2025-06-30 16:34

NEW YORK, June 30 (Reuters) - Surging U.S. government debt may sap investor appetite for key U.S. assets like long-dated Treasuries and the dollar, bolstering the case for turning to opportunities beyond U.S. borders, BlackRock said on Monday. President Donald Trump's tariffs spurred market volatility this year and raised doubts over the dollar's status as the world's reserve currency. Fears of de-dollarization remain far-fetched but rising government debt could increase that risk, said fixed income executives at the world's largest asset manager. Sign up here. "We’ve been highlighting the precarious position of the U.S. government’s indebtedness for some time now, and, if left unchecked, we view debt as the single greatest risk to the 'special status' of the U.S. in financial markets," they said in a third-quarter fixed income outlook note. Congress is debating a tax and spending bill that is a key element of Trump's economic agenda and that non-partisan analysts say will add up to $5 trillion over the next decade to the U.S. federal government debt pile of more than $36 trillion. Higher government debt could reduce the correlation between the direction of long-dated Treasury yields and monetary policy in the United States, BlackRock said, with yields rising despite the Federal Reserve cutting interest rates. Increased supply of U.S. government debt is likely to be met with lower demand from the Fed as well as foreign central banks. That argues for diversification outside of the U.S. government bond market and for more exposure to short-dated U.S. Treasuries that could benefit from interest rate cuts, the asset manager said. "Despite proposed spending cuts, deficits are still climbing - and more of that spending is now going toward interest payments," said BlackRock's investment managers. "With foreign investors stepping back and the government issuing more than half a trillion dollars of debt weekly, the risk of private markets being unable to absorb this debt and consequently pushing government borrowing costs higher, is tangible," they added. https://www.reuters.com/world/us/rising-government-debt-poses-greatest-risk-us-market-standing-says-blackrock-2025-06-30/

2025-06-30 15:21

Market uncertainties from trade war and high interest rates impact M&A Dealmakers optimistic about the rest of the year Asia sees record number of M&A deals over $10 billion NEW YORK, June 29 (Reuters) - Mergers and acquisitions during the first half of this year were not what investment bankers had hoped for, but a burst of big deals in Asia and renewed optimism in U.S. markets could be paving the way for megadeals. Market uncertainties stemming from U.S. President Donald Trump's trade war, high interest rates and broader geopolitical tensions hampered — but did not completely derail — what bankers expected to be a blockbuster year for global M&A, dealmakers say. Sign up here. Trump's tariff policies, kicked off by his self-styled "Liberation Day" on April 2, cast a chill over the markets and pushed several deals and initial public offerings into subsequent quarters. "The expectation was we would see a lot of deal activity in the first half of 2025, and the reality is we didn't see it," said Tommy Rueger, global co-head of equity capital markets at UBS, which Dealogic ranked No. 9 in equity capital markets revenue, according to preliminary data from January 1 through June 27. Interviews with more than a dozen top bankers signal growing confidence that the worst of the market turbulence is over. Fresh record closing highs for the S&P 500 and Nasdaq indexes have helped renew optimism that M&A in the second half of the year will be even stronger, dealmakers say. "There were a lot of deals that were put on hold that will come back," said Ivan Farman, co-head of global M&A at Bank of America, which was ranked No. 3 in overall investment banking revenue and No. 5 for M&A in Dealogic's year-to-date rankings. "I'm optimistic about the second half." There is reason for optimism, dealmakers say, with the recovery in the markets and Trump's easier antitrust policies paving the way for bigger deals. "The probability of very large transactions, perhaps $50 billion-plus, has increased versus a year ago," said John Collins, global co-head of Mergers & Acquisitions at Morgan Stanley, which was ranked No. 4 in overall fee revenue among investment banks and No. 3 for M&A deals. Some $2.14 trillion in deals were signed from January 1 through June 27, up 26% from the same period last year. Part of that increase, however, came from Asia, where activity more than doubled to $583.9 billion. Deal activity in North America rose to $1.04 trillion from January 1 through June 27, up 17% from the first half last year, according to preliminary data from Dealogic. Market volatility, as measured by the VIX index (.VIX) , opens new tab, has dropped to levels that indicate investors feel safer to invest today. "It's been clear that momentum continues to build, paving the way for larger transactions. People are feeling more positive than they were a month ago and starting to implement their decisions," said Philip Ross, vice chairman of Jefferies bank. As the markets calm down, institutional investors are starting to jump back in to equities and more companies are moving forward with IPO plans that had been postponed earlier this quarter. “The combination of all of those together has created, over the last three to four weeks, an incredibly strong new issue backdrop and we’ve seen a significant uptick in activity," Rueger said. Saadi Soudavar, head of equity capital markets for Europe, Middle East and Africa at Deutsche Bank, added: "Equity markets have shown a remarkable ability to shrug off a lot of the tariff and geopolitical related volatility." MORALE BOOSTERS A few big deals helped boost market morale at the height of tariff turmoil, including Global Payments' $24.25 billion acquisition of a card processing and account services firm in April. Charter Communications (CHTR.O) , opens new tabin May agreed to buy privately held rival Cox Communications for $21.9 billion. And U.S.-based equipment manufacturer Chart Industries GTLS.N and Flowserve Corp (FLS.N) , opens new tab agreed to merge, valuing the combined company at about $19 billion. There were 17,528 deals signed during the first half of this year, compared with 20,583 deals in the same period last year, according to Dealogic. But this year's deals were bigger in size, pushing the total value of deals higher. There was a 62% increase in the number of $10 billion-plus deals versus the same period last year, the data shows. Dealmaking in Asia was a bright spot. Overall M&A activity rose to $583.9 billion in the first six months, up from $269.9 billion a year ago. Led by Japan and China, the region accounted for 27.3% of the global M&A activity, gaining more than 11 percentage points from the same period last year. Some of the region's biggest deals were kept within the Asia-Pacific region. Toyota Motor (7203.T) , opens new tab announced plans on June 3 to take one of its suppliers private for $33 billion. On June 16, a consortium led by Abu Dhabi's National Oil Company (ADNOC) launched an $18.7 billion all-cash takeover of Australia's second-largest oil producer Santos (STO.AX) , opens new tab. Asia also helped drive global equity issuance higher despite the market volatility, with overall volume rising nearly 8% to $350 billion from the same period last year. "You will see more Asia-to-Asia activity," said Raghav Maliah, global vice chairman of investment banking at Goldman Sachs, which was ranked No. 2 in overall investment banking fees and No. 1 in M&A revenue. "Japan has been a big driver in all the deal volumes (in Asia) and we do believe that trend will continue." https://www.reuters.com/business/finance/larger-deals-power-global-ma-h1-bankers-signal-appetite-megadeals-2025-06-30/

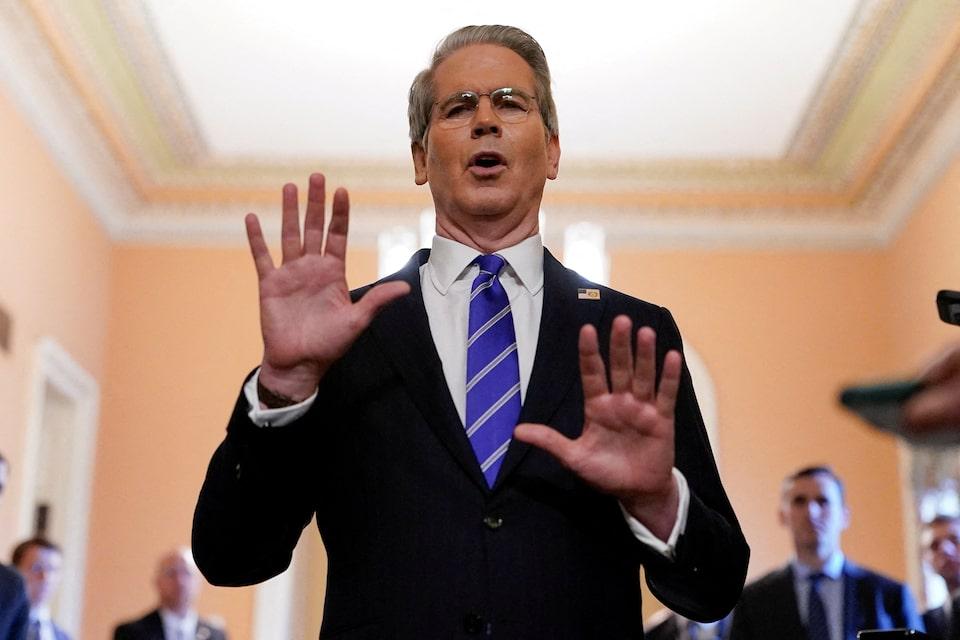

2025-06-30 14:40

Trump says U.S. will send tariff rate letter to Japan Tariff rates expected to increase on July 9 Japan negotiator says the countries are working hard on a deal WASHINGTON, June 30 (Reuters) - President Donald Trump expressed frustration with U.S.-Japan trade negotiations on Monday as Treasury Secretary Scott Bessent warned that countries could be notified of sharply higher tariffs as a July 9 deadline approaches despite good-faith negotiations. Trump wrote in a social media post that Japan's reluctance to import American-grown rice was a sign that countries have become "spoiled with respect to the United States of America." Sign up here. "I have great respect for Japan, they won't take our RICE, and yet they have a massive rice shortage," Trump wrote on Truth Social. "We'll just be sending them a letter, and we love having them as a Trading Partner for many years to come." Trump said last week that his administration would send letters to a number of countries notifying them of their higher tariff rates before July 9, when tariff rates are scheduled to revert from a temporary 10% level to his suspended rates of 11% to 50% announced on April 2. Trump's Monday complaint about U.S.-Japan rice trade follows his comments broadcast on Sunday that Japan engages in "unfair" autos trade with the U.S. White House spokesperson Karoline Leavitt said on Monday that Trump would meet with his trade team to set tariff rates for countries "if they don't come to the table to negotiate in good faith." Bessent, who earlier this month floated the idea of extending the deadline for countries that were negotiating trade deals with the U.S. in good faith, told Bloomberg Television that only Trump would decide on such extensions. He added that he expects "a flurry" of deals ahead of the July 9 deadline and wanted to keep up pressure on trading partners. "We have countries that are negotiating in good faith, but they should be aware that if we can't get across the line because they are being recalcitrant, then we could spring back to the April 2 levels. I hope that won't have to happen," Bessent said. Japan's main tariff negotiator, Ryosei Akazawa, on Monday said that Japan would continue working with the U.S. to reach a trade agreement while defending Japan's national interest. Akazawa said he was aware of Trump's comments on autos, adding that a continuation of Trump's 25% on autos imported from Japan would cause significant damage to its economy. Another key trading partner, the European Union, is open to a trade agreement that maintains a 10% U.S. tariff on EU goods, but wants U.S. commitments to reduce its tariffs in key sectors such as pharmaceuticals, alcohol, semiconductors and commercial aircraft, Bloomberg News reported, citing people familiar with the matter. Reuters reported earlier this month that European officials are increasingly resigned to a 10% rate of "reciprocal" tariffs being the baseline in any trade deal between the U.S. and the EU. Britain negotiated a trade deal on similar terms, accepting a 10% U.S. tariff on many goods, including autos, in exchange for special access for aircraft engines and British beef. https://www.reuters.com/world/us/us-treasurys-bessent-warns-countries-face-higher-tariff-rates-after-july-9-2025-06-30/

2025-06-30 13:50

BRASILIA, June 30 (Reuters) - Brazilian private economists still expect the central bank to start cutting interest rates next January, even after policymakers reinforced guidance that borrowing costs will remain steady for a "very prolonged" period to anchor inflation to target, according to a survey released on Monday. The central bank's weekly survey shows economists project the benchmark Selic rate to be held at 15% through December, before falling to 14.75% in January. Sign up here. Policymakers earlier this month raised the Selic rate by 25 basis points to its current level, bringing the total amount of tightening to 450 basis points since September, and signalled a pause at the next meeting in late July. Following the hike, the median forecast in the survey shifted to a 25-basis-point cut in January, with the Selic rate projected to end 2026 at 12.50%. That outlook remained unchanged on Monday. Diogo Guillen, the central bank's economic policy director, emphasized on Friday that policymakers view any rate-cut debate as premature. The latest survey also showed that the expected inflation rate for 2025 was cut for a fifth straight week to 5.20%, but projections for subsequent years remain unchanged above the 3% official target, which has a 1.5-point tolerance range either side. In recent speeches, central bank Governor Gabriel Galipolo and Guillen reiterated policymakers' commitment to bringing inflation to the 3% target over the "relevant horizon" - the 18-month period influenced by current policy decisions. Policymakers have flagged a rate pause despite projecting inflation to be 3.6% over that horizon. That forecast was based on market expectations that the Selic rate would be held steady at 14.75% until January 2026 - a more dovish path than has materialized. Galipolo and Guillen added that inflation is still expected to converge to the central bank's target under alternative, undisclosed rate paths. https://www.reuters.com/world/americas/brazilian-economists-expect-central-bank-cut-rates-early-2026-despite-hawkish-2025-06-30/

2025-06-30 12:45

LONDON, June 30 (Reuters) - IXM, owned by China's CMOC, has declared force majeure , opens new tab on deliveries of cobalt produced in the Democratic Republic of Congo (DRC) which has suspended exports of the battery material, the commodity trader said on its LinkedIn page. Congo introduced a four-month ban on all cobalt exports in February in an attempt to curb oversupply and support of prices near nine-year lows around $10 a lb. Last week Congo extended the suspension for another three months. Sign up here. https://www.reuters.com/world/africa/cmocs-ixm-declares-force-majeure-cobalt-deliveries-congo-linkedin-post-2025-06-30/

2025-06-30 12:18

June 30 (Reuters) - Gold miner Twangiza Mining SA has accused Rwanda-backed M23 rebels of forcing its employees to work against their will and without pay after seizing its mine in eastern Democratic Republic of Congo. M23 staged a lightning advance earlier this year in eastern Congo, taking control of more land than ever before in North and South Kivu provinces. The Twangiza Mining site is located in South Kivu province. Sign up here. In May, the company said it had been ordered to suspend operations at the mine after M23 accused it of not paying taxes. In a new statement dated Friday, Twangiza Mining, which is headquartered in Congo and describes itself as a Chinese firm, said its workers were being "held in captivity, forced to work in inhuman conditions, without any security measure, remuneration or medical coverage." Reuters could not independently verify the company's assertions. M23 and Congo's government did not respond to requests for comment. The statement from Twangiza Mining also said production had been "paralyzed" and that the site was "entirely controlled" by a group of Rwandan nationals who, working with M23 and claiming to be new investors, have been exploiting the mine "for their own profit by treating our employees like slaves deprived of all protection". Congo, the United Nations and Western powers say Rwanda is supporting M23 by sending troops and arms. Rwanda has long denied helping M23, saying its forces were acting in self-defence against Congo's army and ethnic Hutu militiamen linked to the 1994 Rwandan genocide. Yolande Makolo, Rwanda government spokesperson, said on Monday that Rwanda had nothing to do with the dispute with Twangiza Mining. "Rwanda is not involved in this situation, and the accusations against Rwandan citizens are without basis - there is no record or information of any Rwanda citizens involved in such activities," Makolo said. "This is a local issue that should be taken up with the authorities in the area." On Friday, the foreign ministers of Rwanda and Congo signed a U.S.-brokered peace deal, raising hopes for an end to fighting that has killed thousands and displaced hundreds of thousands more so far this year. U.S. President Donald Trump's administration aims to attract billions of dollars in Western investment to Congo, which is rich in tantalum, gold, cobalt, copper and lithium. Qatar has been hosting talks between Congo and M23. https://www.reuters.com/sustainability/society-equity/congo-gold-miner-says-m23-rebels-force-staff-work-without-pay-2025-06-30/