2025-06-23 23:36

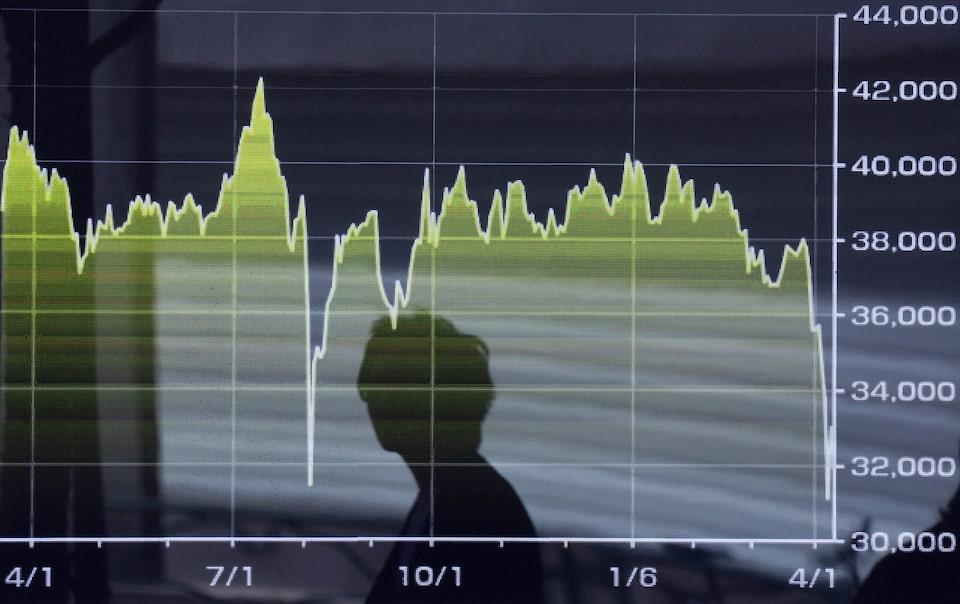

Wall Street shares rally more than 1% Iran and Israel ceasefire appears to hold Brent crude futures settle down 6% US yields fall, German draft budget sends Bund yields higher Dollar extends pullback, gold softens NEW YORK, June 24 (Reuters) - An index of global shares hit a record high on Tuesday with oil prices plummeting further as market sentiment was lifted by the easing of Middle East tensions, after a shaky ceasefire between Israel and Iran began to take hold. U.S. President Donald Trump had announced on Monday that Israel and Iran had reached a ceasefire to end their 12-day-old war. But both sides accused each other of violating the truce on Tuesday, sparking an extraordinary outburst from Trump. Sign up here. Wall Street's main indexes rallied more than 1%, with the benchmark S&P 500 finishing near a record high reached on February 19. The biggest gainers were in financials, technology, communication services, and healthcare stocks. Energy and consumer staples shares were the main drag. The Nasdaq 100 (.NDX) , opens new tab notched a record high close for the first time since February. The Dow Jones Industrial Average (.DJI) , opens new tab rose 1.19% to 43,089.02, the S&P 500 (.SPX) , opens new tab rose 1.11% to 6,092.18 and the Nasdaq Composite (.IXIC) , opens new tab rose 1.43% to 19,912.53. European shares (.STOXX) , opens new tab finished up 1.11%, hitting a one-week high during the session and notching its biggest single-day jump in over a month. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) , opens new tab jumped 2.4% overnight, closing at its highest level since January 2022. MSCI's gauge of stocks across the globe (.MIWD00000PUS) , opens new tab rose 1.45% to 902.88, hitting its highest level on record. "Markets are cheering what is looking to be a ceasefire between Iran and Israel, which means no major impact to supply of oil to global markets," said Talley Leger, chief market strategist at the Wealth Consulting Group. "Risk assets, including equities in general and cyclical pro-economy sectors of the market more specifically, have been rallying. Defensives and safe-haven assets have also been ebbing, which is consistent with what we've been saying and what we know historically." Brent Crude futures settled down 6.1% to $67.14 a barrel. U.S. West Texas Intermediate (WTI) crude fell 6.0% to settle at $64.37. Both contracts had settled down more than 7% in the previous session, having rallied to five-month highs after the U.S. attacked Iran's nuclear facilities over the weekend. The U.S. dollar declined against major currencies including safe-haven Japanese yen and Swiss franc following the truce. The euro gained. The dollar weakened 0.88% to 144.80 against the Japanese yen and dropped 0.90% to 0.80515 against the Swiss franc . The euro was up 0.27% at $1.16125. The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.30% to 97.94. Federal Reserve Chair Jerome Powell said higher tariffs could begin raising inflation this summer, a period that will be key to Fed considering possible rate cuts. Powell spoke at a hearing before the House Financial Services Committee. Data showed that U.S. consumer confidence unexpectedly deteriorated in June, signalling softening labor market conditions. The yield on benchmark U.S. 10-year notes fell 3 basis points to 4.293%. The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 1.2 basis point to 3.817%. Germany's long-term government bond yields rose after the cabinet passed a draft budget for 2025. The yield on the benchmark German 10-year Bunds rose 0.9 basis points to 2.543%. Gold prices fell. Spot gold fell 1.34% to $3,323.49 an ounce. U.S. gold futures settled 1.5% lower at $3,298.40. https://www.reuters.com/world/china/global-markets-wrapup-1-2025-06-23/

2025-06-23 23:27

NAPERVILLE, Illinois, June 23 (Reuters) - Like a broken record, speculators continued selling Chicago corn last week. Their bearish corn stance is now almost identical to their year-ago one, which preceded the all-time net short set in early July. There are some notable differences between the two years, however. Sign up here. The latest Commitments of Traders data, published on Monday afternoon instead of the normal Friday slot due to last week’s holiday, showed that money managers increased their net short position in CBOT corn futures and options to 184,788 contracts through June 17, up from 164,020 a week earlier. That marked funds’ most bearish corn view since late August, and it was their 16th week as net sellers out of the last 19 weeks. A year ago, the managed money corn net short was only a few thousand contracts larger. In June 2024, the U.S. Department of Agriculture projected domestic 2024-25 corn ending stocks rising 4% from 2023-24. USDA currently pegs 2025-26 U.S. corn carryout rising 28% from 2024-25. The volume trend is reversed. USDA’s latest 2025-26 estimate of 1.75 billion bushels is well below the 2024-25 estimate from a year ago of 2.1 billion bushels. However, Brazil is harvesting a bumper corn crop much larger than a year ago, and U.S. crop conditions are above average with decent weather expected in the near term. Both old- and new-crop CBOT corn futures are trading slightly below the year-ago levels. July corn notched a lifetime low on Monday while December futures hit six-month lows. The weakness in nearby corn prices – and the implied roominess in U.S. stockpiles – will be tested next Monday when USDA publishes its June 1 stocks survey. Industry participants will also be watching to see if U.S. corn plantings expand further from the 12-year high pegged in March. OTHER NOTABLE MOVES CBOT soybean oil surged 14.6% in the week ended June 17 but was up as much as 16% after proposed U.S. biofuel blending targets exceeded expectations. That brought most-active futures to the highest levels since October 2023. Money managers extended their net long in CBOT soybean oil futures and options to 46,143 contracts through June 17, up more than 21,000 on the week. For comparison, funds’ net buying has exceeded 35,000 contracts in three different weeks so far this year. Ample global soybean meal supplies have lured funds deep into their bear cave. Through June 17, money managers added more than 20,000 contracts to their CBOT soybean meal net short, which rose to 107,081 futures and options contracts, within a couple hundred of last month’s record. Speculators’ soybean moves echoed their soybean oil ones. Through June 17, money managers boosted their net long in CBOT soybean futures and options to 59,165 contracts, their most bullish stance since November 2023. That compared with 25,639 a week earlier and was split between new longs and short covering. CBOT September wheat rose 3% in the week ended June 17, and money managers cut their net short position in CBOT wheat futures and options to a 13-week low of 81,353 contracts from 94,011 a week earlier. September wheat gained 0.7% over the last three sessions but was up as much as 5% during the period on global supply concerns. Soyoil lost nearly 3% over the last three sessions, meal was down fractionally, and both old- and new-crop corn and soybean contracts posted losses. In addition to monitoring U.S. weather and positioning ahead of USDA’s June 30 stocks and acres reports, traders will need to keep an eye on the Middle East conflict, which tanked crude oil prices on Monday. U.S. President Donald Trump said late on Monday that a ceasefire had been reached between Israel and Iran, so the situation is still very much unfolding. Karen Braun is a market analyst for Reuters. Views expressed above are her own. Enjoying this column? Check out Reuters Open Interest (ROI) , opens new tab, your essential new source for global financial commentary. ROI delivers thought-provoking, data-driven analysis of everything from swap rates to soybeans. Markets are moving faster than ever. ROI , opens new tab can help you keep up. Follow ROI on LinkedIn , opens new tab and X. , opens new tab https://www.reuters.com/markets/us/are-funds-corn-views-heading-ultra-bearish-year-ago-levels-2025-06-23/

2025-06-23 23:25

'Feels like' temperature on East Coast could reach 110F/43C Trains disrupted, electricity demand spikes Extreme heat becoming new normal, scientists warn June 23 (Reuters) - Tens of millions of people sweltered across the U.S. Northeast and Midwest on Monday as record-high heat disrupted electricity supplies and train travel. Heat warnings, which began over the weekend and are set to continue through the week, were in effect across much of the United States. East Coast officials warned that, as the heat combines with humidity, many places could see conditions that "feel like" 110 degrees Fahrenheit (43 degrees Celsius). Sign up here. The National Weather Service warned that nighttime temperatures may not offer much respite from the "oppressive heat," with nighttime forecasts of temperatures in the 70s and possibly even the 80s for East Coast cities. Some East Coast trains were halted en route for safety precautions on Monday, and Amtrak said in a statement that its cars would operate at lower speeds due to heat restrictions. Amtrak heat restrictions kick in when temperatures are higher than 95F (35C). The company also reduces its train speeds when the tracks themselves reach 128F (54C). Health experts urged employers to adjust working hours for outdoor laborers, to ensure they had adequate breaks and opportunities for hydration, and to monitor for signs of heat stroke or exhaustion. "There is a disconnect between the severity of heat waves as a public health risk and the public recognition of that risk," said Howard Frumkin, an expert in environmental and occupational health sciences at the University of Washington. Police departments said they were taking steps to protect officers who were stationed outdoors – urging them to stay hydrated, or to stay in the shade where possible, according to the departments in the North Carolina city of Raleigh and the national capital, Washington D.C. U.S. electrical grid operators directed power plants to be ready to run at maximum force, with electricity demand expected to spike as people run fans and air conditioners to stay cool. In New York City, temperatures for Tuesday were forecast to hit 97F (36C), which would break the city's previous heat record for the date - set more than a century ago, when the mercury hit 96F on June 23, 1888. Scientists have warned that such extremes are fast becoming the new normal – while also upending assumptions about which regions might be spared the worst of climate change. "A lot of people ask the question, 'where is it safe to be?' And the answer is probably – no place," Frumkin said. "We did not think the upper Midwest was going to be vulnerable to heat extremes." The heat was also being felt in Britain, while the Arctic state of Alaska registered its first ever heat advisory last week. Last month, China saw its temperatures soar. NEW NORMAL Of all the weather impacts linked to climate change, extreme heat poses the biggest threat to human life - more dangerous than even floods or hurricanes. Last year marked the world's warmest on record – and temperatures are set to continue climbing for the next few decades as climate-warming emissions also keep rising. "It's just getting hotter everywhere," said Este Geraghty, chief medical officer and health solutions director at Esri, where she uses data and mapping analysis to understand how and where climate risks are developing and help is needed most. Across England this week, the extreme heat could result in hundreds of deaths, according to a rapid analysis , opens new tab by a team of UK scientists. That forecast followed another report , opens new tab by the UK Met Office that found that extreme heat was now 10 times as likely to happen as it was decades ago. Extreme heat can take a heavy economic toll - threatening crop yields, livestock, electrical outages and wildfires, and leading to disruptions to utility services, healthcare, or transportation systems, according to a report , opens new tab this month on insurance risk by Swiss Re Institute. The global heat event this week "is sounding an alarm bell for society," said Nina Arquint, who works as CEO UK & Ireland at Swiss Re Corporate Solutions. "These events are more dangerous than natural catastrophes in terms of human lives lost, yet the true cost is only starting to come to light," Arquint said. https://www.reuters.com/sustainability/climate-energy/oppressive-heat-triggers-health-warnings-across-us-east-midwest-2025-06-23/

2025-06-23 23:13

WASHINGTON, June 23 (Reuters) - The National Highway Traffic Safety Administration is seeking information from Tesla (TSLA.O) , opens new tab after reviewing online videos of a robotaxi allegedly using the wrong lane and of speeding by another driverless vehicle. The U.S. auto safety agency said it is "aware of the referenced incidents and is in contact with the manufacturer to gather additional information." Sign up here. NHTSA routinely asks automakers for additional information after reports of questionable driving behavior by advanced driver assistance systems or automated driving systems. Tesla started a limited, paid robotaxi test service and deployed a dozen or so self-driving cars in Austin, Texas on Sunday. The company plans to avoid bad weather, difficult intersections, and won't take anyone below the age of 18. NHTSA noted that under the law it "does not pre-approve new technologies or vehicle systems – rather, manufacturers certify that each vehicle meets NHTSA’s rigorous safety standards, and the agency investigates incidents involving potential safety defects." Bloomberg News reported NHTSA's query to Tesla earlier on Monday. The EV maker did not immediately respond to a Reuters request for comment. On Monday, Tesla told NHTSA its answers to questions on the safety of its robotaxi deployment in Texas are confidential business information and should not be made public. NHTSA is reviewing answers given in response to the agency's questions about the safety of its self-driving robotaxi in poor weather among numerous issues. The agency has been investigating since October collisions of Tesla vehicles using Full Self-Driving software under conditions of reduced visibility. The probe covers 2.4 million Tesla vehicles equipped with FSD technology after four reported collisions, including a 2023 fatal crash. https://www.reuters.com/business/autos-transportation/nhtsa-contacts-tesla-robotaxi-issues-seen-online-videos-bloomberg-news-reports-2025-06-23/

2025-06-23 22:44

Alberta surpassed gas flaring limit in 2023 and 2024 Province says ceiling did not account for increased production World Bank report showed flaring increasing worldwide CALGARY, June 23 (Reuters) - Energy producers in Alberta, Canada's top oil-producing province, blew past the province's self-imposed limit on annual natural gas flaring in 2024 for a second year in a row, Reuters calculations show. Late last week, Alberta's energy regulator said it was ending the limit on flaring. Reuters is the first to report the change, which the regulator quietly published in a bulletin on its website. Sign up here. On Monday, the regulator confirmed the removal of the limit and said it was responding to direction from the provincial government. Oil production is booming in Canada, the world's No. 4 producer, which has been trying to diversify exports away from the U.S. since President Donald Trump took office and began imposing tariffs on many Canadian exports. Canadian energy companies hope Prime Minister Mark Carney will be more accommodative to the industry than his predecessor Justin Trudeau. A tally by Reuters of Alberta Energy Regulator data shows oil and gas producers in the province flared approximately 912.7 million cubic metres of natural gas in 2024, exceeding the annual provincial limit of 670 million cubic metres by 36%. The province had exceeded the limit in 2023, with regulatory data showing total annual flare volumes of 753 million cubic metres that year. Flaring is the practice of burning off the excess natural gas associated with oil production. If the volumes of gas byproduct are small, and there are no pipelines nearby to transport the gas, companies often choose for economic reasons to dispose of it through flaring instead of capturing it and storing it. Eliminating the practice would cut at least 381 million tonnes of carbon dioxide equivalent in environmentally harmful emissions released into the atmosphere, the World Bank has said. Ryan Fournier, spokesperson for Alberta's Environment Minister Rebecca Shulz, said in an email that the province launched a review of its flare gas policy after the oil and gas industry exceeded the limit for the first time in 2023. He said the province determined the 20-year-old flaring limit no longer served as an effective policy for reducing flaring and the ceiling did not account for increased oil production in the province or new emissions-reduction strategies. The federal energy and environment ministries did not immediately reply to requests for comment. Alberta's crude oil production set an all-time record in 2024 at 1.5 billion barrels, a 4.5% increase over 2023. A 2022 report by the Alberta Energy Regulator showed flaring volumes in the province have been increasing since 2016. A 2024 report by the World Bank — which has been advocating for a global end to the practice of routine flaring by 2030 — found that flaring by oil and gas companies worldwide rose in 2023 even as crude oil production rose only 1% over the same time. While flaring is better for the environment than some other methods of gas disposal such as venting, it still releases a variety of byproducts and greenhouse gases into the atmosphere as well as black soot which can be harmful to human health, said Amanda Bryant, senior oil and gas analyst for the clean energy think-tank the Pembina Institute. She said companies have alternatives available to them, such as investing in equipment that can be used to capture flare gases at site and redirect them back into production for use as fuel. "Getting rid of the rule doesn't get rid of the problem," Bryant said in an interview. "The role of a regulator really needs to be to prevent harmful impacts of industry and to ensure that our resources are developed responsibly." https://www.reuters.com/sustainability/climate-energy/alberta-blew-past-gas-flaring-ceiling-2024-province-eliminates-limit-2025-06-23/

2025-06-23 22:37

US President Trump accuses both sides of violating ceasefire Analysts see less risk to Middle East oil supplies Trump says China can continue to purchase oil from Iran NEW YORK, June 24 (Reuters) - Oil prices fell 6% on Tuesday to settle at a two-week low, on expectations the ceasefire between Israel and Iran will reduce the risk of oil supply disruptions in the Middle East. The ceasefire was on shaky ground with U.S. President Donald Trump accusing both Israel and Iran of violating it just hours after it was announced. Sign up here. Brent crude futures fell $4.34, or 6.1%, to settle at $67.14 a barrel. U.S. West Texas Intermediate (WTI) crude fell $4.14, or 6.0%, to settle at $64.37. Settlement was the lowest for Brent since June 10 and WTI since June 5, both before Israel launched a surprise attack on key Iranian military and nuclear facilities on June 13. "The geopolitical risk premium built up since the first Israeli strike on Iran almost two weeks ago has entirely vanished," said Tamas Varga, a senior analyst at TP ICAP's PVM Oil Associates brokerage and consulting firm. On Monday, both oil contracts settled down more than 7%. They had rallied to five-month highs after the U.S. attacked Iran's nuclear facilities over the weekend. Direct U.S. involvement in the war had investors worried about the Strait of Hormuz, a narrow waterway between Iran and Oman, through which between 18 million and 19 million barrels per day (bpd) of crude oil and fuels flow, nearly a fifth of global consumption. Prices also fell as Trump said China, the world's biggest oil importer, can continue to purchase oil from Iran. In other supply news, Kazakhstan's state energy company KazMunayGaz raised its forecast for oil output at the Chevron-led (CVX.N) , opens new tab Tengiz oilfield, the country's largest, to 35.7 million metric tons in 2025 from 34.8 million tons expected previously. Kazakhstan is a member of the OPEC+ group of countries that includes the Organization of the Petroleum Exporting Countries (OPEC) and allies. Several other OPEC+ members have also been increasing output. In Guyana, oil output rose to 667,000 bpd in May from 611,000 bpd in April, fueled by increases at two of three production facilities operated by U.S. major Exxon Mobil (XOM.N) , opens new tab. U.S. ECONOMY AND OIL INVENTORIES Another factor weighing on oil prices came from U.S. consumer confidence, which unexpectedly deteriorated in June as households increasingly worried about job availability and economic uncertainty from Trump's tariffs. Federal Reserve Bank of New York President John Williams said he expects slower growth and higher inflation this year due in large part to trade tariffs, in comments that suggested he was in no rush to cut interest rates, which could boost economic growth and oil demand. The American Petroleum Institute (API) trade group and the U.S. Energy Information Administration (EIA) were due to release U.S. oil inventory data, , Analysts forecast energy firms pulled about 0.8 million barrels of oil from U.S. stockpiles during the week ended June 20. If correct, that would be the first time energy firms pulled oil from storage for five weeks in a row since January. That compares with a build of 3.6 million barrels during the same week last year and an average decrease of 2.5 million barrels over the past five years (2020-2024). The API releases its numbers on Tuesday and the EIA on Wednesday. https://www.reuters.com/business/energy/us-crude-oil-futures-fall-over-3-trump-announces-israel-iran-ceasefire-2025-06-23/