2025-11-25 22:30

SAO PAULO, Nov 25 (Reuters) - Brazilian meatpacker JBS (Z98.F) , opens new tab said on Tuesday it had signed a binding memorandum of understanding with the shareholders of Viva to combine both firms' assets related to leather production and commercialization. In a securities filing, JBS said the new company will be called JBS VIVA and will be owned 50% by JBS and 50% by Viva's shareholders -- Vanz Holding and Viposa. Sign up here. The company will process more than 20 million leathers per year, with 31 factories and over 11,000 employees, JBS said, adding that the deal still lacks conditions including the signature of definitive agreements. JBS will name the chairman and the Chief Financial Officer of JBS VIVA, while Viva's shareholders will appoint the Chief Executive Officer and the Chief Operating Officer, according to JBS. https://www.reuters.com/business/retail-consumer/meatpacker-jbs-agrees-merge-its-leather-assets-with-ones-viva-2025-11-25/

2025-11-25 22:07

NEW YORK, Nov 25 (Reuters) - Making sense of the forces driving global markets By Alden Bentley, Editor in Charge, Americas Finance and Markets Sign up here. Jamie is enjoying some well-deserved time off, but the Reuters markets team will still keep you up to date on what animated markets today. I'd love to hear from you so please feel free to reach out at [email protected] , opens new tab Today's Key Market Moves Today's Key Reads Wall Street advances as Federal Reserve rate cut bets gather momentum Alphabet on pace to hit $4 trillion market value as AI gains momentum US retail sales growth slows in September; energy prices boost producer inflation US consumer confidence deteriorates in November Good chance Trump may unveil Fed pick by Christmas, Bessent says Fed optimism, Thanksgiving week Several economic indicators contributed to a bad-news-is-good-news scenario that helped convert an overnight pullback into another solid rally, even as Thursday's Thanksgiving holiday threatened to drain market liquidity and volume. All three major stock indexes strengthened. The blue-chip Dow took the lead while sagging shares of artificial intelligence front-runner Nvidia (NVDA.O) , opens new tab limited the Nasdaq's advance even as Google parent Alphabet (GOOGL.O) , opens new tab rose to a record high, closing in on becoming the fourth company to reach $4 trillion in market capitalization. Meta was the biggest boost to the S&P 500 after The Information reported it was in talks with Google to spend billions on its chips for data centers. U.S. retail sales increased a less-than-expected 0.2% in September, suggesting consumer fatigue amid higher prices due to tariffs going into the shutdown that delayed government reports for that month and the next. Meanwhile, labor market worries pushed down the Conference Board's consumer confidence index to 88.7 this month, the lowest level since April. The Labor Department also reported that its September Producer Price Index rebounded 0.3%, after a slight drop in August, due to higher energy and food costs. Following comments from three Fed officials since Friday, futures traders stepped up bets that the central bank would cut its fed funds target range another 25 basis points to 3.50% to 3.75% after its December 9-10 meeting, putting the probability at 76% -- not as certain as a couple of weeks ago, when they priced in near certainty, but more confident than during last week's shakeout. Treasury yields fell on the underwhelming data and prospects for still more monetary policy accommodation, which also weighed on the dollar. What could move markets tomorrow? Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles , opens new tab, is committed to integrity, independence, and freedom from bias. Trading Day is also sent by email every weekday morning. Think your friend or colleague should know about us? Forward this newsletter to them. They can also sign up here. https://www.reuters.com/world/china/global-markets-trading-day-2025-11-25/

2025-11-25 20:24

October deficit impacted by delayed payments due to government shutdown Calendar shift pushed $105 billion in November benefits into October Record customs duties drive revenue increase in October Trump says tariff revenues to 'skyrocket,' CBO lowers estimate of impact on deficits Nov 25 (Reuters) - The U.S. government posted a higher $284 billion deficit for October in a report delayed and impacted by the recent federal government shutdown and reflecting record tariff revenues offset by a shift of some November benefit payments into last month's data, the Treasury Department said on Tuesday. The budget results for the first month of the 2026 fiscal year were delayed by a 43-day shutdown of many federal agencies, which caused delays of some payments, such as for salaries of government employees, a Treasury official said. Sign up here. The deficit last month was up $27 billion, or 10%, from the $257 billion deficit posted in October 2024, largely due to the shift of some $105 billion worth of November benefit outlays for some military and healthcare programs into October. Adjusting for these shifts, the October deficit would have been about $180 billion, a 29% reduction from an adjusted October 2024 deficit of $252 billion. Outlays for October, including the November benefit payments, totaled $689 billion, up 18% from the $584 billion in October 2024. The Treasury official said the department did not have a precise estimate of how much outlays were reduced by the shutdown-delayed payments from various agencies, but that the Treasury believed the reduction was less than 5% of total outlays. Federal law requires any unpaid salaries and other obligations during government shutdowns to be fully paid when funding is restored. Receipts for October totaled $404 billion, a record for the month and a 24% increase from the $327 billion collected in October 2024. TARIFF REVENUES HIT RECORD MONTHLY HIGH Net custom duties were among the biggest revenue drivers in October, reaching a new all-time monthly record of $31.4 billion because of new import tariffs imposed by President Donald Trump since he returned to the White House in January. This inflow beat the previous record of $29.7 billion in September and is more than four times the $7.3 billion recorded in October 2024. Trump said on Monday that tariff revenues would soon "skyrocket" to new records, arguing that businesses have largely depleted an inventory buildup of imported goods prior to his tariffs and would have to now import goods at higher rates. His comments on the Truth Social site appeared to be aimed partly at the U.S. Supreme Court, where justices earlier this month cast doubt on the legality of tariffs Trump imposed under an emergency law. "I look so much forward to the United States Supreme Court's decision on this urgent and time sensitive matter so that we can continue, in an uninterrupted manner to, MAKE AMERICA GREAT AGAIN!" Trump wrote. Meanwhile, the Congressional Budget Office said last week that recent tariff reductions brought about by U.S. trade deals with partner economies had caused the agency to cut its estimate for how much Trump's tariffs would reduce U.S. budget deficits over the next decade by 25% to $3 trillion, including interest costs, from the $4 trillion the agency projected in August. Also driving revenues higher was the $80 billion in non-withheld tax receipts for individuals received in October, which was an increase of $35 billion, or about 75%, from October 2024. The Treasury official said this increase largely reflected payments delayed by wildfires in California, where affected residents were allowed until October 15 to file and pay taxes. Withheld individual income tax receipts rose $16 billion, or 6%, from the year-ago period to $279 billion. But October corporate tax receipts were flat at $18 billion, and the Treasury official attributed the lack of growth to corporate tax breaks contained in the Republican-passed tax-cut and spending bill enacted this year. The U.S. Treasury's interest costs hit $104 billion in October, up $22 billion, or 27%, from October 2024, reflecting a higher debt load and slightly higher weighted average interest rate of 3.36%, the Treasury official said. https://www.reuters.com/world/us/us-posts-284-billion-october-budget-deficit-report-impacted-by-shutdown-2025-11-25/

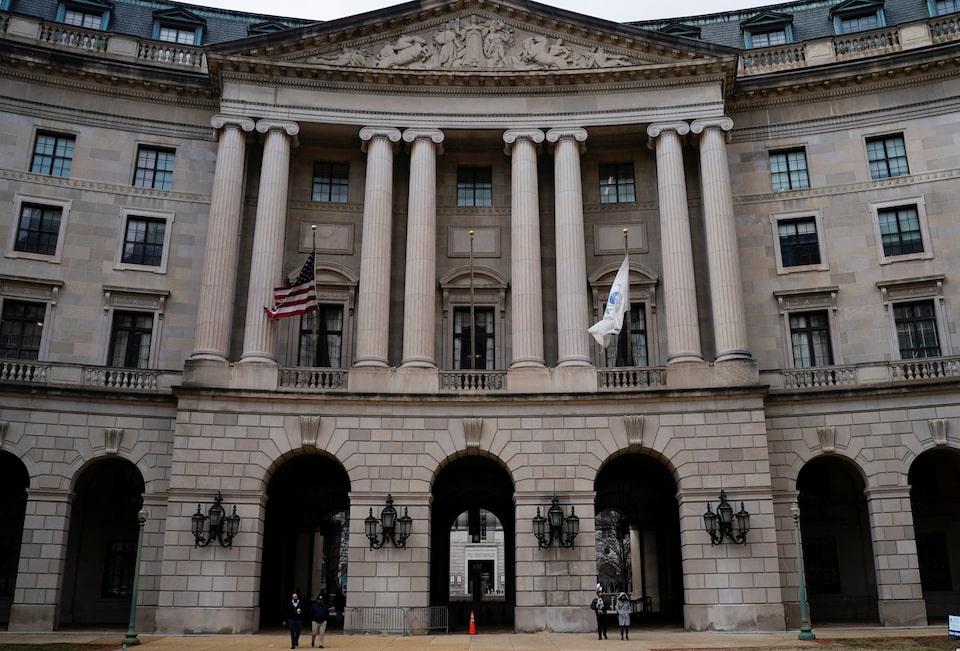

2025-11-25 20:21

Nov 25 (Reuters) - The U.S. Environmental Protection Agency said on Tuesday it would provide states with $3 billion in new funding to reduce lead in drinking water. The agency said it is also making available to states an additional $1.1 billion in previously announced funding to address the lead problem. Sign up here. The money will go toward finding and removing lead pipes that deliver water to homes, schools, and businesses, the agency said in a statement. Lead pipes are the main source of lead in drinking water, according to the EPA. Ingesting the heavy metal can severely affect mental and physical development, especially in children, causing brain damage and other potentially lifelong health issues. “This investment represents the EPA’s unwavering commitment to protecting America's children from the dangers of lead exposure in their drinking water,” said EPA Administrator Lee Zeldin. EPA said updated data shows there are an estimated 4 million lead service lines in the U.S., down from 9 million previously estimated. https://www.reuters.com/legal/litigation/epa-provide-3-billion-us-states-reduce-lead-drinking-water-2025-11-25/

2025-11-25 19:44

BP confirms leak in 20-inch segment, repairs planned Washington and Oregon declared fuel emergency due to closure Shutdown disrupted fuel supplies to Seattle-Tacoma Airport NEW YORK, Nov 25 (Reuters) - BP (BP.L) , opens new tab said on Tuesday it had partially restarted the 400-mile Olympic Pipeline after crews identified the source of a leak of refined products east of Everett, Washington. Washington declared a fuel emergency last week and Oregon followed suit on Monday in response to the system shutdown, which has disrupted jet fuel supplies to Seattle-Tacoma International Airport. Sign up here. The Olympic Pipeline moves refined petroleum products including gasoline, diesel and jet fuel from northern Washington to Oregon and consists of one 16-inch diameter pipeline and one 20-inch pipeline. Crews restored the 16-inch segment of the pipeline system on Tuesday morning after finding no indications of a leak, BP said in an emailed statement. After conducting tests, they were able to confirm a leak in the 20-inch segment and repairs are being planned. BP did not provide timelines for repair of the 20-inch pipe and the full restart of the system. A refined products discharge on the Olympic Pipeline was first reported on November 11. BP shut the entire pipeline system a week later, halting product deliveries. Major carriers including Alaska Airlines (ALK.N) , opens new tab and Delta Air Lines (DAL.N) , opens new tab have implemented plans to minimize the impact of the pipeline disruption on flights out of Seattle-Tacoma International Airport during the busy Thanksgiving travel week by hauling extra fuel via tanker trucks and inbound flights and adding fuel stops to outbound flights. "Delta is operating our full Seattle hub schedule and has discontinued fuel stops on select long-haul flights," the carrier said on Tuesday. "We have discontinued all planned fuel stops but will continue to tanker and truck in additional fuel on a reduced basis as the pipeline increases to normal capacity," Alaska Airlines said. https://www.reuters.com/business/energy/bp-identifies-source-olympic-pipeline-leak-washington-2025-11-25/

2025-11-25 19:40

Judge approves a $5.9 billion bid from an affiliate of Elliott Investment Management for control of Venezuela-owned Citgo Petroleum Citgo is the seventh-largest refiner in the US The transaction still needs approval from the Office of Foreign Assets Control and other regulators HOUSTON, Nov 25 (Reuters) - A U.S. judge on Tuesday approved a $5.9 billion bid from an affiliate of Elliott Investment Management in the court-organized auction of Citgo Petroleum's parent, clearing the way to order the sale of Venezuela-owned PDV Holding. Judge Leonard Stark, from Delaware, overruled pending objections to the bid and set a Friday deadline for a report with any other material issues that could have been overlooked. He asked a court officer overseeing the process to submit a proposed sale order in sufficient time to be signed by Monday, for which parties including Venezuela must reach an agreement on terms. Sign up here. "The Amber Bid offers the best overall combination of price and certainty of closing of any bid submitted," Stark wrote, characterizing the process as fair and equitable. The decision confirms a shift from a recommendation made in August by court officer Robert Pincus, following a bidding war in the competition's last mile that saw new and improved offers for control of Citgo, the seventh-largest U.S. refiner. The main attraction of the bid from Elliott's Amber Energy is that it offers a $2.1 billion payment to the holders of a defaulted Venezuelan bond collateralized with Citgo equity, which is expected to remove a key obstacle to taking ownership of Citgo's assets. "We look forward to working with the talented Citgo team to strengthen the business through capital investment and operational excellence," Amber Energy CEO Gregory Goff, who plans to assume the top role at the refiner, said on Tuesday in a statement. The company will continue to operate as Citgo, and Amber said it's planning operational enhancements and strategic investments to improve profitability. CREDITORS' EIGHT-YEAR LEGAL BATTLE A total of 15 creditors have been fighting in an eight-year case to recover nearly $19 billion in U.S. courts after Venezuela expropriated assets and defaulted on debt. Evercore, a firm advising the court, valued Citgo at about $13 billion as part of the auction, but Venezuela has argued it is worth more than $18 billion. Stark previously denied motions by the Venezuelan parties and Gold Reserve to disqualify him, the court officer overseeing the process and two firms advising the court over an alleged conflict of interest. Amber Energy said it expects the sale to close in 2026, although the transaction still needs approval from the Office of Foreign Assets Control and other regulators. It was not immediately clear if a deadline was set for receiving replies from those authorities. "If OFAC grants a license to Amber Energy, and if this Court’s judgment is not reversed on appeal, many of the judgment-creditors who have spent years and millions of dollars trying to recover on billions of dollars of judgments, to compensate them for harm inflicted by one or more of the Venezuela Parties years or decades ago, will finally obtain relief," Stark wrote. Gold Reserve and creditors Siemens Energy (ENR1n.DE) , opens new tab, Consorcio Andino, Valores Mundiales, Gramercy Distressed Opportunity Fund and G&A Strategic Investments tried to disqualify Amber's bid, saying that Pincus' determination that its price was superior discarded the bidding procedures. Their motion was denied in September. The selection of Amber Energy's offer means those creditors will recover hardly anything from the claims they won against Venezuela for debt defaults and asset expropriations, according to a priority list set by the court for distributing the auction proceeds. But large creditors including ConocoPhillips (COP.N) , opens new tab and miners Crystallex and Rusoro are set to recover billions from proceeds. HOW MINER'S LAWSUIT LED TO SALE In a case first introduced by miner Crystallex in 2017 against Venezuela, Citgo's parent PDV Holding was found liable for the country's debt. The Delaware court has since attempted to secure a deal to satisfy the creditors. In a spiced-up competition, some bidders focused on maximizing proceeds for the 15 creditors in Delaware, while others preferred to reduce litigation by negotiating a payment to the PDVSA bondholders. A New York judge in September confirmed the validity of the defaulted bonds, supporting the holders' claim and boosting Amber's bid. Lawyers representing Venezuela immediately filed an appeal. Amber Energy won a first bidding round last year, but its conditional $7.3 billion offer was rejected by most creditors, creating the need for new rounds this year and a fresh set of rules to encourage competition in the complex auction. Houston-based refiner Citgo Petroleum, the crown jewel of Venezuela's overseas assets, severed ties with PDVSA in 2019 following U.S. sanctions. Both Venezuelan President Nicolas Maduro's government and his political opposition have rejected the auction. https://www.reuters.com/business/energy/us-judge-approves-elliott-affiliate-bid-citgo-petroleum-parent-2025-11-25/