2025-06-27 11:38

EU due to propose 2040 climate goal next week Denmark will lead EU negotiations on the goal Facing pushback from countries concerned by cost COPENHAGEN, June 27 (Reuters) - European nations should not halt the continent's green transition, Denmark's climate minister told Reuters, as his country prepares to lead EU negotiations on a new climate target amid a backlash from some governments concerned about its cost. The European Commission plans to propose a new 2040 climate target next week to slash EU emissions by 90% compared with 1990 levels, but faces pushback from countries including Poland and France which are worried that this aim is too high. Sign up here. Lars Aagaard, energy and climate minister for Denmark, said in an interview that short-term challenges - including budgets stretched by increased military spending - must not distract from Europe's need to switch to green energy. "The answer to Europe's competitiveness is that we transition to using electricity for more things. It's that we can produce it ourselves. We can do that with renewable energy. We can do it with nuclear power," Aagaard said. "It's not a solution for the climate, nor the security challenge, to halt the (green) transition in Europe," he added. Denmark takes over the EU's six-month rotating presidency in July and will lead negotiations on the 2040 goal, at a time when Europe is sharply raising defence spending following Russia's full-scale invasion of Ukraine. The EU's green transition and its race to re-arm are taking place against a "grim background," Aagaard said, citing geopolitical tensions. "It's not a celebration that Europe has to rearm militarily. It's because we are threatened. And it's not a celebration that we have to go green. Climate change is also serious," he said. The European Union has rolled back a series of green policies this year, trying to contain reactions from member countries and struggling industries over environmental rules. The 2040 goal will aim to keep EU countries on track between their 2030 emissions target and a 2050 net zero goal. https://www.reuters.com/sustainability/cop/denmark-warns-eu-against-halting-green-transition-2025-06-27/

2025-06-27 11:27

Executive orders could target grid connection delays, offer federal land for data centers - sources White House to unveil AI Action Plan on July 23 Measures aimed at addressing massive power demand growth for data centers WASHINGTON, June 27 (Reuters) - The Trump administration is readying a package of executive actions aimed at boosting energy supply to power the U.S. expansion of artificial intelligence, according to four sources familiar with the planning. Top economic rivals U.S. and China are locked in a technological arms race and with it secure an economic and military edge. The huge amount of data processing behind AI requires a rapid increase in power supplies that are straining utilities and grids in many states. Sign up here. The moves under consideration include making it easier for power-generating projects to connect to the grid, and providing federal land on which to build the data centers needed to expand AI technology, according to the sources. The administration will also release an AI action plan and schedule public events to draw public attention to the efforts, according to the sources, who requested anonymity to discuss internal deliberations. The White House did not respond to requests for comment. Training large-scale AI models requires a huge amount of electricity, and the industry's growth is driving the first big increase in U.S. power demand in decades. Between 2024 and 2029, U.S. electricity demand is projected to grow at five times the rate predicted in 2022, according to power-sector consultancy Grid Strategies. Meanwhile, power demand from AI data centers could grow more than thirtyfold by 2035, according to a new report by consultancy Deloitte. Building and connecting new power generation to the grid, however, has been a major hurdle because such projects require extensive impact studies that can take years to complete, and existing transmission infrastructure is overwhelmed. Among the ideas under consideration by the administration is to identify more fully developed power projects and move them higher on the waiting list for connection, two of the sources said. Siting data centers has also been challenging because larger facilities require a lot of space and resources, and can face zoning obstacles or public opposition. The executive orders could provide a solution to that by offering land managed by the Defense Department or Interior Department to project developers, the sources said. The administration is also considering streamlining permitting for data centers by creating a nationwide Clean Water Act permit, rather than requiring companies to seek permits on a state-by-state basis, according to one of the sources. In January, Trump hosted top tech CEOs at the White House to highlight the Stargate Project, a multi-billion effort led by ChatGPT's creator OpenAI, SoftBank (9434.T) , opens new tab and Oracle (ORCL.N) , opens new tab to build data centers and create more than 100,000 jobs in the U.S. Trump has prioritized winning the AI race against China and declared on his first day in office a national energy emergency aimed at removing all regulatory obstacles to oil and gas drilling, coal and critical mineral mining, and building new gas and nuclear power plants to bring more energy capacity online. He also ordered his administration in January to produce an AI Action Plan that would make "America the world capital in artificial intelligence" and reduce regulatory barriers to its rapid expansion. That report, which includes input from the National Security Council, is due by July 23. The White House is considering making July 23 "AI Action Day" to draw attention to the report and demonstrate its commitment to expanding the industry, two of the sources said. Trump is scheduled to speak at an AI and energy event in Pennsylvania on July 15 hosted by Senator Dave McCormick. Amazon (AMZN.O) , opens new tab earlier this month announced it would invest $20 billion in data centers in two Pennsylvania counties. https://www.reuters.com/legal/government/trump-plans-executive-orders-power-ai-growth-race-with-china-2025-06-27/

2025-06-27 11:24

Shein confidential filing marks rare departure from Hong Kong IPO norms Hong Kong IPO plan comes after setbacks of UK, US listing attempts Hong Kong IPO also subject to Chinese regulatory approval Confidential filing keeps details out of public view for longer June 27 (Reuters) - China-founded fast-fashion retailer Shein plans to file a draft prospectus confidentially for its Hong Kong listing, marking a rare departure from the usual practice of companies making public filings of IPO documents, three sources with knowledge of the matter said. Shein aims to submit the filing confidentially as soon as this week, one of the sources said. A second source said the filing was expected to be made by Monday. Sign up here. Shein's confidential filing, if approved, would represent a waiver of one of the main listing rules by the Hong Kong exchange for one of the world's most closely-watched IPO candidates, and possibly the largest in the city this year, two of the sources said. The filing will come as the company, which sells low-priced apparel such as $5 dresses and $10 jeans in around 150 countries, makes its third attempt to go public, more than 18 months after it first filed for a U.S. IPO in late 2023. Confidential filings enable companies to keep vital operational and financial information under wraps for longer and allow them to go through the regulatory review process without public disclosure. Hong Kong's listing rules permit confidential filings for secondary listings by companies already listed on recognised overseas exchanges, such as the New York Stock Exchange or Nasdaq. The exchange could also waive or modify the publication requirements in a spinoff from an overseas listed parent upon application by a new applicant, the listing rules show. While this practice is common for IPO applicants in the U.S., it remains relatively rare in Hong Kong, where high-profile IPOs have included Chinese tech giants Xiaomi (1810.HK) , opens new tab and Meituan (3690.HK) , opens new tab, which both filed publicly for their floats. The sources spoke to Reuters on the condition of anonymity as they were not authorised to speak to the media. Shein, founded by China-born entrepreneur Sky Xu, did not reply to a request for comment. The Hong Kong stock exchange declined to comment on individual companies. Documents, including financials, related to Shein's IPO will remain undisclosed until the company passes a hearing with the Hong Kong stock exchange, which is the final step in the city's regulatory approval process. Prior to that final step, Shein must secure an approval from the China Securities Regulatory Commission (CSRC) to go ahead with the Hong Kong IPO. It is not known if Shein has already secured a verbal nod from the Chinese securities regulator. The CSRC did not respond to Reuters request for comment. Reuters first reported last month, citing sources, that Shein was working towards a listing in Hong Kong after its proposed London IPO failed to secure the green light from Chinese regulators. The New York attempt also did not receive CSRC approval, Reuters previously reported. REGULATORY APPROVAL Shein's confidential submission of the prospectus enables Hong Kong and mainland Chinese regulators to assess the IPO application, raise their questions to Shein and prepare it for regulatory approval privately, the sources said. The regulators would be able to do that before public, including potential institutional investors', scrutiny of its application materials, including risk factors, they added. The filing would come against the backdrop of Shein grappling with the knock-on impacts of the Sino-U.S. trade war after U.S. President Donald Trump ended duty-free treatment of ecommerce parcels and hiked tariffs on Chinese goods, hurting its business in the U.S., its biggest market. Shein was valued at $66 billion during its pre-IPO fundraising round in 2023, down by a third from a funding round one year earlier. Its eventual IPO valuation will hinge on the impact of the tariff changes, sources have said. RISK DISCLOSURES A Shein listing would help Hong Kong, which saw $12.8 billion worth of IPOs and second listings in the first half, re-establish its credibility as a global fundraising centre at a time of major volatility stoked by U.S. trade policy changes. Shein, founded in mainland China in 2012, is hoping to succeed in Hong Kong after failed attempts to list in New York and then London, where Britain's financial regulator approved the listing. Shein will have to file with the CSRC within three working days after submitting its IPO application in Hong Kong, in line with Beijing's rules for Chinese firms seeking offshore listings. Shein shifted headquarters from China to Singapore in 2022 and does not own or operate any factories, but remains subject to Chinese IPO rules because its products are mostly made by a network of 7,000 third-party suppliers in China, sources have said. The CSRC applies the rules on a "substance over form" basis, granting it discretion on when and how to implement them. A draft prospectus would normally disclose key risks to a company including those linked to its supply chain. Shein has faced allegations from politicians and campaigners that its supply chain in China is linked to forced labour of Uyghur minorities in Xinjiang, a highly contentious issue for Beijing, which denies any abuses in the cotton-producing province. The U.S. has a ban in place on imports of products made using forced labour from Xinjiang, and Shein has said it does not allow its suppliers to use Chinese cotton in U.S.-bound products. Shein has said its supplier code of conduct prohibiting forced labour applies worldwide. https://www.reuters.com/business/retail-consumer/china-fashion-retailer-shein-file-confidentially-hong-kong-ipo-rare-move-sources-2025-06-27/

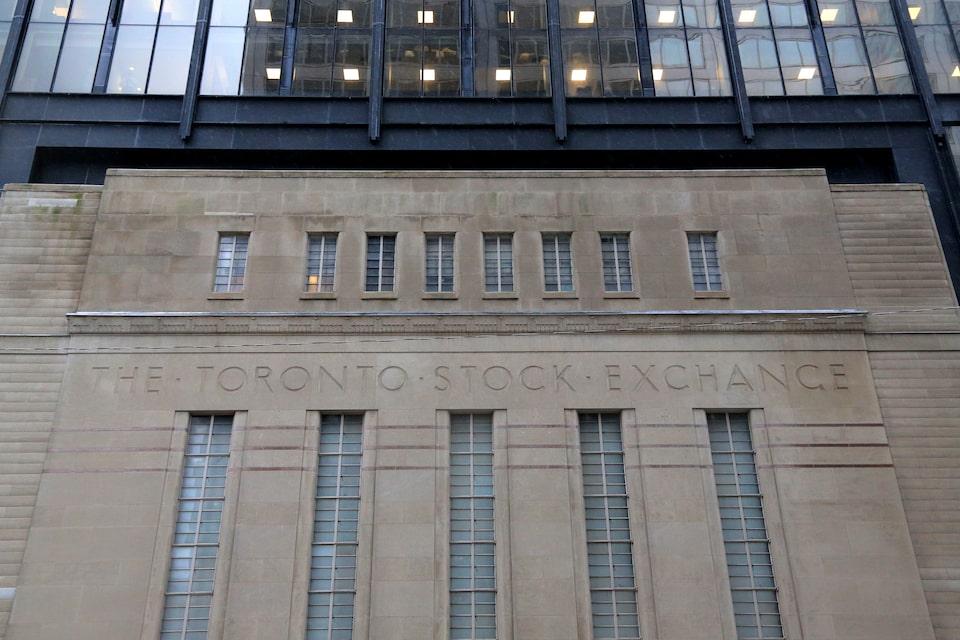

2025-06-27 11:10

TSX ends down 0.2% at 26,692.32 For the week, the index gains 0.7% Materials group falls 2.8% as gold drops Energy ends 0.5% lower June 27 (Reuters) - Canada's main stock index pulled back on Friday from a record high, weighed by declines for mining shares, as data showed the domestic economy contracting and after U.S. President Donald Trump shattered optimism that the United States would reach a tariff deal with Canada. The S&P/TSX composite index (.GSPTSE) , opens new tab ended down 59.63 points, or 0.2%, at 26,692.32, after posting a record closing high on Thursday. For the week, the index was up 0.7% as cooling Middle East tensions boosted investor sentiment. Sign up here. The market has benefited recently from some good news and the reduction of outsized risks, said Ben Jang, a portfolio manager at Nicola Wealth. "But that doesn't mean that economic scarring hasn't occurred," Jang said. Canada's economy contracted by 0.1% in April from March as U.S. tariff uncertainty weighed on the goods-producing sector. Preliminary data pointed to a further decline in activity for May. Trump abruptly cut off trade talks with Canada over its new tax targeting U.S. technology firms, calling it a "blatant attack" and saying that he would set a new tariff rate on Canadian goods within the next week. The materials group, which includes fertilizer companies and metal mining stocks, fell 2.8% as easing of U.S.-China trade tensions reduced the appeal of safe-haven gold. Energy also ended lower, falling 0.5%, as the price of oil posted a steep weekly decline. TC Energy Corp (TRP.TO) , opens new tab was a bright spot. Its shares rose 2.4% after the company started collecting tolls for the Southeast Gateway natural gas pipeline in Mexico. Seven of 10 major sectors ended higher, with real estate adding 0.7% as long-term borrowing costs fell. The Canadian 10-year eased 2.5 basis points to 3.315%, pulling back from an earlier one-week high. https://www.reuters.com/world/americas/tsx-futures-flat-gold-falls-investors-await-us-inflation-data-2025-06-27/

2025-06-27 10:56

PESHAWAR, Pakistan, June 27 (Reuters) - At least nine people died when floodwaters swept away children in a river in northern Pakistan and relatives jumped into the water to try to save them on Friday, officials said. The family was having a picnic breakfast by the Swat River and the children were in the water taking photos when the sudden flood hit, district administrator Shehzad Mahboob said. Sign up here. Relatives rushed in but were also caught up in the deluge which had been swollen by monsoon rains, he added. It was still too early to say how many children and how many adults had died, Mahboob told Reuters. Nine bodies have been recovered so far, he said. Four members of the family were rescued alive and another four are still missing. The family group were tourists from Pakistan visiting the Swat Valley, local mayor Shahid Ali Khan said. Locals and more than 80 rescue workers were searching for survivors, rescue official Shah Fahad said. The Provincial Disaster Management Authority later issued an alert saying there were high flood levels and warning people to take precautions. Tens of thousands of tourists, mostly from other parts of Pakistan, visit the north's peaks and glaciers every year during the summer travel season. Prime Minister Shehbaz Sharif "expressed his grief over the tourists' deaths," his office said in a statement. https://www.reuters.com/business/environment/nine-dead-floodwaters-sweep-away-children-relatives-pakistan-2025-06-27/

2025-06-27 10:53

LONDON, June 27 (Reuters) - What matters in U.S. and global markets today By Mike Dolan , opens new tab, Editor-At-Large, Finance and Markets Sign up here. The glass appears half full once again. With midyear approaching, the main Wall Street stock indexes are back within a hair's breadth of new records, helped along by a weakening dollar, the prospect of lower borrowing rates, increasing trade optimism and a renewed focus on the artificial intelligence theme. Throw in some positive tax and regulatory twists, and now we’re likely to see new highs for the S&P 500 and Nasdaq later today. It's Friday, so today I'll provide a quick overview of what's happening in global markets and then offer you some weekend reading suggestions away from the headlines. Today's Market Minute * The United States has reached an agreement with China on how to expedite rare earth shipments to the U.S., a White House official said on Thursday, amid efforts to end a trade war between the world's biggest economies. * European Union leaders discussed new proposals from the United States on a trade deal at a summit in Brussels on Thursday, with Commission President Ursula von der Leyen not ruling out tariff talks could fail and saying "all options remain on the table". * Iran would respond to any future U.S. attack by striking American military bases in the Middle East, Supreme Leader Ayatollah Ali Khamenei said on Thursday, in his first televised remarks since a ceasefire was reached between Iran and Israel. * U.S. Treasury Secretary Scott Bessent on Thursday asked Republicans in Congress to remove a "retaliatory tax" proposal that targets foreign investors from their sweeping budget legislation, as lawmakers struggled to find a path forward on the bill. * What will be the biggest pain trades in the second half of 2025? ROI columnist Jamie McGeever discusses the most vulnerable positions. Wall St flirts with new record While still underperforming the MSCI's all-country index for the year so far, and lagging euro zone stocks by some 20% in dollar terms in 2025, the S&P500 has all but completed a remarkable 20% round trip from the peak of February to the troughs of April and back. The VIX 'fear index' (.VIX) , opens new tab ebbed to its lowest in four months, while gold prices slipped to their lowest in almost a month. With more than 40% of S&P500 revenues coming from overseas, the dollar's (.DXY) , opens new tab slide to 3-year lows this week spotlights a 10%-plus currency tailwind in 2025. The greenback remained near the year's lows on Friday. And even though President Donald Trump's harrying of Federal Reserve Chair Jerome Powell unnerves many about the long-term inflation impact of threatening Fed independence, it has stepped up bets about a resumption of interest rate cuts - and most clearly after Powell's term ends next year. While markets awaited the latest U.S. May inflation update later on Friday - with oil prices brushing off the latest Middle East conflict to resume a near 20% year-on-year drop - two and 10-year Treasury yields , fell to their lowest since early May on Thursday. The bond market has been soothed in part by this week's Fed proposal on overhauling how much capital large global banks must hold against relatively low-risk assets, part of a bid to boost banks' participation in Treasury markets. But markets got a further lift overnight from signs of some movement on bilateral trade negotiations ahead of July 9's expiry of the 90-day pause on Trump's sweeping tariff hikes. The White House said the United States reached an agreement with China on how to expedite rare earth shipments to the U.S. European Union leaders discussed new proposals from the United States on a trade deal at a summit in Brussels late on Thursday, with Commission President Ursula von der Leyen saying "all options remain on the table". German Chancellor Friedrich Merz urged the EU to do a "quick and simple" trade deal rather than a "slow and complicated" one, even as French President Emmanuel Macron struck a cautious note. And while the U.S. fiscal bill is still struggling through the Senate, there was an important development on tax provisions that may ease foreign investor concerns. Treasury Secretary Scott Bessent asked Republicans in Congress to remove a "retaliatory tax" proposal - the controversial Section 899 that targets foreign investors with higher tax in retaliation for any overseas disputes. Justifying the removal, Bessent said that under a G7 agreement, a 15% global corporate minimum tax will not apply to U.S. companies under "Pillar 2" of the Organization for Economic Cooperation and Development tax deal. The latest economic numbers, meantime, were a mixed bag but show few signs of a sharp downturn yet. Durable goods orders boomed in May well above forecasts, while the labor market remained resilient with a drop in weekly jobless claims. May trade data, on the other hand, showed a sharp drop in exports. As the second-quarter earnings season comes into view next month, the longer-term AI investment theme was given a fresh spur from an above-forecast revenue readout from Micron Technology (MU.O) , opens new tab - even though its stock ended lower on Thursday. AI darling Nvidia (NVDA.O) , opens new tab hit a new record high, however, up more than 80% from the lows of April. In other corporate news, Nike's (NKE.N) , opens new tab shares jumped 10% overnight as its first-quarter revenue outlook exceeded market expectations. Elsewhere, stocks in Europe were sharply higher on Friday - chiming with Wall Street. They have been boosted by the defense spending push at this week's NATO summit and as details of Germany's big fiscal stimulus unfolded. German lawmakers on Thursday passed a multi-billion-euro package of fiscal relief measures to support companies and boost investment, involving corporate tax breaks amounting to almost 46 billion euros ($54 billion) from this year through to 2029. Despite the positive noises on a U.S. trade deal, Chinese stocks (.CSI300) , opens new tab bucked the global trend and were in the red on Friday. China's industrial profits swung back into sharp decline, falling 9.1% in May from a year earlier, as factory activity slowed in the face of broader economic stress. There was better news in Japan as core consumer inflation in Tokyo slowed sharply in June. Tech stocks led the Nikkei (.N225) , opens new tab up more than 1%. Weekend reads: * TARIFF DAMAGE: Even though President Donald Trump appears to have retreated from his more extreme trade tariff plans due to market, industry and political pushback, trade barriers will damage the economy over the next decade. So claims a Peterson Institute paper by Warwick McKibbin, Marcus Noland and Geoffrey Shuetrim, who estimate the impact under five different scenarios , opens new tab - which get worse the bigger the retaliation overseas and the higher the country risk premium demanded by global investors. "Contrary to Trump's promises to revive U.S. industry, America's manufacturing and agriculture sectors see disproportionate losses in production and employment due to his tariffs." * OPAQUE DEBT: Global sovereign debt vulnerability is rising and 54% of low-income countries are already in or at high risk of debt distress, with many spending more on debt repayments than on education, healthcare and infrastructure combined. With frequent global shocks adding to the risk, the World Bank's Axel van Trotsenburg argues on Project Syndicate that debt obligations are now more complex, with a wider range of creditors and some borrowing occurring behind closed doors , opens new tab and outside the scrutiny of oversight mechanisms. "Without urgent action to improve transparency, unsustainable debt-service burdens in the developing world will become common." * UKRAINE VS RUSSIA IN AFRICA: On Africa's dry western tip, Mauritania has become an unlikely staging post for Ukraine's increasingly global struggle with its adversary Russia. Reuters' Jessica Donati and Olena Harmash detail Kyiv's Africa Strategy in seeking allies with aide and embassies - countering Russia's much more entrenched presence in the continent. * SIU SIMPLE: With much attention on the European Union's ability to attract or unlock much-needed investment capital, accelerating its capital markets integration - or Savings and Investments Union - is seen as critical. Nicholas Veron at Bruegel proposes catalyzing this by hardening a central supervisory system to replace the current complex hybrid of a central agency - the European Securities and Markets Authority - alongside national supervisory bodies. "The way to reform it is by pooling all capital market supervisory authority into a transformed multicentric ESMA , opens new tab that would operate mostly through its own offices in EU countries, ensuring supervisory consistency and no preferential treatment for any single financial centre." * WEGOVY TEEN IMPACT: A fast-growing cohort of American teens who have chosen to take Novo Nordisk's weight-loss drug Wegovy, placing them at the forefront of a monumental shift in the treatment of childhood obesity. A Reuters special report by Chad Terhune and Robin Respaut found children who had taken Wegovy or a similar weight-loss drug, to speak with them about their experiences. The reporters spent more than a year closely following four teens and their families to examine in detail the impact of treatment. Chart of the day: U.S. stock markets have completed a remarkable 20% round trip since February to stand back at the brink of new records - with the S&P500 up more than 10% on this time last year. Today's events to watch * U.S. May personal consumption expenditures inflation gauge (0830EDT) University of Michigan's final June consumer survey (10:00 AM EDT) * New York Federal Reserve President John Williams and Cleveland Fed President Beth Hammack speak Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. https://www.reuters.com/business/finance/global-markets-view-usa-2025-06-27/