2025-06-20 18:58

Putin says Russia must not let economy slip into recession Tells officials to ensure balanced growth for cooling economy Pressure mounting on central bank to cut rates more quickly Sberbank says it has financed no new projects this year ST PETERSBURG, Russia, June 20 (Reuters) - Russian President Vladimir Putin on Friday dismissed claims the war in Ukraine is devastating the Russian economy, citing continued growth, low debt and economic diversification as signs of resilience, while business leaders voiced concern about the economy's health. Speaking at the closing session of the Saint Petersburg Economic Forum, Putin responded to a moderator’s statement that credible reports suggest the war is “killing” the Russian economy. “As a well-known writer once said: ‘The reports of my death are greatly exaggerated,’” Putin said, quoting Mark Twain. Sign up here. Putin said 43% of Russia’s GDP is now unrelated to the energy or defence sectors, underscoring efforts to diversify the economy. The three-day forum featured intense debate over the risks of economic stagnation. Inflation remains high at 9.59% annually, more than double the central bank’s 4% target, but it has been gradually easing since late April, according to the economy ministry. In October, the Bank of Russia raised its key interest rate to its highest level since the early 2000s to combat inflation. Earlier this month, it cut the rate by one percentage point to 20%. But the Kremlin has criticised the move as insufficient, warning that the economy could cool too rapidly after two years of war-driven growth. “Our most important task is to ensure the economy’s transition to a balanced growth trajectory,” Putin said in a keynote address. He defined balanced growth as moderate inflation, low unemployment and sustained economic momentum. "At the same time, some specialists and experts point to the risks of stagnation and even recession. This should not be allowed under any circumstances," Putin said. Striking a more pessimistic tone, Economy Minister Maxim Reshetnikov warned on Thursday that Russia is teetering on the edge of a recession. He said future monetary policy decisions will determine whether the country avoids a downturn. Central Bank Governor Elvira Nabiullina, who has led the institution through multiple crises since 2013, has faced criticism over high interest rates and currency volatility. She remains in her post with Putin's personal support. Deputy Prime Minister Alexander Novak said: "It's time to cut the rate and start heating up the economy. Demand for credit is weak, said German Gref, CEO of Russia's largest lender, Sberbank (SBER.MM) , opens new tab, and called for faster rate cuts. "It is especially worrying that we, as the largest bank, which finances ... almost 60% of all investment projects in the country, have not financed a single new project since the new year," Gref said on Friday. Alexey Mordashov, majority shareholder of steelmaker Severstal, warned of a looming credit crisis and rising bankruptcies. He noted that steel consumption fell 14% in the first five months of 2025 compared to the same period last year. "This cooling is a serious problem right now,” Mordashov said. “Continuing with the current monetary policy could worsen these negative consequences.” https://www.reuters.com/markets/europe/russia-must-not-let-economy-slip-into-recession-says-putin-2025-06-20/

2025-06-20 18:08

June 20 (Reuters) - A measure of future U.S. economic activity fell in May for the sixth straight month and triggered a recession signal, held down by consumer pessimism, weak new orders for manufactured goods, an uptick in jobless benefits claims and a drop in building permit applications. The Conference Board's Leading Economic Index fell by 0.1% to 99.0 last month after a downwardly revised 1.4% drop in April, which was the largest decline in the index since the spring of 2020 at the start of the COVID-19 pandemic. The decline matched the consensus expectation among economists polled by Reuters. Sign up here. A rebound in stock prices in May following a series of temporary roll backs in President Donald Trump's wave of tariffs was the main positive contributor to the index, the Conference Board's senior manager for business cycle indicators, Justyna Zabinska-La Monica, said in a statement. But that was slightly outweighed by those other factors. "With the substantial negatively revised drop in April and the further downtick in May, the six-month growth rate of the Index has become more negative, triggering the recession signal," she said. "The Conference Board does not anticipate recession, but we do expect a significant slowdown in economic growth in 2025 compared to 2024, with real GDP growing at 1.6% this year and persistent tariff effects potentially leading to further deceleration in 2026." The Leading Index had signaled a recession a few years ago during the peak of the inflation wave that followed the pandemic, but the economy never slid into contraction. https://www.reuters.com/world/us/us-leading-indicators-slip-may-triggering-recession-signal-conference-board-says-2025-06-20/

2025-06-20 17:43

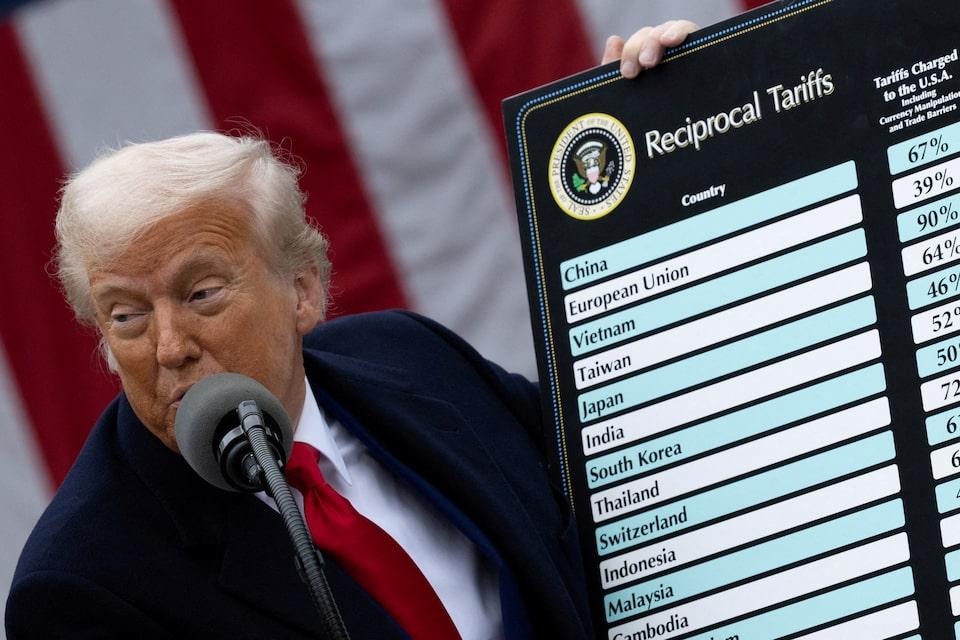

WASHINGTON, June 20 (Reuters) - The U.S. Supreme Court declined on Friday to speed up its consideration of whether to take up a challenge to President Donald Trump's sweeping tariffs even before lower courts have ruled in the dispute. The Supreme Court denied a request by a family-owned toy company, Learning Resources, that filed the legal challenge against Trump's tariffs to expedite the review of the dispute by the nation's top judicial body. Sign up here. The company, which makes educational toys, won a court ruling on May 29 that Trump cannot unilaterally impose tariffs using the emergency legal authority he had cited for them. That ruling is currently on hold, leaving the tariffs in place for now. Learning Resources asked the Supreme Court to take the rare step of immediately hearing the case to decide the legality of the tariffs, effectively leapfrogging the U.S. Court of Appeals for the District of Columbia Circuit in Washington, where the case is pending. Two district courts have ruled that Trump's tariffs are not justified under the law he cited for them, the International Emergency Economic Powers Act. Both of those cases are on appeal. No court has yet backed the sweeping emergency tariff authority Trump has claimed. https://www.reuters.com/legal/government/us-supreme-court-declines-speed-up-decision-taking-up-fight-over-trump-tariffs-2025-06-20/

2025-06-20 17:42

Oil markets have rallied since Israel-Iran conflict escalated Putin says OPEC+ is raising oil output, but gradually ST PETERSBURG, Russia, June 20 (Reuters) - Russian President Vladimir Putin said on Friday that oil prices had not risen significantly due to the conflict between Iran and Israel, and that there was no need for the OPEC+ group of oil producers to intervene in oil markets. Oil prices have rallied as a week-old air war between Israel and Iran escalated and uncertainty about potential U.S. involvement kept investors on edge, with Brent crude futures touching their highest since late January. Sign up here. Putin said the price of oil now stands at around $75 per barrel, while before the conflict escalated it stood at $65. "Of course, we see that the current situation in the Middle East, the current situation related to the conflict between Iran and Israel, has led to a certain increase in prices. But this increase, in the opinion of our experts, is not significant," Putin told the St Petersburg Economic Forum. Iran is the third largest producer among members of the Organization of the Petroleum Exporting Countries. Hostilities could disrupt its supply of oil and thereby increase prices. Putin also said OPEC and allies including Russia - a group known as OPEC+, which pumps about half of the world's oil - were increasing oil output, but doing so gradually, to ensure balance in the oil market and "comfortable" prices. "We will all see together how the situation unfolds. So far no immediate response is required," he said. https://www.reuters.com/business/energy/putin-says-no-need-opec-intervene-oil-market-due-iran-israel-conflict-2025-06-20/

2025-06-20 13:49

Retail sales in April grew by 0.3% led by motor vehicles, parts Advanced estimate show sales likely to contract by 1.1% in May Analysts had estimated April sales to increase by 0.5% OTTAWA, June 20 (Reuters) - Canada's retail sales were up in April on a monthly basis but were below estimates, data showed on Friday, as the momentum seen in the previous months when customers advanced purchases to beat the impact of tariffs continued. Retail sales in April grew by 0.3% to C$70.11 billion ($51.11 billion) from 0.8% observed in the month earlier, Statistics Canada said, adding sales grew in six of the nine subsectors. Sign up here. An advanced estimate of sales shows that the number is likely to contract by 1.1% in May. "Canadian consumers continued to spend in April, but a decline in the May advance estimate for retail sales provides another indication that the economy is heading for a stall in Q2," Andrew Grantham, senior economist at CIBC Capital Markets wrote in a note. Retail sales are closely watched by economists and analysts as they give an indication of the trend of the GDP. They had been largely increasing in the previous months as uncertainty around the timing and magnitude of tariffs brought forward purchases. The sales have started showing signs of decline as tariffs have come into effect and analysts expect that they are likely to go down in the coming months. Feedback from respondents for April highlighted the effects of trade tensions between Canada and the United States on Canadian retail businesses, the statistics agency said. "Despite six of nine subsectors posting monthly gains in retail sales, all nine subsectors saw a negative impact on sales," it said. Analysts polled by Reuters had estimated the April sales to increase by 0.5% on a monthly basis and 0.2% excluding automotive and parts sales. StatsCan reported that excluding automotive and parts sales, the number shrank by 0.3% from a drop of 0.8% in March. The biggest jump in sales in April came from sales at motor vehicle and parts dealers, registering a growth of 1.9%, and was led by sales at new car dealers and used car dealers. This is the biggest category of sales and contributes over a quarter of total retail sales. The biggest drop in sales came from gasoline stations and fuel vendors which shrank by 2.7% and were closely followed by sales at retailers selling clothing and accessories posting a drop of 2.2%. In volume terms, retail sales increased 0.5% in April. ($1 = 1.3718 Canadian dollars) https://www.reuters.com/world/americas/canadas-retail-sales-up-april-likely-post-big-drop-may-2025-06-20/

2025-06-20 12:33

KARACHI, June 20 (Reuters) - Pakistan has signed term sheets with 18 commercial banks for a 1.275 trillion Pakistani rupee ($4.50 billion) Islamic finance facility to help pay down mounting debt in its power sector, the power minister said on Friday. The government, which owns or controls much of the power infrastructure, is grappling with ballooning “circular debt”, unpaid bills and subsidies, that has choked the sector and weighed on the economy. Sign up here. The liquidity crunch has disrupted supply, discouraged investment and added to fiscal pressure, making it a key focus under Pakistan’s $7 billion IMF programme. Finding funds to plug the gap has been a persistent challenge, with limited fiscal space and high-cost legacy debt making resolution efforts more difficult. “Eighteen commercial banks will provide these loans through Islamic financing,” Power Minister Awais Leghari told Reuters. “It will be repaid in 24 quarterly instalments over six years.” The facility, structured under Islamic principles, is secured at a concessional rate of 3-month KIBOR, the benchmark rate banks use to price loans, minus 0.9%, a formula agreed on by the IMF. Leghari said it will not add to public debt. Existing liabilities carry higher costs, including late payment surcharges on Independent Power Producers of up to KIBOR plus 4.5%, and older loans ranging slightly above benchmark rates. Meezan Bank (AMZN.PSX) , opens new tab, HBL (HBL.PSX) , opens new tab, National Bank of Pakistan (NBPK.PSX) , opens new tab and UBL (UBL.PSX) , opens new tab were among the banks participating in the deal, he said. The government expects to allocate 323 billion rupees annually to repay the loan, capped at 1.938 trillion rupees over six years. The agreement also aligns with Pakistan’s target of eliminating interest-based banking by 2028, with Islamic finance now comprising about a quarter of total banking assets. ($1 = 283.5000 Pakistani rupees) https://www.reuters.com/sustainability/boards-policy-regulation/pakistan-signs-45-billion-loans-with-local-banks-ease-power-sector-debt-2025-06-20/