European companies, according to Reuters calculations. The July 1 arbitration ruling raises gas prices under the contract between PGNiG and Gazprom between 2018 and the next potential change of price from the years 2020 and 2021, which Orlen estimates could cost it $290 million, the company said. The ruling did not specify the terms of settlement between the companies and did not award any compensation for Gazprom, leaving it up to the companies to agree terms of settlement, Orlen said, adding that it cannot make any payments to Gazprom under existing regulations. "Orlen operates in accordance with the law and complies with applicable sanctions, which currently prevent it from making any payments under the judgment," the company said. In the next stage, the tribunal will rule on both sides' claims over prices in 2021 and 2022, as well as claims resulting from Gazprom's halt of supplies to Poland in 2022, the Polish company said. ($1 = 0.8477 euros) https://www.reuters.com/business/energy/orlen-may-owe-290-million-gazprom-scores-partial-gas-price-dispute-win-2025-07-02/

2025-07-02 16:36

July 2 (Reuters) - Brazil's central bank signaled a "very prolonged" pause in its interest rate-hiking cycle because policymakers need more time to assess whether data are moving in the desired direction, a senior official said on Wednesday. The bank's monetary policy director, Nilton David, stressed that the decision to halt the tightening cycle reflects the need to wait for signs that excess economic growth beyond potential has been absorbed, allowing inflationary pressures to ease. Sign up here. "We do believe the length of time (rates remain unchanged) has an effect," he told an event hosted by Citi. David added that the process inevitably involves a slowdown in Latin America's largest economy, which has been consistently surprising to the upside for four years. "We are absolutely convinced that monetary policy works," he said. "It's only a matter of time and things will converge." The central bank raised its benchmark interest rate by 25 basis points last month to a near two-decade high of 15% and signaled it would pause tightening at its next policy meeting in July. Since September, cumulative hikes have totaled 450 basis points in an effort to tame annual inflation, which has been long running above 5%, exceeding the 3% target. https://www.reuters.com/world/americas/brazils-central-bank-needs-time-assess-data-after-signaling-pause-rate-hikes-2025-07-02/

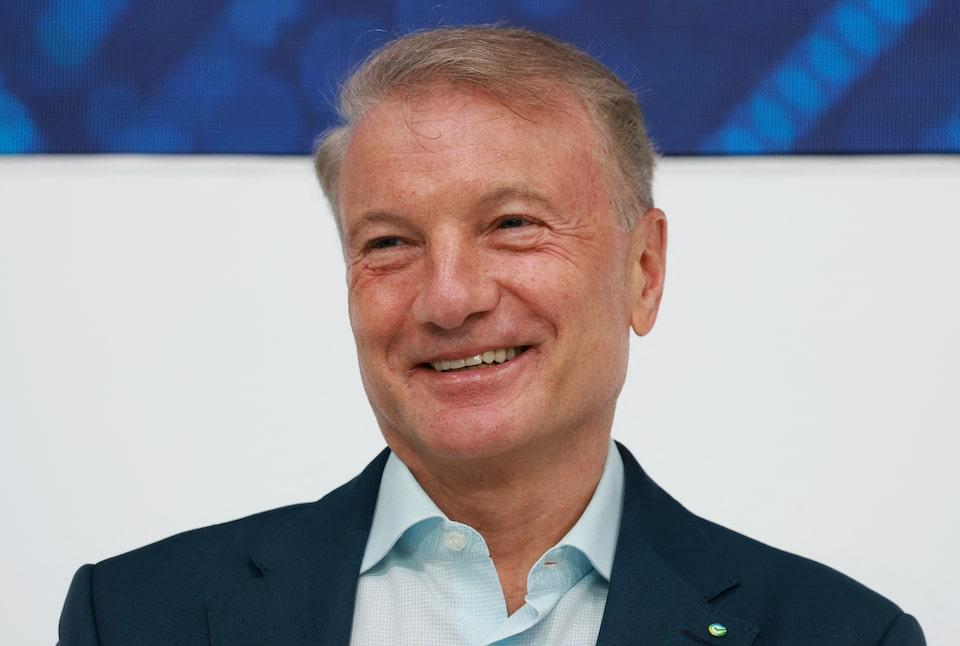

2025-07-02 16:32

ST PETERSBURG, Russia, July 2 (Reuters) - German Gref, CEO of Russia's dominant lender Sberbank (SBER.MM) , opens new tab, on Wednesday said he did not see any potential benefits to Russia's development of the digital rouble beyond the possible exception of cross-border settlements. Russian banks will be required to offer customers the means to make payments using digital roubles from September 1, 2026, the central bank said last week, pushing the project's planned launch back by over a year. Sign up here. More than 130 countries are exploring digital versions of their currencies, according to the Atlantic Council, as the world's financial authorities respond to declining cash usage and the threat to their money-printing powers from the likes of bitcoin. Moscow hopes the digital rouble will simplify foreign trade payments that have been complicated by Western sanctions over the conflict in Ukraine. "I don't see its advantages," Gref told reporters during a financial forum in St Petersburg. "As an individual, I don't understand why digital roubles are needed. As a bank... I don't yet understand it very well either." Russian banks already have strong digital finance capacities, such as cashless settlements, Gref said, reiterating that he saw no possibility for the digital rouble to meaningfully transform Russia's economy. No digital currency has become dominant within any country, he said, but there could be a future in cross-border settlements. "Domestically, I don't see it yet," he said. https://www.reuters.com/business/finance/sberbank-ceo-puzzled-by-russias-push-create-digital-rouble-2025-07-02/

2025-07-02 15:46

Sterling, British stocks also fall sharply Tumbles reflect investor fears about UK deficit, draws comparison with Liz Truss Traders eye finance minister's Rachel Reeves' position LONDON, July 2 (Reuters) - British government bonds tumbled sharply on Wednesday as a tearful appearance by Chancellor Rachel Reeves in parliament a day after the government backed down on its welfare reforms reignited concern over Britain's finances. Reeves was attending Prime Minister's Questions on Wednesday following the government's decision to sharply scale back plans to cut benefits. The sharp plunge in British assets immediately drew comparisons with Liz Truss' short-lived premiership nearly three years ago, which was derailed by a bond market selloff. Sign up here. Investors are monitoring Reeves' status after the British government's reversal on welfare reforms meant the plans would no longer save taxpayers any money, shredding the margin Britain relies on to meet its fiscal rules. The welfare reform U-turn was "signalling that the Labour Party is a lot less concerned about what the gilt market thinks," said Gordon Shannon, portfolio manager, TwentyFour Asset Management. "I would have thought it was seared into politicians' memories what happened to Liz Truss." The yield on the 10-year government bond, or gilt, rose as much as 22 basis points on the day at one point, to 4.681% , as investors ditched British debt. It then recovered somewhat to 4.60%. At its peak, the benchmark yield was set for its largest one-day jump since October 2022, the aftermath of Truss' chaotic package of large, unfunded tax cuts that scuttled her premiership. During the depths of the 2022 crisis, the yield on the 10-year gilt rose by 50 bps in a single day at one point. The selloff also hit very long dated gilts, and 30-year yields rose 17 basis points. “The latest headline would suggest more uncertainty with regards to the current government," said Simon Blundel, head of European fundamental fixed income investments at BlackRock. "It's another thing for us to look at and position for,” he said, though he added that BlackRock had generally taken a positive stance towards gilts and the market was not as vulnerable as it was in 2022, when turmoil in Britain's pensions sector exacerbated moves. Investors in bonds around the world are growing increasingly nervous about government deficits from Japan to the United States, with Britain seen as among the more vulnerable. REEVES' POSITION IN FOCUS Earlier on Wednesday, British assets were trading slightly lower, but the selloff intensified rapidly after Reeves appeared alongside Prime Minister Kier Starmer during the weekly prime minister's questions looking exhausted and upset. Traders also focused on comments from Starmer seemingly not endorsing Reeves, though Starmer's press secretary later said Reeves has his full support, and she was upset because of "a personal matter". Reeves has repeatedly emphasised her commitment to self-imposed fiscal rules, limiting the amount Britain will borrow, and, analysts said, Wednesday's market moves reflected fears that she would be replaced, creating even more uncertainty. "The gilt market is largely concerned that a new chancellor will rip up Reeves' fiscal rules and go for excessive unfunded borrowing. Combine that with a plan that has not delivered or is unlikely to deliver much growth or productivity gains, then it looks a very risky strategy to adopt!" Craig Inches, head of rates and cash at Royal London Asset Management, said. Reeves has also been blamed by some Labour members of parliament for pushing for billions of pounds of savings that were described as cruel and targeting the most vulnerable. Sterling dropped around 1% against the dollar and also weakened sharply against the euro, which rose 0.8% to its highest on the pound in two months. , Britain's domestically focused mid-cap index (.FTMC) , opens new tab was down 1.3% on the day, sharply underperforming European stocks. "The deficit is going to have to be closed somehow, clearly the signal from yesterday is that can’t come from substantial spending cuts, I don’t think it’s possible for the government to borrow the money, that leaves tax rises," Nick Rees, head of macro research at Monex Europe, said. "It's a pretty ugly outlook for sterling." https://www.reuters.com/world/uk/uk-bonds-suffer-biggest-selloff-since-october-2022-worries-build-over-finance-2025-07-02/

2025-07-02 14:35

BRASILIA, July 2 (Reuters) - Brazil's central bank said on Wednesday that technology services provider C&M Software, which serves financial institutions lacking connectivity infrastructure, had reported a cyberattack on its systems. The bank did not provide further details of the attack, but said in a statement that it ordered C&M to shut down financial institutions' access to the infrastructure it operates. Sign up here. C&M Software commercial director Kamal Zogheib said the company was a direct victim of the cyberattack, which involved the fraudulent use of client credentials in an attempt to access its systems and services. C&M said critical systems remain intact and fully operational, adding that all security protocol measures had been implemented. The company is cooperating with the central bank and the Sao Paulo state police in the ongoing investigation, added Zogheib. Brazilian financial institution BMP told Reuters that it and five other institutions experienced unauthorized access to their reserve accounts during the attack, which took place on Monday. BMP said the affected accounts are held directly at the central bank and used exclusively for interbank settlement, with no impact on client accounts or internal balances. BMP added it has taken all necessary operational and legal steps and holds sufficient collateral "to fully cover the impacted amount, without any harm to its operations or business partners." An official familiar with the ongoing investigation, who spoke on condition of anonymity, said C&M provides services to around two dozen small financial institutions, and the amounts involved in the attack do not reach into the billions of reais. Another source said there were no losses suffered by clients. The central bank has used the term "financial institutions lacking their own connectivity infrastructure" to refer to digital payment institutions, which have grown rapidly in Latin America's largest economy, boosted by innovations driving competition in the sector. For instance, the Pix instant payment system, developed and operated by the central bank, was launched in late 2020 and has become the most widely used payment method in the country. https://www.reuters.com/world/americas/brazils-cm-software-hit-by-cyberattack-central-bank-says-2025-07-02/

2025-07-02 12:40

July 2 (Reuters) - Tech billionaire Joe Lonsdale said on Wednesday he is investing in a new crypto-focused U.S. bank being launched by Anduril co-founder Palmer Luckey that aims to fill the void left by Silicon Valley Bank's collapse. Before a March 2023 liquidity crisis, SVB had long been a major primary banking channel for early-stage technology firms and venture capitalists - entities deemed too risky by traditional banks. Sign up here. Many startups struggled to access capital and meet immediate obligations such as payrolls after the bank collapsed. Lonsdale, who co-founded Palantir (PLTR.O) , opens new tab, said in an emailed statement to Reuters that he is a "proud investor" in the project. The proposed lender, called Erebor, has applied for a national bank charter and plans to serve technology businesses in areas such as artificial intelligence, crypto, defense and manufacturing, as well as individuals who work at or invest in them, according to its charter application. Like Anduril and Palantir, Erebor takes its name from J.R.R. Tolkien's "The Lord of the Rings" series. In the books, Erebor is the "Lonely Mountain", a fortress whose treasures are reclaimed from the dragon Smaug. The application for Erebor, to be headquartered in Columbus, Ohio, outlines a digital-only model, with a secondary office in New York. According to the charter application, the bank will be led by Owen Rapaport and Jacob Hirshman, a former adviser to stablecoin company Circle (CRCL.N) , opens new tab. Erebor is also planning to hold stablecoins on its balance sheet. A crypto asset class pegged to currencies such as the U.S. dollar, stablecoins are designed to hold a steady value backed by reserves. Fintechs and established financial institutions are increasingly adopting stablecoins to accelerate cross-border payments faster, simplify settlements and expand access to digital financial services. The bank in a regulatory filing said it aims to be "the most regulated entity conducting and facilitating stablecoin transactions." The Financial Times first reported the news and said that the group of tech billionaires backing Erebor also includes Peter Thiel's Founders Fund. Luckey and Lonsdale are not expected to be involved in the day-to-day management of the bank, the Financial Times report said. Luckey, Thiel, and a spokesperson for Erebor did not immediately respond to Reuters' requests for comment. https://www.reuters.com/business/tech-billionaires-led-by-palmer-luckey-launch-new-bank-rival-svb-ft-reports-2025-07-02/