2025-06-27 12:46

BERLIN, June 27 (Reuters) - Germany is considering changing its foreign trade law to prevent the company running the Nord Stream 2 pipelines from being taken over, a document showed on Friday, as part of Berlin's efforts to prevent any resumption of Russian gas imports. For decades Germany relied on cheap Russian gas, but since the outbreak of the conflict in Ukraine, it has sought alternatives. Sign up here. German Chancellor Friedrich Merz has said he will ensure Nord Stream 2, which the country once backed, would not go into operation, but for now the country has no legal means to prevent a sale of the assets, owned by Russian giant Gazprom (GAZP.MM) , opens new tab. The Nord Stream pipeline system comprises two double pipelines across the Baltic Sea to Germany and was the biggest route for Russian gas to enter Europe, capable of delivering 110 billion cubic metres of gas a year. The second link Nord Stream 2 was completed in 2021. It never became operational due to deteriorating relations between Russia and the West and was hit by unexplained explosions in 2022 that left one of its two lines intact. Swiss-based Nord Stream 2 has been going through insolvency procedures that could lead to asset sales. In November, The Wall Street Journal reported that U.S. investor Stephen P. Lynch was attempting to acquire Nord Stream 2, a report the Russian government denied. In a parliamentary response dated June 24, the German Economy Ministry said the government was discussing a possible amendment during this legislative period to the foreign trade law as it does not currently provide for any investment review in the event of a takeover. Der Spiegel magazine first reported the news. Former economy ministry state secretary and Green lawmaker Michael Kellner said the government must close this loophole. "Pipelines in Germany or Europe do not belong in the hands of Russian or American companies," he told Reuters. Gazprom did not reply to a request for comment. https://www.reuters.com/business/energy/germany-considers-law-reform-block-russian-owned-nord-stream-takeover-2025-06-27/

2025-06-27 12:38

BEIJING, June 27 (Reuters) - China's central bank said on Friday that it would adjust the pace and intensity of policy implementation in response to domestic and global economic and financial conditions. The world's No.2 economy has faced pressure this year due to U.S. President Donald Trump's imposition of tariffs on Chinese products and persistent deflationary pressure at home. Sign up here. "The external environment has grown increasingly complex and challenging, with weakening momentum in global economic growth, rising trade barriers, and diverging economic performance among major economies," the People's Bank of China (PBOC) said in a summary of its quarterly monetary policy committee meeting. The economy "still faces difficulties and challenges such as insufficient domestic demand, persistently low price levels, and multiple hidden risks," the bank said. "It is suggested that the intensity of monetary policy adjustments be increased, and the forward-looking, targeted and effective nature of monetary policy adjustments be enhanced," it added. In May, the PBOC unveiled a raft of easing steps, including interest rate cuts and a major liquidity injection, as Beijing stepped up efforts to soften the economic damage caused by the trade war with the United States. Investors are watching for signs of fresh stimulus from an expected Politburo meeting in July as well as clues from an anticipated plenum later this year, where top party leaders are likely to discuss the country’s 2026–2030 five-year plan. "On the monetary policy front, we do not expect an aggressive move unless there is a wholesale change in the leadership's economic belief," analysts at ANZ said in a note. ANZ expects the central bank to cut its key interest rate by 10 basis points ahead of the expected Politburo meeting, followed by a further 30-basis-point reduction after the party plenum, likely in August, the analysts said. The PBOC said it would guide financial institutions to step up credit supply, and push for the lowering of overall social financing costs. It also pledged to enhance the resilience of the foreign exchange market, to guard against the risk of exchange rate overshooting, and to keep the yuan exchange rate "basically stable at a reasonable and balanced level". On the beleaguered property market, the bank said it would increase efforts to revitalise existing commercial housing and land inventory, and continue to consolidate the "stable momentum" in the sector. https://www.reuters.com/markets/asia/chinas-central-bank-pledges-speed-up-policy-response-economic-conditions-2025-06-27/

2025-06-27 12:37

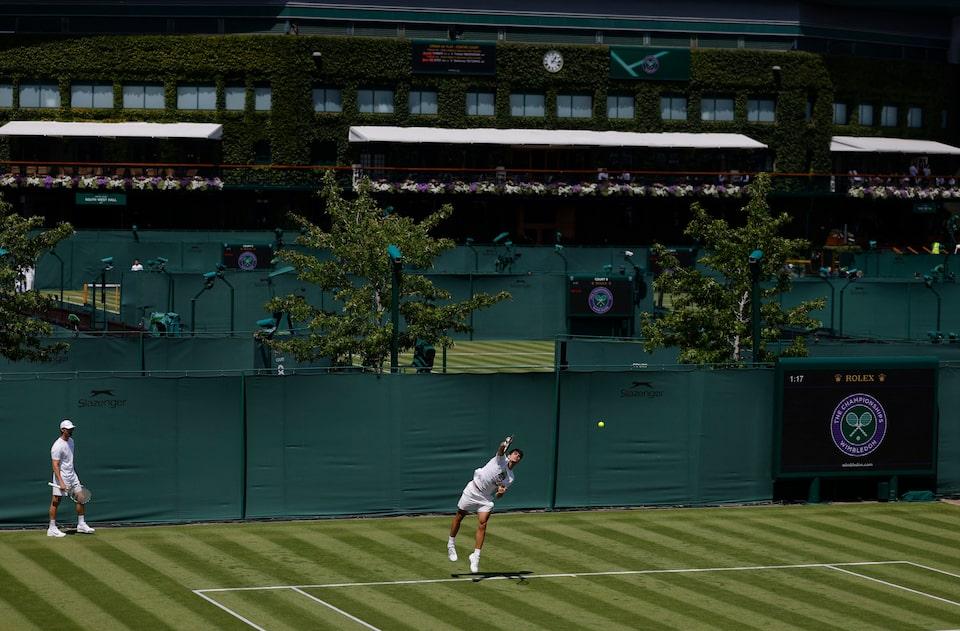

LONDON, June 27 (Reuters) - Wimbledon is braced for its hottest ever start with London set to endure a searing heatwave that is forecast to peak as play begins at the All England Club on Monday. With the mercury expected to rise into the mid-30s Celsius on Monday after a hot weekend, players, organisers, ticket holders and those queuing face a challenging day. Sign up here. The previous record temperature for the start of the grass court Grand Slam event was set in 2001 when 29.3C was reached. Monday's expected blast of heat could even surpass the tournament record of 35.7 degrees in 2015 when on-court temperatures were significantly higher than that. Wimbledon's heat rule will likely come into force, allowing a 10-minute break in play when the Wet Bulb Globe Temperature (WBGT) is at or above 30.1 degrees Celsius. The WBGT, which will be taken before the start of play and then at 1400 and 1700, takes various factors into account including ambient temperature, humidity, wind and sun angle. The rule will apply after the second set for all best of three set matches, and after the third for all best of five set matches with players allowed to leave the court during the break, but not to receive coaching or medical treatment. 'LESS INTERESTING' While welcoming the heat rule, Chris Taylor, an environmental physiology researcher at the University of Roehampton, said the heat could affect the quality of matches. "It's good that they have a rule that uses the Wet Bulb Globe Temperature but what it doesn't factor in is what the players are doing," he told Reuters. "Most of the heat risk for players relates to their actual body temperature increasing, 80% of their body temperature is related to what they're doing. "Many players will change the way they play if it's that warm, shorter points and perhaps less interesting for the fans. "Top players with the resources for warm weather training are used to heat and are conditioned and will probably be okay, but the real problem is for players who are not used to it and cannot adapt their play." He also said iced towels applied to the back of the neck during changeovers are not necessarily the best way for players to cool down. "It's like a football team giving a pain-killing injection to their star player before a cup final, it makes them feel better but the injury is still there," he said. "If it's core body temperature you want to bring down, the towels aren't really going to do much. "The feet and the forearms have a lot of blood vessels and (cooling them down) is quite a good method of heat exchange, also the groin where you have the femoral artery." 'COMPREHENSIVE PLANS' While elite players are likely to cope with the expected heat, Wimbledon organisers are taking precautions to protect the general public and staff, including ball boys and girls (BBGs). "Adverse weather is a key consideration in our planning for The Championships, and we are prepared for the predicted hot weather, with comprehensive plans in place for guests, players, staff and the BBGs," a club statement said. More free water refill stations will be provided around the grounds and real-time weather alerts will be announced on big screens and via the tournament website. Staff shifts will also be adjusted to mitigate the heat while 'shade-mapping' will help people get away from the sun. After extreme heat on Monday and Tuesday, temperatures are expected to drop to the low to mid 20s for the rest of the week with some rain showers likely. https://www.reuters.com/sports/tennis/wimbledon-set-scorching-start-heatwave-looms-2025-06-27/

2025-06-27 12:33

SINGAPORE, June 27 (Reuters) - Singapore boosted the share of renewables in its power generation mix to a record high in May, an analysis of the latest market data showed, as the country ramped up renewable imports and accelerated local solar power generation. Domestic solar generation in May rose at the fastest pace since March 2024 and renewable imports rose a third straight month to their highest in more than two years, lifting the share of renewables in the city-state's power mix to 2.58%, data from the National Electricity Market of Singapore showed. Sign up here. Cross-border power trade is seen as key to easing regional reliance on fossil fuels amid growing data centre-driven power demand. Singapore expects to meet 6 GW, or around one-third of its power demand from clean electricity imports by 2035, as Asia's second-smallest country has limited renewable energy potential. Gas-fired power plants in Singapore account for about 95% of its power capacity. In the five months through May, the data showed Singapore imported 122.7 million kilowatt-hours of clean power, or 0.52% of total generation, the data showed. It did not import any power during the same period last year, the data showed, and only started importing small quantities in the last quarter of 2024. The share of imports in Singapore's power mix rose for a third straight month in May, displacing some fossil fuel-fired generation. Singapore's total electricity generation grew 0.4% during the first five months, the data showed. Singapore has two active cross-border power trade deals: the 200 MW Lao PDR–Thailand–Malaysia–Singapore (LTMS) and the 50 MW Energy Exchange Malaysia (ENEGEM) pilot project with Malaysia's state utility Tenaga Nasional Berhad. The Singapore Energy Market Authority's chief executive said in October the terms of an extension to the LTMS had yet to be finalised, as Singapore was waiting for Thailand to finalise details on transmission charges for the multilateral deal. On Friday, the EMA told Reuters in a statement that discussions were "ongoing for future enhancements to the LTMS," without elaborating further. https://www.reuters.com/sustainability/boards-policy-regulation/singapores-renewables-usage-hits-record-high-imports-solar-output-rise-2025-06-27/

2025-06-27 12:10

COPENHAGEN, June 27 (Reuters) - Shipping company Maersk (MAERSKb.CO) , opens new tab said on Friday it had decided to resume vessel calls at Israel's Haifa port. "With the prospect of current cease-fire agreement bringing de-escalation to the conflict, we have decided to resume vessel calls to the Port of Haifa, and acceptance for both import and export cargo is now open," Maersk said in a statement. Sign up here. Maersk last Friday said it had temporarily paused vessel calls at Haifa port, amid Israel's conflict with Iran. https://www.reuters.com/world/middle-east/maersk-resumes-haifa-port-calls-2025-06-27/

2025-06-27 11:47

Heads of Fed, ECB, BoJ, BoE and BoK meet Investors await comments on trade, dollar status FRANKFURT, June 30 (Reuters) - A million-dollar question will hang over the world's top central bankers when they meet in Sintra, Portugal, from Monday evening: Is the monetary system centred on the U.S. currency beginning to unravel? The central bank heads of the United States, the euro zone, Britain, Japan and South Korea will also have a chance to give their views on how global trade tensions and war in the Middle East are affecting the outlook for inflation and growth at the European Central Bank's annual get-together. Sign up here. But with inflation seemingly under control in most countries, the much deeper issue likely to permeate their discussions is: Could U.S. President Donald Trump's protectionist and unpredictable economic policies bring an end to the system that has ruled global finance for 80 years? "Like everybody else, they are struggling to figure out what kind of world we're heading into," said BNP Paribas chief economist Isabelle Mateos y Lago, who will also attend the forum in the picturesque hill town near Lisbon. "They've probably realised we're not going to get any answers anytime soon. And so the question is: How do you run monetary policy in that kind of environment?" Investors will hope to get some clues when Fed chair Jerome Powell, ECB President Christine Lagarde and the governors of the central bank of Japan, Britain and South Korea sit down for a panel discussion at the ECB's Forum on Central Banking on Tuesday afternoon. Among them, Powell will probably be in the hottest seat. He has been under intense pressure from Trump to cut interest rates but he has so far resisted. Any sign that the Fed's independence from the White House is under threat could erode the dollar's status as the world's currency of choice for trading, saving and investing. With his position bolstered by a recent U.S. Supreme Court ruling, Powell is likely to stick to his guns. But he faces an increasingly divided Federal Open Market Committee. Trump may also name Powell's successor well before his term expires next May, potentially undermining Powell's message. "A successor perceived by the market to be more open to accommodating Trump's wishes...risks damaging the independence of the Fed in setting policy," economists at Investec wrote. These fears have driven the dollar down to an almost four-year low of $1.17 against the euro in recent months. EURO'S MOMENT? ECB President Christine Lagarde will be in a relatively novel position for any chief of the euro zone's central bank: promoting the single currency as a bastion of stability. While her predecessor Mario Draghi faced speculation about a collapse of the euro until only a few years ago, Lagarde is capitalising on the dollar's woes to promote "euro's moment". If pessimism about the single currency proved overdone a decade ago, economists -- and Lagarde herself -- are adamant the European Union has its work cut out if it is to elevate the euro from its status as distant second in the global currency chart. The EU, still more a confederation of states than anything resembling a union, is widely seen as needing greater financial, economic and military integration before it can challenge the dollar's status. A net 16% of 75 central banks surveyed by OMFIF said they plan to increase euro holdings over the next 12 to 24 months, making it the most in-demand currency but still far less popular than gold. "I'm more optimistic about what's happening in Europe than I've been in a long time, but there's no guarantee of success," BNP Paribas' Mateos y Lago said. The central bankers of South Korea, Japan and Britain are likely to face some tricky questions of their own. The Bank of Japan is becoming increasingly cautious about raising interest rates -- despite some internal qualms and sticky food-price inflation -- due to the expected impact of U.S. tariffs. The Bank of Korea, which had been fearing a flood of cheap Chinese goods, could be forced to end its current easing cycle due to a sudden upswing in the property market. The Bank of England, where three of nine policymakers voted for a cut earlier this month, is also trying to work out whether signs of a slowdown in the labour market will ease still-strong inflation pressures from fast pay growth. "You start to see a lot more division in terms of voting and amongst the economists," KBRA’s European Macro Strategist Gordon Kerr said. "I think everybody just needs to be paying attention and be ready to react." https://www.reuters.com/business/finance/dollar-question-hovers-over-top-central-bankers-meeting-sintra-2025-06-30/