2025-11-25 19:33

Indexes up: Dow 1.43%, S&P 500 0.91%, Nasdaq 0.67% Alphabet up after report on talks with Meta to supply AI chips Retail sales, producer prices, consumer confidence reports released Kohl's and Abercrombie boost S&P Retail index NEW YORK, Nov 25 (Reuters) - Wall Street extended its rally on Tuesday as a spate of economic data appeared to support the case for the U.S. Federal Reserve to implement its third and final rate cut of the year in December, while softness in the tech sector limited the Nasdaq's gains. All three major U.S. stock indexes closed in positive territory, with the blue-chip Dow out front. But sagging shares of artificial intelligence frontrunner Nvidia (NVDA.O) , opens new tab limited the Nasdaq's advance. Sign up here. Nvidia dipped 2.6%, while the Philadelphia SE Semiconductor index (.SOX) , opens new tab eked out a 0.2% gain. An influx of economic data was released, much of it supporting views that the Federal Open Market Committee will reduce its key Fed funds target rate by 25 basis points at its upcoming monetary policy meeting, but official reports were stale due to delays related to the recent protracted government shutdown. The Commerce and Labor departments issued September reports on retail sales and producer prices, respectively, which showed spending softened and that inflation continued to cool. More recent data from the Conference Board showed a worse-than-expected deterioration of consumer confidence, with near-term expectations tumbling nearly 12%. "At the last Fed meeting, (Fed Chair Jerome) Powell pretty much said (the Fed) would be on hold" at its next meeting due to a lack of economic data, said Paul Nolte, market strategist at Murphy & Sylvest in Elmhurst, Illinois. "Then we had Fed governors speaking and we've gone from 'we're not going to do anything in December' to 'we need to cut in December because we're seeing some serious weakening in the job market.'" Financial markets agree, and are currently pricing in an 84.7% likelihood of that happening, compared with 50.1% a week ago. That probability has gained strength in recent days following dovish remarks by New York Fed President John Williams and Fed Governor Christopher Waller, among others. U.S. Treasury Secretary Scott Bessent said there was a good chance U.S. President Donald Trump will name his pick for Powell's successor before Christmas, with White House economic adviser Kevin Hassett widely seen as a likely frontrunner. "We have an idea who the next Fed chair might be and he's on the dovish side," Nolte added. "So I think the markets are feeling pretty good that interest rates are on the way down throughout 2026." The Dow Jones Industrial Average (.DJI) , opens new tab rose 664.18 points, or 1.43%, to 47,112.45, the S&P 500 (.SPX) , opens new tab gained 60.77 points, or 0.91%, to 6,765.89 and the Nasdaq Composite (.IXIC) , opens new tab gained 153.59 points, or 0.67%, to 23,025.59. Among the 11 major sectors in the S&P 500, healthcare (.SPXHC) , opens new tab led the gainers, while energy shares (.SPNY) , opens new tab suffered the steepest percentage decline. While softer-than-expected retail sales data and the dour consumer confidence reading raised concerns over the health of the consumer, a smattering of generally positive retail earnings helped send the S&P 500 retail index (.SPXRT) , opens new tab up 2.0%. Department store chain Kohl's (KSS.N) , opens new tab jumped 42.5% and clothing retailer Abercrombie & Fitch (ANF.N) , opens new tab surged 37.5%, after the companies hiked their annual earnings forecasts. But Burlington Stores (BURL.N) , opens new tab tumbled 12.2% after third-quarter revenue missed estimates. Alphabet's shares (GOOGL.O) , opens new tab rose 1.5% after the Information reported Meta Platforms was in discussions to use Google's AI chips in its data centers from 2027 and rent chips from Google Cloud by next year. Meta Platforms added 3.8%. U.S.-listed shares of Alibaba slipped 2.3% even after the Chinese e-commerce firm beat quarterly revenue expectations. Advancing issues outnumbered decliners by a 4.05-to-1 ratio on the NYSE. There were 181 new highs and 45 new lows on the NYSE. On the Nasdaq, 3,355 stocks rose and 1,296 fell as advancing issues outnumbered decliners by a 2.59-to-1 ratio. The S&P 500 posted 40 new 52-week highs and 2 new lows while the Nasdaq Composite recorded 140 new highs and 80 new lows. Volume on U.S. exchanges was 16.68 billion shares, compared with the 19.78 billion average for the full session over the last 20 trading days. https://www.reuters.com/business/us-futures-ease-with-investors-focus-data-alphabet-shines-2025-11-25/

2025-11-25 19:22

Critics blast move as bad for public health Trump EPA also seeks to delay coal plant cleanup deadline EPA will take public comment on plan until January 7 WASHINGTON, Nov 25 (Reuters) - President Donald Trump's administration has asked a federal court to strike down 2024 soot limits for power plants and factories and separately delayed by three years a deadline for coal plants to clean up coal waste. Critics called the moves a blatant retreat from important public-health protections. Soot has been linked to asthma and cardiovascular illness. Sign up here. Last year, President Joe Biden's EPA said the tighter annual standard of 9 micrograms per cubic meter would avoid more than 800,000 cases of asthma symptoms, 2,000 hospital visits and 4,500 premature deaths. Trump has championed reviving the coal industry. In a filing on Monday, the EPA sided with 24 states led by Kentucky and industry groups including the National Association of Manufacturers that had sued the regulator to reverse the 2024 standard on soot, or fine particulate matter, known as PM2.5. Nearly 91% of existing coal plants already meet the toughened standard. On Tuesday, the EPA announced a proposal to extend by three years the deadline for a small number of large coal plants to cease operation of coal-fired boilers and close unlined coal ash impoundments. The new deadline would be October 2031 "to promote electric grid reliability." The EPA will seek comments on the extension until January 7. The EPA said in a statement that the 2024 rule costs "hundreds of millions, if not billions of dollars to American citizens if allowed to be implemented" and was not based on a full review of available science. "EPA will conduct a thorough review as required by the Clean Air Act," a spokesperson said in a statement. The Trump administration in March targeted soot as one of dozens of regulations it planned to roll back. In total, the agency announced more than 30 deregulatory measures in a dizzying succession of press releases. The country's dirtiest coal plants would be among the biggest beneficiaries from a rollback of soot limits. They include the Colstrip Power Plant in Montana, which the EPA says is the country's only coal plant without modern pollution controls for particulate matter. Environmental groups blasted the move away from the tighter EPA soot standard. “EPA’s motion is a blatant attempt to avoid legal requirements for a rollback, in this case for one of the most impactful actions the agency has taken in recent years to protect public health,” said Hayden Hashimoto, attorney at the Clean Air Task Force. https://www.reuters.com/legal/litigation/us-epa-seeks-scrap-tougher-soot-limits-critics-warn-health-risks-2025-11-25/

2025-11-25 18:58

FRANKFURT/DUESSELDORF, Nov 25 (Reuters) - Worker representatives met at Thyssenkrupp Steel Europe (TKSE) on Tuesday to start a process of agreeing on job security and co-determination if the German group is sold to India's Jindal Steel International, the IG Metall union said. Jindal Steel has made an indicative bid for TKSE, Europe's second-largest steelmaker, and is currently carrying out detailed due diligence to assess whether to launch a formal binding offer for the business. Sign up here. Workers at Thyssenkrupp's (TKAG.DE) , opens new tab steel division, which have traditionally commanded substantial clout over corporate decisions, are aiming to maintain that influence should an ownership change take place. "A fair and best-owner agreement is intended to provide security for employees, locations, co-determination and the future of TKSE in the event of a possible sale to the Jindal Group," said the union in a statement. IG Metall said it had asked management of TKSE as well as parent Thyssenkrupp to enter negotiations on the matter at short notice, adding that Jindal Steel International had also been informed about the process. A spokesman for Thyssenkrupp said the company intended to soon enter negotiations with IG Metall. Jindal Steel International was not immediately available for comment https://www.reuters.com/business/union-launches-job-security-talks-thyssenkrupp-steel-if-jindal-sale-goes-through-2025-11-25/

2025-11-25 18:53

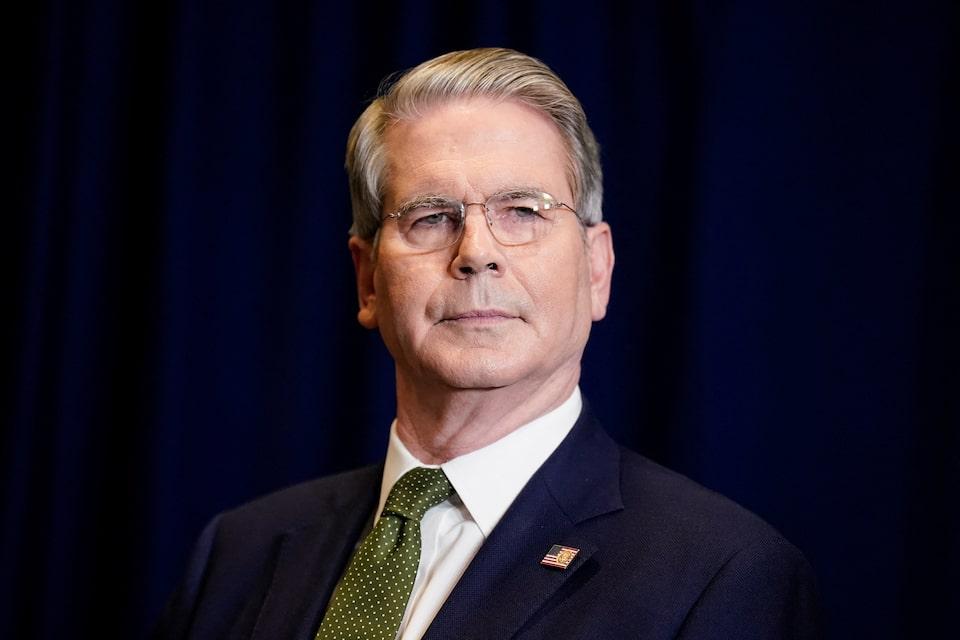

Bessent concludes interviews for Fed leader, five candidates remain Hassett seen as frontrunner, White House calls it speculation Betting markets show Hassett in front, Waller in second WASHINGTON, Nov 25 (Reuters) - U.S. Treasury Secretary Scott Bessent said on Tuesday he was concluding a second round of interviews later in the day for a new U.S. Federal Reserve leader, and there was a good chance President Donald Trump would announce his pick before Christmas. White House economic adviser Kevin Hassett is seen by allies and advisers of Trump as the frontrunner, Bloomberg reported, citing unnamed people familiar with the matter. Hassett, like Trump, has said interest rates should be lower than they are now under the leadership of Fed Chair Jerome Powell. Sign up here. Bessent has narrowed the search for a successor to Powell, whose leadership term expires in May, to Hassett and four others from as many as 11, and said in an interview with CNBC the latest interviews have focused on how the candidates would guide what has become a "very complicated operation." "We're going to have the last interview in the second round today ... We got five very strong candidates," Bessent said. "I think that there's a very good chance that the president will make an announcement before Christmas," Bessent said. "But it's his prerogative, whether it's ... before the Christmas holidays, and the New Year’s. But things are moving along very well." WHITE HOUSE CALLS REPORT SPECULATION The selection of Powell's successor offers Trump an opportunity to install someone more like-minded about wanting lower interest rates than Powell has proven to be. Trump, who elevated Powell to lead the Fed during his first term, persistently lashes out at the Fed chief for not cutting rates sharply. The White House dismissed Bloomberg's report on Hassett, who also served as an economic adviser to Trump during the president's first term. “Until an announcement is made by President Trump, discussion about Fed nominations is speculation,” White House spokesman Kush Desai said. The other remaining candidates include former Fed Governor Kevin Warsh; current Governors Christopher Waller and Michelle Bowman, who is also the vice chair for supervision; and Rick Rieder, BlackRock's chief investment officer for global fixed income. Earlier on Tuesday, online betting markets Kalshi and Polymarket reflected a neck-and-neck race between Hassett and Waller, whose prospects were seen improving sharply this week after Waller said he had a good second interview with Bessent. "I talked to Scott about 10 days ago. We had a nice, a great, meeting," Waller said on Monday on the Fox Business "Mornings with Maria" show. "I think they are looking for someone who has merit, experience, and knows what they are doing in the job, and I think I fit that." Following the Bloomberg report, however, bets favoring Hassett surged on both platforms, with each assigning around a 50% likelihood in early afternoon trading of Hassett getting tapped for the job. The Fed has cut interest rates by a quarter-percentage point at its last two meetings, and rate futures markets are positioned for a third cut at its next meeting in December. Its benchmark rate is now set in a range of 3.75% to 4.00%. Waller and Bowman - both appointed by Trump in his first term - began arguing for lower rates this summer after growing convinced that the risk of a weakening job market was greater than the risk that inflation would turn sharply upward. The two dissented in favor of a rate cut at July's meeting when the Fed held rates steady. https://www.reuters.com/world/us/bessent-says-very-good-chance-trump-will-announce-new-fed-chair-before-christmas-2025-11-25/

2025-11-25 17:54

LONDON, Nov 24 (Reuters) - (This Nov 24 story has been corrected to change the month of former Hub head Cecilia Skingsley's departure to June, from May, in paragraph 1) The Bank for International Settlements, the umbrella body for central banks, on Tuesday named a new head of its Innovation Hub that oversees its influential work on digital currencies, artificial intelligence and other up-and-coming technologies. Sign up here. Tommaso Mancini-Griffoli, assistant director for payments, currencies and infrastructure at the International Monetary Fund (IMF), will join the Switzerland-based BIS at the start of March, BIS said in a statement. Often dubbed the central bankers' central bank, the BIS has been looking to fill the role since former Swedish central banker Cecilia Skingsley left in June, two years before her term was due to end. The BIS innovation unit was set up in 2019 to identify and develop new technologies and rapidly expanded to seven financial centres from London to Hong Kong, though reports this year said it was set to be pared back. Central bank digital currencies in particular have become a geopolitical hot topic and late last year the BIS suddenly quit a flagship project it had been collaborating on with China and a number of other Asian central banks. It has also issued increasingly stark warnings about stablecoins - a type of cryptocurrency usually pegged 1:1 to the dollar - and urged countries to move rapidly towards the tokenisation of their currencies. Mancini-Griffoli will lead its efforts to foster international collaboration among central banks on innovative financial technology, BIS said. https://www.reuters.com/business/finance/central-bank-body-bis-appoints-new-head-digital-currency-hub-2025-11-25/

2025-11-25 17:00

Package exceeds government's initial forecast of $4-$5 billion Economy Minister Espinoza announces aid talks Bolivia's dollar bonds rise to highest since 2022 LA PAZ, Nov 25 (Reuters) - Bolivia is negotiating multilateral financing that will exceed $9 billion for public and private projects, Economy Minister Jose Gabriel Espinoza said Tuesday in the first major policy announcement since centrist President Rodrigo Paz took office this month. The package, arranged with a consortium of lenders, exceeds the government's initial $4–$5 billion forecast and is designed to stabilize an economy battered by high inflation, a widening fiscal deficit, and a shortage of foreign currency. Sign up here. Espinoza, who announced the aid talks during a press conference on Tuesday, said roughly a third of that financing is expected to arrive within the next 60 to 90 days. Bolivia's U.S. dollar bonds rose on Tuesday and were both trading at their highest levels since 2022, at around 92 cents on the dollar each, according to LSEG data. Bolivian bonds have risen close to 60% this year, among the best performers in JPMorgan's emerging markets bond index. Funds from creditors including the World Bank and the Development Bank of Latin America (CAF) will support private sector initiatives in infrastructure, renewable energy, and financial inclusion, the minister told Reuters in an interview ahead of the press conference. "It's not just public sector borrowing," Espinoza said. "This marks a new phase of development where the private sector will play a very important role," he said. Bolivia, a major producer of natural gas and grains, is facing one of its worst economic crises in decades after years of state-heavy policies and nationalization under the previous socialist administration deterred foreign investment and strained public finances. Paz, who took office on Nov. 8, has pledged a market-oriented approach to attract foreign investment while avoiding abrupt shocks to the economy that could undermine Bolivia's social safety net. As part of Tuesday's announcement, the government scrapped the country's wealth tax, citing its role in discouraging investment. Taxes on financial transactions were also lifted. The fresh credit lines and tax measures still require congressional approval before they can take effect. A more austere 2026 budget will include a 30% cut in public spending, Espinoza said. The government took the spending reduction decision on its own and not as a result of any pressure from the International Monetary Fund (IMF), he said, adding Bolivia remains open to dialogue with the Fund. "If they (the IMF) approach us, that is welcome, but in the meantime we will proceed with our plans," he told Reuters. CRYPTO INTEGRATION As part of a broader modernization push, the government will integrate cryptocurrencies into the formal financial system, starting with stablecoins, Espinoza said. Banks will be allowed to offer crypto services so that they "begin to function as a legal tender payment instrument," Espinoza said. These services include savings accounts, credit cards and loans. Cryptocurrency adoption in Bolivia surged after a prior ban was lifted last year and analysts say volumes have since grown sharply as more customers use the assets as a hedge against the depreciating boliviano. "You can't control crypto globally, so you have to recognize it and use it to your advantage," Espinoza said, adding the policy could boost financial inclusion. https://www.reuters.com/world/americas/bolivia-negotiating-9-billion-multilateral-loans-spur-recovery-2025-11-25/